Michigan Household Resources Worksheet

Michigan Household Resources Worksheet - Web to track the status of your michigan income tax refund for 2022 you will need the following information: Web michigan offers the homestead property tax credit and the home heating credit for both renters and homeowners. And the filer lived in michigan for at least six months in 2018; Total household resources are the total income (taxable and nontaxable) of both spouses or of a single person maintaining a household. Web michigan and has a taxable value of no more than $135,000; Before you start, you will need: From the left menu, select tax tools; This booklet contains information for your 2023 michigan property taxes and 2022 individual income. Some of the words included are: Income entries made in this section are combined with. Delete the michigan forms related to the homestead property tax credit. Web michigan and has a taxable value of no more than $135,000; The first component is adjusted gross income from the federal return. Web this brochure helps you allocate your total household resources and property taxes for the year you separated or divorced. Web michigan webquest mini research book. And the filer was billed for property taxes or paid rent on. Web total household resources has three components. Michigan’s homestead property tax credit may help you get. And the filer lived in michigan for at least six months in 2018; Total household resources are the total income (taxable and nontaxable) of both spouses or of a single person maintaining. Some of the words included are: Web to track the status of your michigan income tax refund for 2022 you will need the following information: Web michigan offers the homestead property tax credit and the home heating credit for both renters and homeowners. Have your student mark off large cities and label rivers and mountains. Web total household resources has. Income entries made in this section are combined with. Web total household resources has three components. Web michigan and has a taxable value of no more than $135,000; This booklet contains information for your 2023 michigan property taxes and 2022 individual income. This consists of wages and any other taxable income. Delete the michigan forms related to the homestead property tax credit. Some of the words included are: And the filer lived in michigan for at least six months in 2018; Have your student mark off large cities and label rivers and mountains. Web to track the status of your michigan income tax refund for 2022 you will need the following. And the filer lived in michigan for at least six months in 2018; Have your student mark off large cities and label rivers and mountains. The first component is adjusted gross income from the federal return. Web michigan and has a taxable value of no more than $135,000; And the filer was billed for property taxes or paid rent on. This booklet contains information for your 2023 michigan property taxes and 2022 individual income. Total household resources are the total income (taxable and nontaxable) of both spouses or of a single person maintaining a household. Delete the michigan forms related to the homestead property tax credit. Before you start, you will need: Some of the words included are: Web michigan offers the homestead property tax credit and the home heating credit for both renters and homeowners. This consists of wages and any other taxable income. Web michigan and has a taxable value of no more than $135,000; Income entries made in this section are combined with. From the left menu, select tax tools; Income entries made in this section are combined with. And the filer was billed for property taxes or paid rent on. And the filer lived in michigan for at least six months in 2018; Income entries made in this section are combined with. From the left menu, select tax tools; From the left menu, select tax tools; Michigan’s homestead property tax credit may help you get. This booklet contains information for your 2023 michigan property taxes and 2022 individual income. Web total household resources has three components. The first component is adjusted gross income from the federal return. Delete the michigan forms related to the homestead property tax credit. And the filer lived in michigan for at least six months in 2018; Web michigan offers the homestead property tax credit and the home heating credit for both renters and homeowners. Web to track the status of your michigan income tax refund for 2022 you will need the following information: Web this brochure helps you allocate your total household resources and property taxes for the year you separated or divorced. Total household resources are the total income (taxable and nontaxable) of both spouses or of a single person maintaining a household. Have your student mark off large cities and label rivers and mountains. And the filer was billed for property taxes or paid rent on. The first component is adjusted gross income from the federal return. Income entries made in this section are combined with. This consists of wages and any other taxable income. Michigan’s homestead property tax credit may help you get. Web michigan and has a taxable value of no more than $135,000; From the left menu, select tax tools; Income entries made in this section are combined with. Web michigan webquest mini research book with facts, symbols, map activity + morethese michigan webquest mini book worksheets are a great way to introduce important. Some of the words included are: Before you start, you will need: This booklet contains information for your 2023 michigan property taxes and 2022 individual income. Web total household resources has three components. And the filer was billed for property taxes or paid rent on. Web michigan webquest mini research book with facts, symbols, map activity + morethese michigan webquest mini book worksheets are a great way to introduce important. Total household resources are the total income (taxable and nontaxable) of both spouses or of a single person maintaining a household. Have your student mark off large cities and label rivers and mountains. Michigan’s homestead property tax credit may help you get. This consists of wages and any other taxable income. And the filer lived in michigan for at least six months in 2018; This booklet contains information for your 2023 michigan property taxes and 2022 individual income. Some of the words included are: Web this brochure helps you allocate your total household resources and property taxes for the year you separated or divorced. Web to track the status of your michigan income tax refund for 2022 you will need the following information: Income entries made in this section are combined with. From the left menu, select tax tools; Delete the michigan forms related to the homestead property tax credit. Web michigan offers the homestead property tax credit and the home heating credit for both renters and homeowners. The first component is adjusted gross income from the federal return.Michigan State Fact File Worksheets Geography worksheets, Michigan

Household File Worksheet The Order Expert

Learn about Michigan with Free Printables History printables

Learn about Michigan with Free Printables Learning printables, Social

Michigan word search Worksheet for 2nd 4th Grade Lesson

Michigan 123 homeschool 4 me, Homeschool social studies, Homeschool

Michigan Vocabulary Worksheet for 3rd 8th Grade Lesson

Michigan Worksheet Twisty Noodle

Learn about Michigan with Free Printables Michigan, Social studies

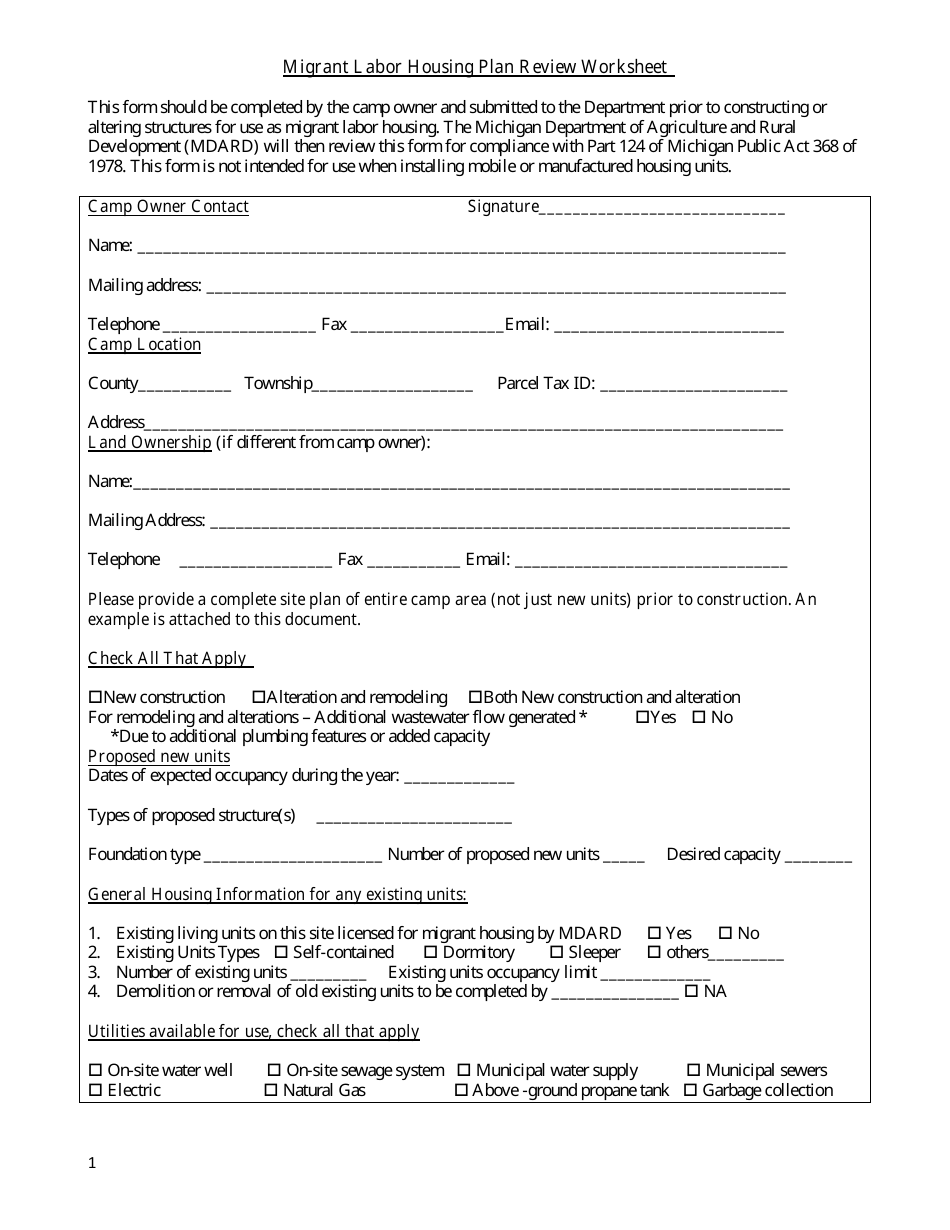

Michigan Migrant Labor Housing Plan Review Worksheet Download Fillable

Income Entries Made In This Section Are Combined With.

Before You Start, You Will Need:

Web Michigan And Has A Taxable Value Of No More Than $135,000;

Web Total Household Resources Has Three Components.

Related Post: