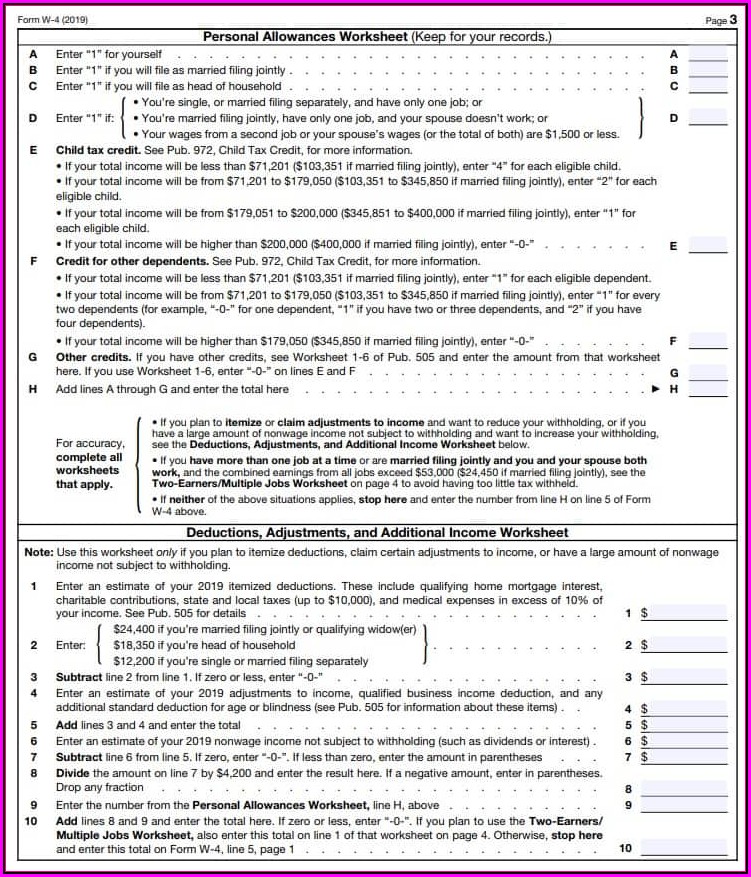

Mw507 Personal Exemptions Worksheet

Mw507 Personal Exemptions Worksheet - Web the second page of form mw507 is the personal exemptions worksheet. Web mw507 requires you to list multiple forms of income, such as wages, interest, or alimony. Web this is the worksheet form that your employee will need to fill out so that you can calculate the estimated income tax to withhold from the employee’s paycheck based on their. This exemption is reduced once the taxpayer's federal adjusted gross income exceeds $100,000 ($150,000 if filing joint, head of household, or. (generally the value of your exemption will be. Number of additional exemptions for dependents over 65. Web complete the personal exemption worksheet on page 2 to further adjust your maryland withholding based on itemized deductions, and certain other expenses that exceed your. Web you wish to claim more exemptions, or if your adjusted gross income will be more than $100,000 if you are filing single or married filing separately ($150,000, if you are filing. Web the personal exemption is $3,200. Generally, you can claim one personal tax exemption for yourself and one for your spouse if you are married. It looks like you would have 1 exemption for yourself, 1 for your child, and 1 if you file as. Multiply the number of your personal exemptions by the value of each exemption from the table below. Web the personal exemption is $3,200. Within this section, taxpayers can calculate the total deduction they are eligible to claim on line 1. Web mw 507 page 2 line 1 a. We last updated the employee's maryland withholding exemption certificate in january. Multiply the number of your personal exemptions by the value of each exemption from the table below. For maryland state government employees only. It looks like you would have 1 exemption for yourself, 1 for your child, and 1 if you. It looks like you would have 1 exemption for yourself, 1 for your child, and 1 if you file as. Web mw 507 page 2 line 1 a. For maryland state government employees only. Web the personal exemption is $3,200. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web mw507 requires you to list multiple forms of income, such as wages, interest, or alimony. Web mw 507 page 2 line 1 a. Web the second page of form mw507 is the personal exemptions worksheet. Web complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Get everything done in minutes. We last updated the employee's maryland withholding exemption certificate in january. Multiply the number of your personal exemptions by the value of each exemption from the table below. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web mw 507 page 2 line 1 a. Consider completing a new form. Web i can't fill out the form for you, but here are the instructions for the mw507. It looks like you would have 1 exemption for yourself, 1 for your child, and 1 if you file as. Get everything done in minutes. Web you wish to claim more exemptions, or if your adjusted gross income will be more than $100,000. Get everything done in minutes. Web exemptions, or if your adjusted gross income will be more than $100,000, you must complete the worksheet below, if you are filing single or married filing separately ($150,000, if you. Consider completing a new form mw507 each year and when your. Web mw 507 personal exemptions worksheet line 1 a. Number of additional exemptions. Get everything done in minutes. Web the second page of form mw507 is the personal exemptions worksheet. Generally, you can claim one personal tax exemption for yourself and one for your spouse if you are married. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web complete form mw507 so. For maryland state government employees only. Web the second page of form mw507 is the personal exemptions worksheet. Web the personal exemption is $3,200. This exemption is reduced once the taxpayer's federal adjusted gross income exceeds $100,000 ($150,000 if filing joint, head of household, or. Get everything done in minutes. Multiply the number of your personal exemptions by the value of each exemption from the table below. Number of additional exemptions for dependents over 65. This exemption is reduced once the taxpayer's federal adjusted gross income exceeds $100,000 ($150,000 if filing joint, head of household, or. Within this section, taxpayers can calculate the total deduction they are eligible to claim. Web mw 507 personal exemptions worksheet line 1 a. Web complete the personal exemption worksheet on page 2 to further adjust your maryland withholding based on itemized deductions, and certain other expenses that exceed your. Web total number of exemptions you are claiming not to exceed line f in personal exemption worksheet on page 2. Web you wish to claim more exemptions, or if your adjusted gross income will be more than $100,000 if you are filing single or married filing separately ($150,000, if you are filing. Within this section, taxpayers can calculate the total deduction they are eligible to claim on line 1 of. Web complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Generally, you can claim one personal tax exemption for yourself and one for your spouse if you are married. Web i can't fill out the form for you, but here are the instructions for the mw507. Web mw507 requires you to list multiple forms of income, such as wages, interest, or alimony. Web mw 507 page 2 line 1 a. For maryland state government employees only. Web the personal exemption is $3,200. Get everything done in minutes. Additional withholding per pay period under agreement with. Web how to determine the number of exemptions to claim. Multiply the number of your personal exemptions by the value of each exemption from the table below. Web the second page of form mw507 is the personal exemptions worksheet. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Consider completing a new form mw507 each year and when your. We last updated the employee's maryland withholding exemption certificate in january. Consider completing a new form mw507 each year and when your. This exemption is reduced once the taxpayer's federal adjusted gross income exceeds $100,000 ($150,000 if filing joint, head of household, or. Generally, you can claim one personal tax exemption for yourself and one for your spouse if you are married. Multiply the number of your personal exemptions by the value of each exemption from the table below. Web mw507 requires you to list multiple forms of income, such as wages, interest, or alimony. Web the second page of form mw507 is the personal exemptions worksheet. Web how to determine the number of exemptions to claim. (generally the value of your exemption will be. Web you wish to claim more exemptions, or if your adjusted gross income will be more than $100,000 if you are filing single or married filing separately ($150,000, if you are filing. It looks like you would have 1 exemption for yourself, 1 for your child, and 1 if you file as. Multiply the number of your personal exemptions by the value of each exemption from the table below. Multiply the number of your personal exemptions by the value of each exemption from the table below. Web mw 507 page 2 line 1 a. For maryland state government employees only. Web the personal exemption is $3,200. Web mw 507 personal exemptions worksheet line 1 a.Form Va4 Personal Exemption Worksheet printable pdf download

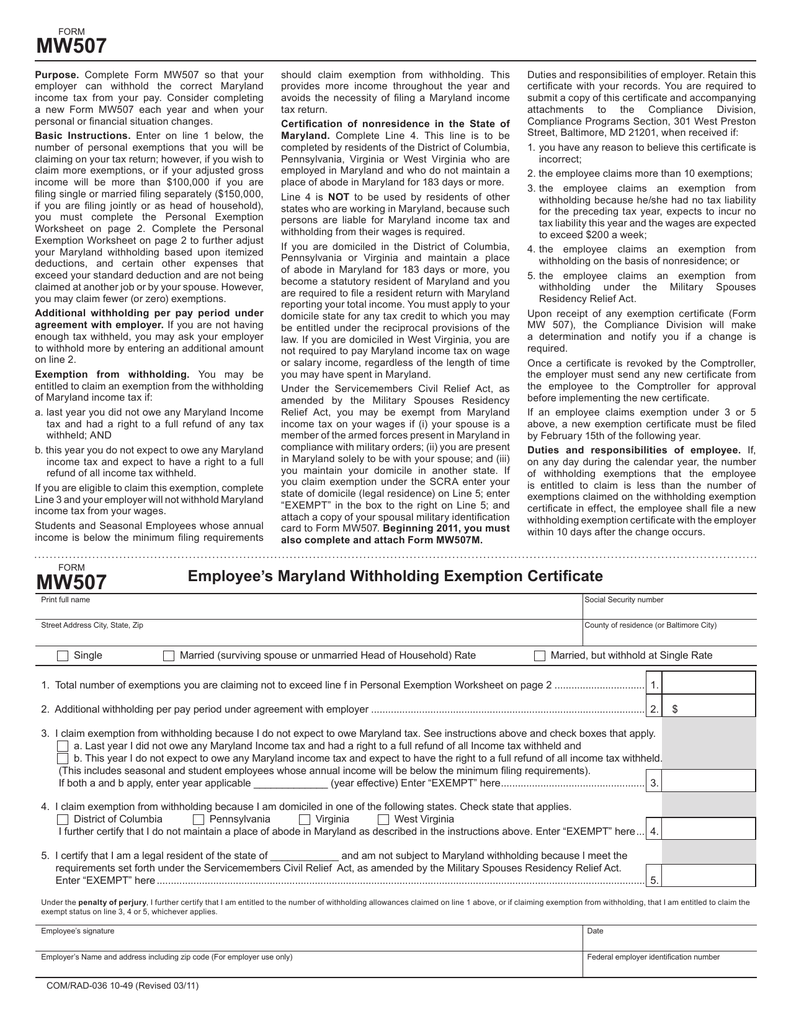

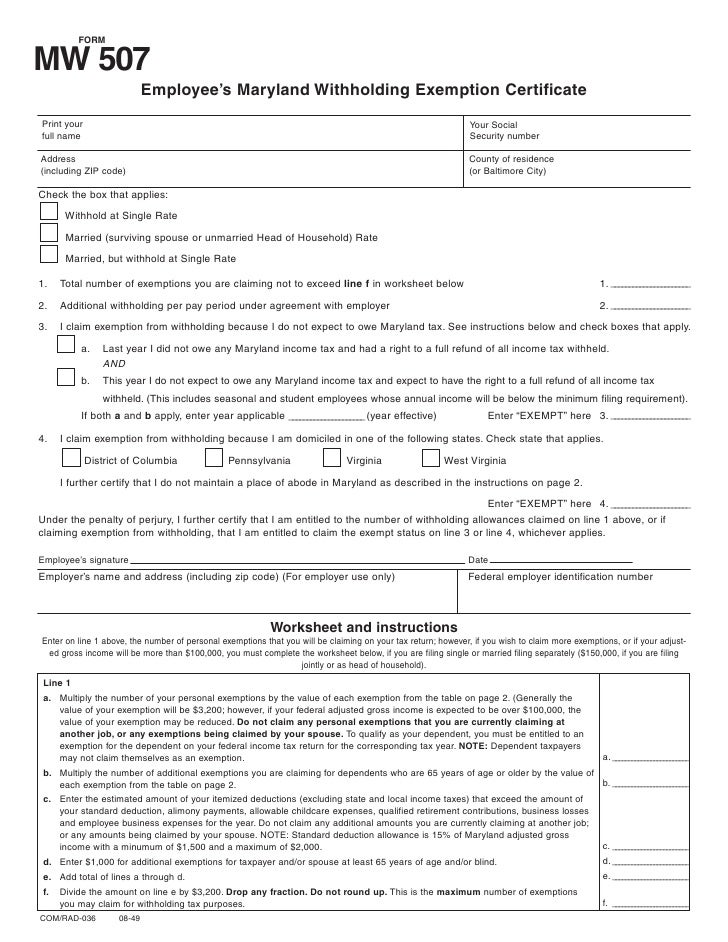

MW507

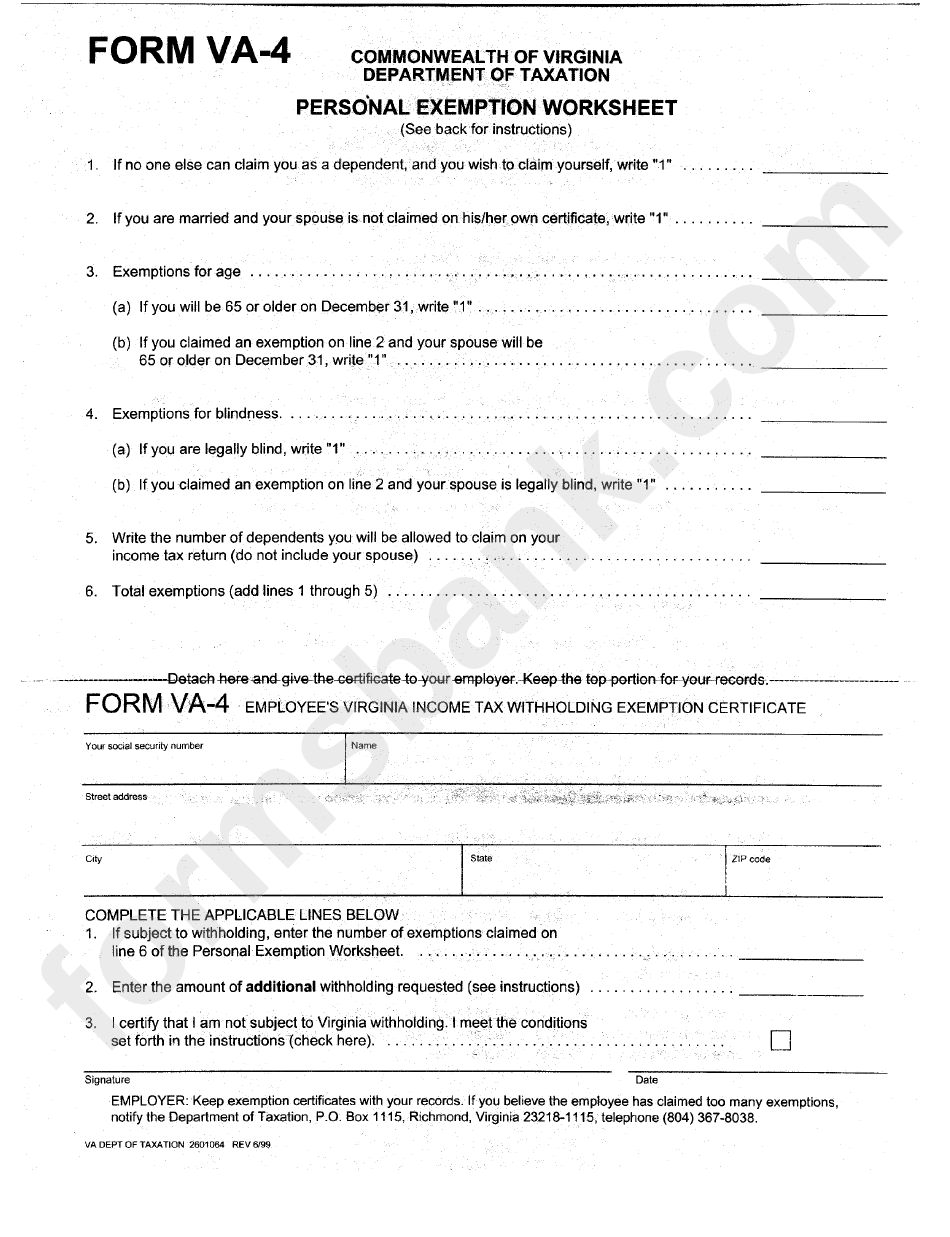

(PDF) COMMONWEALTH OF VIRGINIA DEPARTMENT OF TAXATION PERSONAL

addieslambdesigns Filling Out Maryland Mw507

Fillable W2 Form 2019 Pdf Form Resume Examples djVaZpG2Jk

mw507 Withholding Tax Personal Exemption (United States)

Mw507 Form Help amulette

Employee's Maryland Withholding Exemption Certificate

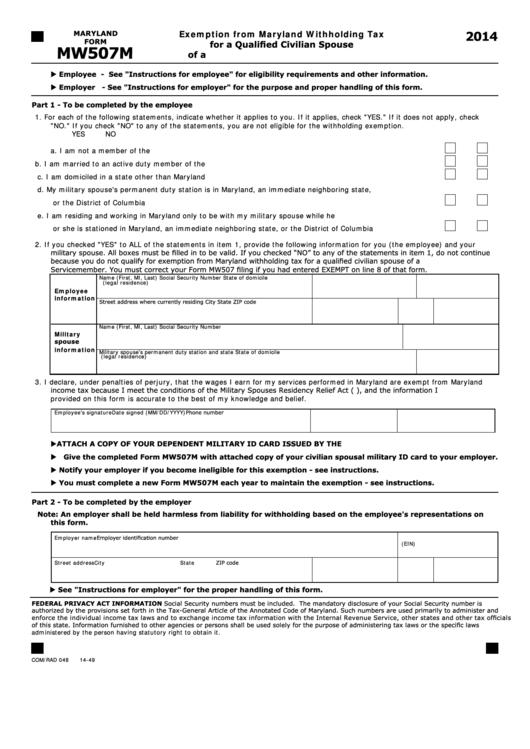

Fillable Maryland Form Mw507m Exemption From Maryland Withholding Tax

Fill Free fillable forms Comptroller of Maryland

Web Total Number Of Exemptions You Are Claiming Not To Exceed Line F In Personal Exemption Worksheet On Page 2.

Number Of Additional Exemptions For Dependents Over 65.

Web Complete The Personal Exemption Worksheet On Page 2 To Further Adjust Your Maryland Withholding Based On Itemized Deductions, And Certain Other Expenses That Exceed Your.

Web Complete Form Mw507 So That Your Employer Can Withhold The Correct Maryland Income Tax From Your Pay.

Related Post: