Nj Medical Expenses Worksheet F

Nj Medical Expenses Worksheet F - The user is on notice that neither the state of nj site nor. You might be able to deduct qualified medical expenses that are more than 7.5% of your adjusted gross income. Continue completing the return with line 45. Web google™ translate is an online service for which the user pays nothing to obtain a purported language translation. Stay up to date on vaccine information. Web are eligible for a new jersey earned income tax credit or other credit do not complete lines 29 through 44. Web please report the monthly dollar amount paid in 2020 for each expense and also provide monthly resources. In my return medical expense are not. Web medical expenses, including medical insurance premiums, are deductible on your federal tax return to the extent they exceed 7.5% of your adjusted gross income,. Web medical expense calculation worksheet. In turbotax forms, worksheet f, line 1b, is an addition for nj medical insurance. You might be able to deduct qualified medical expenses that are more than 7.5% of your adjusted gross income. Covid19.nj.gov call njpies call center for medical information related to covid: Stay up to date on vaccine information. In my return medical expense are not. Continue completing the return with line 45. Web medical expense calculation worksheet. Web income tax depreciation adjustment worksheet: Web google™ translate is an online service for which the user pays nothing to obtain a purported language translation. You might be able to deduct qualified medical expenses that are more than 7.5% of your adjusted gross income. If your parent(s) reported zeroes for all expenses and/or resources,. Web are eligible for a new jersey earned income tax credit or other credit do not complete lines 29 through 44. The user is on notice that neither the state of nj site nor. Continue completing the return with line 45. Web medical expense calculation worksheet. Web income tax depreciation adjustment worksheet: Web please report the monthly dollar amount paid in 2020 for each expense and also provide monthly resources. Statement in support of exclusion for amounts received. Covid19.nj.gov call njpies call center for medical information related to covid: For tax returns filed in. If your parent(s) reported zeroes for all expenses and/or resources,. Covid19.nj.gov call njpies call center for medical information related to covid: Claiming medical expense deductions on your tax return is one way to lower your tax bill. For tax returns filed in. Web are eligible for a new jersey earned income tax credit or other credit do not complete lines. Statement in support of exclusion for amounts received. Web are eligible for a new jersey earned income tax credit or other credit do not complete lines 29 through 44. Stay up to date on vaccine information. If your parent(s) reported zeroes for all expenses and/or resources,. Web medical expenses deduction on new jersey individual return. Covid19.nj.gov call njpies call center for medical information related to covid: Statement in support of exclusion for amounts received. For tax returns filed in. Web income tax depreciation adjustment worksheet: You might be able to deduct qualified medical expenses that are more than 7.5% of your adjusted gross income. Covid19.nj.gov call njpies call center for medical information related to covid: Web medical expense calculation worksheet. Web medical expenses, including medical insurance premiums, are deductible on your federal tax return to the extent they exceed 7.5% of your adjusted gross income,. Continue completing the return with line 45. In my return medical expense are not. The user is on notice that neither the state of nj site nor. Stay up to date on vaccine information. Web the nj medical expense deduction is calculated on worksheet f. Web google™ translate is an online service for which the user pays nothing to obtain a purported language translation. To accomplish this, your deductions must be from a list. In my return medical expense are not. Web please report the monthly dollar amount paid in 2020 for each expense and also provide monthly resources. Continue completing the return with line 45. You might be able to deduct qualified medical expenses that are more than 7.5% of your adjusted gross income. The user is on notice that neither the state. Web it is usually easier to reach the nj income threshold for the medical deduction of 2%, compared to the federal income threshold of 7.5%. In my return medical expense are not. Statement in support of exclusion for amounts received. In turbotax forms, worksheet f, line 1b, is an addition for nj medical insurance. If your parent(s) reported zeroes for all expenses and/or resources,. Web are eligible for a new jersey earned income tax credit or other credit do not complete lines 29 through 44. The user is on notice that neither the state of nj site nor. For tax returns filed in. To accomplish this, your deductions must be from a list. Stay up to date on vaccine information. Web medical expense calculation worksheet. You might be able to deduct qualified medical expenses that are more than 7.5% of your adjusted gross income. Continue completing the return with line 45. Web medical expenses deduction on new jersey individual return. Web google™ translate is an online service for which the user pays nothing to obtain a purported language translation. Web please report the monthly dollar amount paid in 2020 for each expense and also provide monthly resources. Covid19.nj.gov call njpies call center for medical information related to covid: Web medical expenses, including medical insurance premiums, are deductible on your federal tax return to the extent they exceed 7.5% of your adjusted gross income,. Web income tax depreciation adjustment worksheet: Web the nj medical expense deduction is calculated on worksheet f. For tax returns filed in. Web medical expense calculation worksheet. Web please report the monthly dollar amount paid in 2020 for each expense and also provide monthly resources. In turbotax forms, worksheet f, line 1b, is an addition for nj medical insurance. Web google™ translate is an online service for which the user pays nothing to obtain a purported language translation. Web it is usually easier to reach the nj income threshold for the medical deduction of 2%, compared to the federal income threshold of 7.5%. The user is on notice that neither the state of nj site nor. You might be able to deduct qualified medical expenses that are more than 7.5% of your adjusted gross income. Statement in support of exclusion for amounts received. Web medical expenses, including medical insurance premiums, are deductible on your federal tax return to the extent they exceed 7.5% of your adjusted gross income,. To accomplish this, your deductions must be from a list. Continue completing the return with line 45. In my return medical expense are not. Web income tax depreciation adjustment worksheet: Web are eligible for a new jersey earned income tax credit or other credit do not complete lines 29 through 44. If your parent(s) reported zeroes for all expenses and/or resources,.Medical Expense Printable + How to Save on Prescriptions Medical

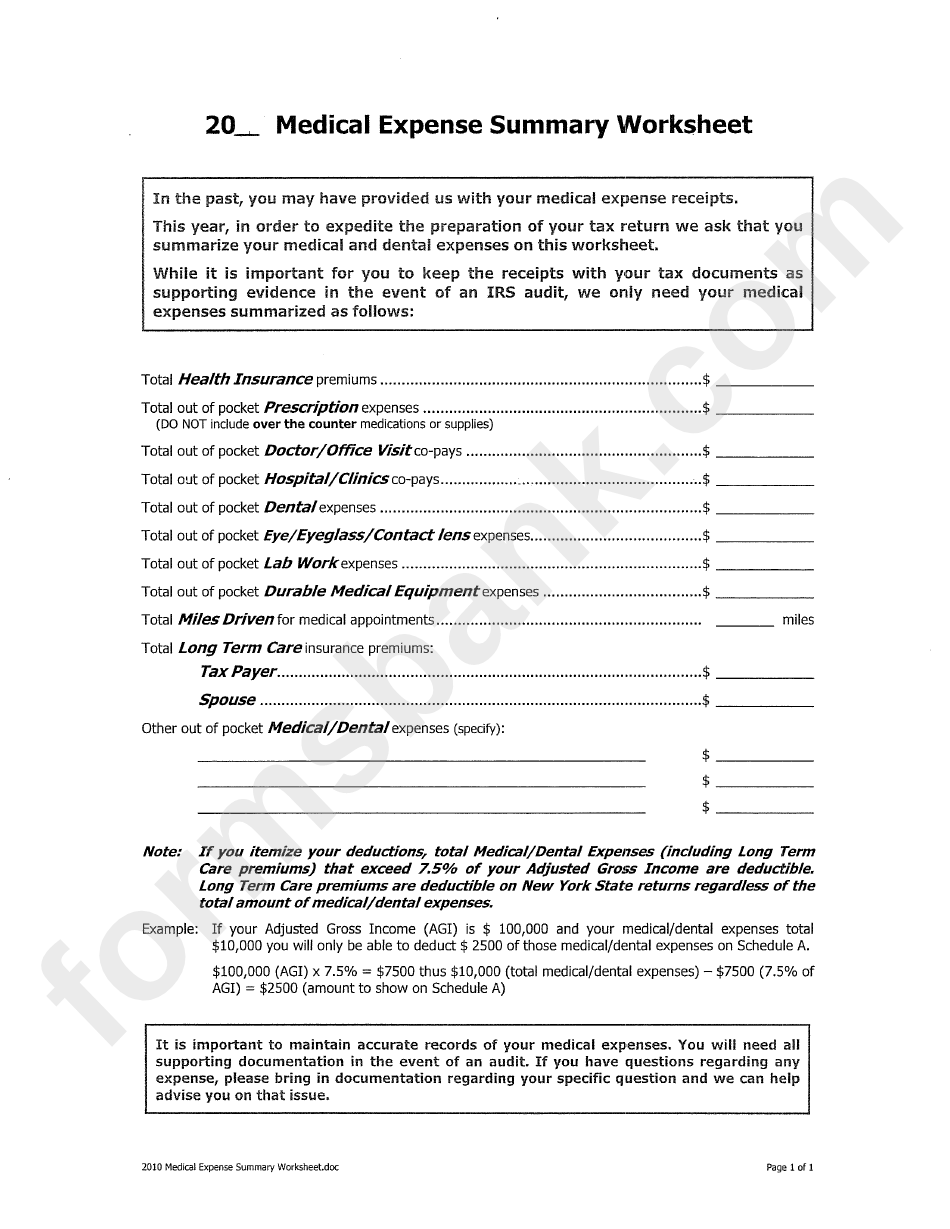

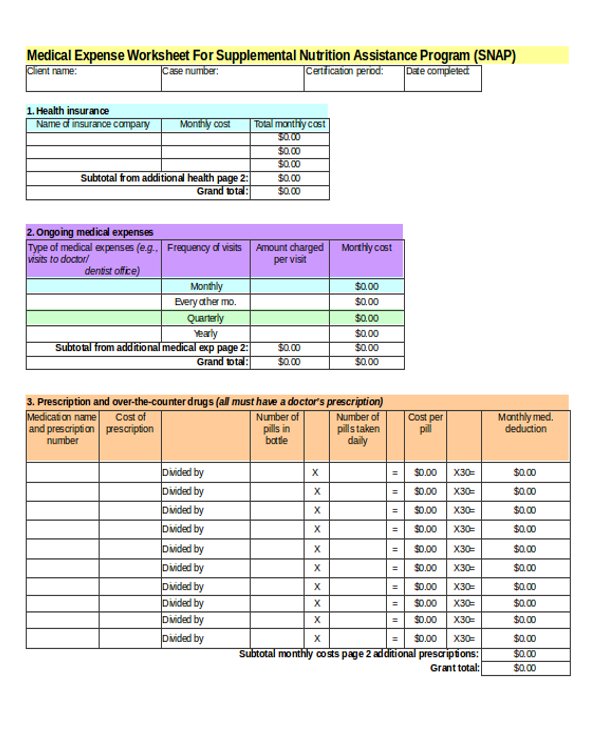

Medical Expense Summary Worksheet printable pdf download

Anchor Tax Service Nurses & medical professionals

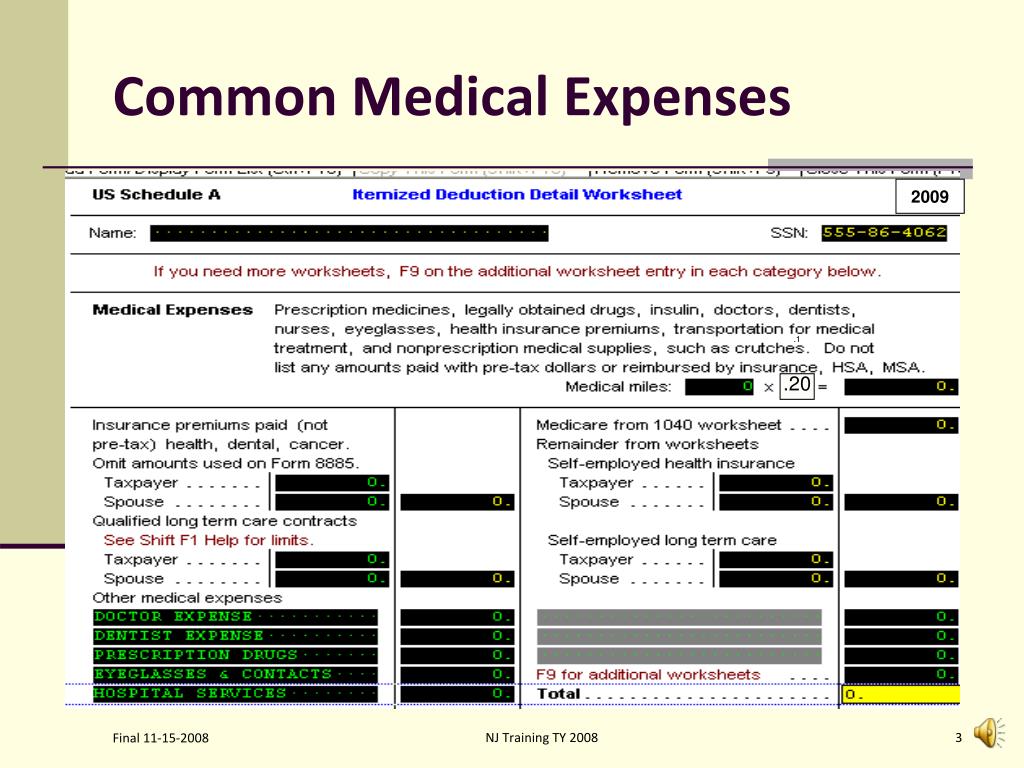

PPT Itemized Deductions PowerPoint Presentation, free download ID

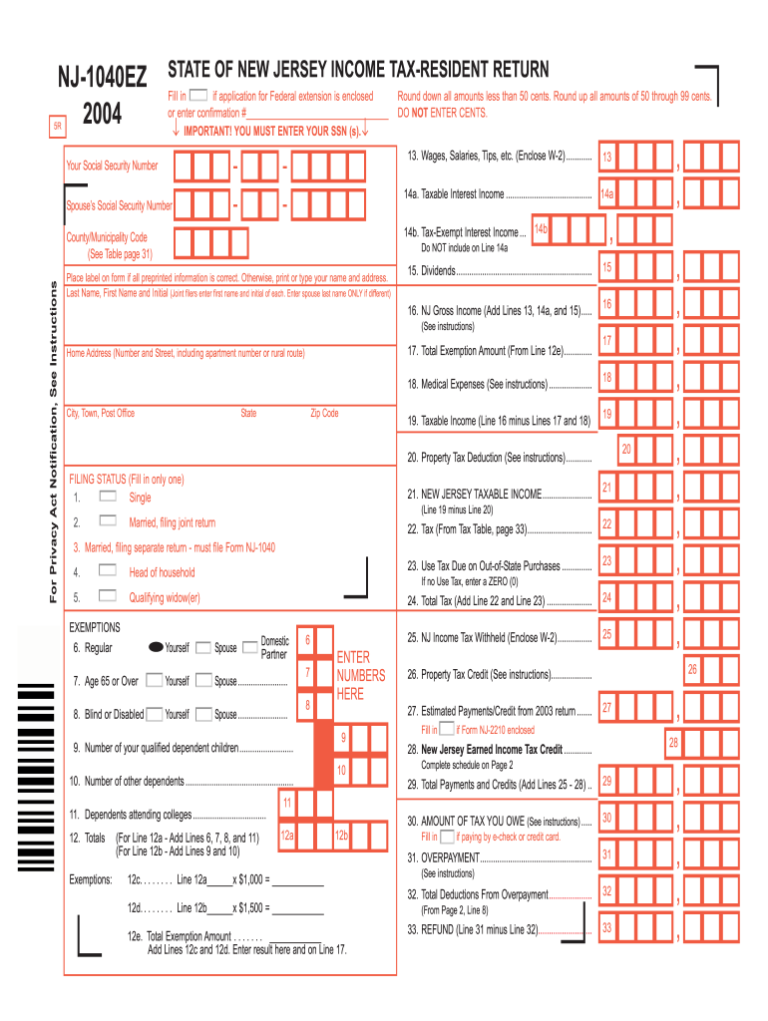

Nj 1040 Fill Online Printable Fillable Blank PDFfiller 1040 Form

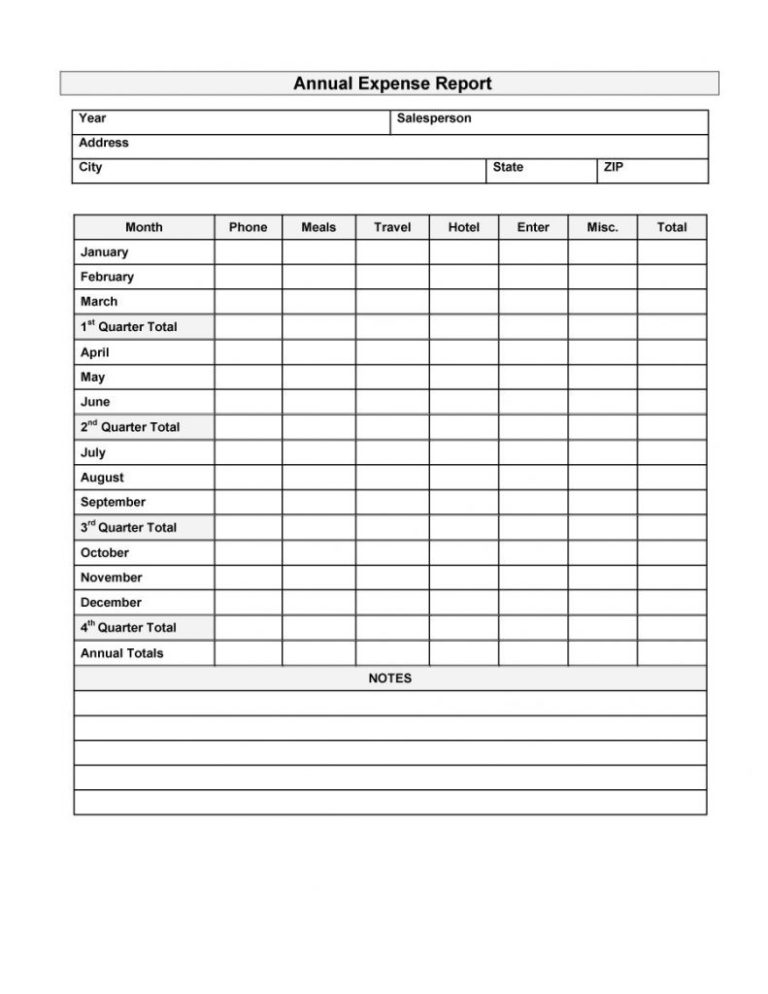

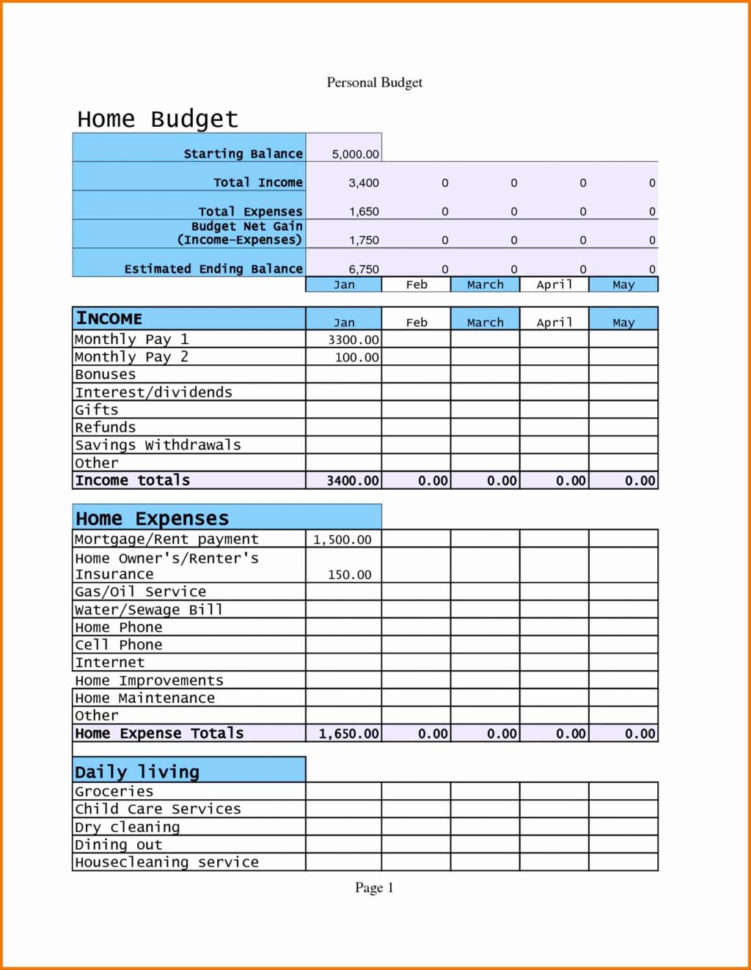

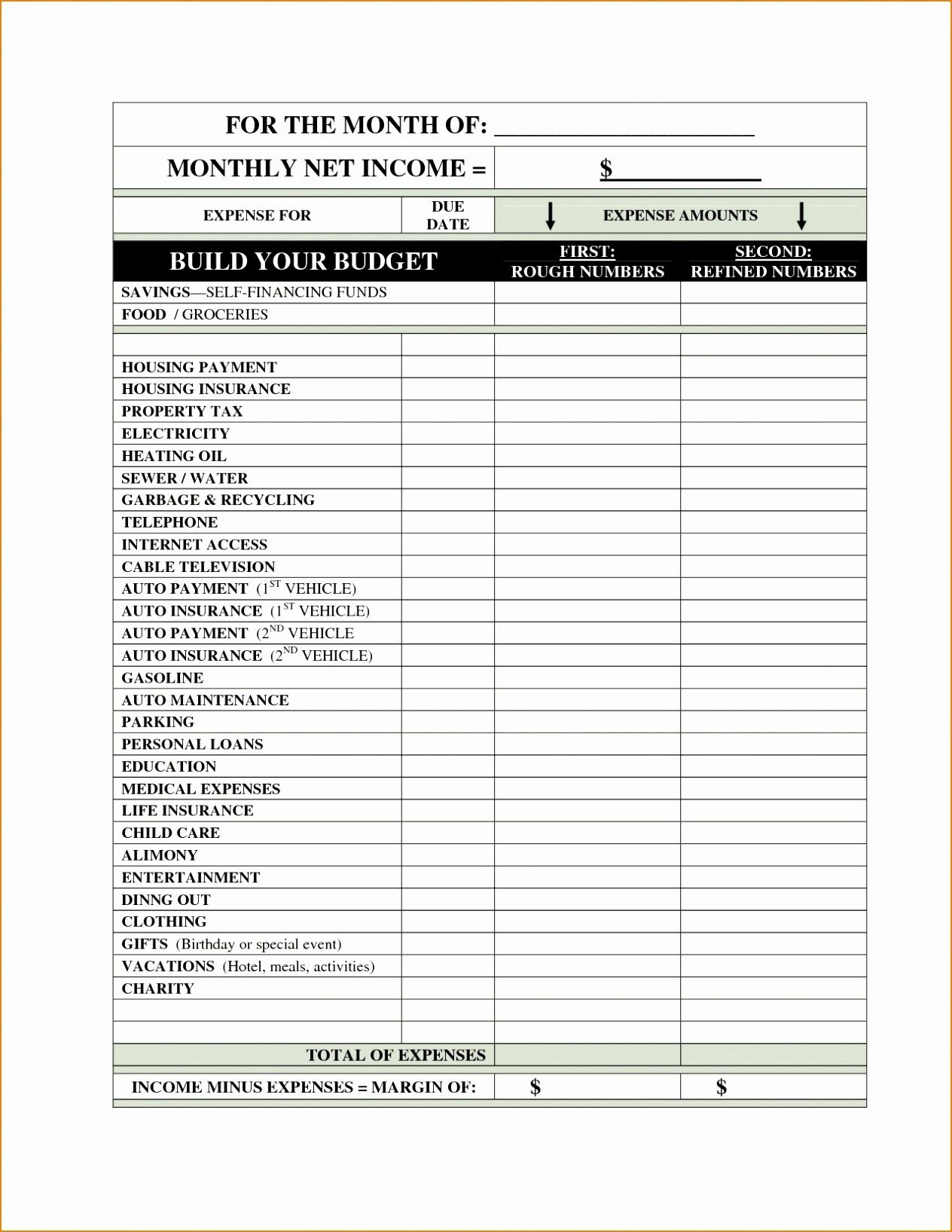

Keep Track Of Medical Expenses Spreadsheet with Track Expenses

New Jersey Resident Return New Jersey Free Download

Sample Timesheet Report Sample Web u

Excel Spreadsheet For Medical Expenses Google Spreadshee excel

Schedule A Medical Expenses Worksheet —

Web Medical Expenses Deduction On New Jersey Individual Return.

Claiming Medical Expense Deductions On Your Tax Return Is One Way To Lower Your Tax Bill.

Covid19.Nj.gov Call Njpies Call Center For Medical Information Related To Covid:

Web The Nj Medical Expense Deduction Is Calculated On Worksheet F.

Related Post: