Nj Pension Exclusion Worksheet

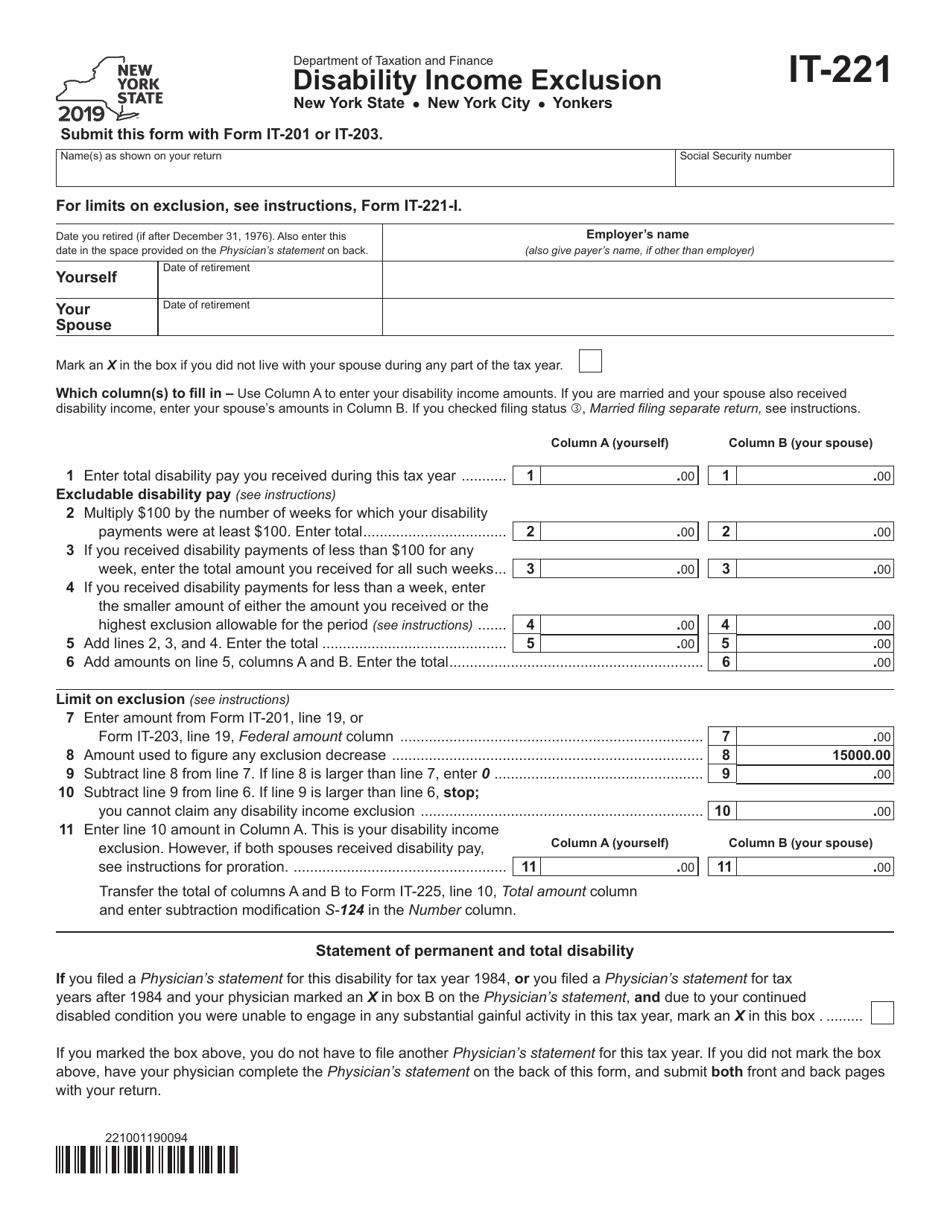

Nj Pension Exclusion Worksheet - Web for 2020, for a married couple filing jointly, the exclusion is $100,000. The 'pension exclusion' and the 'other retirement income exclusion,' kiely said. If you are filing a resident. Web new jersey actually has two exclusions; You qualify for the new jersey pension exclusion if you and/or your spouse, if filing jointly, are 62 or older on dec. Under the general rule, you figure the. For a married person filing separately, the exclusion is $50,000. So the pension exclusion offsets your. Web if you use the general rule method, part of your pension or annuity payment is taxable and part is excluded from your income every year. Web it’s a big help — if you qualify. It appears that turbotax included a $6,000 special. For a married person filing separately, the exclusion is $50,000. The unclaimed pension exclusion and the special exclusion. Web in completing nj tax worksheet d manually, i calculated an exclusion of $6,000 less than turbotax. Web for 2020, for a married couple filing jointly, the exclusion is $100,000. If you are filing a resident. And for an individual filing as. Web it’s a big help — if you qualify. Web new jersey allows taxpayers aged 62 or older to exclude pension income from taxation if their income was at or below a certain amount, said bernie kiely, a. Under the general rule, you figure the. Web it’s a big help — if you qualify. Web the 2019 pension exclusion allows married couples who file jointly can exclude $80,000 of income, married filing separately can exclude $40,000 and singles. Web if you use the general rule method, part of your pension or annuity payment is taxable and part is excluded from your income every year. You. Web new jersey actually has two exclusions; Web in completing nj tax worksheet d manually, i calculated an exclusion of $6,000 less than turbotax. Web new jersey allows taxpayers aged 62 or older to exclude pension income from taxation if their income was at or below a certain amount, said bernie kiely, a. Web for 2020, for a married couple. Web new jersey actually has two exclusions; Web there are two parts to the exclusion: Web new jersey allows taxpayers aged 62 or older to exclude pension income from taxation if their income was at or below a certain amount, said bernie kiely, a. And for an individual filing as. Web the 2019 pension exclusion allows married couples who file. Web for 2020, for a married couple filing jointly, the exclusion is $100,000. If you are filing a resident. Web it’s a big help — if you qualify. If you did not use your. The unclaimed pension exclusion and the special exclusion. And for an individual filing as. The 'pension exclusion' and the 'other retirement income exclusion,' kiely said. Web there are two parts to the exclusion: Web the 2019 pension exclusion allows married couples who file jointly can exclude $80,000 of income, married filing separately can exclude $40,000 and singles. Web the general rule. Under the general rule, you figure the. The unclaimed pension exclusion and the special exclusion. Web new jersey actually has two exclusions; If you are filing a resident. Web it’s a big help — if you qualify. If you receive annuity payments from a nonqualified retirement plan, you must use the general rule. It appears that turbotax included a $6,000 special. Web the 2019 pension exclusion allows married couples who file jointly can exclude $80,000 of income, married filing separately can exclude $40,000 and singles. Web for 2020, for a married couple filing jointly, the exclusion is. The 'pension exclusion' and the 'other retirement income exclusion,' kiely said. And for an individual filing as. Web if you use the general rule method, part of your pension or annuity payment is taxable and part is excluded from your income every year. Under the general rule, you figure the. Web there are two parts to the exclusion: Web it’s a big help — if you qualify. You qualify for the new jersey pension exclusion if you and/or your spouse, if filing jointly, are 62 or older on dec. The 'pension exclusion' and the 'other retirement income exclusion,' kiely said. If you did not use your. Web for 2020, for a married couple filing jointly, the exclusion is $100,000. Web if you use the general rule method, part of your pension or annuity payment is taxable and part is excluded from your income every year. Web the 2019 pension exclusion allows married couples who file jointly can exclude $80,000 of income, married filing separately can exclude $40,000 and singles. Web new jersey actually has two exclusions; For a married person filing separately, the exclusion is $50,000. The unclaimed pension exclusion and the special exclusion. If you are filing a resident. Web in completing nj tax worksheet d manually, i calculated an exclusion of $6,000 less than turbotax. Under the general rule, you figure the. If you receive annuity payments from a nonqualified retirement plan, you must use the general rule. Web the general rule. So the pension exclusion offsets your. Web new jersey allows taxpayers aged 62 or older to exclude pension income from taxation if their income was at or below a certain amount, said bernie kiely, a. It appears that turbotax included a $6,000 special. Web there are two parts to the exclusion: And for an individual filing as. Web new jersey allows taxpayers aged 62 or older to exclude pension income from taxation if their income was at or below a certain amount, said bernie kiely, a. And for an individual filing as. Web the general rule. If you did not use your. Under the general rule, you figure the. So the pension exclusion offsets your. If you receive annuity payments from a nonqualified retirement plan, you must use the general rule. Web if you use the general rule method, part of your pension or annuity payment is taxable and part is excluded from your income every year. Web it’s a big help — if you qualify. Web for 2020, for a married couple filing jointly, the exclusion is $100,000. Web the 2019 pension exclusion allows married couples who file jointly can exclude $80,000 of income, married filing separately can exclude $40,000 and singles. The 'pension exclusion' and the 'other retirement income exclusion,' kiely said. The unclaimed pension exclusion and the special exclusion. If you are filing a resident. It appears that turbotax included a $6,000 special. You qualify for the new jersey pension exclusion if you and/or your spouse, if filing jointly, are 62 or older on dec.Form IT221 Download Fillable PDF or Fill Online Disability

43 colorado pension and annuity exclusion worksheet Worksheet For Fun

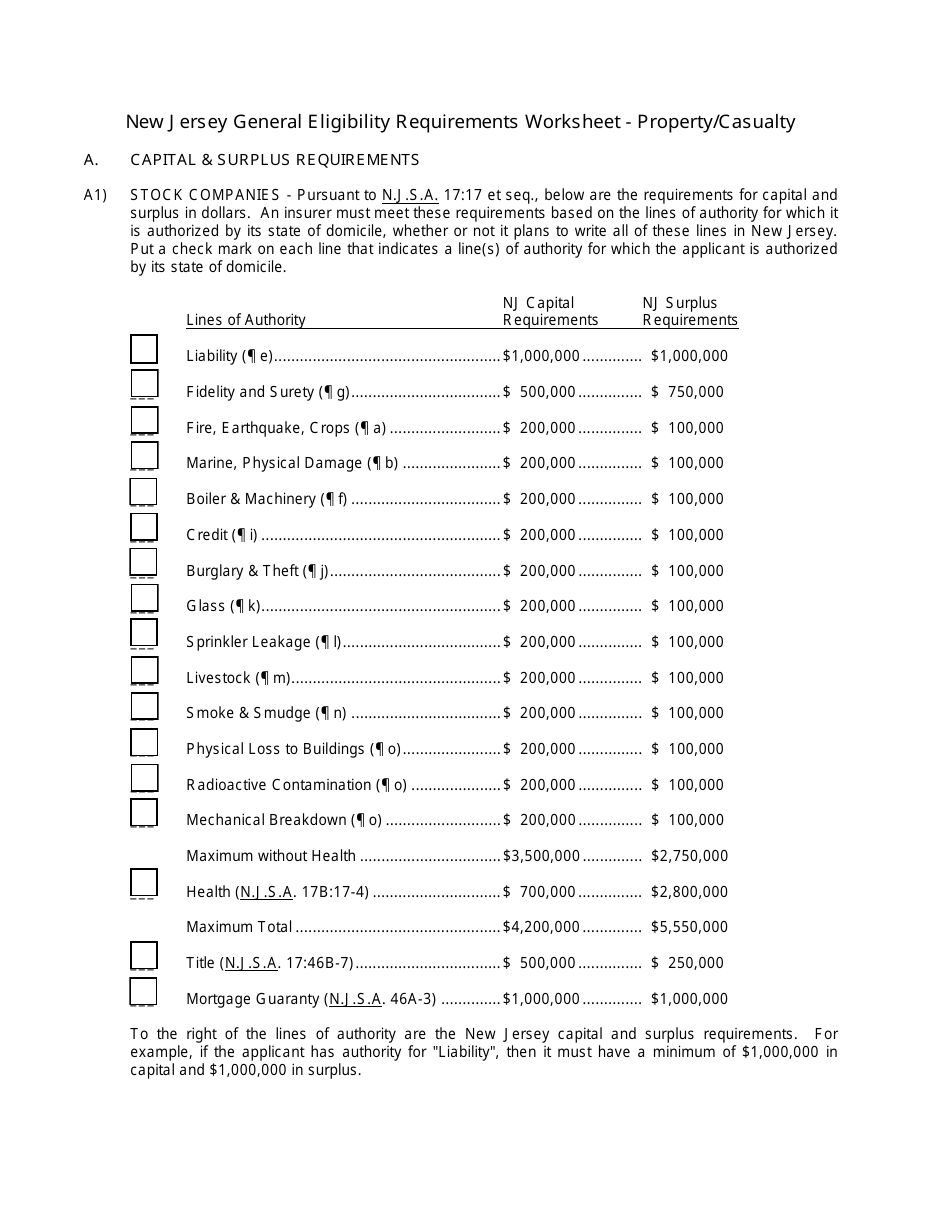

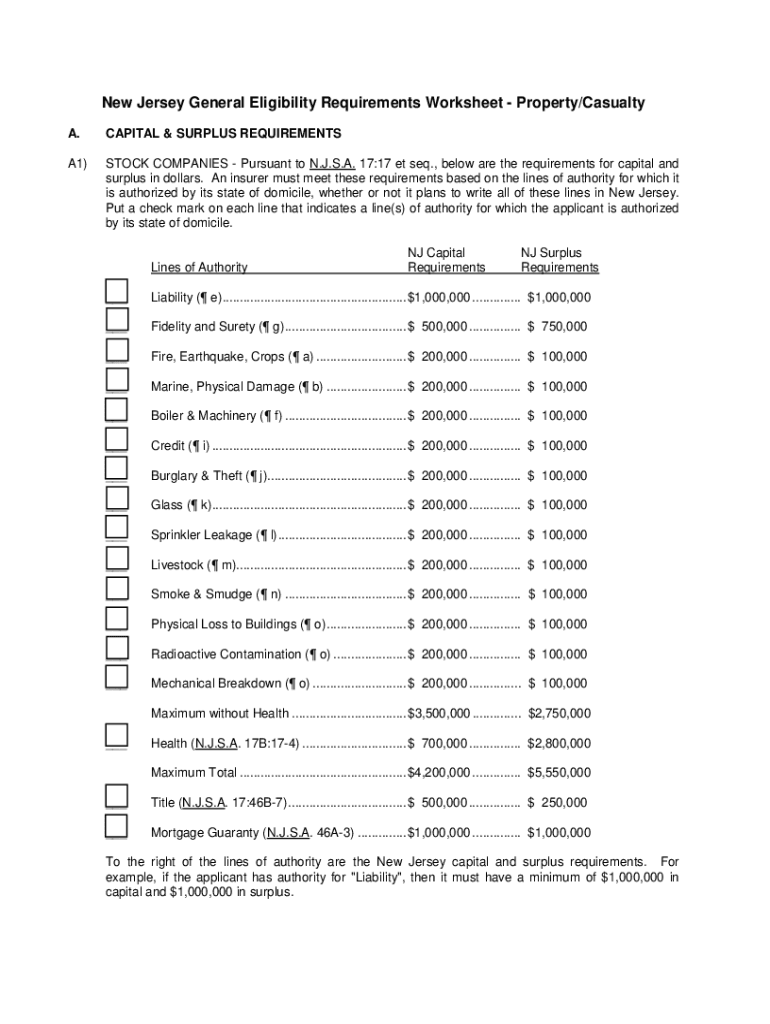

New Jersey New Jersey General Eligibility Requirements Worksheet

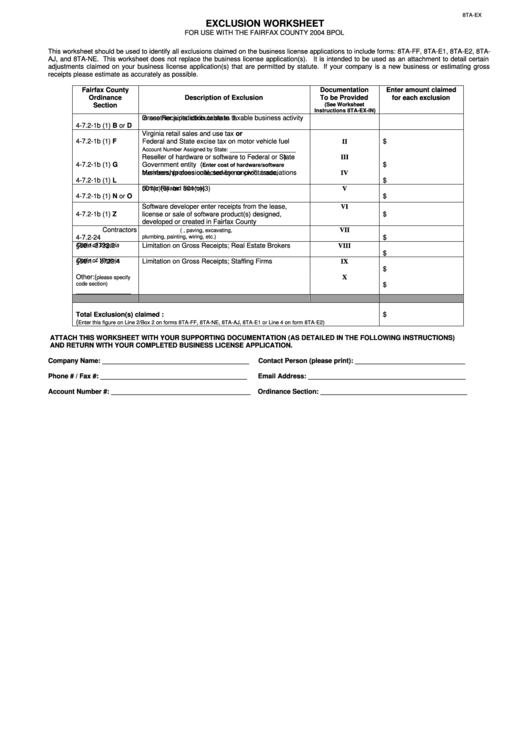

Form 8taEx Exclusion Worksheet For Use With The Fairfax County 2004

ACCT362 Pension Plan Worksheet 1 YouTube

Worksheet B Earned Credit Eic Uncategorized Resume Examples

New Jersey General Eligibility Requirements Worksheet Fill Out and

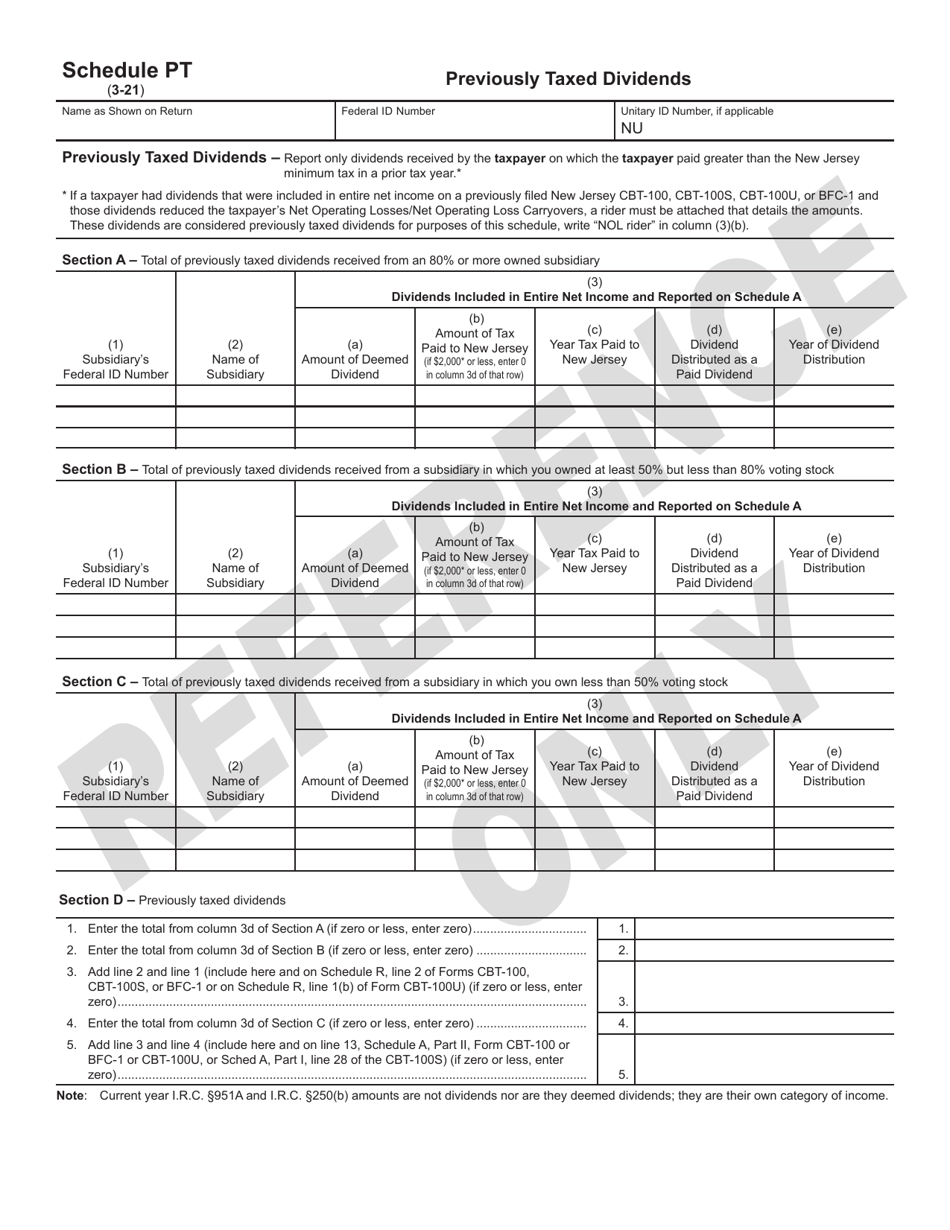

Schedule PT Download Printable PDF or Fill Online Dividend Exclusion

Maryland Pension Exclusion 2017

What You Need to Know About the NJ Pension Exclusion Access Wealth

Web In Completing Nj Tax Worksheet D Manually, I Calculated An Exclusion Of $6,000 Less Than Turbotax.

For A Married Person Filing Separately, The Exclusion Is $50,000.

Web There Are Two Parts To The Exclusion:

Web New Jersey Actually Has Two Exclusions;

Related Post: