Nol Calculation Worksheet

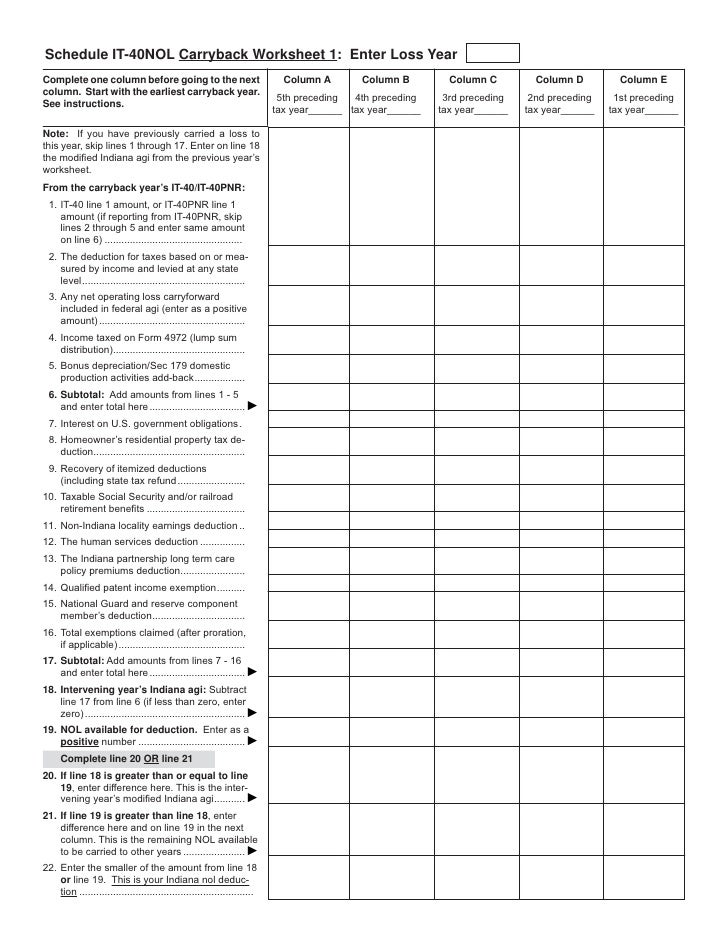

Nol Calculation Worksheet - This tax worksheet calculates a personal income tax current year net operating loss and carryover. An individual, estate, or trust files form 1045 to apply for a quick tax refund resulting from: Web the issue is that turbotax does not calculate the nol therefore the worksheet does not exist in turbotax. Questions with zero are included. Web worksheet #1 is a table of all multiplication facts with zero or one as a factor. If you have a nol you can carry this loss to another year and use. Form 1040, line 11b (taxable income) + nol deduction = nol carryover calculation worksheet 1, line 2. Form 1045, net operating loss worksheet. Below are six versions of our grade 5 math worksheet on multiplying whole numbers. Web net operating losses (nols) example calculation. The amount is calculated as follows: Solved•by intuit•34•updated december 21, 2022. Below are six versions of our grade 5 math worksheet on multiplying whole numbers. While you can enter the nol into turbotax as. Web a net operating loss (nol) is what it is called when a business’ allowable deductions exceed its gross income in a tax year. Calculating the net operating loss. Solved•by intuit•34•updated december 21, 2022. Web the issue is that turbotax does not calculate the nol therefore the worksheet does not exist in turbotax. Web a net operating loss (nol) is what it is called when a business’ allowable deductions exceed its gross income in a tax year. This bloomberg tax portfolio examines the background. 0 & 1 times tables: Form 1040, line 11b (taxable income) + nol deduction = nol carryover calculation worksheet 1, line 2. Questions with zero are included. Web if your deductions for the year are more than your income for the year, you may have a net operating loss (nol). This tax worksheet calculates a personal income tax current year. Web net operating losses (nols) example calculation. Calculating the net operating loss. This bloomberg tax portfolio examines the background and rationale of irc §172, provides. The amount is calculated as follows: An individual, estate, or trust files form 1045 to apply for a quick tax refund resulting from: Web the issue is that turbotax does not calculate the nol therefore the worksheet does not exist in turbotax. If you have a nol you can carry this loss to another year and use. Below are six versions of our grade 5 math worksheet on multiplying whole numbers. Questions with zero are included. An individual, estate, or trust files form. For our illustrative modeling exercise, our company has the following assumptions. Below are six versions of our grade 5 math worksheet on multiplying whole numbers. An individual, estate, or trust files form 1045 to apply for a quick tax refund resulting from: Web if your business loss is large enough to wipe out all other income sources, it is called. Web if your deductions for the year are more than your income for the year, you may have a net operating loss (nol). Multiplication facts practice with all factors less than 5, vertical format. Proseries professional has a net operating loss worksheet that. Web the issue is that turbotax does not calculate the nol therefore the worksheet does not exist. Below are six versions of our grade 5 math worksheet on multiplying whole numbers. Calculating the net operating loss. An individual, estate, or trust files form 1045 to apply for a quick tax refund resulting from: Form 1045, net operating loss worksheet. This bloomberg tax portfolio examines the background and rationale of irc §172, provides. Web if your deductions for the year are more than your income for the year, you may have a net operating loss (nol). 0 & 1 times tables: Publication 536 covers nols for individuals, estates and trusts:. Proseries professional has a net operating loss worksheet that. Web common questions for nols in proseries. Multiplication facts practice with all factors less than 5, vertical format. Form 1040, line 11b (taxable income) + nol deduction = nol carryover calculation worksheet 1, line 2. If you have a nol you can carry this loss to another year and use. While you can enter the nol into turbotax as. Below are six versions of our grade 5. Web worksheet #1 is a table of all multiplication facts with zero or one as a factor. Publication 536 covers nols for individuals, estates and trusts:. Web if your deductions for the year are more than your income for the year, you may have a net operating loss (nol). Calculating the net operating loss. Solved•by intuit•34•updated december 21, 2022. This tax worksheet calculates a personal income tax current year net operating loss and carryover. While you can enter the nol into turbotax as. Web net operating losses (nols) example calculation. Web if your business loss is large enough to wipe out all other income sources, it is called a net operating loss (nol). Form 1040, line 11b (taxable income) + nol deduction = nol carryover calculation worksheet 1, line 2. Web common questions for nols in proseries. Web a net operating loss (nol) is what it is called when a business’ allowable deductions exceed its gross income in a tax year. Multiplication facts practice with all factors less than 5, vertical format. The amount is calculated as follows: If you have a nol you can carry this loss to another year and use. An individual, estate, or trust files form 1045 to apply for a quick tax refund resulting from: Form 1045, net operating loss worksheet. Questions with zero are included. For our illustrative modeling exercise, our company has the following assumptions. Web the issue is that turbotax does not calculate the nol therefore the worksheet does not exist in turbotax. Proseries professional has a net operating loss worksheet that. This bloomberg tax portfolio examines the background and rationale of irc §172, provides. Calculating the net operating loss. Web worksheet #1 is a table of all multiplication facts with zero or one as a factor. This tax worksheet calculates a personal income tax current year net operating loss and carryover. Form 1045, net operating loss worksheet. Web a net operating loss (nol) is what it is called when a business’ allowable deductions exceed its gross income in a tax year. Questions with zero are included. Below are six versions of our grade 5 math worksheet on multiplying whole numbers. For our illustrative modeling exercise, our company has the following assumptions. If you have a nol you can carry this loss to another year and use. 0 & 1 times tables: Web if your business loss is large enough to wipe out all other income sources, it is called a net operating loss (nol). Web net operating losses (nols) example calculation. Publication 536 covers nols for individuals, estates and trusts:. Form 1040, line 11b (taxable income) + nol deduction = nol carryover calculation worksheet 1, line 2.Net Operating Loss Computation for Individuals

Nol Calculation Worksheet Excel Ivuyteq

AMT NOL Calculation Worksheet Alternative Minimum Tax Tax Deduction

Nol Calculation Worksheet Excel Worksheet List

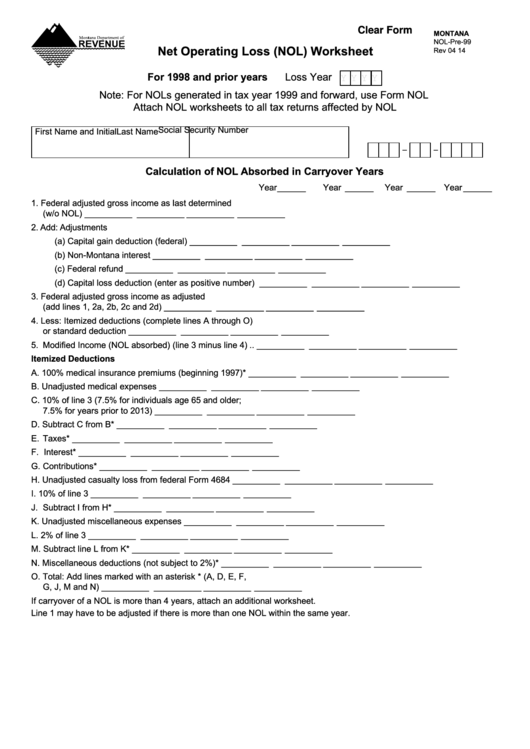

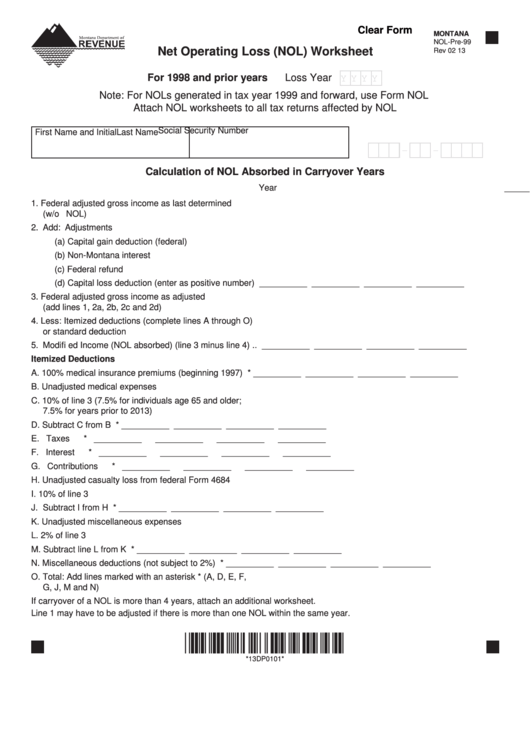

Fillable Form NolPre99 Net Operating Loss (Nol) Worksheet 2014

Fillable Form NolPre99 Net Operating Loss (Nol) Worksheet (For 1998

Nol Calculation Worksheet Excel Ivuyteq

Nol Calculation Worksheet Excel Worksheet List

Nol Calculation Worksheet Excel Worksheet List

Nol Calculation Worksheet Excel Ivuyteq

Web If Your Deductions For The Year Are More Than Your Income For The Year, You May Have A Net Operating Loss (Nol).

Web The Issue Is That Turbotax Does Not Calculate The Nol Therefore The Worksheet Does Not Exist In Turbotax.

While You Can Enter The Nol Into Turbotax As.

Web Common Questions For Nols In Proseries.

Related Post: