Nol Carryover Worksheet Excel

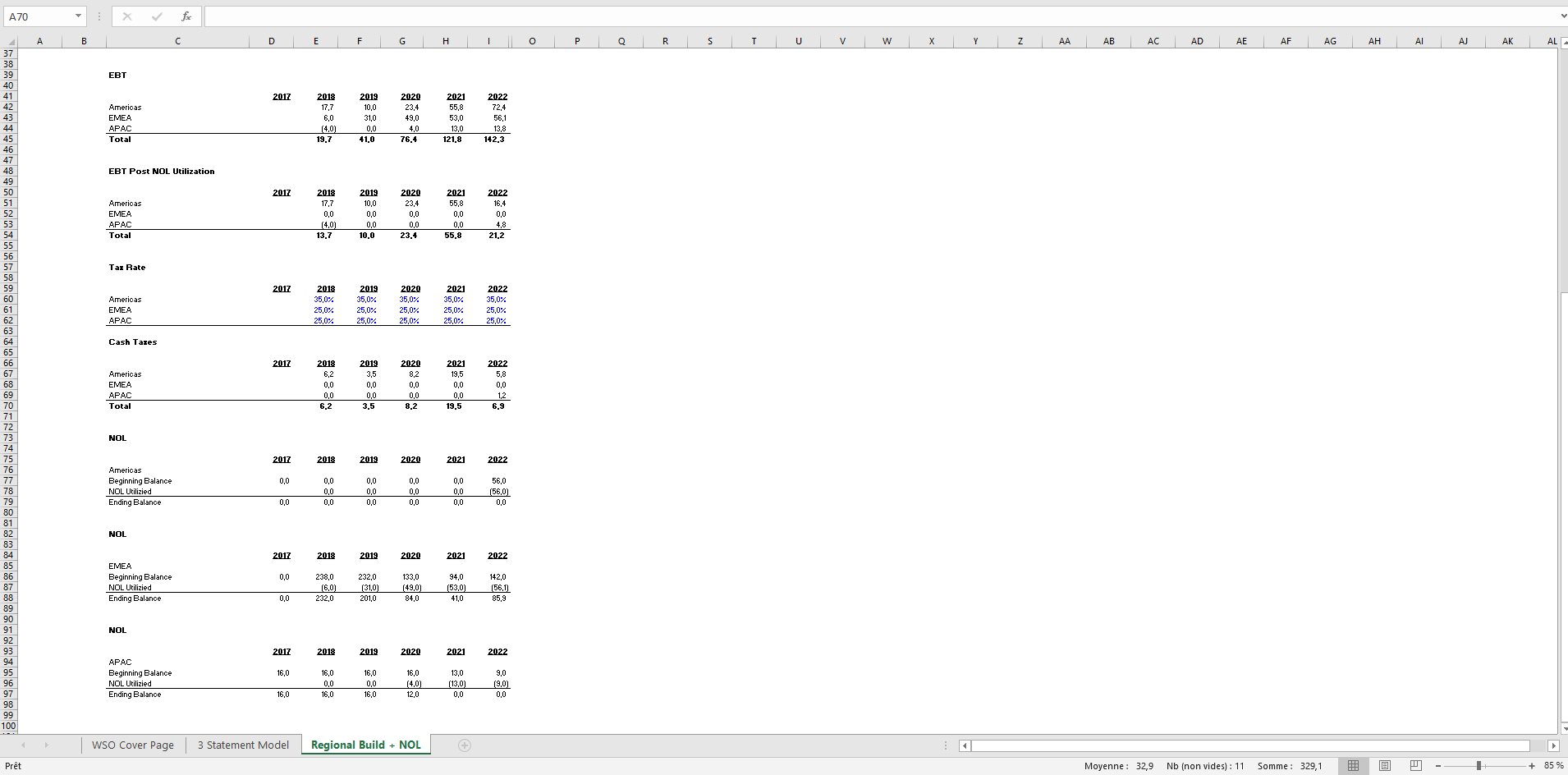

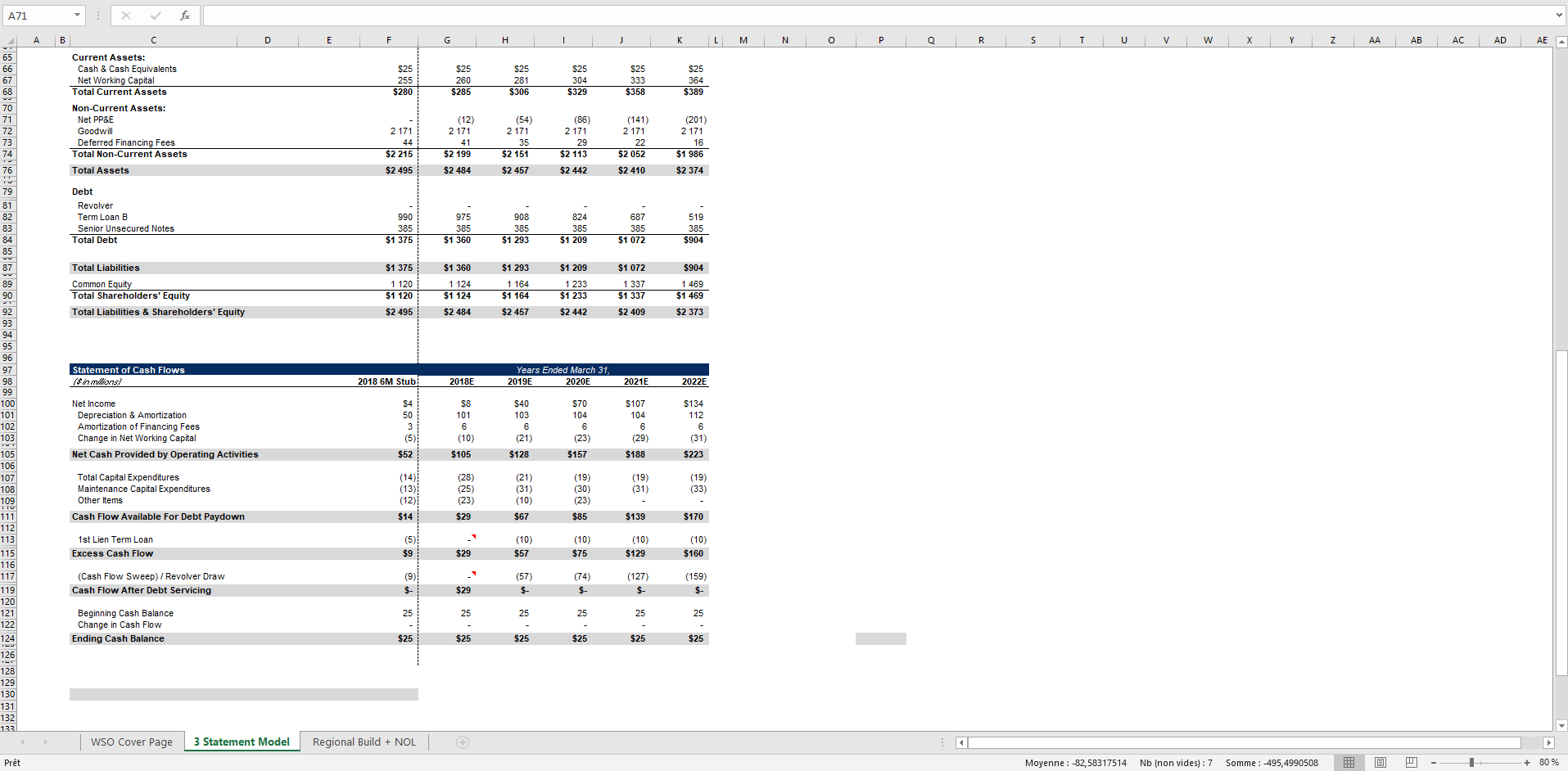

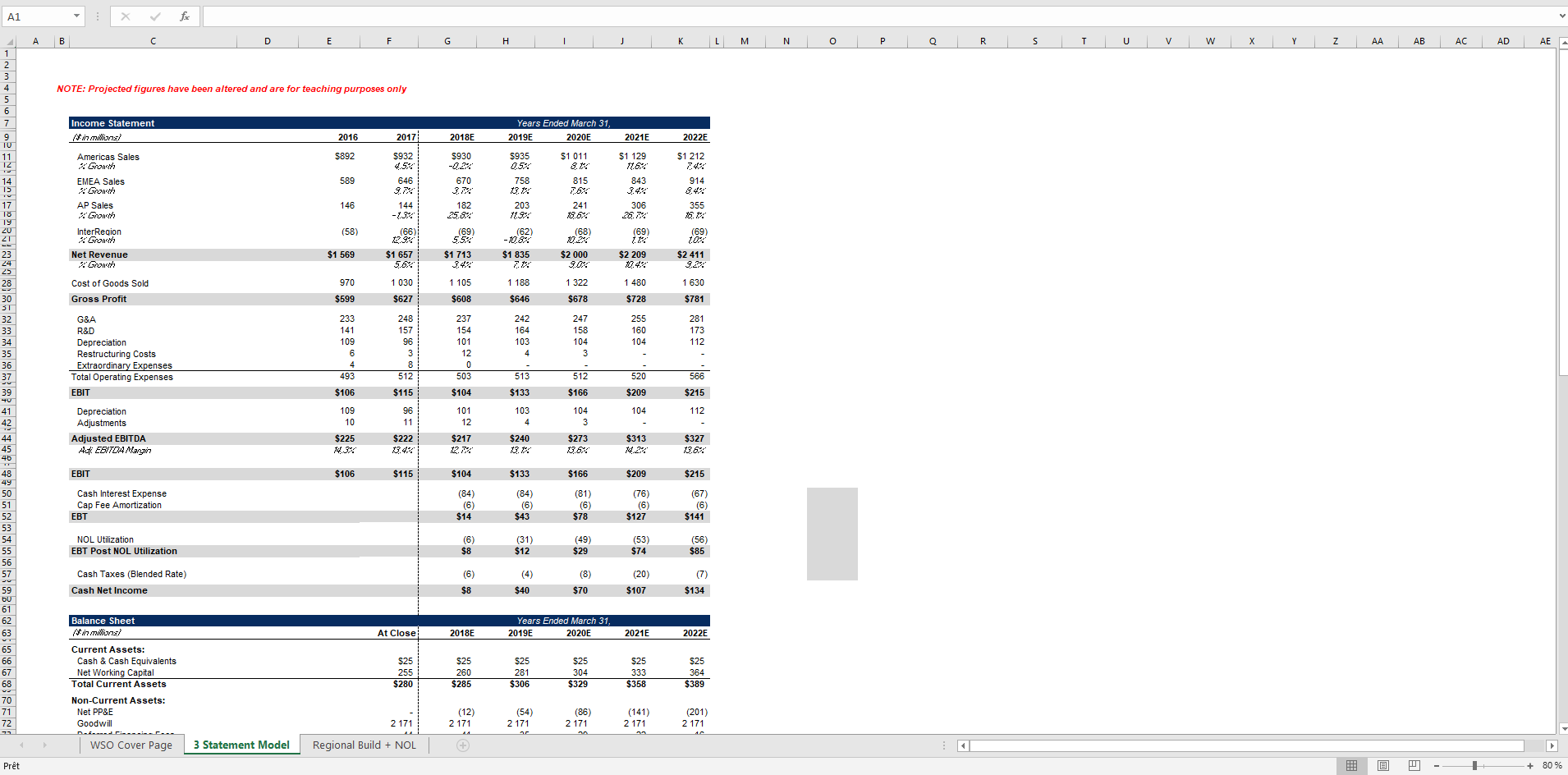

Nol Carryover Worksheet Excel - Web nebraska corporation net operating loss worksheet) on line 11 of form 1120n, or on line 6 of form 1120xn. Web net operating losses (nols) are who tax benefits providing to a company operate at a loss beneath u.s. Web go to income/deductions > click net operating loss worksheet. Web use this worksheet to compute the corporate taxpayer’s nebraska net operating loss (nol) carryforward. Web if you have a wisconsin nol carryover from more than one loss year which can be applied to a certain year, add all of your wisconsin nol carryovers to that year together. Web nols are tax credits carried forward to offset positive taxable profits, which reduces future income taxes. The taxable total the negative. This worksheet must be attached to the nebraska corporation income. Type 'nol' in the search area, then click on ' jump to nol'. Figuring your nol.3 when to use an nol.4 waiving the carryback period.5 how to carry an nol back or. Download wso's free net operating loss ( nol) carryforward model template below! Form 1040, line 11b (taxable income) + nol deduction = nol carryover calculation worksheet 1, line 2. Enter the number of years you wish to carry back the nol; This worksheet must be attached to the nebraska corporation income. This template allows you to model a. Web net operating loss worksheet/form 1045; Web nebraska corporation net operating loss worksheet) on line 11 of form 1120n, or on line 6 of form 1120xn. This worksheet must be attached to the nebraska corporation income. Web february 19, 2020 2:11 pm. The amount is calculated as follows: Type 'nol' in the search area, then click on ' jump to nol'. Ultratax/1120 determines if any normal carryover is available by netting the prior. Some of the worksheets displayed are 2020 publication 536, work 3 record of wisconsin nol carryback and, net. Web nol steps.2 how to figure an nol.2 worksheet 1. Enter the number of years you wish. This tax worksheet calculates a personal income tax current year net operating loss and carryover. Web net operating loss worksheet/form 1045; How do i reduce the nol carryover the reflect amounts no longer available? Web nols are tax credits carried forward to offset positive taxable profits, which reduces future income taxes. The amount is calculated as follows: Form 1040, line 11b (taxable income) + nol deduction = nol carryover calculation worksheet 1, line 2. Web net operating losses (nols) will the tax benefits provided on a company operating at ampere net under u.s. Web net operating loss worksheet/form 1045; Web february 19, 2020 2:11 pm. Create a line that’s the opening balance. Create a line that’s the opening balance. Web steps to create a tax loss carryforward schedule in excel: Web february 19, 2020 2:11 pm. Web use this worksheet to compute the corporate taxpayer’s nebraska net operating loss (nol) carryforward. Web nols are tax credits carried forward to offset positive taxable profits, which reduces future income taxes. Form 1040, line 11b (taxable income) + nol deduction = nol carryover calculation worksheet 1, line 2. Calculate the firm’s earnings before tax (ebt) for each year. Ultratax/1120 determines if any normal carryover is available by netting the prior. Web net operating losses (nols) will the tax benefits provided on a company operating at ampere net under u.s. Web if. The taxable income is negatively. This template allows you to model a. Enter the number of years you wish to carry back the nol; This worksheet must be attached to the nebraska corporation income. Web net operating losses (nols) are who tax benefits providing to a company operate at a loss beneath u.s. Web net operating losses (nols) are who tax benefits providing to a company operate at a loss beneath u.s. Download wso's free net operating loss ( nol) carryforward model template below! Web nols are tax credits carried forward to offset positive taxable profits, which reduces future income taxes. You should be able to enter your net operating loss carryover amounts.. Web nol steps.2 how to figure an nol.2 worksheet 1. Web steps to create a tax loss carryforward schedule in excel: Web nebraska corporation net operating loss worksheet) on line 11 of form 1120n, or on line 6 of form 1120xn. The amount is calculated as follows: Web go to income/deductions > click net operating loss worksheet. Type 'nol' in the search area, then click on ' jump to nol'. Web nol steps.2 how to figure an nol.2 worksheet 1. Figuring your nol.3 when to use an nol.4 waiving the carryback period.5 how to carry an nol back or. The taxable income is negatively. Ultratax/1120 determines if any normal carryover is available by netting the prior. This tax worksheet calculates a personal income tax current year net operating loss and carryover. Web nols are tax credits carried forward to offset positive taxable profits, which reduces future income taxes. Web net operating losses (nols) are who tax benefits providing to a company operate at a loss beneath u.s. The taxable total the negative. Create a line that’s the opening balance. Enter the number of years you wish to carry back the nol; Download wso's free net operating loss ( nol) carryforward model template below! Web steps to create a tax loss carryforward schedule in excel: Specific instructions complete the name of the corporation, federal id. Web february 19, 2020 2:11 pm. The amount is calculated as follows: Web nebraska corporation net operating loss worksheet) on line 11 of form 1120n, or on line 6 of form 1120xn. Web go to income/deductions > click net operating loss worksheet. Web use this worksheet to compute the corporate taxpayer’s nebraska net operating loss (nol) carryforward. Web net operating loss worksheet/form 1045; Type 'nol' in the search area, then click on ' jump to nol'. You should be able to enter your net operating loss carryover amounts. This template allows you to model a. Some of the worksheets displayed are 2020 publication 536, work 3 record of wisconsin nol carryback and, net. Web february 19, 2020 2:11 pm. Web net operating losses (nols) will the tax benefits provided on a company operating at ampere net under u.s. Specific instructions complete the name of the corporation, federal id. Web net operating loss worksheet/form 1045; Calculate the firm’s earnings before tax (ebt) for each year. Web use this worksheet to compute the corporate taxpayer’s nebraska net operating loss (nol) carryforward. Web steps to create a tax loss carryforward schedule in excel: Web if you have a wisconsin nol carryover from more than one loss year which can be applied to a certain year, add all of your wisconsin nol carryovers to that year together. Create a line that’s the opening balance. Ultratax/1120 determines if any normal carryover is available by netting the prior. The amount is calculated as follows: Web nols are tax credits carried forward to offset positive taxable profits, which reduces future income taxes.nol carryover worksheet excel Fill Online, Printable, Fillable Blank

Net Operating Loss (NOL) Carryforward Excel Model Template Eloquens

Net Operating Loss (NOL) Carryforward Excel Model Template Eloquens

T201 Tax Loss Carryforwards YouTube

Nol Calculation Worksheet Excel Worksheet List

Nol Carryover Worksheet Master of Documents

Net Operating Loss (NOL) Carryforward Excel Model Template Eloquens

Entering a NOL Carryover in the Corporate Module Accountants Community

Net Operating Loss (NOL) Carryforward Excel Model Template Eloquens

Nol Carryover Worksheet Master of Documents

This Worksheet Must Be Attached To The Nebraska Corporation Income.

How Do I Reduce The Nol Carryover The Reflect Amounts No Longer Available?

Web Go To Income/Deductions > Click Net Operating Loss Worksheet.

This Tax Worksheet Calculates A Personal Income Tax Current Year Net Operating Loss And Carryover.

Related Post: