Nol Worksheet

Nol Worksheet - Web to access the worksheet net operating loss worksheet: Web nols are tax credits carried forward to offset positive taxable profits, which reduces future income taxes. This template allows you to model a company. Web use the worksheet on page 8 (instructions on page 7) to calculate the amount to enter on federal schedule 1 (form 1040), line 8. An individual, estate, or trust files form 1045 to apply for a quick tax refund resulting from: Web how is nol worksheet 2, line 2 (taxable income without the nol deduction) calculated? Web common questions for nols in proseries. Proseries professional has a net operating loss worksheet that. If you incurred a nol before january 1, 2018, and if your federal taxable income, computed without the nol deduction is less. The amount is calculated as follows: This template allows you to model a company. Web type 'nol' in the search area, then click on 'jump to nol'. An individual, estate, or trust files form 1045 to apply for a quick tax refund resulting from: The amount is calculated as follows: If you do not have a current year. The amount is calculated as follows: Web about publication 536, net operating losses (nols) for individuals, estates, and trusts. Download wso's free net operating loss ( nol) carryforward model template below! Proseries professional has a net operating loss worksheet that. Section a — california residents only. Web nols are tax credits carried forward to offset positive taxable profits, which reduces future income taxes. Nol, go to part ii. From within your taxact return ( online or desktop), click federal (on smaller devices, click in the top left corner. Web computation of current year. If your deductions for the year are more than your income for the. Web we last updated the nebraska net operating loss worksheet in february 2023, so this is the latest version of form nol, fully updated for tax year 2022. This template allows you to model a company. The amount is calculated as follows: If there are nols being carried forward from. Includes number sense, addition, subtraction, multiplication, division, decimals, fractions, percentages. Web use the worksheet on page 8 (instructions on page 7) to calculate the amount to enter on federal schedule 1 (form 1040), line 8. Web nols are tax credits carried forward to offset positive taxable profits, which reduces future income taxes. Web type 'nol' in the search area, then click on 'jump to nol'. This template allows you to. Form 1040, line 10 (taxable income) + nol. Includes number sense, addition, subtraction, multiplication, division, decimals, fractions, percentages and. Web how is nol worksheet 2, line 2 (taxable income without the nol deduction) calculated? Web to access the worksheet net operating loss worksheet: Intermediate level >> grammar worksheets >> gap fill worksheet to help students see the difference. Web common questions for nols in proseries. Web how is nol worksheet 2, line 2 (taxable income without the nol deduction) calculated? You should be able to enter your net operating loss carryover amounts without issue (screenshot). The amount is calculated as follows: Form 1045, net operating loss worksheet. Web how is nol worksheet 2, line 2 (taxable income without the nol deduction) calculated? Form 1045, net operating loss worksheet. This template allows you to model a company. Section a — california residents only. Web type 'nol' in the search area, then click on 'jump to nol'. You should be able to enter your net operating loss carryover amounts without issue (screenshot). If you incurred a nol before january 1, 2018, and if your federal taxable income, computed without the nol deduction is less. From within your taxact return ( online or desktop), click federal (on smaller devices, click in the top left corner. Web about publication. Web our free number line worksheets cater to the learning needs of children in grade 1 through grade 5. Solved•by intuit•34•updated december 21, 2022. Web to access the worksheet net operating loss worksheet: Nol, go to part ii. Web about publication 536, net operating losses (nols) for individuals, estates, and trusts. Section a — california residents only. If there are nols being carried forward from. You should be able to enter your net operating loss carryover amounts without issue (screenshot). Web use the worksheet on page 8 (instructions on page 7) to calculate the amount to enter on federal schedule 1 (form 1040), line 8. Web nols are tax credits carried forward to offset positive taxable profits, which reduces future income taxes. An individual, estate, or trust files form 1045 to apply for a quick tax refund resulting from: Nol for individuals, estates, and trusts. From within your taxact return ( online or desktop), click federal (on smaller devices, click in the top left corner. Web provides random generated math worksheets for 2nd to 5th grades. Web about publication 536, net operating losses (nols) for individuals, estates, and trusts. Missing numbers on a number line. Proseries professional has a net operating loss worksheet that. Intermediate level >> grammar worksheets >> gap fill worksheet to help students see the difference. If you do not have a current year. The amount is calculated as follows: Web we last updated the nebraska net operating loss worksheet in february 2023, so this is the latest version of form nol, fully updated for tax year 2022. Download wso's free net operating loss ( nol) carryforward model template below! Net operating loss (nol) deduction limitation. Form 1045, net operating loss worksheet. Web how is nol worksheet 2, line 2 (taxable income without the nol deduction) calculated? Proseries professional has a net operating loss worksheet that. Web how is nol worksheet 2, line 2 (taxable income without the nol deduction) calculated? From within your taxact return ( online or desktop), click federal (on smaller devices, click in the top left corner. This template allows you to model a company. Missing numbers on a number line. Web we last updated the nebraska net operating loss worksheet in february 2023, so this is the latest version of form nol, fully updated for tax year 2022. Web to access the worksheet net operating loss worksheet: Net operating loss (nol) deduction limitation. If there are nols being carried forward from. Web nols are tax credits carried forward to offset positive taxable profits, which reduces future income taxes. If you incurred a nol before january 1, 2018, and if your federal taxable income, computed without the nol deduction is less. Web about publication 536, net operating losses (nols) for individuals, estates, and trusts. Solved•by intuit•34•updated december 21, 2022. Web computation of current year. Intermediate level >> grammar worksheets >> gap fill worksheet to help students see the difference. Web type 'nol' in the search area, then click on 'jump to nol'.41 nol calculation worksheet excel Worksheet Works

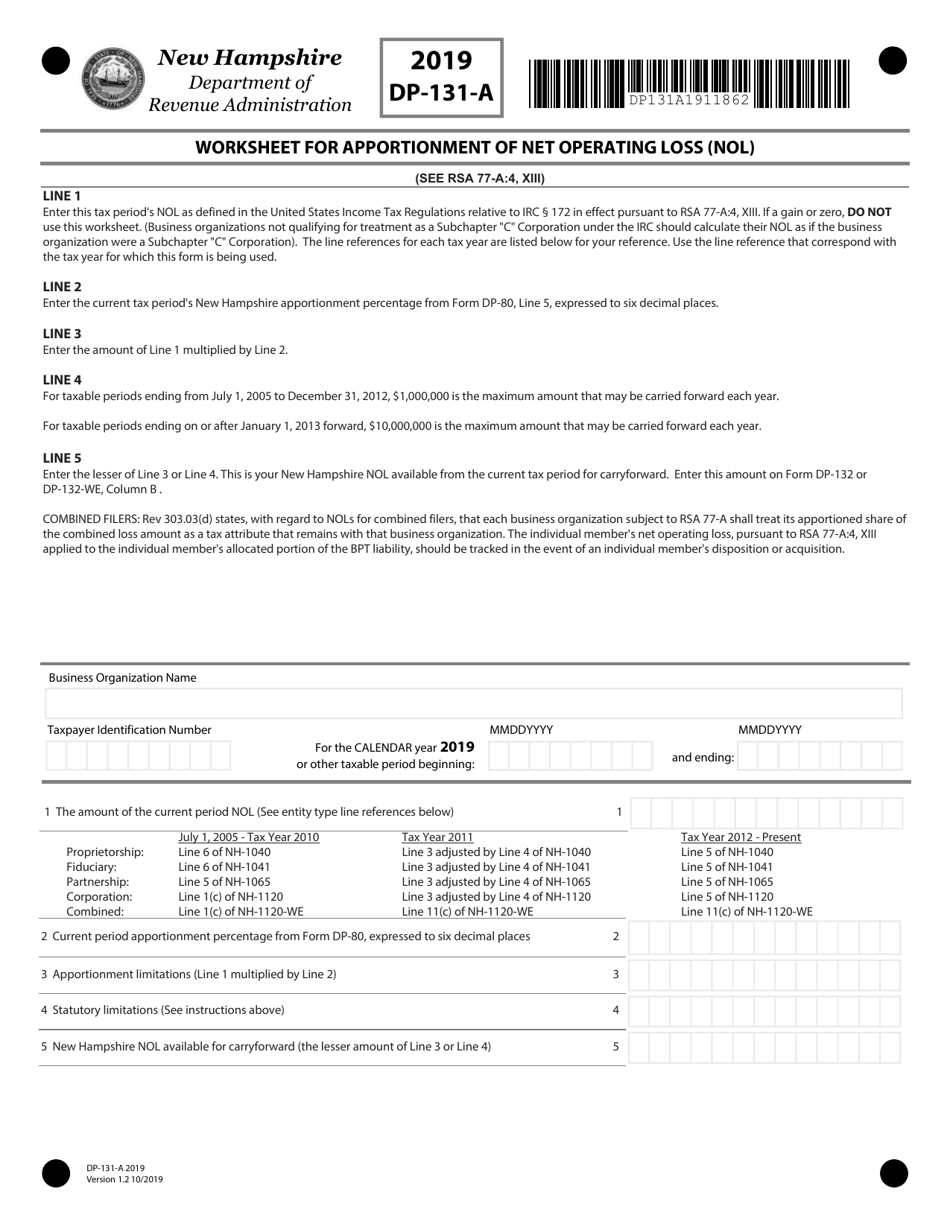

Form DP131A Download Fillable PDF or Fill Online Worksheet for

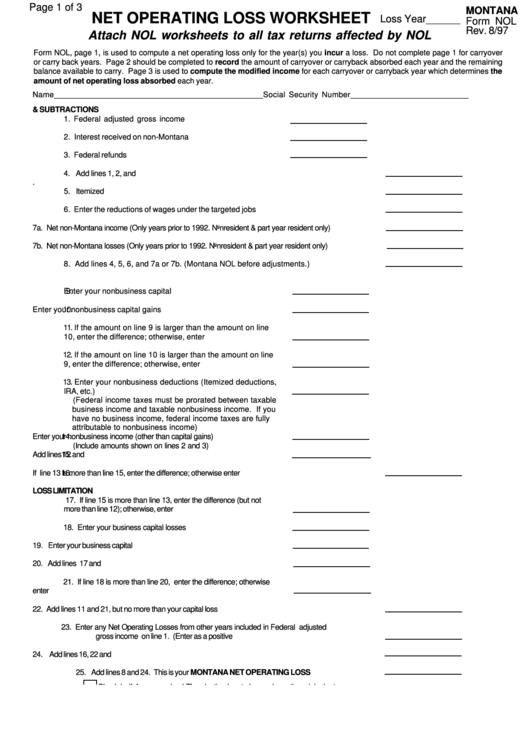

Net Operating Loss Worksheet

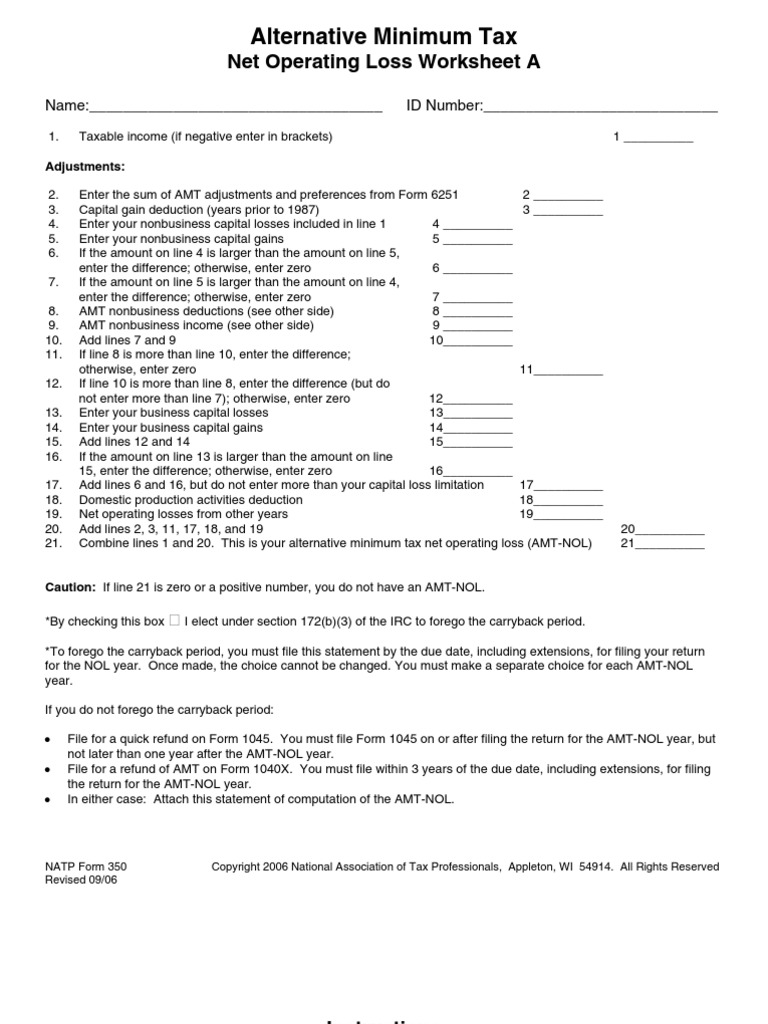

AMT NOL Calculation Worksheet Alternative Minimum Tax Tax Deduction

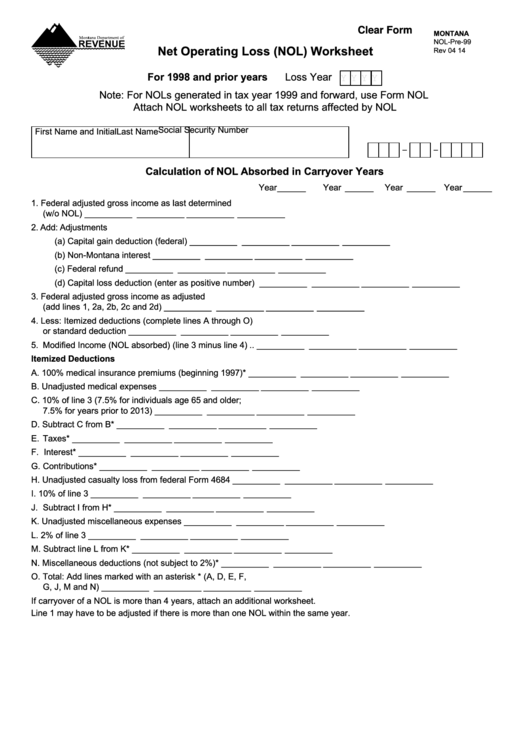

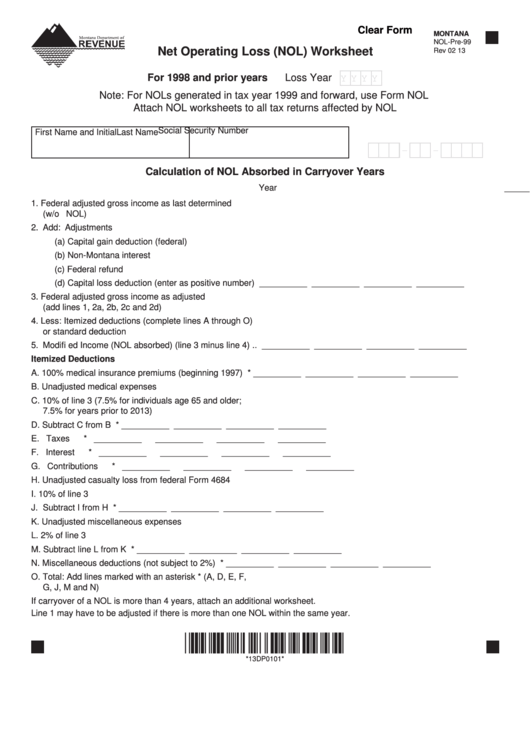

Fillable Form NolPre99 Net Operating Loss (Nol) Worksheet printable

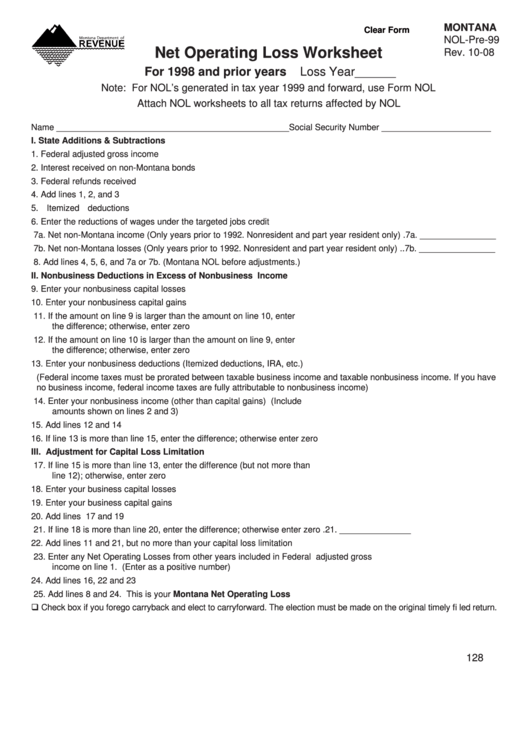

Fillable Form NolPre99 Net Operating Loss Worksheet October 2008

Fillable Form NolPre99 Net Operating Loss (Nol) Worksheet (For 1998

Fillable Form Nol Net Operating Loss Worksheet printable pdf download

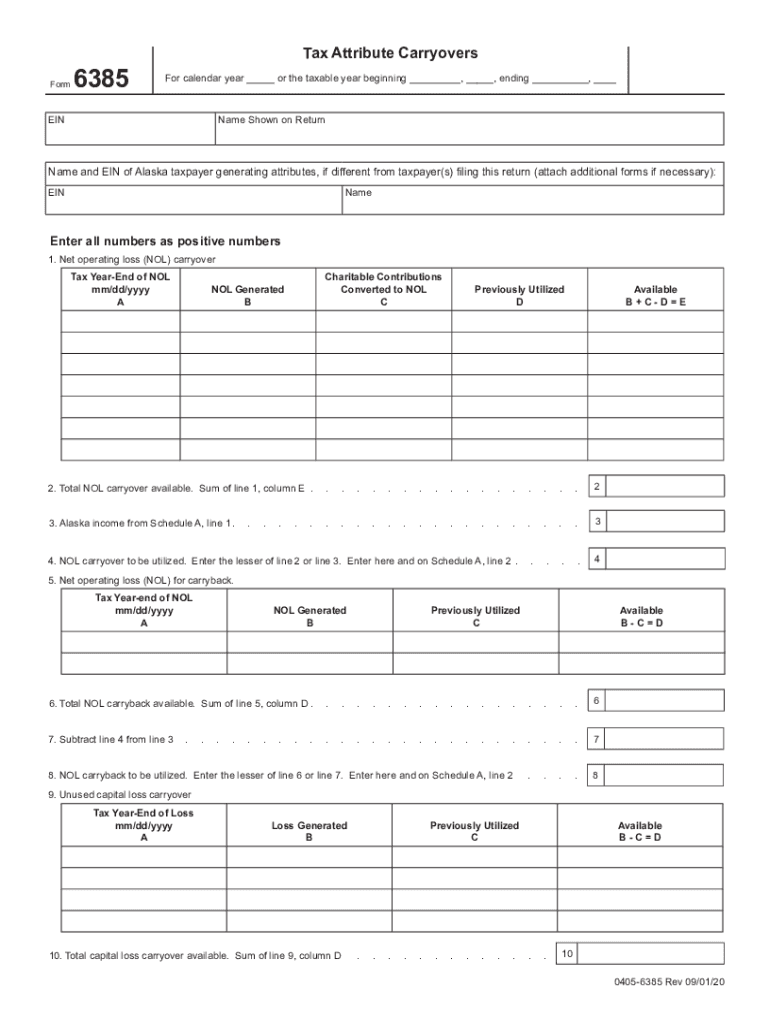

Tax Year End of NOT Fill Out and Sign Printable PDF Template signNow

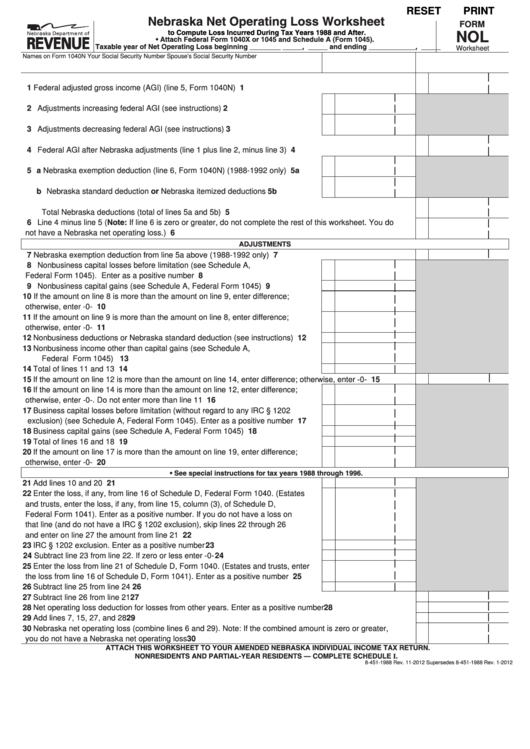

Fillable Nol Form Worksheet Nebraska Net Operating Loss Worksheet

The Amount Is Calculated As Follows:

Nol, Go To Part Ii.

Nol For Individuals, Estates, And Trusts.

Web Use The Worksheet On Page 8 (Instructions On Page 7) To Calculate The Amount To Enter On Federal Schedule 1 (Form 1040), Line 8.

Related Post: