Oregon Personal Allowances Worksheet

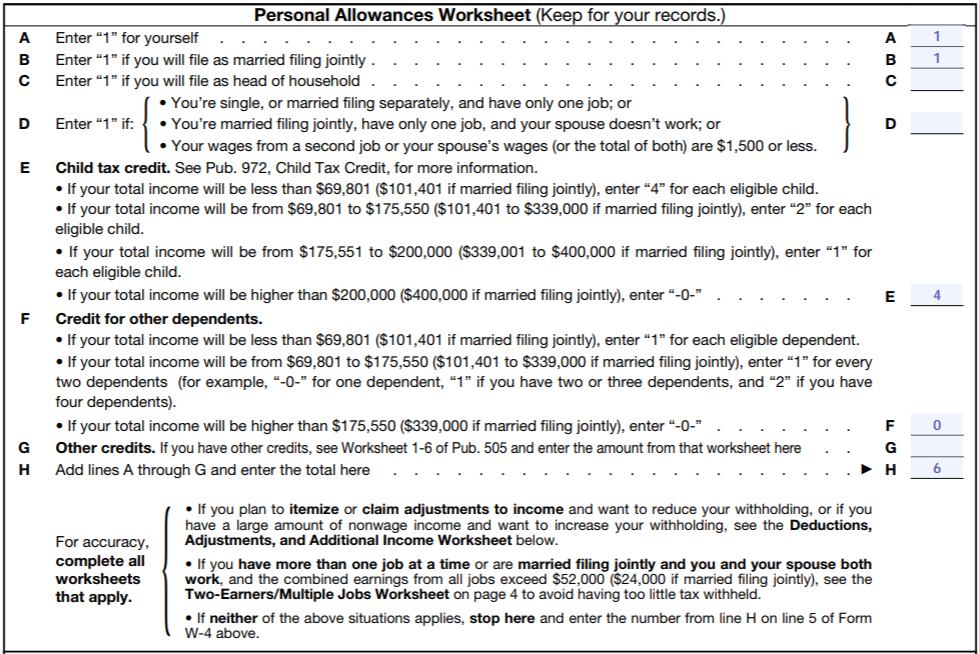

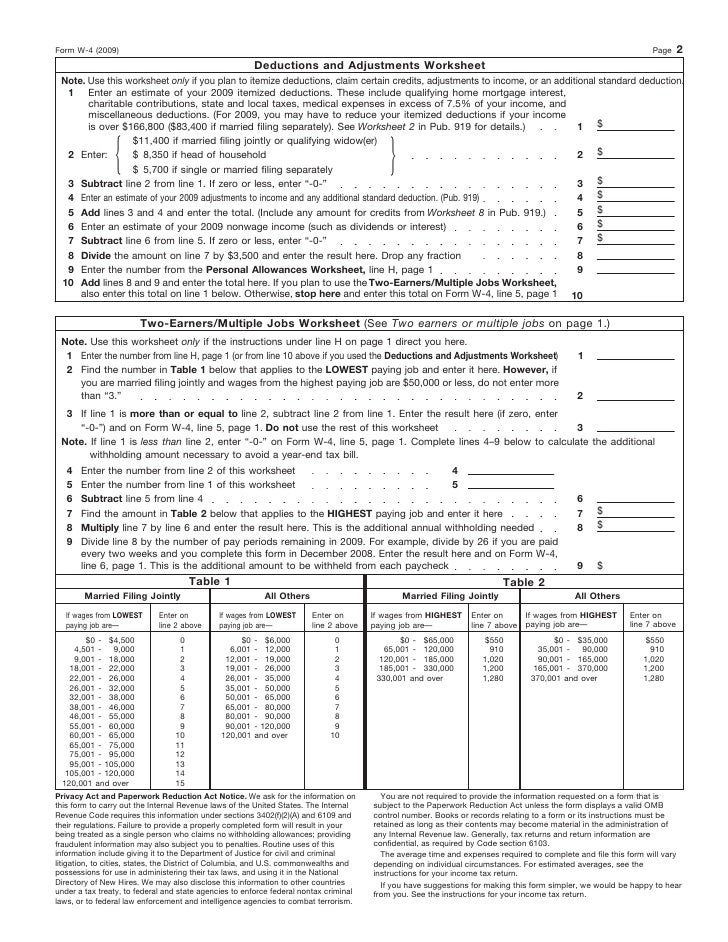

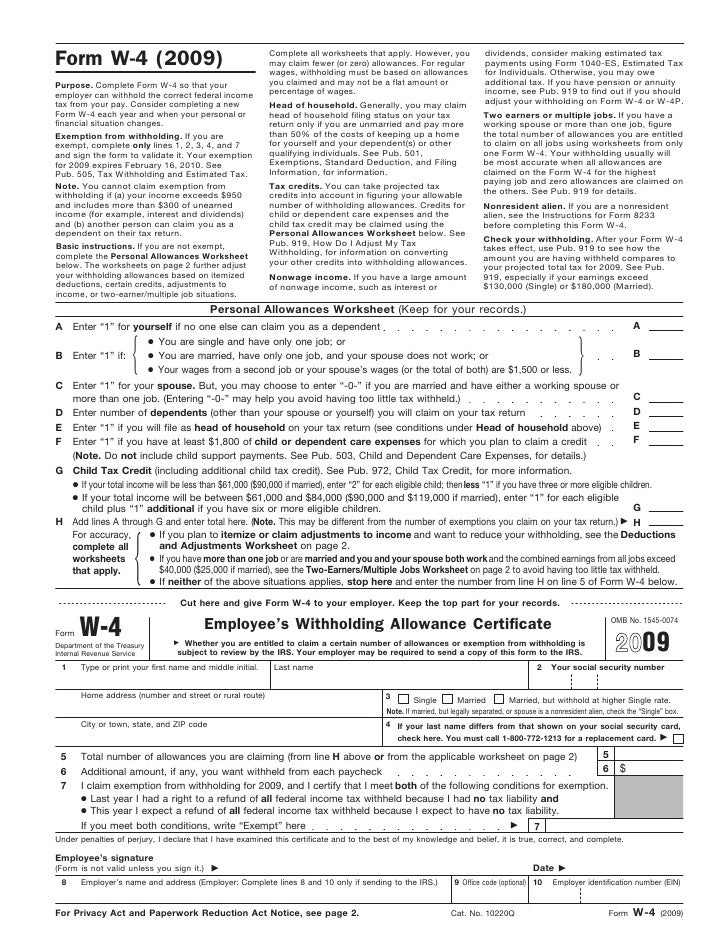

Oregon Personal Allowances Worksheet - The annual tax credit amount per exemption has changed from $210 to $213. Oregon taxpayers should use this worksheet if: Web by kristine cummings / august 15, 2022. This changed the number of federal allowances employees should claim,. The annualized deduction for federal tax. This changed the number of federal allowances employees should claim,. (a) they claim federal credits that don’t apply to oregon, such as the. Your eligibility to claim a certain number of allowances or an exemption from withholding may be subject to review by the oregon department of revenue. H&r block’s tax pros help answer your tax questions. Web allowances for oregon income tax withholding. Web by kristine cummings / august 15, 2022. Your 2018 tax return may still result. The income tax withholding formula for the state of oregon includes the following changes: H&r block’s tax pros help answer your tax questions. Web allowances for oregon income tax withholding. Your 2019 tax return may. The income tax withholding formula for the state of oregon includes the following changes: (a) they claim federal credits that don’t apply to oregon, such as the. Your 2018 tax return may still result. The annual tax credit amount per exemption has changed from $210 to $213. Your 2018 tax return may still result. Web allowances for oregon income tax withholding. Your eligibility to claim a certain number of allowances or an exemption from withholding may be subject to review by the oregon department of revenue. H&r block’s tax pros help answer your tax questions. The standard deduction amount for single filers claiming. Your 2018 tax return may still result. The annualized deduction for federal tax. Your 2019 tax return may. This changed the number of federal allowances employees should claim,. This changed the number of federal allowances employees should claim,. Your eligibility to claim a certain number of allowances or an exemption from withholding may be subject to review by the oregon department of revenue. This changed the number of federal allowances employees should claim,. Web by kristine cummings / august 15, 2022. The income tax withholding formula for the state of oregon includes the following changes: The annual tax. This changed the number of federal allowances employees should claim,. The income tax withholding formula for the state of oregon includes the following changes: Web this worksheet provides an estimate of the oregon personal income tax most people need to have withheld to cover their 2018 tax liability. Your 2020 tax return may still result in a tax due or. Your 2020 tax return may still result in a tax due or refund. Web by kristine cummings / august 15, 2022. Your eligibility to claim a certain number of allowances or an exemption from withholding may be subject to review by the oregon department of revenue. H&r block’s tax pros help answer your tax questions. Web allowances for oregon income. Your 2018 tax return may still result. H&r block’s tax pros help answer your tax questions. Web by kristine cummings / august 15, 2022. The income tax withholding formula for the state of oregon includes the following changes: The annualized deduction for federal tax. Your 2020 tax return may still result in a tax due or refund. The annualized deduction for federal tax. This changed the number of federal allowances employees should claim,. (a) they claim federal credits that don’t apply to oregon, such as the. Oregon taxpayers should use this worksheet if: Oregon taxpayers should use this worksheet if: Web by kristine cummings / august 15, 2022. H&r block’s tax pros help answer your tax questions. Your eligibility to claim a certain number of allowances or an exemption from withholding may be subject to review by the oregon department of revenue. The standard deduction amount for single filers claiming. The income tax withholding formula for the state of oregon includes the following changes: (a) they claim federal credits that don’t apply to oregon, such as the. This changed the number of federal allowances employees should claim,. Web allowances for oregon income tax withholding. Your 2019 tax return may. Your eligibility to claim a certain number of allowances or an exemption from withholding may be subject to review by the oregon department of revenue. Web by kristine cummings / august 15, 2022. The standard deduction amount for single filers claiming. This changed the number of federal allowances employees should claim,. The annual tax credit amount per exemption has changed from $210 to $213. H&r block’s tax pros help answer your tax questions. The annualized deduction for federal tax. Your 2020 tax return may still result in a tax due or refund. Web this worksheet provides an estimate of the oregon personal income tax most people need to have withheld to cover their 2018 tax liability. Your 2018 tax return may still result. Oregon taxpayers should use this worksheet if: Web allowances for oregon income tax withholding. Web this worksheet provides an estimate of the oregon personal income tax most people need to have withheld to cover their 2018 tax liability. (a) they claim federal credits that don’t apply to oregon, such as the. This changed the number of federal allowances employees should claim,. Web by kristine cummings / august 15, 2022. Your 2018 tax return may still result. Your 2020 tax return may still result in a tax due or refund. The annual tax credit amount per exemption has changed from $210 to $213. Your eligibility to claim a certain number of allowances or an exemption from withholding may be subject to review by the oregon department of revenue. Oregon taxpayers should use this worksheet if: This changed the number of federal allowances employees should claim,. The standard deduction amount for single filers claiming.This Year is Different Revisit Your Withholding Elections Now! Merriman

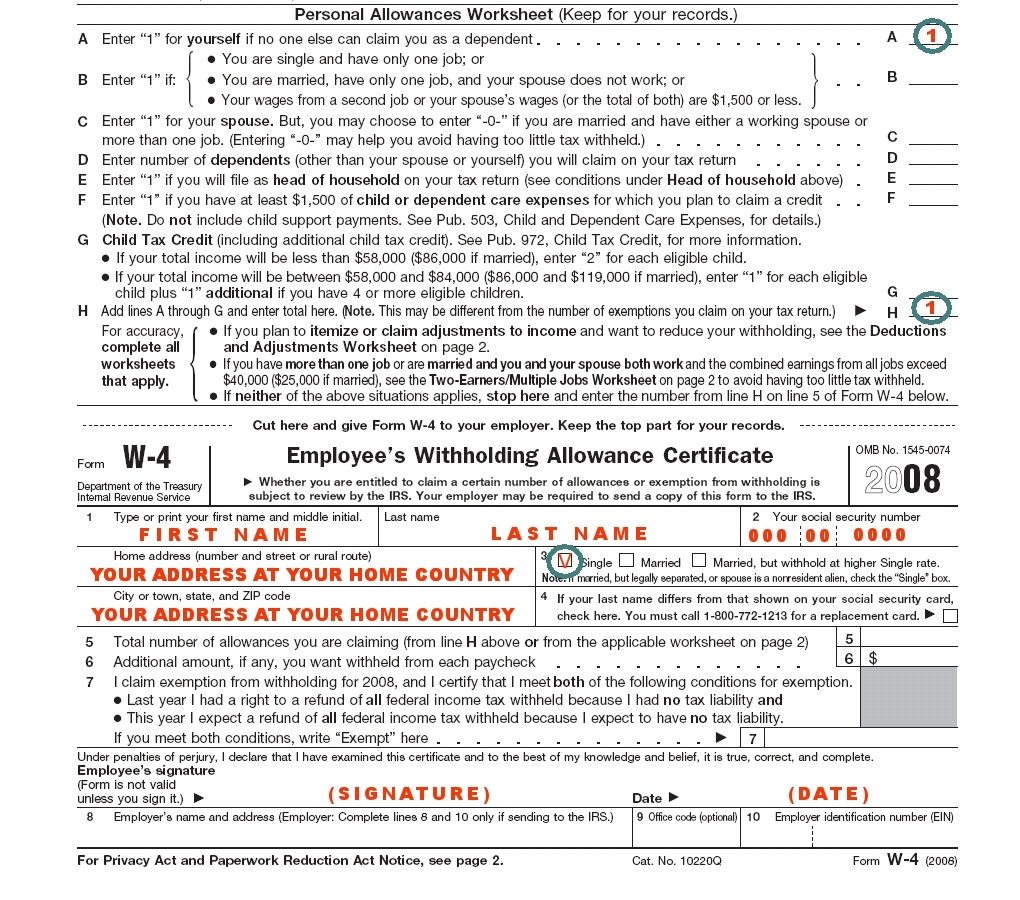

Sample W 4 Form W4 Form 2021 Printable

Oregon Personal Allowances Worksheet Printable Free Onenow

Oregon Personal Allowances Worksheets

Oregon Personal Allowances Worksheets

Oregon Personal Allowances Worksheet 2018 Form Tripmart

Oregon Employee Withholding Form 2022 2023

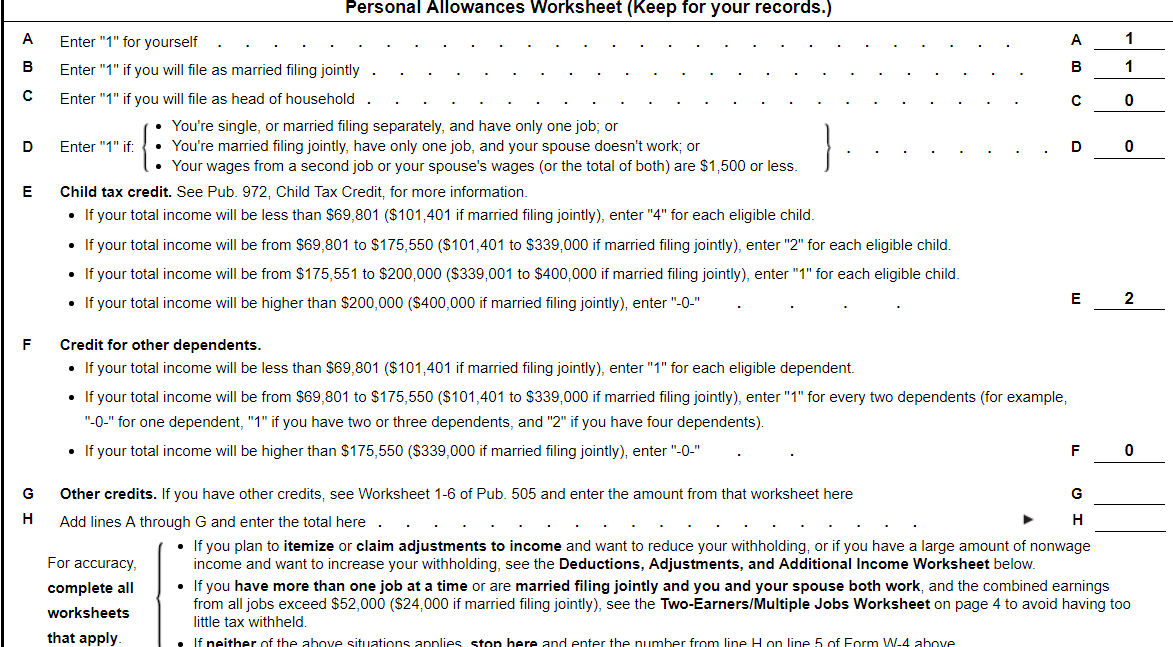

Form W4Personal Allowances Worksheet

Form W4*Employee Withholding Allowance Certificate

16+ Cool Personal Allowances Worksheet

The Income Tax Withholding Formula For The State Of Oregon Includes The Following Changes:

Your 2019 Tax Return May.

The Annualized Deduction For Federal Tax.

H&R Block’s Tax Pros Help Answer Your Tax Questions.

Related Post: