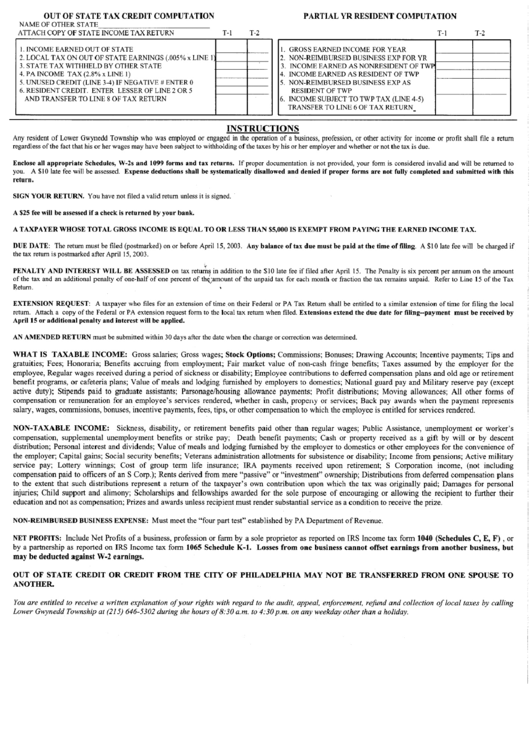

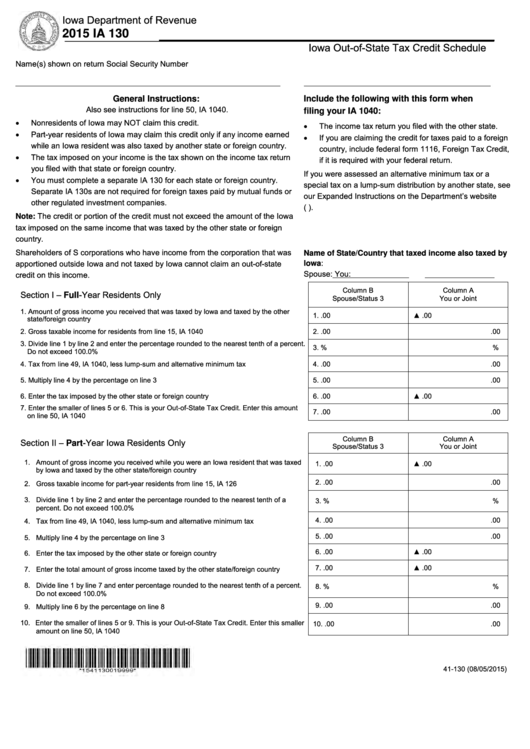

Out Of State Tax Credit Worksheet

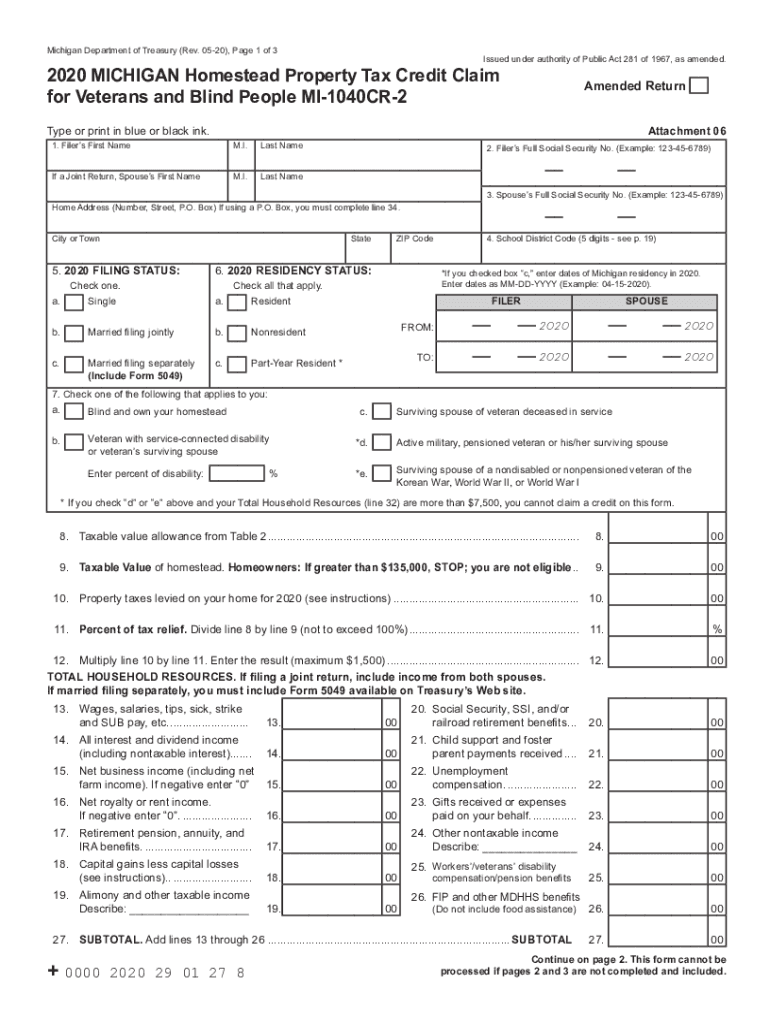

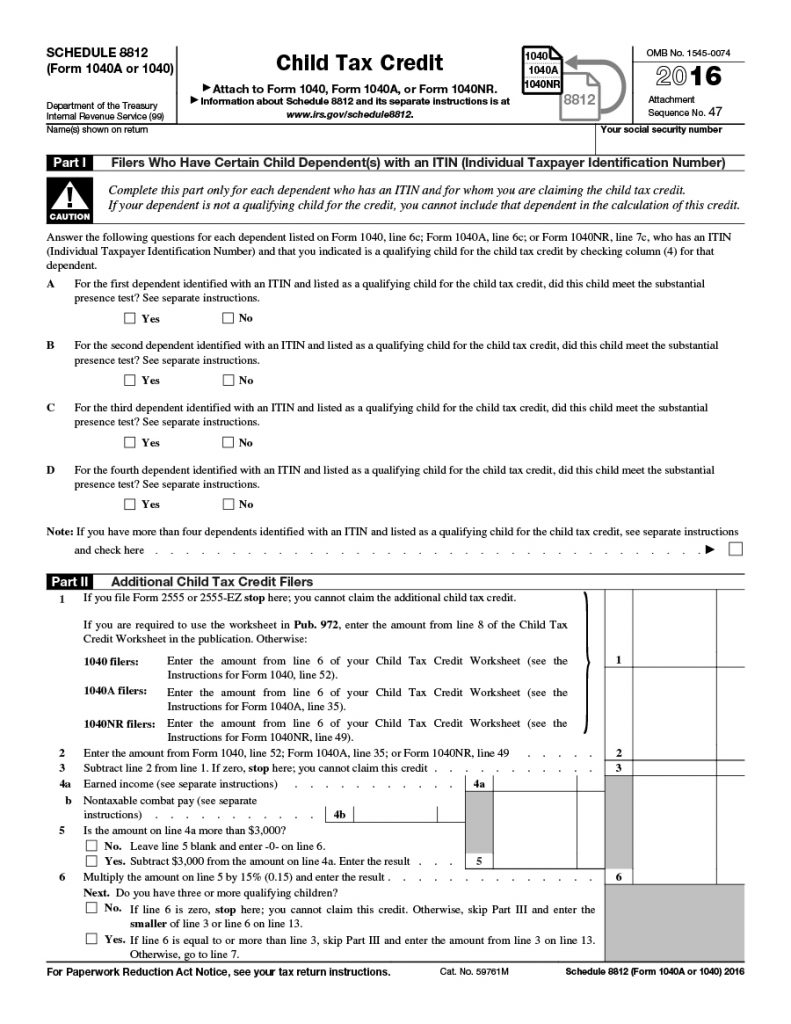

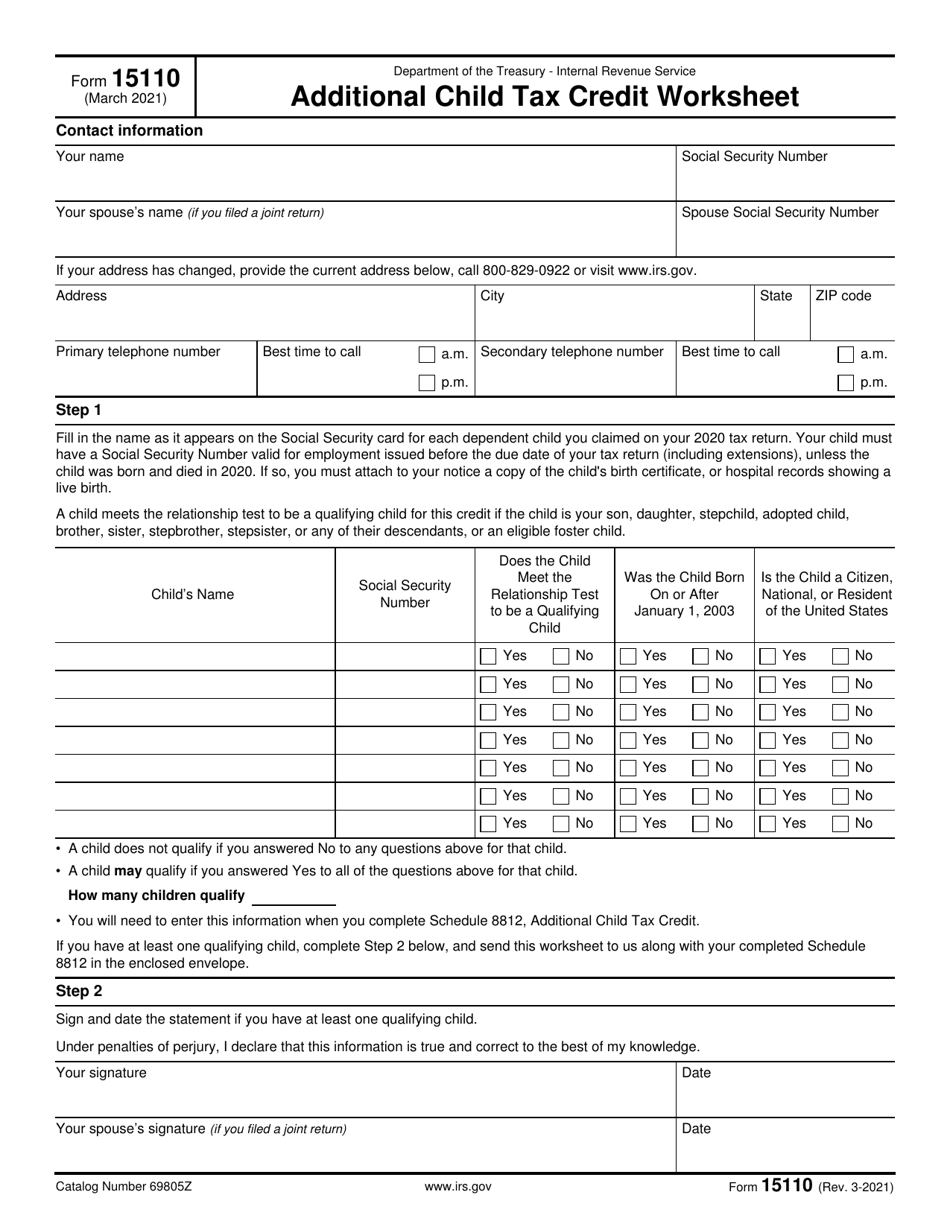

Out Of State Tax Credit Worksheet - Complete a separate worksheet for each state. You may need to look up the sales tax that could have been deducted using the. Local credit for income tax paid to other state (subtract line 13. Web the tax paid in each state; Some of the worksheets for this concept are state and local refund work, personal allowances work, tax year. Web out of state tax credit. Use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). Compute your tax as though no. Total income from all sources (combined for joint filers) from federal form 1040, line 22; If you, your spouse with whom you are filing a joint return, or a dependent was enrolled in coverage through. Web (b) elected to deduct state and local general sales taxes instead of state and local income taxes. Complete a separate worksheet for each state. And the credit amount calculated for each state. Use the sc1040tc instructions to complete this. Use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child. If you, your spouse with whom you are filing a joint return, or a dependent was enrolled in coverage through. And the credit amount calculated for each state. Or 1040ez, line 4, while a. Total income from all sources (combined for joint filers) from federal form 1040, line 22; Local credit for income tax paid to other state (subtract line. Web after completing the return of the other state, complete your north carolina return and include all income from inside and outside the state. Web using the maryland tax table or computation worksheet contained in the instructions for forms 502 or 504. Or 1040ez, line 4, while a. Complete a separate worksheet for each state. And the credit amount calculated. And the credit amount calculated for each state. Web using the maryland tax table or computation worksheet contained in the instructions for forms 502 or 504. Web (b) elected to deduct state and local general sales taxes instead of state and local income taxes. You may need to look up the sales tax that could have been deducted using the.. He figures his american opportunity credit based on qualified education expenses of $4,000, which results in a credit of. Some of the worksheets for this concept are state and local refund work, personal allowances work, tax year. Or 1040ez, line 4, while a. Local credit for income tax paid to other state (subtract line 13. Web the tax paid in. Web requirement to reconcile advance payments of the premium tax credit. And the credit amount calculated for each state. Compute your tax as though no. Local credit for income tax paid to other state (subtract line 13. Web out of state tax credit. Some of the worksheets for this concept are state and local refund work, personal allowances work, tax year. If you, your spouse with whom you are filing a joint return, or a dependent was enrolled in coverage through. Web the requirements for the american opportunity credit. Web the tax paid in each state; Local credit for income tax paid to. Use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). Or 1040ez, line 4, while a. Web out of state tax credit. Web using the maryland tax table or computation worksheet contained in the instructions for forms 502 or 504. Worksheets are state and local refund work,. Complete a separate worksheet for each state. Worksheets are state and local refund work, personal allowances work, tax year. Use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). Or 1040ez, line 4, while a. Local credit for income tax paid to other state (subtract line 13. Worksheets are state and local refund work, personal allowances work, tax year. You may need to look up the sales tax that could have been deducted using the. Local credit for income tax paid to other state (subtract line 13. Web the requirements for the american opportunity credit. Web requirement to reconcile advance payments of the premium tax credit. Web after completing the return of the other state, complete your north carolina return and include all income from inside and outside the state. Compute your tax as though no. Web requirement to reconcile advance payments of the premium tax credit. Web the requirements for the american opportunity credit. Web the tax paid in each state; Complete a separate worksheet for each state. And the credit amount calculated for each state. If you, your spouse with whom you are filing a joint return, or a dependent was enrolled in coverage through. Use the sc1040tc instructions to complete this. Web (b) elected to deduct state and local general sales taxes instead of state and local income taxes. Web out of state tax credit. Total income from all sources (combined for joint filers) from federal form 1040, line 22; Worksheets are state and local refund work, personal allowances work, tax year. Web using the maryland tax table or computation worksheet contained in the instructions for forms 502 or 504. Use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). Or 1040ez, line 4, while a. You may need to look up the sales tax that could have been deducted using the. Local credit for income tax paid to other state (subtract line 13. Some of the worksheets for this concept are state and local refund work, personal allowances work, tax year. He figures his american opportunity credit based on qualified education expenses of $4,000, which results in a credit of. Web after completing the return of the other state, complete your north carolina return and include all income from inside and outside the state. He figures his american opportunity credit based on qualified education expenses of $4,000, which results in a credit of. Web out of state tax credit. Web requirement to reconcile advance payments of the premium tax credit. Complete a separate worksheet for each state. Or 1040ez, line 4, while a. Compute your tax as though no. Web (b) elected to deduct state and local general sales taxes instead of state and local income taxes. And the credit amount calculated for each state. Use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). Web using the maryland tax table or computation worksheet contained in the instructions for forms 502 or 504. Local credit for income tax paid to other state (subtract line 13. Total income from all sources (combined for joint filers) from federal form 1040, line 22; Use the sc1040tc instructions to complete this. Some of the worksheets for this concept are state and local refund work, personal allowances work, tax year. Web the requirements for the american opportunity credit.2020 Form MI DoT MI1040CR2 Fill Online, Printable, Fillable, Blank

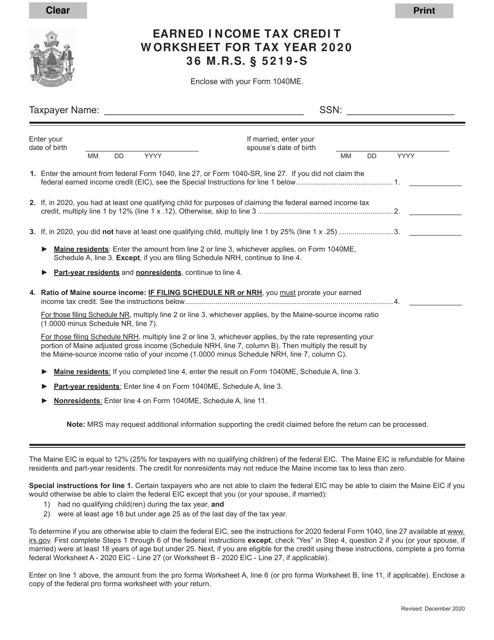

California Earned Tax Credit Worksheet 2020 ideas 2022

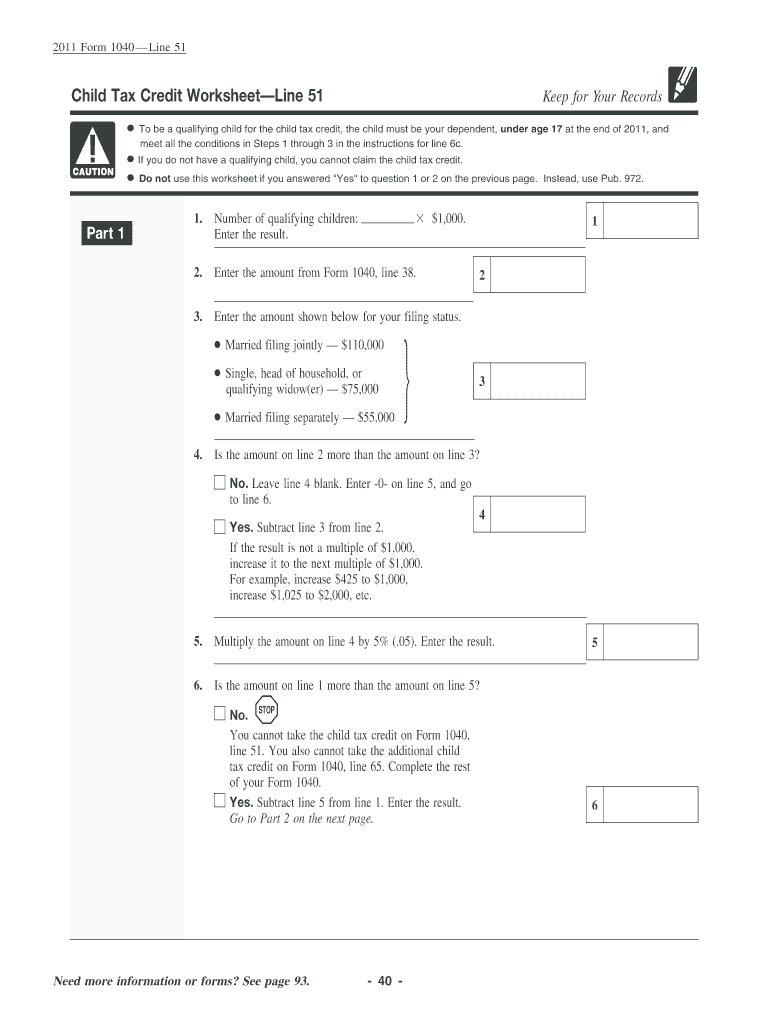

Child Tax Credit Worksheet / Quick guide on how to complete child

Worksheet For Filing Taxes Master of Documents

Out Of State Tax Credit Computation Partial Yr Resident Computation

IRS Form 15110 Download Fillable PDF or Fill Online Additional Child

Child Tax Credit Worksheet Parents, this is what happens to your

Child Tax Credit Worksheet Form 8812 Additional Child Tax Credit

Fillable Form 130 Iowa OutOfState Tax Credit Schedule 2015

2020 Maine Earned Tax Credit Worksheet Download Fillable PDF

If You, Your Spouse With Whom You Are Filing A Joint Return, Or A Dependent Was Enrolled In Coverage Through.

You May Need To Look Up The Sales Tax That Could Have Been Deducted Using The.

Web The Tax Paid In Each State;

Worksheets Are State And Local Refund Work, Personal Allowances Work, Tax Year.

Related Post: