Pa Gross Compensation Worksheet

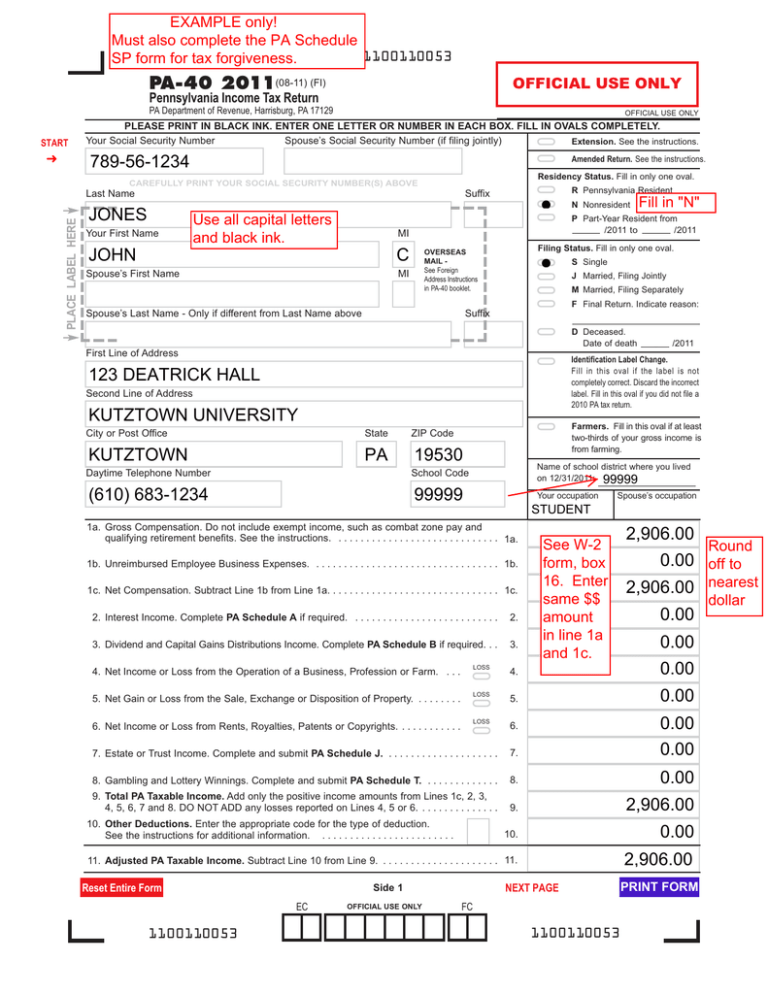

Pa Gross Compensation Worksheet - Web if you enter an amount in the pa taxable income force column, ultratax cs takes the difference between this field and the federal taxable income column amount and. Web the following worksheet provides specific parameters for filing an expense loss cost multiplier and an overall contribution rate in compliance with 34 pa. The number you get would. Web on the pa gross compensation worksheet under the compensation from federal forms 1099r section the pa type codes do not hold over the reopening. Web this form is used to report an employer's quarterly gross and taxable wages, and uc contributions due. Web no, you do not need to mail the gross compensation worksheet with your return. Web that’s the maximum weekly benefit that was available to anyone in the state. Between $1,573.50 and $786.76, multiply that number by 2/3. For a detailed calculation of your. That is for your records and to be used as a checklist to make sure that you. Between $1,573.50 and $786.76, multiply that number by 2/3. Web this form is used to report an employer's quarterly gross and taxable wages, and uc contributions due. That is for your records and to be used as a checklist to make sure that you. Web the following worksheet provides specific parameters for filing an expense loss cost multiplier and an. Between $1,573.50 and $786.76, multiply that number by 2/3. The number you get would. Web this form is used to report an employer's quarterly gross and taxable wages, and uc contributions due. Web if you enter an amount in the pa taxable income force column, ultratax cs takes the difference between this field and the federal taxable income column amount. Web no, you do not need to mail the gross compensation worksheet with your return. The number you get would. Web if you enter an amount in the pa taxable income force column, ultratax cs takes the difference between this field and the federal taxable income column amount and. For a detailed calculation of your. Between $1,573.50 and $786.76, multiply. Between $1,573.50 and $786.76, multiply that number by 2/3. That is for your records and to be used as a checklist to make sure that you. Web the following worksheet provides specific parameters for filing an expense loss cost multiplier and an overall contribution rate in compliance with 34 pa. Web on the pa gross compensation worksheet under the compensation. Web on the pa gross compensation worksheet under the compensation from federal forms 1099r section the pa type codes do not hold over the reopening. Web that’s the maximum weekly benefit that was available to anyone in the state. Web this form is used to report an employer's quarterly gross and taxable wages, and uc contributions due. Between $1,573.50 and. Web the following worksheet provides specific parameters for filing an expense loss cost multiplier and an overall contribution rate in compliance with 34 pa. That is for your records and to be used as a checklist to make sure that you. Web no, you do not need to mail the gross compensation worksheet with your return. Between $1,573.50 and $786.76,. Web if you enter an amount in the pa taxable income force column, ultratax cs takes the difference between this field and the federal taxable income column amount and. For a detailed calculation of your. Between $1,573.50 and $786.76, multiply that number by 2/3. That is for your records and to be used as a checklist to make sure that. That is for your records and to be used as a checklist to make sure that you. Web that’s the maximum weekly benefit that was available to anyone in the state. Web on the pa gross compensation worksheet under the compensation from federal forms 1099r section the pa type codes do not hold over the reopening. Web if you enter. Web this form is used to report an employer's quarterly gross and taxable wages, and uc contributions due. Web the following worksheet provides specific parameters for filing an expense loss cost multiplier and an overall contribution rate in compliance with 34 pa. Between $1,573.50 and $786.76, multiply that number by 2/3. Web if you enter an amount in the pa. Web this form is used to report an employer's quarterly gross and taxable wages, and uc contributions due. Web that’s the maximum weekly benefit that was available to anyone in the state. Web no, you do not need to mail the gross compensation worksheet with your return. Web if you enter an amount in the pa taxable income force column,. Web the following worksheet provides specific parameters for filing an expense loss cost multiplier and an overall contribution rate in compliance with 34 pa. The number you get would. Web this form is used to report an employer's quarterly gross and taxable wages, and uc contributions due. Web that’s the maximum weekly benefit that was available to anyone in the state. Between $1,573.50 and $786.76, multiply that number by 2/3. Web if you enter an amount in the pa taxable income force column, ultratax cs takes the difference between this field and the federal taxable income column amount and. For a detailed calculation of your. Web no, you do not need to mail the gross compensation worksheet with your return. That is for your records and to be used as a checklist to make sure that you. Web on the pa gross compensation worksheet under the compensation from federal forms 1099r section the pa type codes do not hold over the reopening. That is for your records and to be used as a checklist to make sure that you. Web on the pa gross compensation worksheet under the compensation from federal forms 1099r section the pa type codes do not hold over the reopening. Web the following worksheet provides specific parameters for filing an expense loss cost multiplier and an overall contribution rate in compliance with 34 pa. Web that’s the maximum weekly benefit that was available to anyone in the state. Web no, you do not need to mail the gross compensation worksheet with your return. Web if you enter an amount in the pa taxable income force column, ultratax cs takes the difference between this field and the federal taxable income column amount and. Web this form is used to report an employer's quarterly gross and taxable wages, and uc contributions due. Between $1,573.50 and $786.76, multiply that number by 2/3.PA40 2011

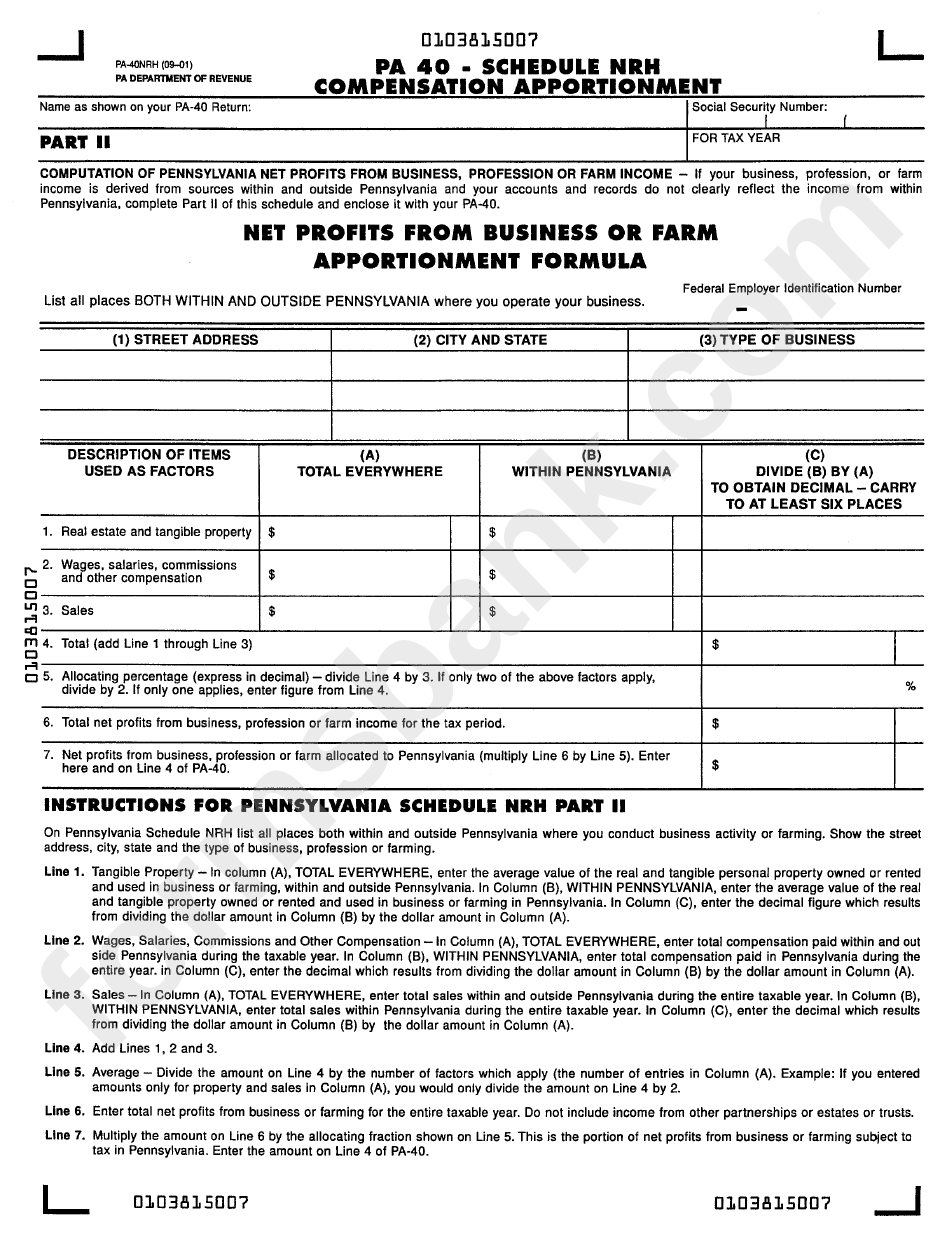

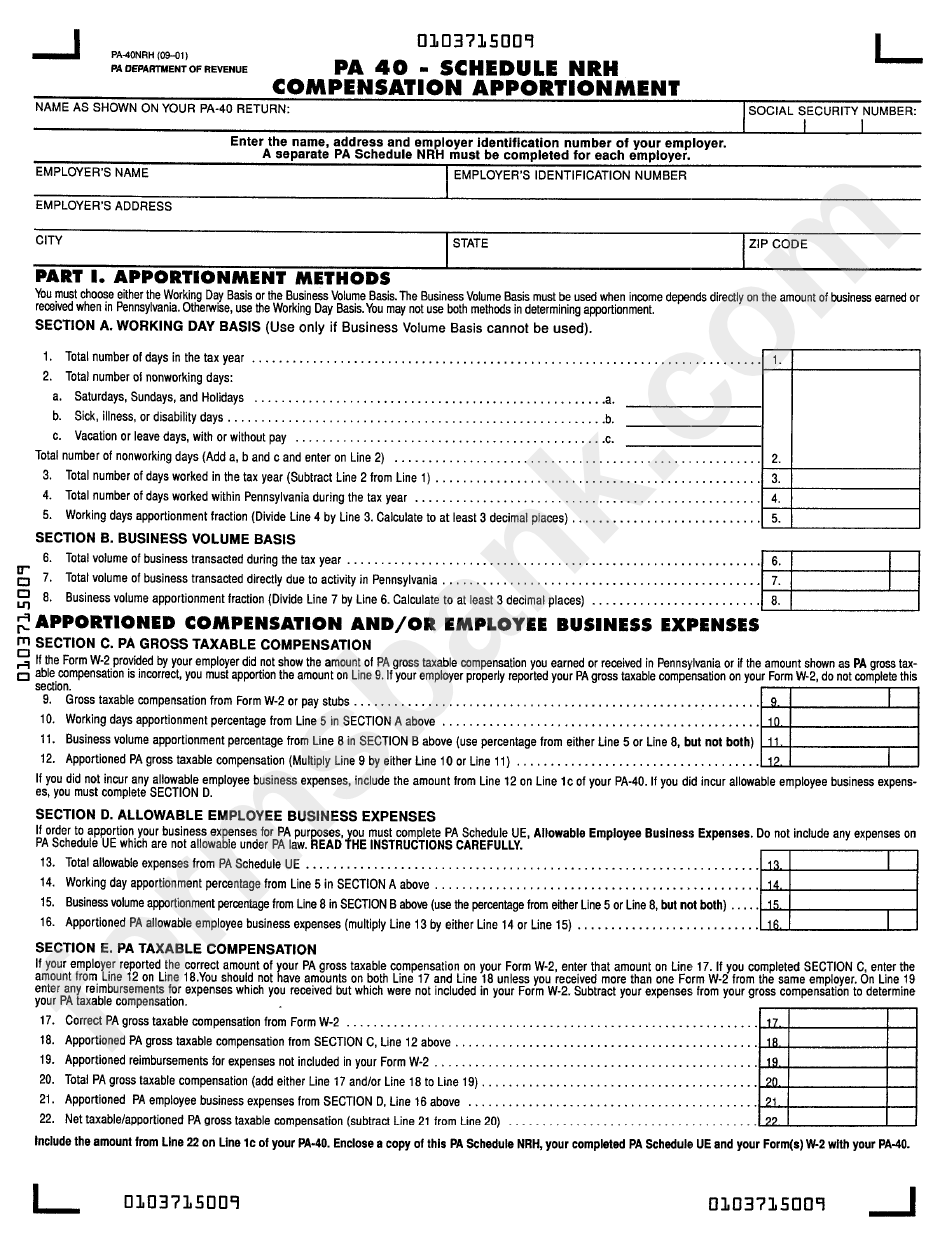

Form Pa40 Schedule Nrh Compensation Apportionment Pa Department

calculating gross pay worksheet

Gross Pay Vs Net Pay Worksheet Worksheet List

Gross Pay worksheet

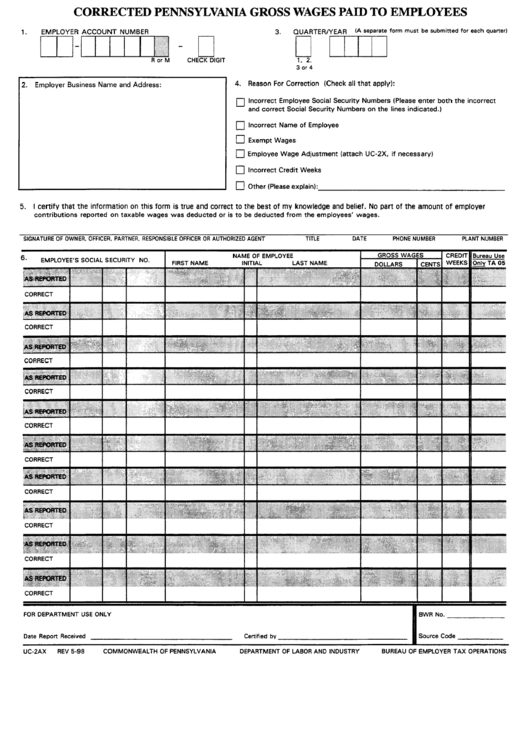

Form Uc2ax Corrected Pennsylvania Gross Wages Paid To Employees

Payroll Report Template Excel PDF Template

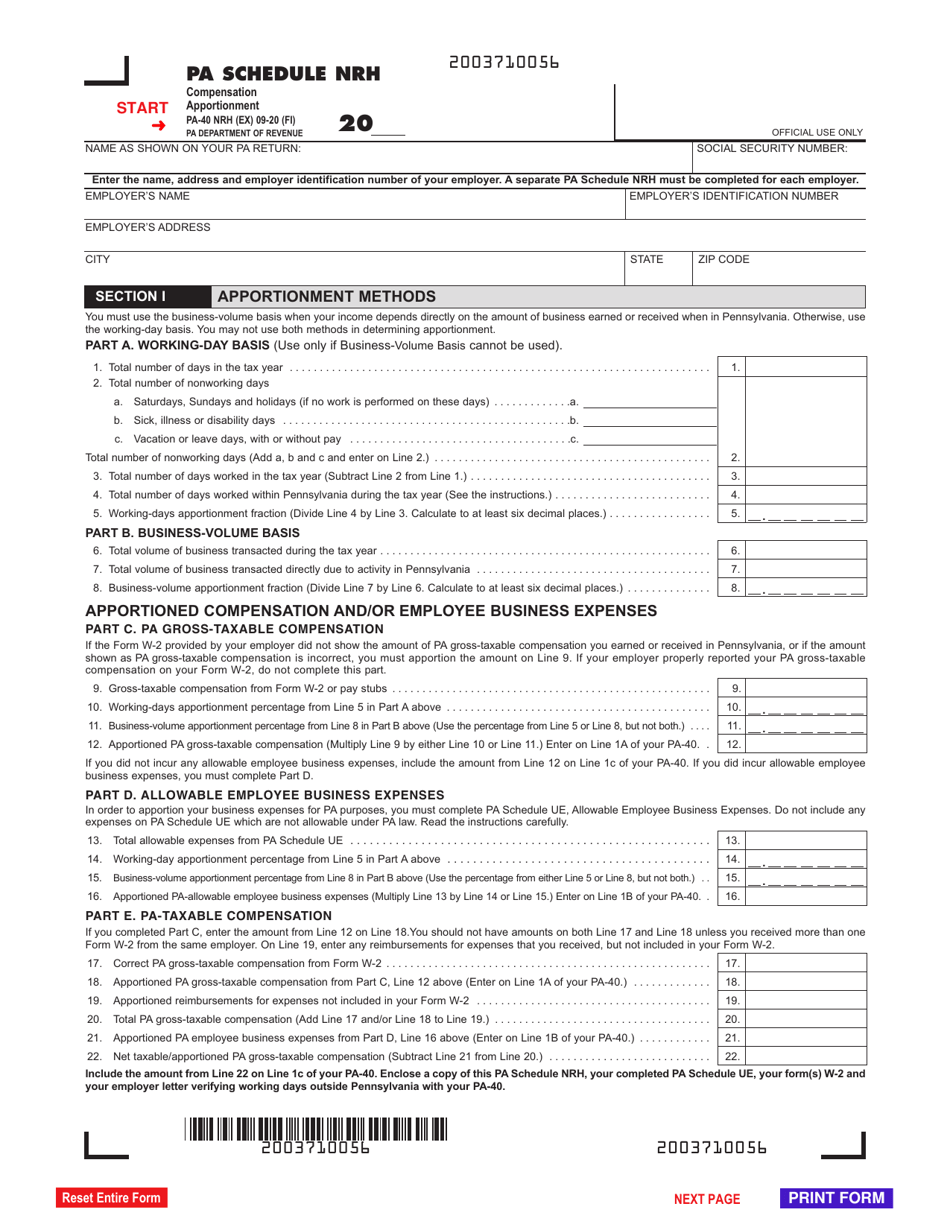

Pa 40 Schedule Nrh Compensation Apportionment Form Pa Department Of

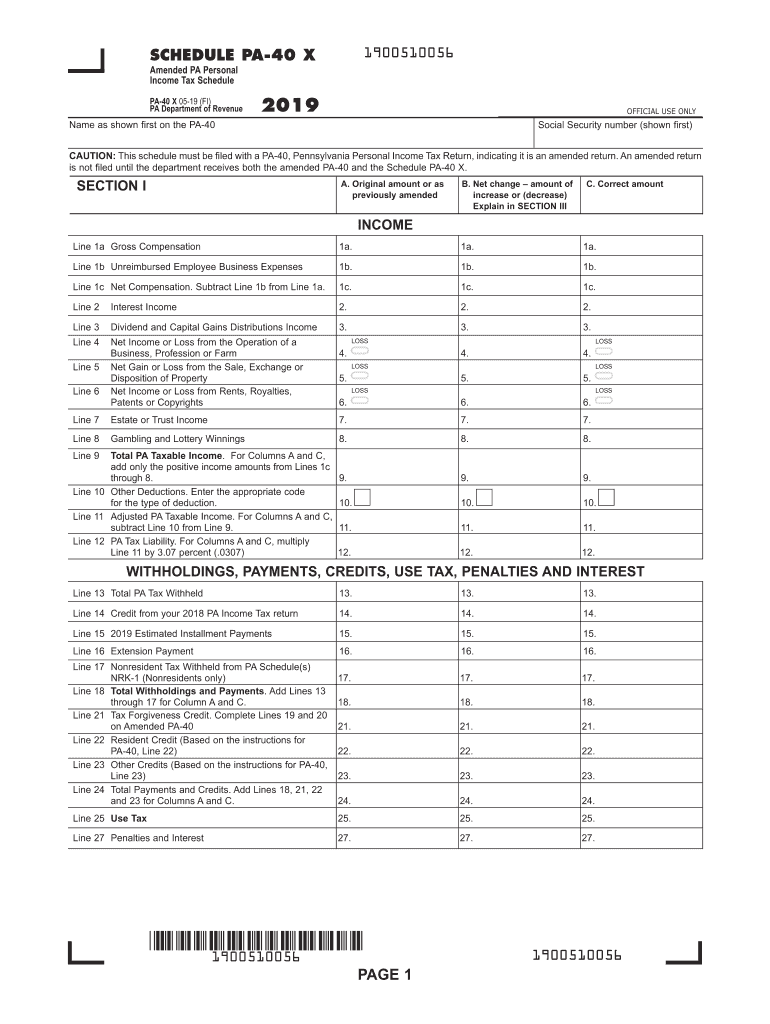

Schedule Pa 40x Fill Out and Sign Printable PDF Template signNow

Form PA40 Schedule NRH Download Fillable PDF or Fill Online

The Number You Get Would.

For A Detailed Calculation Of Your.

Related Post: