Partner Basis Worksheet Instructions

Partner Basis Worksheet Instructions - Basis is the amount of your investment in property for tax purposes. For more information on partner tax basis capital account reporting, get the. A partner's distributive share of partnership loss will be allowed only to the extent of the adjusted basis, before reduction by current year's losses, of such partner's interest. Web how does the partner's basis worksheet calculate the basis limitation on the deductibility of a partner's share of partnership losses? Web to assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a partner’s interest in the partnership is found in. The partner must reduce the basis by. Enjoy smart fillable fields and. Answer a partner's distributive share of. 17 _____ ** if the withdrawals. Web there are two methods to select the partner basis worksheet to print in the client and government copies of the return. Answer a partner's distributive share of. Multiply line 1 by the tax rate on line 2. The basis of an interest in a. Web how to fill out and sign partnership basis calculation worksheet excel online? Web use the basis wks screen, partner’s adjusted basis worksheet, to calculate a partner’s new basis after increases and/or decreases are made to basis. Web how to fill out and sign partnership basis calculation worksheet excel online? Subtract line 16 from 11. Basis is the amount of your investment in property for tax purposes. Enjoy smart fillable fields and. 1) at the office group level for all partnership returns or. Web to assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a partner's interest in the partnership is found in the partner's. Get your online template and fill it in using progressive features. Web how does the partner's basis worksheet calculate the basis limitation on the deductibility of a partner's share of. Web this tax worksheet calculates, for carryforward purposes, a partner’s “outside” basis in a partnership interest. Enjoy smart fillable fields and. For more information on partner tax basis capital account reporting, get the. Send filled & signed partnership. 1) at the office group level for all partnership returns or. Multiply line 1 by the tax rate on line 2. Where a partner has a negative tax basis capital account at the beginning or end of the tax year, the partnership may want to compare the partner’s. Subtract line 16 from 11. Answer a partner's distributive share of. Web to assist the partners in determining their basis in the partnership,. Web this tax worksheet calculates, for carryforward purposes, a partner’s “outside” basis in a partnership interest. A partner's distributive share of partnership loss will be allowed only to the extent of the adjusted basis, before reduction by current year's losses, of such partner's interest. Easily sign the partnership basis worksheet excel with your finger. Web you can figure the adjusted. The basis of an interest in a. Web this tax worksheet calculates, for carryforward purposes, a partner’s “outside” basis in a partnership interest. Web open the partner basis worksheet excel and follow the instructions. 1) at the office group level for all partnership returns or. Outside basis refers to basis each partner. Easily sign the partnership basis worksheet excel with your finger. A partner's distributive share of partnership loss will be allowed only to the extent of the adjusted basis, before reduction by current year's losses, of such partner's interest. Web there are two methods to select the partner basis worksheet to print in the client and government copies of the return.. Send filled & signed partnership. Basis is the amount of your investment in property for tax purposes. 1) at the office group level for all partnership returns or. Get your online template and fill it in using progressive features. Web use the basis wks screen, partner’s adjusted basis worksheet, to calculate a partner’s new basis after increases and/or decreases are. Multiply line 1 by the tax rate on line 2. Web to assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a partner’s interest in the partnership is found in. A partner's distributive share of partnership loss will be allowed only to the extent of the adjusted basis, before reduction by current. Web open the partner basis worksheet excel and follow the instructions. 17 _____ ** if the withdrawals. For more information on partner tax basis capital account reporting, get the. Easily sign the partnership basis worksheet excel with your finger. Subtract line 16 from 11. A partner's distributive share of partnership loss will be allowed only to the extent of the adjusted basis, before reduction by current year's losses, of such partner's interest. Basis is the amount of your investment in property for tax purposes. Web how does the partner's basis worksheet calculate the basis limitation on the deductibility of a partner's share of partnership losses? Answer a partner's distributive share of. Send filled & signed partnership. Get your online template and fill it in using progressive features. Web there are two methods to select the partner basis worksheet to print in the client and government copies of the return. The basis of an interest in a. Where a partner has a negative tax basis capital account at the beginning or end of the tax year, the partnership may want to compare the partner’s. Multiply line 1 by the tax rate on line 2. Outside basis refers to basis each partner. The partner must reduce the basis by. Web this tax worksheet calculates, for carryforward purposes, a partner’s “outside” basis in a partnership interest. Enjoy smart fillable fields and. 1) at the office group level for all partnership returns or. Answer a partner's distributive share of. Web how to fill out and sign partnership basis calculation worksheet excel online? Basis is the amount of your investment in property for tax purposes. For more information on partner tax basis capital account reporting, get the. Web use the basis wks screen, partner’s adjusted basis worksheet, to calculate a partner’s new basis after increases and/or decreases are made to basis during the current year. Web how does the partner's basis worksheet calculate the basis limitation on the deductibility of a partner's share of partnership losses? The partner must reduce the basis by. 1) at the office group level for all partnership returns or. A partner's distributive share of partnership loss will be allowed only to the extent of the adjusted basis, before reduction by current year's losses, of such partner's interest. Web worksheet for tracking the basis of a partner’s interest in the partnership. Where a partner has a negative tax basis capital account at the beginning or end of the tax year, the partnership may want to compare the partner’s. Subtract line 16 from 11. Enjoy smart fillable fields and. Web to assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a partner’s interest in the partnership is found in. Web you can figure the adjusted basis of your partnership interest by adding items that increase your basis and then subtracting items that decrease your basis. Easily sign the partnership basis worksheet excel with your finger.Solved Assessment 4 Partnerships 2 Exercise 2 Worksheet

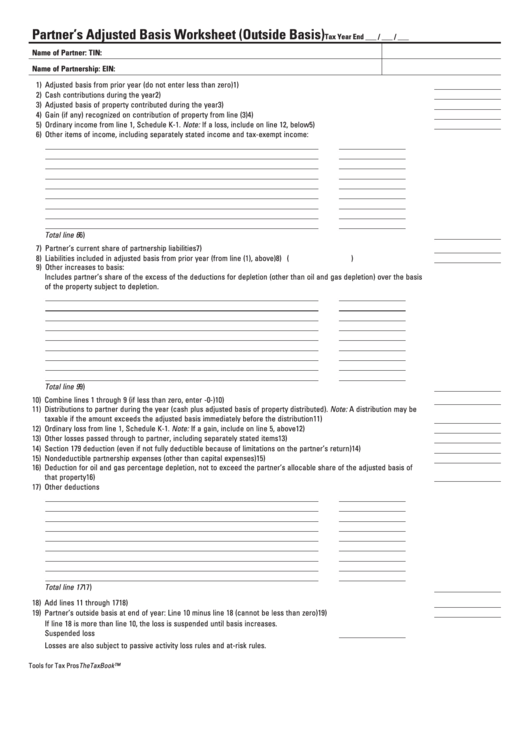

Partners Adjusted Basis Worksheet Public Finance Economy Of The

Business & Partnership(1120S & 1065)

Partnership Basis Calculation Worksheet Studying Worksheets

Worksheet How to Prepare Your Business for a Partnership

Partner Basis Worksheet Template Excel Portal Tutorials

My Partner's Qualities (Worksheet) Therapist Aid Marriage

basis worksheet for partnership

Fillable Partner'S Adjusted Basis Worksheet (Outside Basis) Template

Impulse Control Worksheets For Adults Mental Health Worksheets

Web Open The Partner Basis Worksheet Excel And Follow The Instructions.

Multiply Line 1 By The Tax Rate On Line 2.

Web There Are Two Methods To Select The Partner Basis Worksheet To Print In The Client And Government Copies Of The Return.

17 _____ ** If The Withdrawals.

Related Post: