Printable Itemized Deductions Worksheet

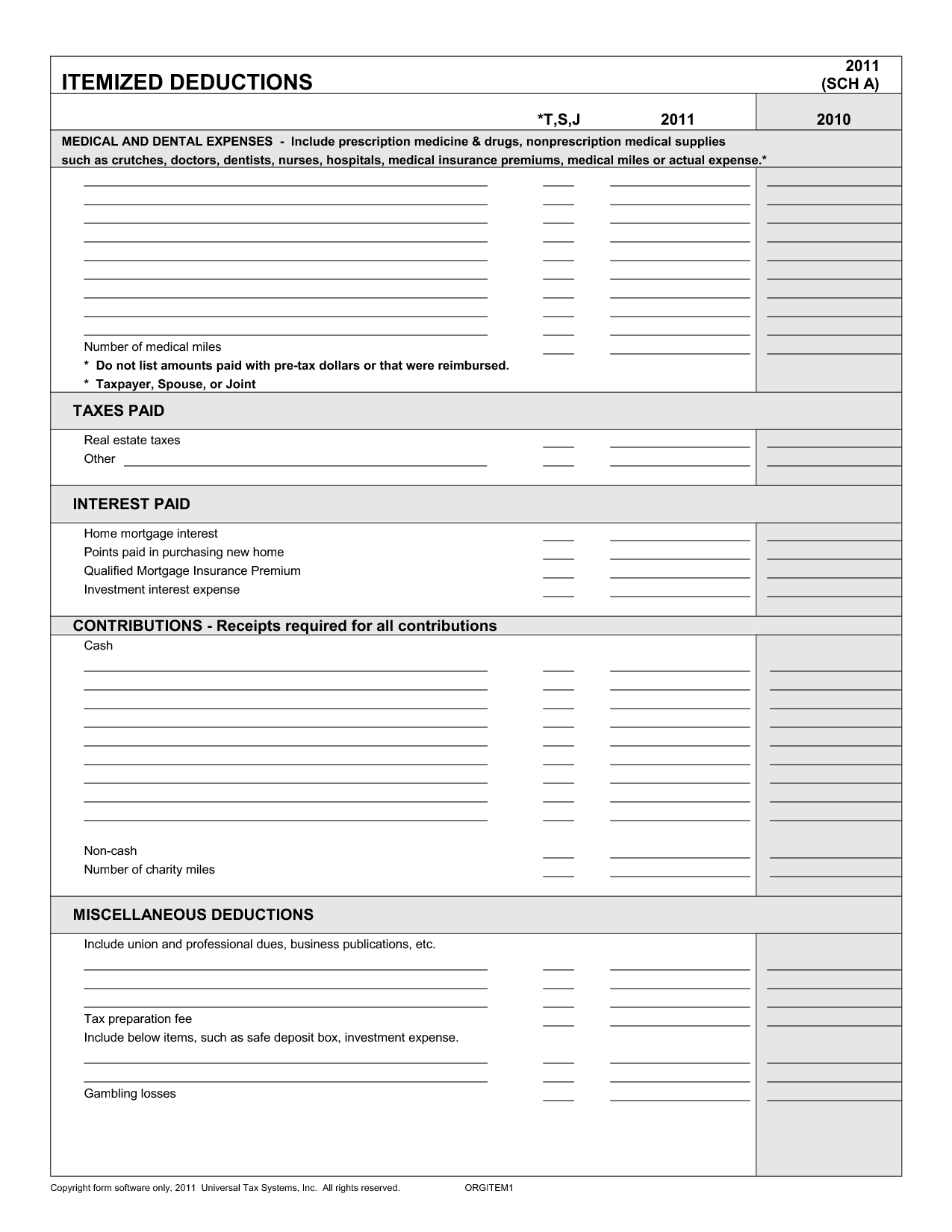

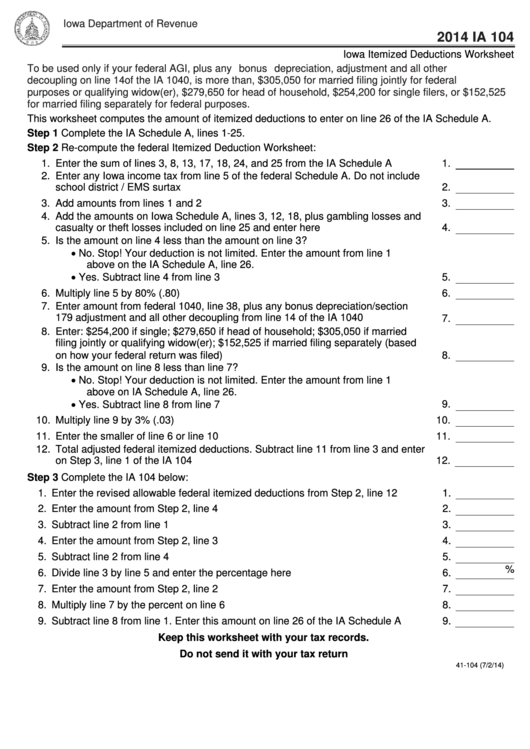

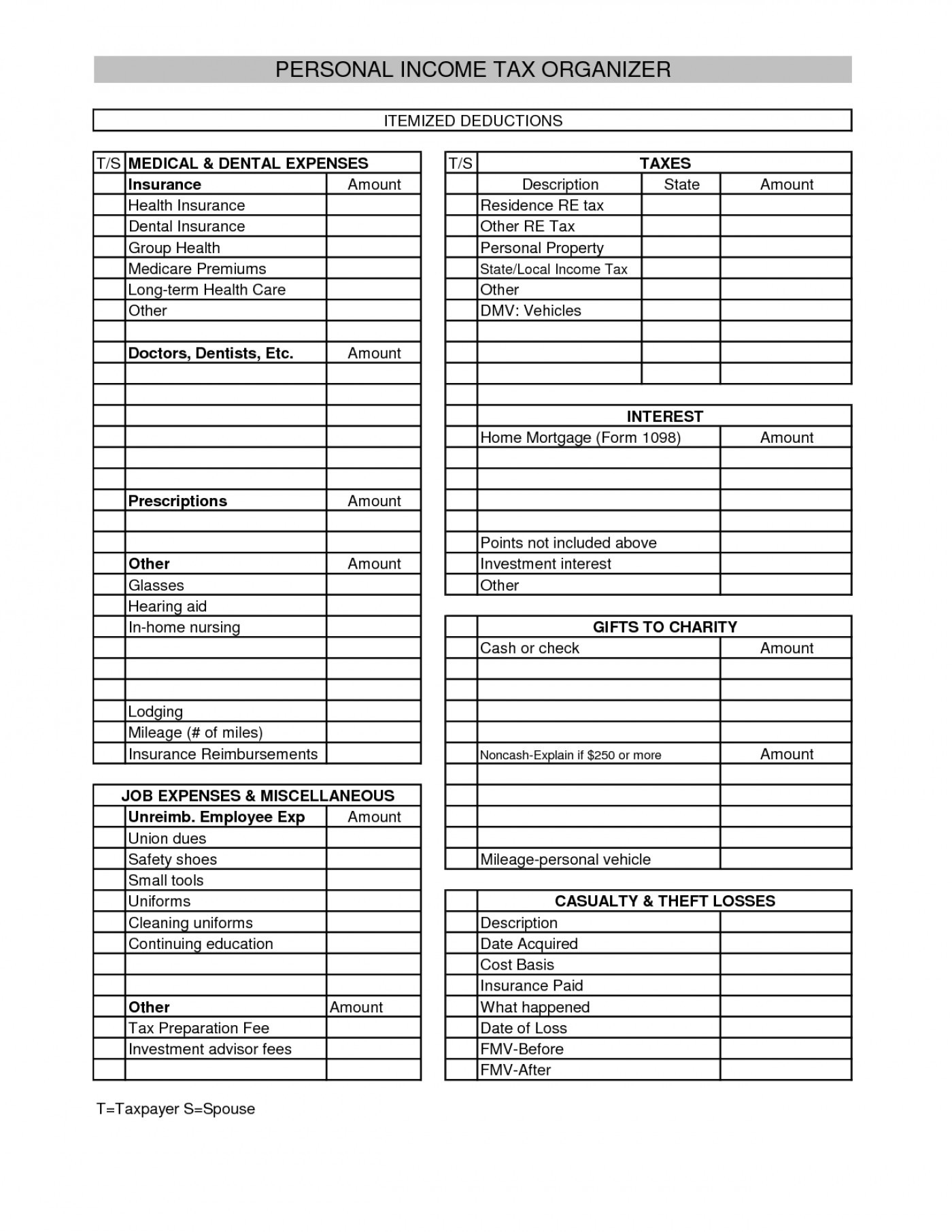

Printable Itemized Deductions Worksheet - Web showing 8 worksheets for itemized deduction. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): Classroom expenses of teachers, counselors, and principals. Web complete the itemized deductions worksheet in the instructions for schedule ca (540), line 29. Publication 502 (2021), medical and dental expenses. Worksheets are schedule a itemized deductions, deductions form 1040 itemized, itemized deductions work, i. Web adjustment worksheet educator expenses. 30 enter the larger of the amount on line 29 or your standard deduction. Save or instantly send your ready. For virginia income tax purposes, federal itemized. Reduction for state and local income taxes. 30 enter the larger of the amount on line 29 or your standard deduction. Web adjustment worksheet educator expenses. Web nurse tax deduction worksheet. Jan 13, 2022 — instructions: Easily fill out pdf blank, edit, and sign them. Jan 13, 2022 — instructions: Save or instantly send your ready. For virginia income tax purposes, federal itemized. Publication 502 (2021), medical and dental expenses. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): Use this worksheet to figure the amount, if any, of your medical. Web itemized deductions include amounts you paid for state and local income or sales taxes, real estate taxes, personal property taxes, mortgage interest,. Save or instantly send your ready. Easily fill out pdf blank, edit, and sign them. Jan 13, 2022 — instructions: Maximum $250 each ($500 joint). Web nurse tax deduction worksheet. Use this worksheet to figure the amount, if any, of your medical. Web download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. Maximum $250 each ($500 joint). Save or instantly send your ready documents. Save or instantly send your ready. Web complete printable itemized deductions worksheet online with us legal forms. Classroom expenses of teachers, counselors, and principals. Use this worksheet to figure the amount, if any, of your medical. Web showing 8 worksheets for itemized deduction. Save or instantly send your ready documents. Web download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. For virginia income tax purposes, federal itemized. Web complete printable itemized deductions worksheet online with us legal forms. Web limited itemized deduction worksheet as instructed on the worksheet. Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents. Save or instantly send your ready. Web adjustment worksheet educator expenses. Publication 502 (2021), medical and dental expenses. Worksheets are schedule a itemized deductions, deductions form 1040 itemized, itemized deductions work, i. Easily fill out pdf blank, edit, and sign them. Worksheets are schedule a itemized deductions, deductions form 1040 itemized, itemized deductions work, i. Web complete the itemized deductions worksheet in the instructions for schedule ca (540), line 29. For virginia income tax purposes, federal itemized. Web complete printable itemized deductions worksheet online with us legal forms. Maximum $250 each ($500 joint). Web complete the itemized deductions worksheet in the instructions for schedule ca (540), line 29. For virginia income tax purposes, federal itemized. Web limited itemized deduction worksheet as instructed on the worksheet. Web nurse tax deduction worksheet. Save or instantly send your ready. Web download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. Web nurse tax deduction worksheet. The source information that is required for each tax. Reduction for state and local income taxes. Worksheets are schedule a itemized deductions, deductions form 1040 itemized, itemized deductions work, i. Publication 502 (2021), medical and dental expenses. Tax deductions for calendar year 2 0 ___ ___ hired help space. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. 30 enter the larger of the amount on line 29 or your standard deduction. Easily fill out pdf blank, edit, and sign them. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): For virginia income tax purposes, federal itemized. Web adjustment worksheet educator expenses. Web limited itemized deduction worksheet as instructed on the worksheet. Web showing 8 worksheets for itemized deduction. This worksheet allows you to itemize your tax deductions for a given year. Save or instantly send your ready documents. Jan 13, 2022 — instructions: Web complete the itemized deductions worksheet in the instructions for schedule ca (540), line 29. For virginia income tax purposes, federal itemized. Web itemized deductions include amounts you paid for state and local income or sales taxes, real estate taxes, personal property taxes, mortgage interest, and disaster losses. Web complete the itemized deductions worksheet in the instructions for schedule ca (540), line 29. Save or instantly send your ready documents. Classroom expenses of teachers, counselors, and principals. Maximum $250 each ($500 joint). Web nurse tax deduction worksheet. Web adjustment worksheet educator expenses. Worksheets are schedule a itemized deductions, deductions form 1040 itemized, itemized deductions work, i. Web showing 8 worksheets for itemized deduction. 30 enter the larger of the amount on line 29 or your standard deduction. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. Reduction for state and local income taxes. This worksheet allows you to itemize your tax deductions for a given year. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): Tax deductions for calendar year 2 0 ___ ___ hired help space.10++ Itemized Deductions Worksheet Worksheets Decoomo

Itemized Deductions Worksheet 2018 Printable Worksheets and

Maximize Your SelfEmployment Tax Deductions With This Worksheet

Itemized Deductions Worksheet 2017 Printable Worksheets and

8 Tax Itemized Deduction Worksheet /

17 Schedule C Deductions Worksheet /

Tax Deduction Worksheet for Police Officers Fill and Sign Printable

Form Ia 104 Iowa Itemized Deductions Worksheet 2014 printable pdf

Itemized Deductions Worksheet 2018 Printable Worksheets and

Itemized Deductions Worksheet —

The Source Information That Is Required For Each Tax.

Easily Fill Out Pdf Blank, Edit, And Sign Them.

Web Limited Itemized Deduction Worksheet As Instructed On The Worksheet.

Save Or Instantly Send Your Ready.

Related Post: