Qbi Worksheet

Qbi Worksheet - Web the specific worksheet used to calculate the deduction primarily depends on the taxpayer’s taxable income (without consideration of the qbid). Web how to enter and calculate the qualified business income deduction (section 199a) in lacerte. Web worksheets to help your students practice reading and using words with qu.this resource contains 38 worksheets.these sheets are ready to go and require no prep! Many owners of sole proprietorships, partnerships, s corporations. This worksheet is for taxpayers who: You can figure out how familiar you are with: Web go to delete a form: Web quiz & worksheet goals. 2 posters for the qu digraph words. Web qu digraph activities and worksheets in printable and digital formats includes. 2 posters for the qu digraph words. Web qu digraph activities and worksheets in printable and digital formats includes. Many owners of sole proprietorships, partnerships, s corporations. Web how to enter and calculate the qualified business income deduction (section 199a) in lacerte. In the left menu, select the dropdown arrow next to tax tools and then under that select tools; Web go to delete a form: This worksheet is for taxpayers who: Have taxable income of $157,500 or less ($315,000 or less if married. Solved•by intuit•792•updated march 23, 2023. Web quiz & worksheet goals. Many owners of sole proprietorships, partnerships, s corporations. Web 78 rows this worksheet is designed for tax professionals to evaluate the type of legal. 2 posters for the qu digraph words. How to analyze letters to a ceo written by unhappy customers analyzing the number of bugs in a. You can figure out how familiar you are with: Many owners of sole proprietorships, partnerships, s corporations. Solved•by intuit•792•updated march 23, 2023. You can figure out how familiar you are with: Web worksheets to help your students practice reading and using words with qu.this resource contains 38 worksheets.these sheets are ready to go and require no prep! Trade, business, or aggregation information 1. (a) name (b)check if specified service (c)check if aggregated (d)taxpayer identification number. In the left menu, select the dropdown arrow next to tax tools and then under that select tools; You can figure out how familiar you are with: Trade, business, or aggregation information 1. Web 78 rows this worksheet is designed for tax professionals to evaluate the type of. In the left menu, select the dropdown arrow next to tax tools and then under that select tools; Web the specific worksheet used to calculate the deduction primarily depends on the taxpayer’s taxable income (without consideration of the qbid). Web the qualified business income (qbi) deduction allows you to deduct up to 20 percent of your qbi. Web how to. 2 posters for the qu digraph words. Trade, business, or aggregation information 1. This worksheet is for taxpayers who: You can figure out how familiar you are with: Web how to enter and calculate the qualified business income deduction (section 199a) in lacerte. Web 78 rows this worksheet is designed for tax professionals to evaluate the type of legal. Web quiz & worksheet goals. Web the qualified business income (qbi) deduction allows you to deduct up to 20 percent of your qbi. Solved•by intuit•792•updated march 23, 2023. Trade, business, or aggregation information 1. Web worksheets to help your students practice reading and using words with qu.this resource contains 38 worksheets.these sheets are ready to go and require no prep! (a) name (b)check if specified service (c)check if aggregated (d)taxpayer identification number. You can figure out how familiar you are with: Web how to enter and calculate the qualified business income deduction (section 199a). Have taxable income of $157,500 or less ($315,000 or less if married. 2 posters for the qu digraph words. In the left menu, select the dropdown arrow next to tax tools and then under that select tools; Web qu digraph activities and worksheets in printable and digital formats includes. Web 78 rows this worksheet is designed for tax professionals to. 2 posters for the qu digraph words. Web worksheets to help your students practice reading and using words with qu.this resource contains 38 worksheets.these sheets are ready to go and require no prep! Solved•by intuit•792•updated march 23, 2023. Web go to delete a form: Web the specific worksheet used to calculate the deduction primarily depends on the taxpayer’s taxable income (without consideration of the qbid). Web 78 rows this worksheet is designed for tax professionals to evaluate the type of legal. You can figure out how familiar you are with: How to analyze letters to a ceo written by unhappy customers analyzing the number of bugs in a. Web the qualified business income (qbi) deduction allows you to deduct up to 20 percent of your qbi. (a) name (b)check if specified service (c)check if aggregated (d)taxpayer identification number. Web qu digraph activities and worksheets in printable and digital formats includes. Trade, business, or aggregation information 1. Web how to enter and calculate the qualified business income deduction (section 199a) in lacerte. In the left menu, select the dropdown arrow next to tax tools and then under that select tools; Many owners of sole proprietorships, partnerships, s corporations. Have taxable income of $157,500 or less ($315,000 or less if married. This worksheet is for taxpayers who: 24 pages of qu activities, worksheets and games. Web quiz & worksheet goals. Web 78 rows this worksheet is designed for tax professionals to evaluate the type of legal. You can figure out how familiar you are with: Web how to enter and calculate the qualified business income deduction (section 199a) in lacerte. (a) name (b)check if specified service (c)check if aggregated (d)taxpayer identification number. 2 posters for the qu digraph words. Web worksheets to help your students practice reading and using words with qu.this resource contains 38 worksheets.these sheets are ready to go and require no prep! Web go to delete a form: Web the qualified business income (qbi) deduction allows you to deduct up to 20 percent of your qbi. 24 pages of qu activities, worksheets and games. This worksheet is for taxpayers who: Solved•by intuit•792•updated march 23, 2023. Web the specific worksheet used to calculate the deduction primarily depends on the taxpayer’s taxable income (without consideration of the qbid). In the left menu, select the dropdown arrow next to tax tools and then under that select tools; Have taxable income of $157,500 or less ($315,000 or less if married. Web quiz & worksheet goals.Tax Newsletter December 2020 Basics & Beyond

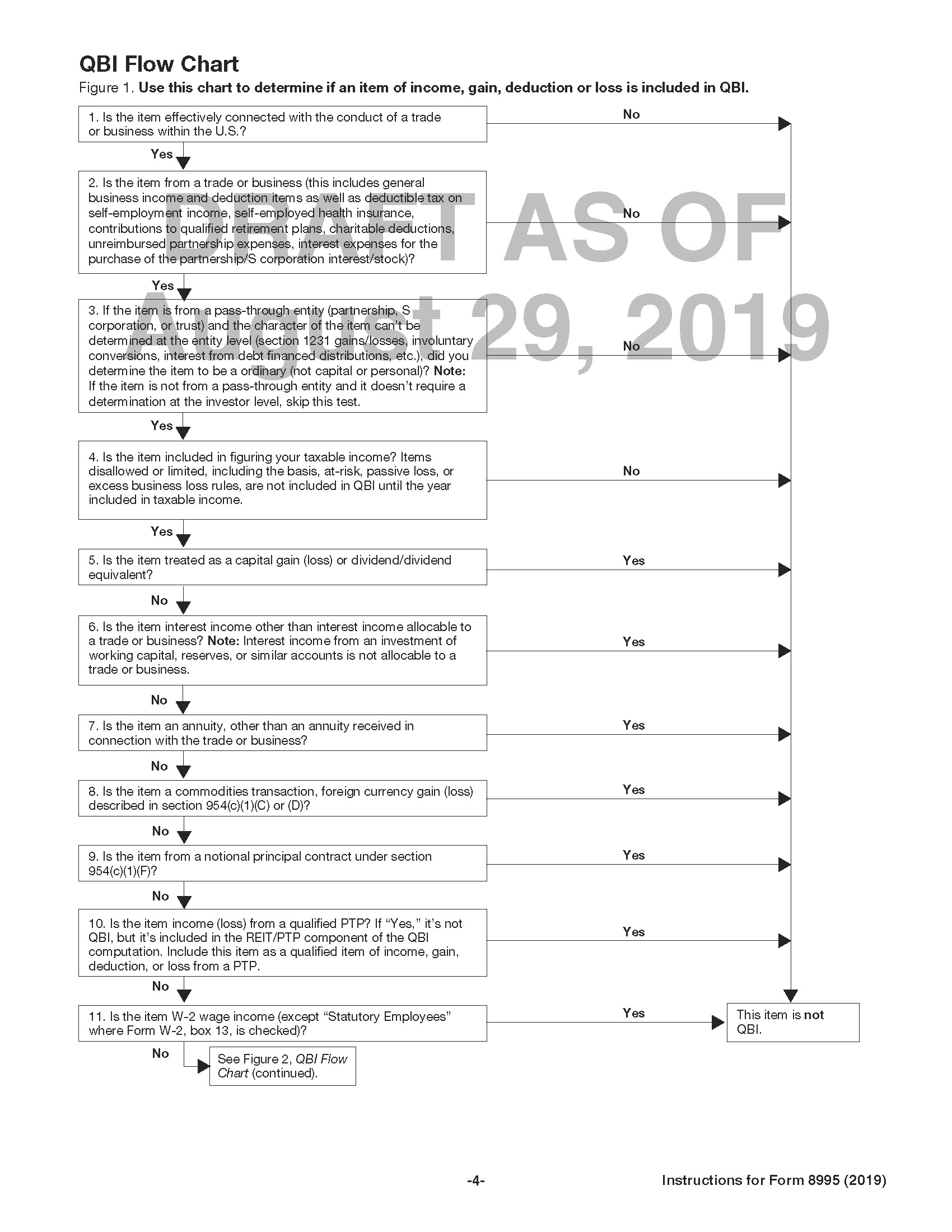

Draft Instructions to 2019 Form 8995 Contain More Informal IRS Guidance

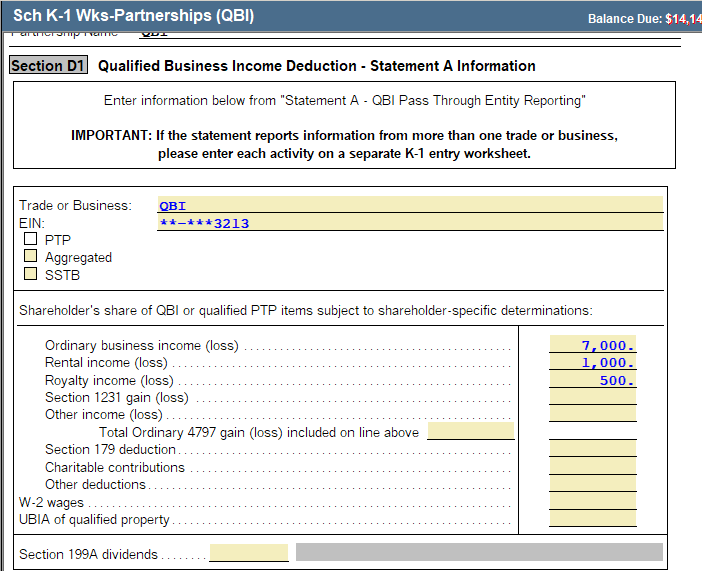

How to enter and calculate the qualified business Tax Pro Community

Qualified Business Deduction Summary Form Charles Leal's Template

Solved 199A special allocation for QBI Intuit Accountants Community

Update On The Qualified Business Deduction For Individuals

Qbi Loss Tracking Worksheet

QBI Deduction (simplified calculation) YouTube

Quiz & Worksheet Determining QBI Deductions

Qbi deduction calculator YuweiRio

How To Analyze Letters To A Ceo Written By Unhappy Customers Analyzing The Number Of Bugs In A.

Web Qu Digraph Activities And Worksheets In Printable And Digital Formats Includes.

Trade, Business, Or Aggregation Information 1.

Many Owners Of Sole Proprietorships, Partnerships, S Corporations.

Related Post: