Qualified Dividends And Capital Gain Tax Worksheet--Line 16

Qualified Dividends And Capital Gain Tax Worksheet--Line 16 - 24) 25) tax on all taxable income. Enter the smaller of line 45 or line 46. Enter the smaller of line 23 or line 24. Start by indicating the portion of your gross income. If you are required to use this worksheet to figure the tax on an amount from. Web 2018 form 1040—line 11a qualified dividends and capital gain tax worksheet—line 11a. Enter the smaller of line 25 or line 26. Instead, you will need to use. If the amount on line 1 is $100,000 or more, use the tax computation worksheet. Web for 2003, the irs added qualified dividends and the new rates to the worksheet so that millions of taxpayers will still be able to get their full tax benefits without the schedule d. When you have qualified dividends or capital gains, you do not use the tax table. Web how do i download my qualified dividends and capital gain tax worksheet? Prior to completing this file, make sure you fill out form 1040. Instead, you will need to use. It was not included with the 1040. • before completing this worksheet, complete form 1040. Instead, 1040 line 16 “tax” asks you to. Web to figure the tax. Enter the smaller of line 45 or line 46. Web tax on all taxable income (including capital gains and qualified dividends). Start by indicating the portion of your gross income. Web see the instructions for line 16 to see if you must use the worksheet below to figure your tax. Use the qualified dividends and capital gain tax worksheet to figure your tax, if you do not have to use the schedule. Web qualified dividends and capital gain tax worksheet—line 16. Enter the smaller of line 45 or line 46. Web 2018 form 1040—line 11a qualified dividends and capital gain tax worksheet—line 11a. Web qualified dividends and capital gain tax worksheet—line 16 keep for your records see the earlier instructions for line 16 to see if you can use this worksheet to figure your. Web to figure the tax. Web tax. Web for 2003, the irs added qualified dividends and the new rates to the worksheet so that millions of taxpayers will still be able to get their full tax benefits without the schedule d. Enter the smaller of line 25 or line 26. If the amount on line 1 is $100,000 or more, use the tax computation worksheet. Web to. Web for 2003, the irs added qualified dividends and the new rates to the worksheet so that millions of taxpayers will still be able to get their full tax benefits without the schedule d. Enter the smaller of line 23 or line 24. If you are required to use this worksheet to figure the tax on an amount from. 24). See the earlier instructions for line 11a to see if you can use. It was not included with the 1040. Start by indicating the portion of your gross income. Enter the smaller of line 23 or line 24. If the amount on line 1 is $100,000 or more, use the tax computation worksheet tax on all taxable income. Enter the smaller of line 25 or line 26. If the amount on line 1 is $100,000 or more, use the tax computation worksheet tax on all taxable income. If the amount on line 1 is $100,000 or more, use the tax computation worksheet. However, not all dividends reported on those lines may have met the holding period requirement. Web. Instead, you will need to use. When you have qualified dividends or capital gains, you do not use the tax table. Turbotax will generate the worksheet to. You can find them in the form 1040 instructions. Web the strangest fluke of the tax return is that the actual calculation of how much base tax you owe does not have a. If the amount on line 1 is $100,000 or more, use the tax computation worksheet. Web the strangest fluke of the tax return is that the actual calculation of how much base tax you owe does not have a form. Web 2018 form 1040—line 11a qualified dividends and capital gain tax worksheet—line 11a. Start by indicating the portion of your. Enter the smaller of line 45 or line 46. Instead, you will need to use. Web 2018 form 1040—line 11a qualified dividends and capital gain tax worksheet—line 11a. Instead, 1040 line 16 “tax” asks you to. Web the tax computation for line 16 of form 1040 can be calculated in one of four ways: Web qualified dividends and capital gain tax worksheet—line 16 keep for your records see the earlier instructions for line 16 to see if you can use this worksheet to figure your. If you are required to use this worksheet to figure the tax on an amount from. It was not included with the 1040. Prior to completing this file, make sure you fill out form 1040. If the amount on line 1 is $100,000 or more, use the tax computation worksheet. See the earlier instructions for line 11a to see if you can use. Use the qualified dividends and capital gain tax worksheet to figure your tax, if you do not have to use the schedule. Web otherwise, complete the qualified dividends and capital gain tax worksheet in the instructions for form 1040, line 16, (or in the instructions for form. Web for 2003, the irs added qualified dividends and the new rates to the worksheet so that millions of taxpayers will still be able to get their full tax benefits without the schedule d. Web how do i download my qualified dividends and capital gain tax worksheet? However, not all dividends reported on those lines may have met the holding period requirement. Web tax on all taxable income (including capital gains and qualified dividends). Web • see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. Start by indicating the portion of your gross income. 24) 25) tax on all taxable income. See the earlier instructions for line 11a to see if you can use. Web to figure the tax. Start by indicating the portion of your gross income. • before completing this worksheet, complete form 1040. Web 2018 form 1040—line 11a qualified dividends and capital gain tax worksheet—line 11a. Web how do i download my qualified dividends and capital gain tax worksheet? When you have qualified dividends or capital gains, you do not use the tax table. 24) 25) tax on all taxable income. Web see the instructions for line 16 to see if you must use the worksheet below to figure your tax. Turbotax will generate the worksheet to. If the amount on line 1 is $100,000 or more, use the tax computation worksheet. If you are required to use this worksheet to figure the tax on an amount from. Web for 2003, the irs added qualified dividends and the new rates to the worksheet so that millions of taxpayers will still be able to get their full tax benefits without the schedule d. Enter the smaller of line 45 or line 46. Web the strangest fluke of the tax return is that the actual calculation of how much base tax you owe does not have a form. Web tax on all taxable income (including capital gains and qualified dividends)." Qualified Dividends and Capital Gain Tax Worksheet." not showing

Capital Gains Tax Worksheet To get professional and arranged, you

Qualified Dividends And Capital Gain Tax Worksheet 1040A —

Qualified Dividends and Capital Gain Tax Worksheet 2016

Qualified Dividends And Capital Gain Tax Worksheet Calculator veche

Qualified Dividends And Capital Gain Tax Worksheet 2016 —

Capital gaines work sheet Fill out & sign online DocHub

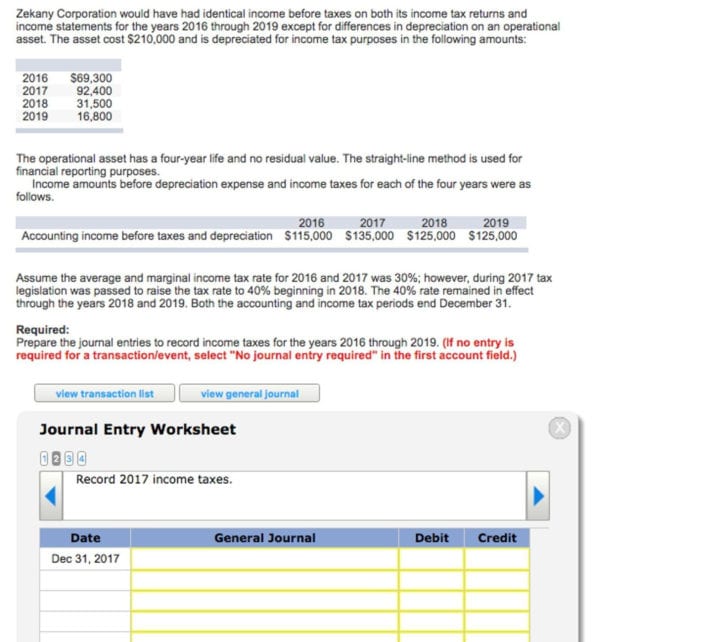

SOLUTION Qualified Dividends and Capital Gain Tax Worksheet Studypool

" Qualified Dividends and Capital Gain Tax Worksheet." not showing

Qualified Dividends And Capital Gain Tax Worksheet 2019 worksheet today

Enter The Smaller Of Line 23 Or Line 24.

Prior To Completing This File, Make Sure You Fill Out Form 1040.

Web Otherwise, Complete The Qualified Dividends And Capital Gain Tax Worksheet In The Instructions For Form 1040, Line 16, (Or In The Instructions For Form.

Instead, 1040 Line 16 “Tax” Asks You To.

Related Post: