Recovery Rebate Credit Worksheet Line 13 Turbotax

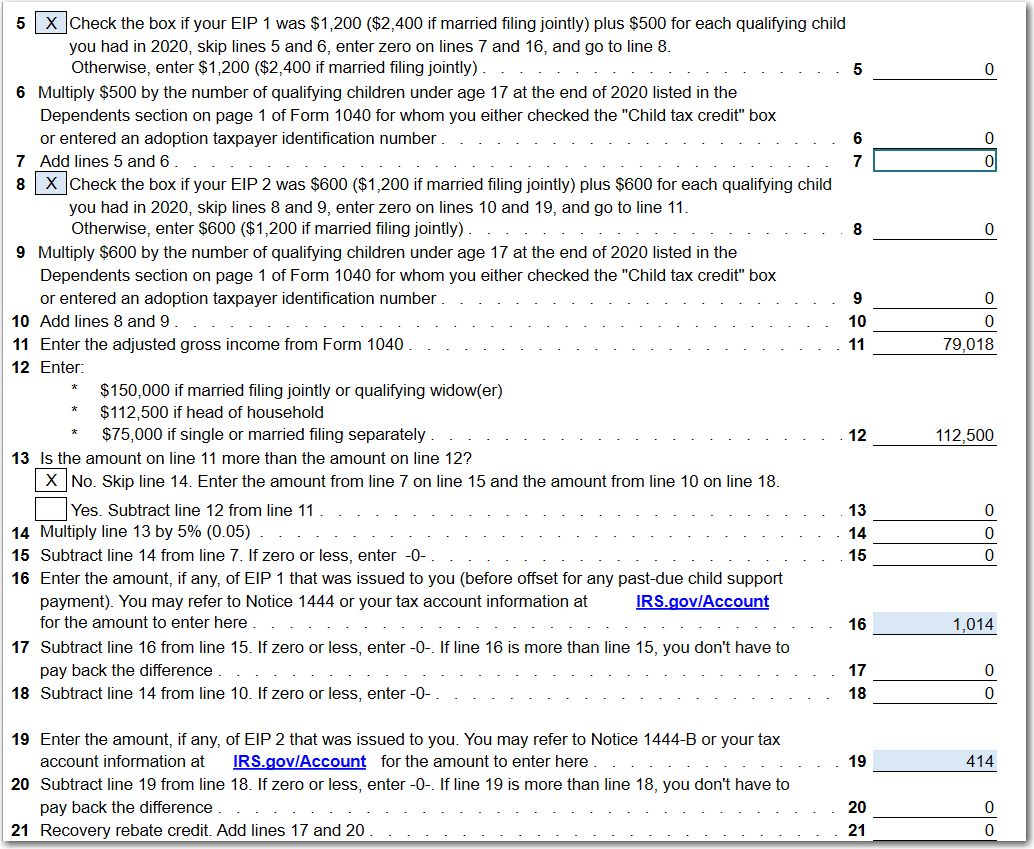

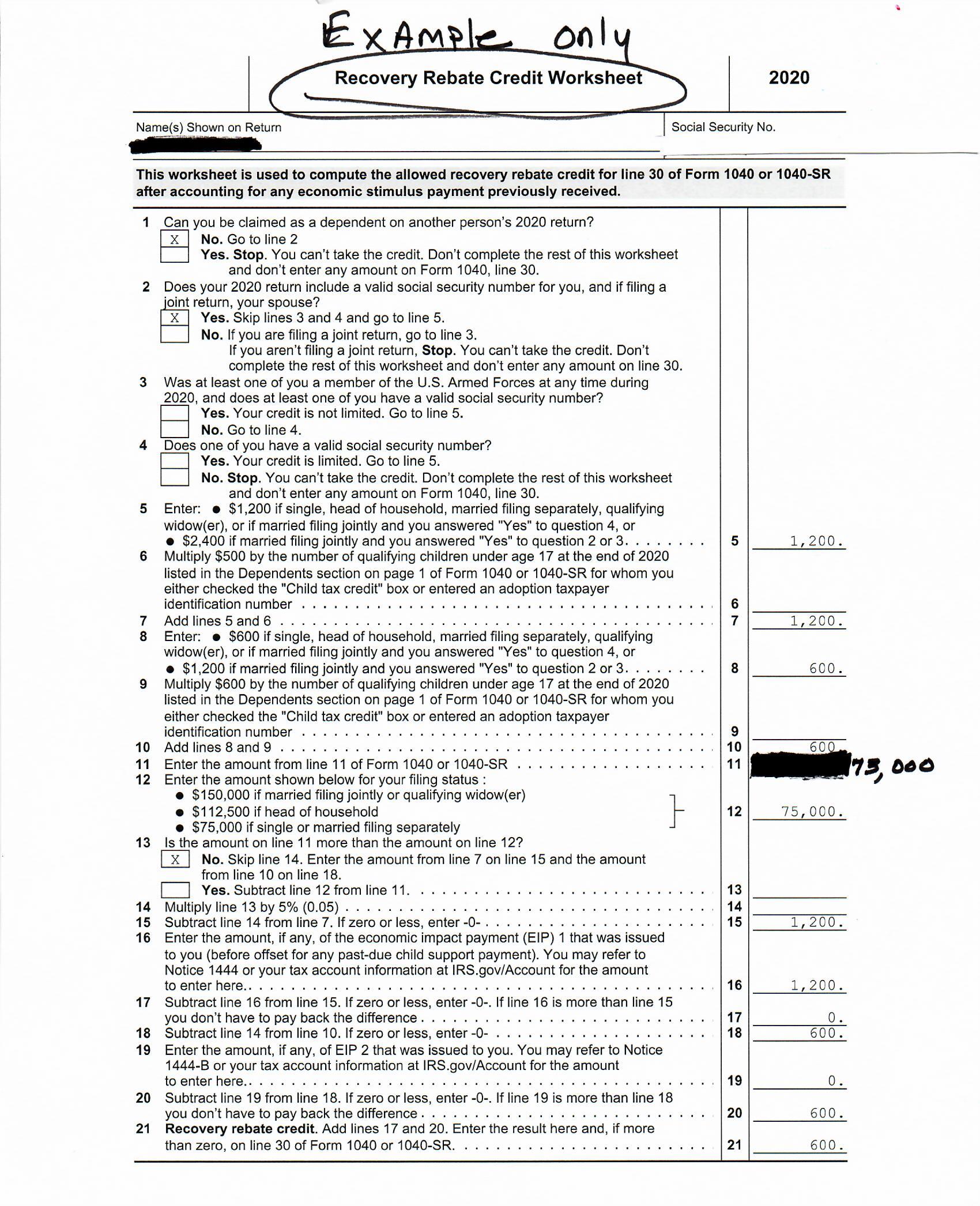

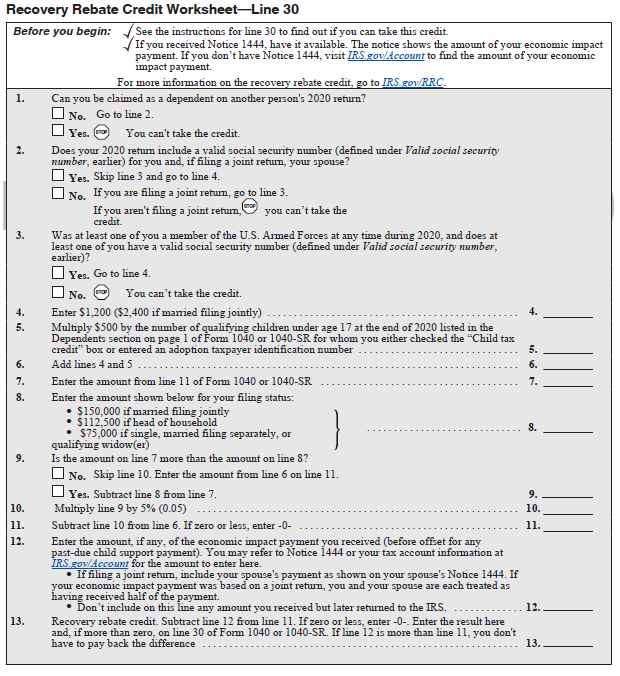

Recovery Rebate Credit Worksheet Line 13 Turbotax - Web the recovery rebate credit amount is figured just like the third economic impact (stimulus) payment, except that it uses your client's tax year 2021 information to. Joint filers with a spouse will. Web line 11 if your income is above the threshold on line 10, the stimulus payment is reduced by 5% of the excess over the threshold. Web enter the amount in your tax preparation software or in the form 1040 recovery rebate credit worksheet to calculate your credit. Web your income will impact the amount of your recovery rebate credit. Web if you have not received one or more of your stimulus checks, you will receive your payment in the form of a recovery rebate credit on line 30 of your 2020. The income limit threshold never changed. Web the recovery rebate credit is a credit that was authorized by the coronavirus aid, relief, and economic security (cares) act. Web the advance payment went down by $5 for every $100 over the limit. Web turbotax is checking the entry for the recovery rebate credit worksheet: Web the advance payment went down by $5 for every $100 over the limit. Web use fill to complete blank online thetaxbook pdf forms for free. So, if you were eligible for. Web if you have not received one or more of your stimulus checks, you will receive your payment in the form of a recovery rebate credit on line. Web the advance payment went down by $5 for every $100 over the limit. Web the recovery rebate credit is a credit that was authorized by the coronavirus aid, relief, and economic security (cares) act. Web turbotax is checking the entry for the recovery rebate credit worksheet: Joint filers with a spouse will. If you earn more than $75k, your. Joint filers with a spouse will. Web your income will impact the amount of your recovery rebate credit. So, if you were eligible for. Once completed you can sign your fillable form or send for signing. If you earn more than $75k, your credit could be reduced to zero. Web if you have not received one or more of your stimulus checks, you will receive your payment in the form of a recovery rebate credit on line 30 of your 2020. Web your income will impact the amount of your recovery rebate credit. If you earn more than $75k, your credit could be reduced to zero. Line 12 the. Web enter the amount in your tax preparation software or in the form 1040 recovery rebate credit worksheet to calculate your credit. Joint filers with a spouse will. Line 12 the amount the taxpayer qualifies for. So, if you were eligible for. All forms are printable and. Once completed you can sign your fillable form or send for signing. Web enter the amount in your tax preparation software or in the form 1040 recovery rebate credit worksheet to calculate your credit. Web the recovery rebate credit amount is figured just like the third economic impact (stimulus) payment, except that it uses your client's tax year 2021 information. Line 12 the amount the taxpayer qualifies for. Web your income will impact the amount of your recovery rebate credit. Once completed you can sign your fillable form or send for signing. All forms are printable and. Web turbotax is checking the entry for the recovery rebate credit worksheet: If you earn more than $75k, your credit could be reduced to zero. Web turbotax is checking the entry for the recovery rebate credit worksheet: Web the advance payment went down by $5 for every $100 over the limit. Web line 11 if your income is above the threshold on line 10, the stimulus payment is reduced by 5% of. Web enter the amount in your tax preparation software or in the form 1040 recovery rebate credit worksheet to calculate your credit. Web the recovery rebate credit is a credit that was authorized by the coronavirus aid, relief, and economic security (cares) act. Web if you have not received one or more of your stimulus checks, you will receive your. Web if you have not received one or more of your stimulus checks, you will receive your payment in the form of a recovery rebate credit on line 30 of your 2020. Web the recovery rebate credit amount is figured just like the third economic impact (stimulus) payment, except that it uses your client's tax year 2021 information to. So,. Web enter the amount in your tax preparation software or in the form 1040 recovery rebate credit worksheet to calculate your credit. If you earn more than $75k, your credit could be reduced to zero. Joint filers with a spouse will. So, if you were eligible for. All forms are printable and. Web your income will impact the amount of your recovery rebate credit. Web if you have not received one or more of your stimulus checks, you will receive your payment in the form of a recovery rebate credit on line 30 of your 2020. Web the recovery rebate credit is a credit that was authorized by the coronavirus aid, relief, and economic security (cares) act. Once completed you can sign your fillable form or send for signing. Line 12 the amount the taxpayer qualifies for. Web the advance payment went down by $5 for every $100 over the limit. The income limit threshold never changed. Web use fill to complete blank online thetaxbook pdf forms for free. Web line 11 if your income is above the threshold on line 10, the stimulus payment is reduced by 5% of the excess over the threshold. Web turbotax is checking the entry for the recovery rebate credit worksheet: Web the recovery rebate credit amount is figured just like the third economic impact (stimulus) payment, except that it uses your client's tax year 2021 information to. Web the recovery rebate credit is a credit that was authorized by the coronavirus aid, relief, and economic security (cares) act. Web if you have not received one or more of your stimulus checks, you will receive your payment in the form of a recovery rebate credit on line 30 of your 2020. Web use fill to complete blank online thetaxbook pdf forms for free. So, if you were eligible for. All forms are printable and. Web line 11 if your income is above the threshold on line 10, the stimulus payment is reduced by 5% of the excess over the threshold. Web turbotax is checking the entry for the recovery rebate credit worksheet: If you earn more than $75k, your credit could be reduced to zero. Line 12 the amount the taxpayer qualifies for. Once completed you can sign your fillable form or send for signing. The income limit threshold never changed. Joint filers with a spouse will.Recovery Rebate Credit Worksheet ATX Line 30 COVID19 ATX Community

Recovery Rebate Credit Worksheet « Tax Guru Kertetter Letter

ReadyToUse Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

The recovery rebate credit calculator MollieAilie

Recovery Rebate Credit Worksheet 2020 ideas 2022

Who "could" Qualify for 2nd Stimulus?

What You Need to Know About Filling Out Your Recovery Rebate Credit

Recovery Rebate Credit Worksheet « Tax Guru Kertetter Letter

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

Tax Implications of COVID19 Passport Software Inc.

Web The Advance Payment Went Down By $5 For Every $100 Over The Limit.

Web Your Income Will Impact The Amount Of Your Recovery Rebate Credit.

Web The Recovery Rebate Credit Amount Is Figured Just Like The Third Economic Impact (Stimulus) Payment, Except That It Uses Your Client's Tax Year 2021 Information To.

Web Enter The Amount In Your Tax Preparation Software Or In The Form 1040 Recovery Rebate Credit Worksheet To Calculate Your Credit.

Related Post: