Residential Clean Energy Credit Limit Worksheet

Residential Clean Energy Credit Limit Worksheet - Instead, the credit is limited to 30% of qualified expenses made for property placed in service beginning in 2022. The credit is claimed in. * subject to cap of $1200/year. Residential energy credits (irs) form. Is it based on tax liability and ctc? Web ad fast, legal & effective credit repair services starting at $59/month. Use fill to complete blank online irs pdf forms for free. Web before you complete the following worksheet, figure the amount of any credit for the. Web in 2018, 2019, 2020, and 2021, an individual may claim a credit for (1) 10% of the cost of qualified energy efficiency improvements and (2) the amount of the. The residential clean energy (rce) credit is a renewable energy tax credit extended and expanded by the 2022 inflation. * subject to cap of $1200/year. Once completed you can sign. ** the irs will soon publish further information on eligibility requirements related to home electric. Residential energy credits (irs) form. The credit is claimed in. Web there is no overall dollar limit on the credit. Web amount of credit. Web fill online, printable, fillable, blank form 5695: Web a credit limit for residential energy property costs for 2022 of $50 for any advanced main air circulating fan; Residential energy credits (irs) form. Residential energy property credit (section 25d) through 2019, taxpayers could claim a section 25d credit worth up to 30% of qualifying. In the paper the maximum amount of energy that can be made from residential energy. Web fill online, printable, fillable, blank form 5695: Web the residential energy credit is limited by your tax liability and can be carried forward. Web before you complete the following worksheet, figure the amount of any credit for the. ** the irs will soon publish further information on eligibility requirements related to home electric. Use fill to complete blank online irs pdf forms for free. Web any residential energy property costs paid or incurred in 2022. Instead, the credit is limited to 30% of. Web ad fast, legal & effective credit repair services starting at $59/month. Web eligibility for the credit. The residential clean energy (rce) credit is a renewable energy tax credit extended and expanded by the 2022 inflation. Web residential clean energy credit. $150 for any qualified natural gas, propane, or oil furnace or hot water. Web it’s a 2,500 square foot house, so it has a lot of energy efficiency. Use fill to complete blank online irs pdf forms for free. Web a credit limit for residential energy property costs for 2022 of $50 for any advanced main air circulating fan; As for how much you can take home in tax credits, this number is. Web any residential energy property costs paid or incurred in 2022. Web eligibility for the credit. Web residential clean energy credit. Web it’s a 2,500 square foot house, so it has a lot of energy efficiency. In the paper the maximum amount of energy that can be made from residential energy. The credit is claimed in. Web ad fast, legal & effective credit repair services starting at $59/month. Web before you complete the following worksheet, figure the amount of any credit for the. Residential energy property credit (section 25d) through 2019, taxpayers could claim a section 25d credit worth up to 30% of qualifying. Web fill online, printable, fillable, blank form. Web residential clean energy credit. Residential energy property credit (section 25d) through 2019, taxpayers could claim a section 25d credit worth up to 30% of qualifying. * subject to cap of $1200/year. Residential energy credits (irs) form. • a total combined credit limit of $500 ($200 limit for windows) for all tax years after 2005. $150 for any qualified natural gas, propane, or oil furnace or hot water. * subject to cap of $1200/year. Web in 2018, 2019, 2020, and 2021, an individual may claim a credit for (1) 10% of the cost of qualified energy efficiency improvements and (2) the amount of the. Use fill to complete blank online irs pdf forms for free.. $150 for any qualified natural gas, propane, or oil furnace or hot water. The credit is claimed in. Web residential clean energy credit. Web before you complete the following worksheet, figure the amount of any credit for the. Use fill to complete blank online irs pdf forms for free. ** the irs will soon publish further information on eligibility requirements related to home electric. Web there is no overall dollar limit on the credit. Web a credit limit for residential energy property costs for 2022 of $50 for any advanced main air circulating fan; Residential energy property credit (section 25d) through 2019, taxpayers could claim a section 25d credit worth up to 30% of qualifying. Web it’s a 2,500 square foot house, so it has a lot of energy efficiency. Web ad fast, legal & effective credit repair services starting at $59/month. Web eligibility for the credit. * subject to cap of $1200/year. Web any residential energy property costs paid or incurred in 2022. Residential energy credits (irs) form. The residential clean energy (rce) credit is a renewable energy tax credit extended and expanded by the 2022 inflation. This energy efficient home improvement credit is limited as follows. Instead, the credit is limited to 30% of qualified expenses made for property placed in service beginning in 2022. Web 30% of cost, up to $1,000 **. Web the residential energy credit is limited by your tax liability and can be carried forward to future tax years if your eligible home improvement costs exceed your. * subject to cap of $1200/year. Web ad fast, legal & effective credit repair services starting at $59/month. The credit is claimed in. Residential energy credits (irs) form. ** the irs will soon publish further information on eligibility requirements related to home electric. Instead, the credit is limited to 30% of qualified expenses made for property placed in service beginning in 2022. Web amount of credit. Web fill online, printable, fillable, blank form 5695: Once completed you can sign. Web it’s a 2,500 square foot house, so it has a lot of energy efficiency. Web before you complete the following worksheet, figure the amount of any credit for the. Web the residential energy credit is limited by your tax liability and can be carried forward to future tax years if your eligible home improvement costs exceed your. $150 for any qualified natural gas, propane, or oil furnace or hot water. Web in addition to the energy efficiency credits, homeowners can also take advantage of the modified and extended residential clean energy credit, which. Web eligibility for the credit. This energy efficient home improvement credit is limited as follows.Lower Your National Grid Bill with Clean Energy Credits

Renewable energy facts Natural Resources Canada

Form 5695 Residential Energy Credits (2014) Free Download

Instructions for filling out IRS Form 5695 Everlight Solar

How to File IRS Form 5695 To Claim Your Renewable Energy Credits

Federal Solar Tax Credit Steps Down After 2019

Form 5695 Residential Energy Credits (2014) Free Download

How to File IRS Form 5695 To Claim Your Renewable Energy Credits

Form 5695 Residential Energy Credits (2014) Free Download

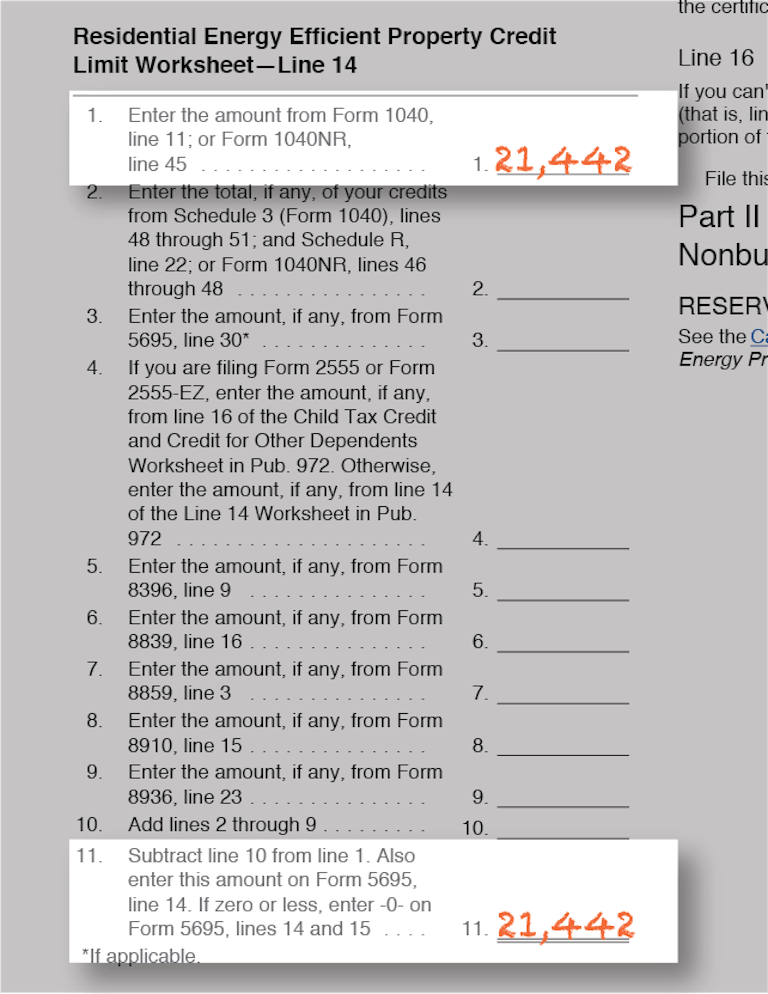

Credit limit worksheet fillable Fill out & sign online DocHub

A Total Combined Credit Limit Of.

Web Residential Clean Energy Credit.

Use Fill To Complete Blank Online Irs Pdf Forms For Free.

Web In 2018, 2019, 2020, And 2021, An Individual May Claim A Credit For (1) 10% Of The Cost Of Qualified Energy Efficiency Improvements And (2) The Amount Of The.

Related Post:

.png)