Schedule C Car & Truck Expenses Worksheet

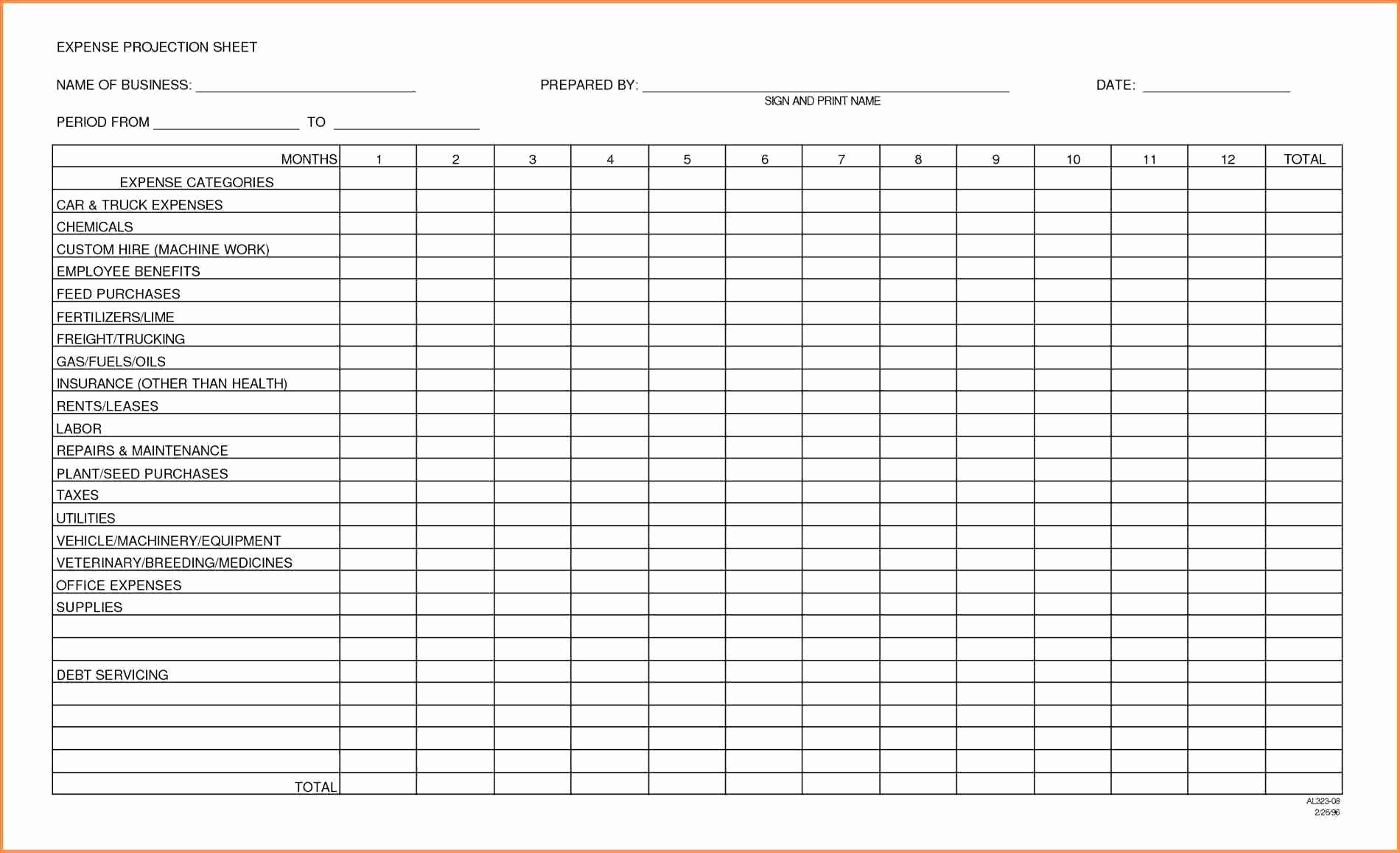

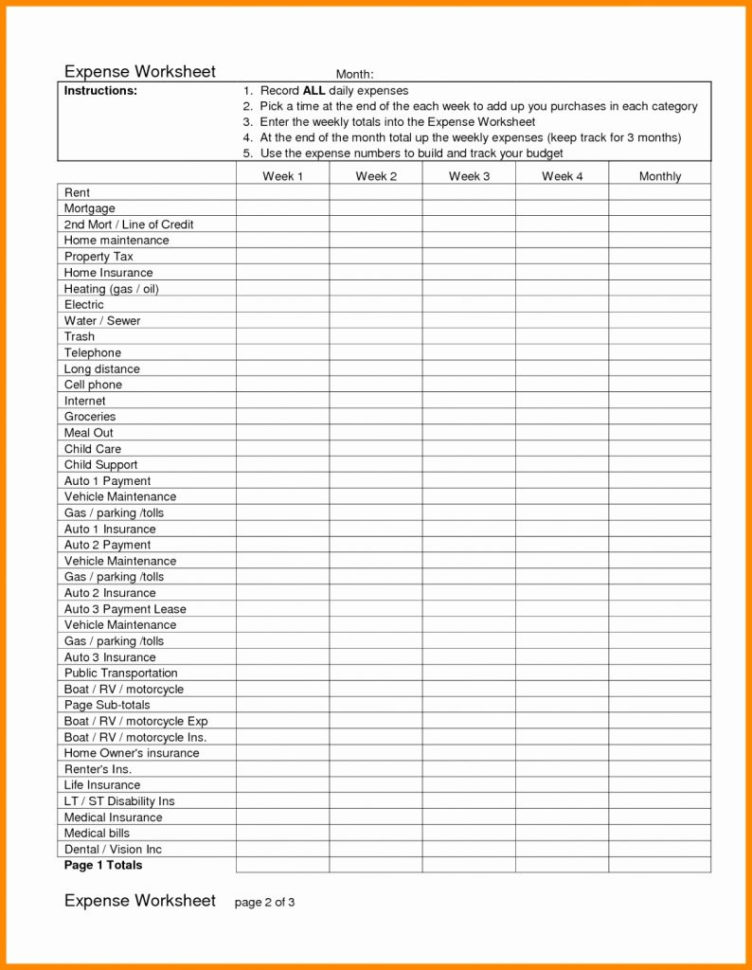

Schedule C Car & Truck Expenses Worksheet - • if a profit, enter on both. 31 net profit or (loss). Vehicle loan and loan interest; Web for entering vehicle expenses in an individual return, intuit proseries has a motor real truck expense worksheet. Web car and truck expenses. Between one workplace and another, to meet clients or. You may only use one. Web on the business income (schedule c)screen, there's an input field for car and truck expenses [adjustment]. Web write it off using: An entry here will flow to line 9 of the schedule c, but this field. Web car allowance and mileage policies for 2022. If you need to hire an editor, designer, photographer, or other creative pro, write off what you pay them. Expense category amount comments fuel repairs tires insurance fixed. You should uses this workbook if you're claiming 31 net profit or (loss). Web car and truck expenses. Subtract line 30 from line 29. You should uses this workbook if you're claiming Web on the business income (schedule c)screen, there's an input field for car and truck expenses [adjustment]. Web schedule c worksheet hickman & hickman, pllc. Web schedule c worksheet hickman & hickman, pllc. There are two methods you can use to deduct your vehicles expenses, standard mileage rate or actual car expenses. Subtract line 30 from line 29. Vehicle loan and loan interest; Web write it off using: As you calculate your company car allowance or mileage rate for 2022, keep in mind the following three pressure points for employees. Expense category amount comments fuel repairs tires insurance fixed. Web you can categorize these types of expenses as car and truck: Web schedule c worksheet hickman & hickman, pllc. Web car and truck expenses o you may deduct. You may only use one. • if a profit, enter on both. Vehicle loan and loan interest; 31 net profit or (loss). Web car allowance and mileage policies for 2022. • if a profit, enter on both. Between one workplace and another, to meet clients or. You should uses this workbook if you're claiming Web for entering vehicle expenses in an individual return, intuit proseries has a motor real truck expense worksheet. Web schedule c worksheet hickman & hickman, pllc. • if a profit, enter on both. Between one workplace and another, to meet clients or. Web car and truck expenses o you may deduct car/truck expenses for local or extended business travel, including: Expense category amount comments fuel repairs tires insurance fixed. If you need to hire an editor, designer, photographer, or other creative pro, write off what you. • if a profit, enter on both. Web you can categorize these types of expenses as car and truck: An entry here will flow to line 9 of the schedule c, but this field. Web method worksheet in the instructions to figure the amount to enter on line 30. 31 net profit or (loss). • if a profit, enter on both. Web for entering vehicle expenses in an individual return, intuit proseries has a motor real truck expense worksheet. Web car and truck expenses. As you calculate your company car allowance or mileage rate for 2022, keep in mind the following three pressure points for employees. Web car and truck expenses o you may. You should uses this workbook if you're claiming Web car and truck expenses o you may deduct car/truck expenses for local or extended business travel, including: Subtract line 30 from line 29. An entry here will flow to line 9 of the schedule c, but this field. If you need to hire an editor, designer, photographer, or other creative pro,. An entry here will flow to line 9 of the schedule c, but this field. Web schedule c worksheet hickman & hickman, pllc. Between one workplace and another, to meet clients or. If you need to hire an editor, designer, photographer, or other creative pro, write off what you pay them. You may only use one. Expense category amount comments fuel repairs tires insurance fixed. 31 net profit or (loss). Web car and truck expenses o you may deduct car/truck expenses for local or extended business travel, including: You should uses this workbook if you're claiming Web on the business income (schedule c)screen, there's an input field for car and truck expenses [adjustment]. Web car allowance and mileage policies for 2022. Web for entering vehicle expenses in an individual return, intuit proseries has a motor real truck expense worksheet. As you calculate your company car allowance or mileage rate for 2022, keep in mind the following three pressure points for employees. Web car and truck expenses. Vehicle loan and loan interest; Web write it off using: Web you can categorize these types of expenses as car and truck: Subtract line 30 from line 29. Web method worksheet in the instructions to figure the amount to enter on line 30. There are two methods you can use to deduct your vehicles expenses, standard mileage rate or actual car expenses. • if a profit, enter on both. 31 net profit or (loss). Web schedule c worksheet hickman & hickman, pllc. Web car and truck expenses o you may deduct car/truck expenses for local or extended business travel, including: Subtract line 30 from line 29. Web for entering vehicle expenses in an individual return, intuit proseries has a motor real truck expense worksheet. Between one workplace and another, to meet clients or. If you need to hire an editor, designer, photographer, or other creative pro, write off what you pay them. Web on the business income (schedule c)screen, there's an input field for car and truck expenses [adjustment]. Vehicle loan and loan interest; Web you can categorize these types of expenses as car and truck: As you calculate your company car allowance or mileage rate for 2022, keep in mind the following three pressure points for employees. You should uses this workbook if you're claiming Web write it off using: There are two methods you can use to deduct your vehicles expenses, standard mileage rate or actual car expenses. Web car and truck expenses.The Car Truck Expenses Worksheet Schedule C Review —

Schedule C Car And Truck Expenses Worksheet Awesome Driver —

Top Car Truck Expenses Worksheet Schedule C Price Design —

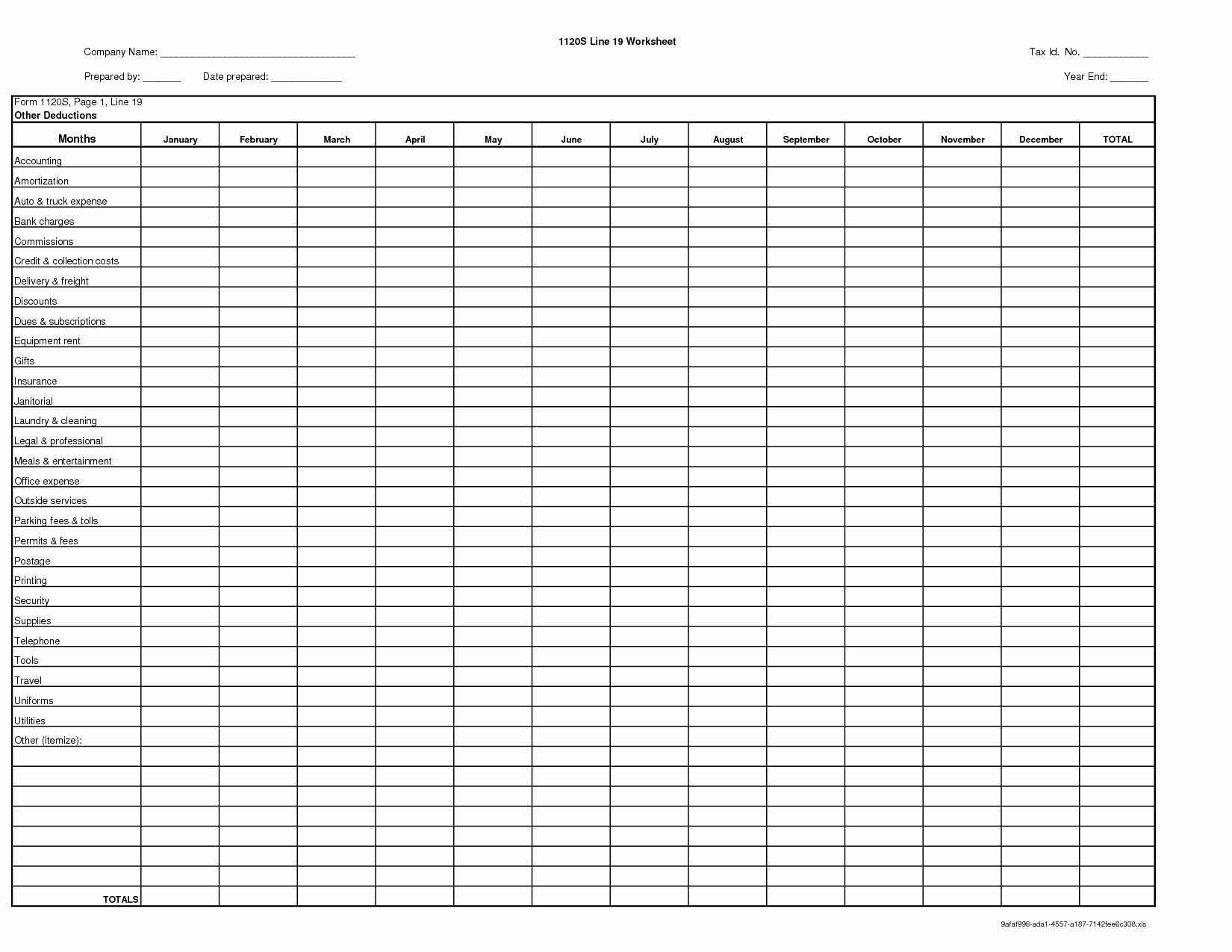

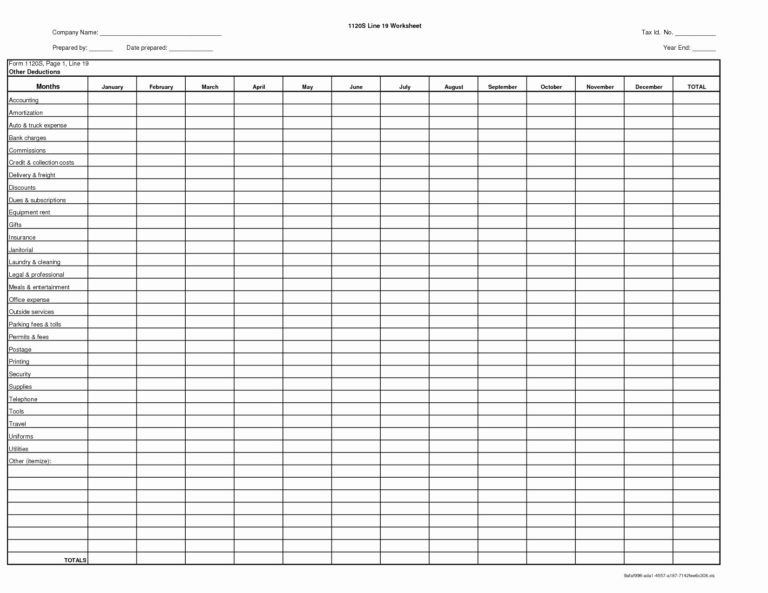

Schedule C Spreadsheet —

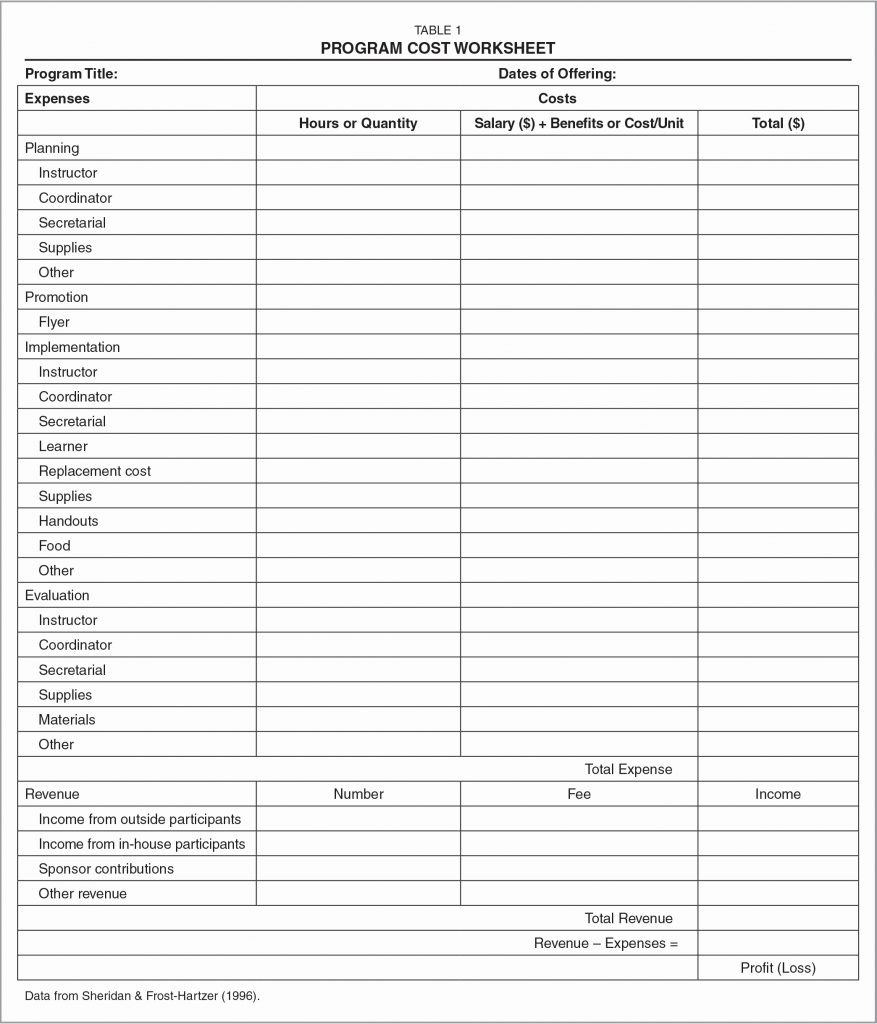

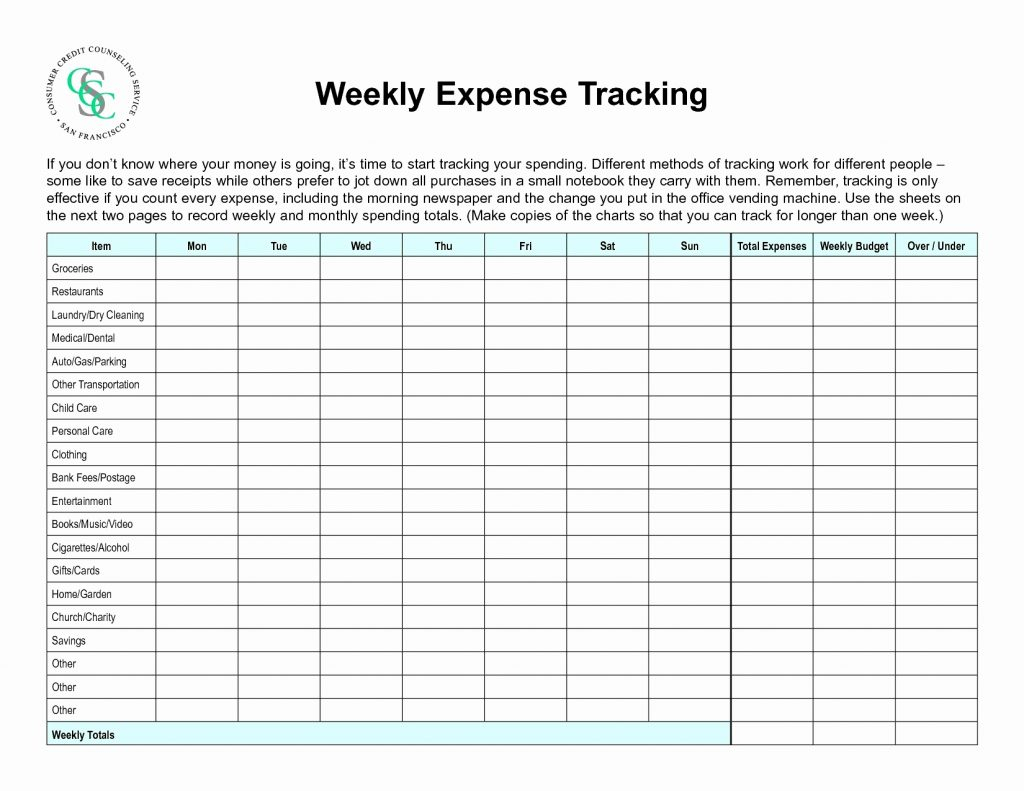

Schedule C Expenses Worksheet

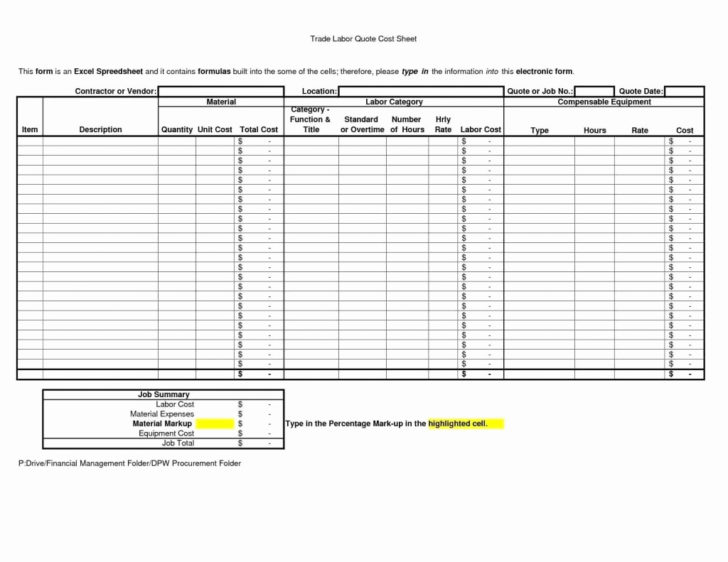

Truck Driver Expense Spreadsheet Schedule C Car And Expenses —

Trucking Expenses Spreadsheet Of Schedule C Car And Truck —

Schedule C Expenses Spreadsheet Or Schedule C Car And Truck —

Schedule C Spreadsheet within Schedule C Expenses Spreadsheet Car And

Trucking Expenses Spreadsheet Of Schedule C Car And Truck —

Web Car Allowance And Mileage Policies For 2022.

Expense Category Amount Comments Fuel Repairs Tires Insurance Fixed.

Web Method Worksheet In The Instructions To Figure The Amount To Enter On Line 30.

An Entry Here Will Flow To Line 9 Of The Schedule C, But This Field.

Related Post: