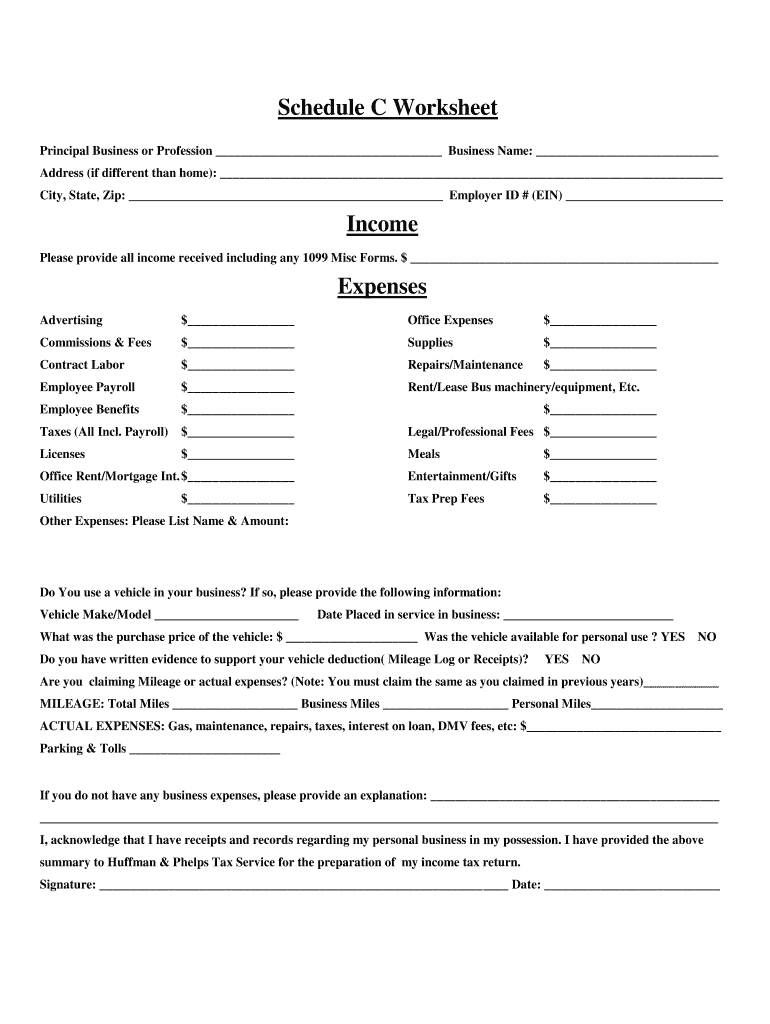

Schedule C Worksheet Misc Exp Other

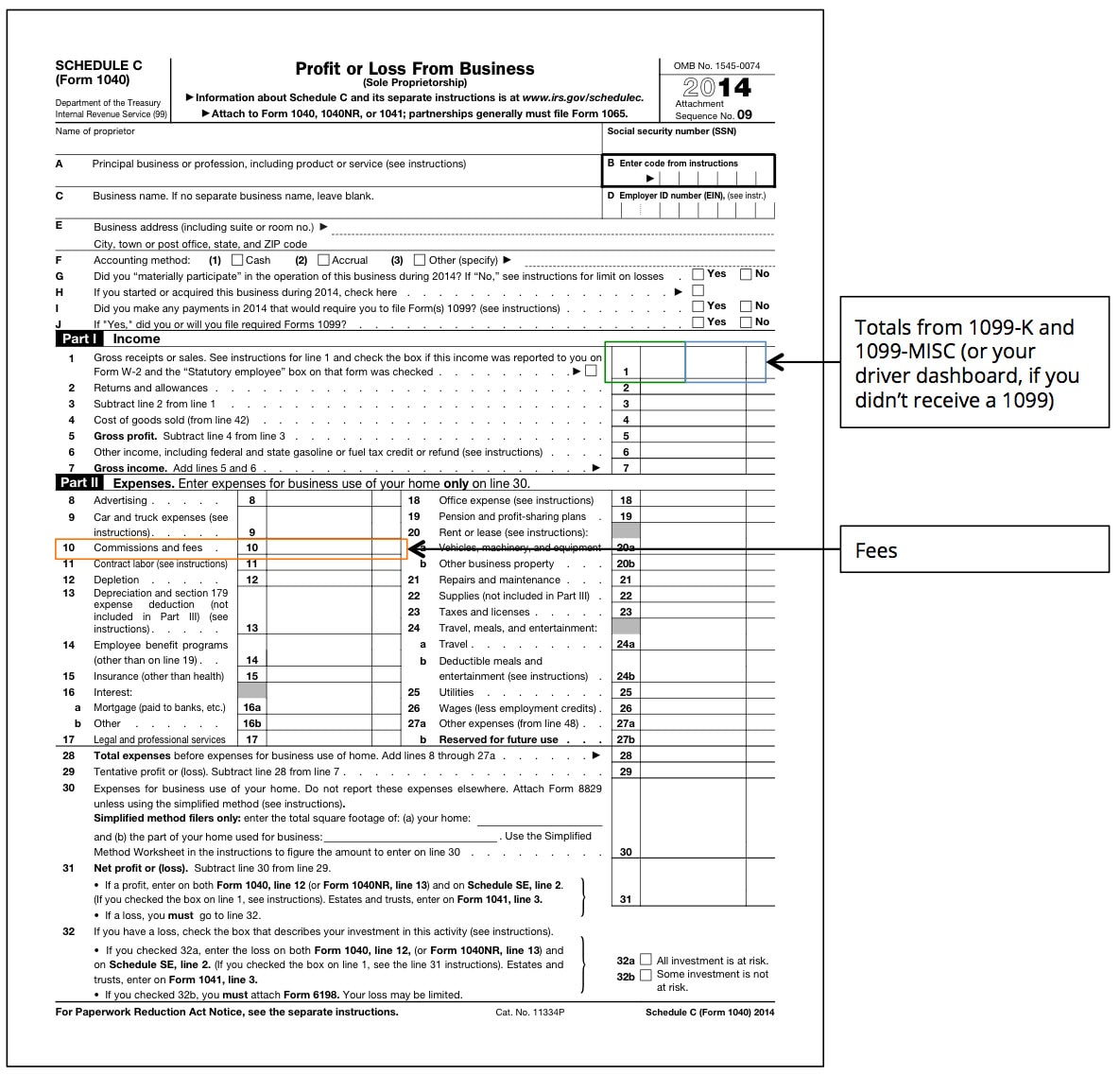

Schedule C Worksheet Misc Exp Other - Web schedule c worksheet hickman & hickman, pllc. Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own information to support all schedule c’s business. 2021 schedue c & e worksheets.xlsx author: Page 3 if this vehicle does not take the standard mileage deduction, please list the actual expenses. Web as the preparer you should ask sufficient questions to determine she has no other jobs or expenses and document the conversation and reasons for your. Page 3 if this vehicle does not take the standard mileage deduction, please list the actual expenses. Web schedule c worksheet hickman & hickman, pllc. Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own information to support all schedule c’s business. Web as the preparer you should ask sufficient questions. Page 3 if this vehicle does not take the standard mileage deduction, please list the actual expenses. 2021 schedue c & e worksheets.xlsx author: Web schedule c worksheet hickman & hickman, pllc. Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own information to support all schedule c’s business. Web as. Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own information to support all schedule c’s business. Page 3 if this vehicle does not take the standard mileage deduction, please list the actual expenses. 2021 schedue c & e worksheets.xlsx author: Web schedule c worksheet hickman & hickman, pllc. Web as. 2021 schedue c & e worksheets.xlsx author: Web as the preparer you should ask sufficient questions to determine she has no other jobs or expenses and document the conversation and reasons for your. Web schedule c worksheet hickman & hickman, pllc. Page 3 if this vehicle does not take the standard mileage deduction, please list the actual expenses. Web schedule. Page 3 if this vehicle does not take the standard mileage deduction, please list the actual expenses. Web as the preparer you should ask sufficient questions to determine she has no other jobs or expenses and document the conversation and reasons for your. 2021 schedue c & e worksheets.xlsx author: Web schedule c worksheet hickman & hickman, pllc. Web schedule. Web as the preparer you should ask sufficient questions to determine she has no other jobs or expenses and document the conversation and reasons for your. Web schedule c worksheet hickman & hickman, pllc. Page 3 if this vehicle does not take the standard mileage deduction, please list the actual expenses. 2021 schedue c & e worksheets.xlsx author: Web schedule. Web schedule c worksheet hickman & hickman, pllc. 2021 schedue c & e worksheets.xlsx author: Web as the preparer you should ask sufficient questions to determine she has no other jobs or expenses and document the conversation and reasons for your. Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own. Page 3 if this vehicle does not take the standard mileage deduction, please list the actual expenses. Web as the preparer you should ask sufficient questions to determine she has no other jobs or expenses and document the conversation and reasons for your. 2021 schedue c & e worksheets.xlsx author: Web schedule c worksheet hickman & hickman, pllc. Web schedule. Web as the preparer you should ask sufficient questions to determine she has no other jobs or expenses and document the conversation and reasons for your. Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own information to support all schedule c’s business. 2021 schedue c & e worksheets.xlsx author: Web. 2021 schedue c & e worksheets.xlsx author: Web as the preparer you should ask sufficient questions to determine she has no other jobs or expenses and document the conversation and reasons for your. Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own information to support all schedule c’s business. Page. Web as the preparer you should ask sufficient questions to determine she has no other jobs or expenses and document the conversation and reasons for your. Web schedule c worksheet hickman & hickman, pllc. Page 3 if this vehicle does not take the standard mileage deduction, please list the actual expenses. Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own information to support all schedule c’s business. 2021 schedue c & e worksheets.xlsx author: Web schedule c worksheet hickman & hickman, pllc. Web as the preparer you should ask sufficient questions to determine she has no other jobs or expenses and document the conversation and reasons for your. 2021 schedue c & e worksheets.xlsx author: Page 3 if this vehicle does not take the standard mileage deduction, please list the actual expenses.20++ Simplified Method Worksheet Schedule C Worksheets Decoomo

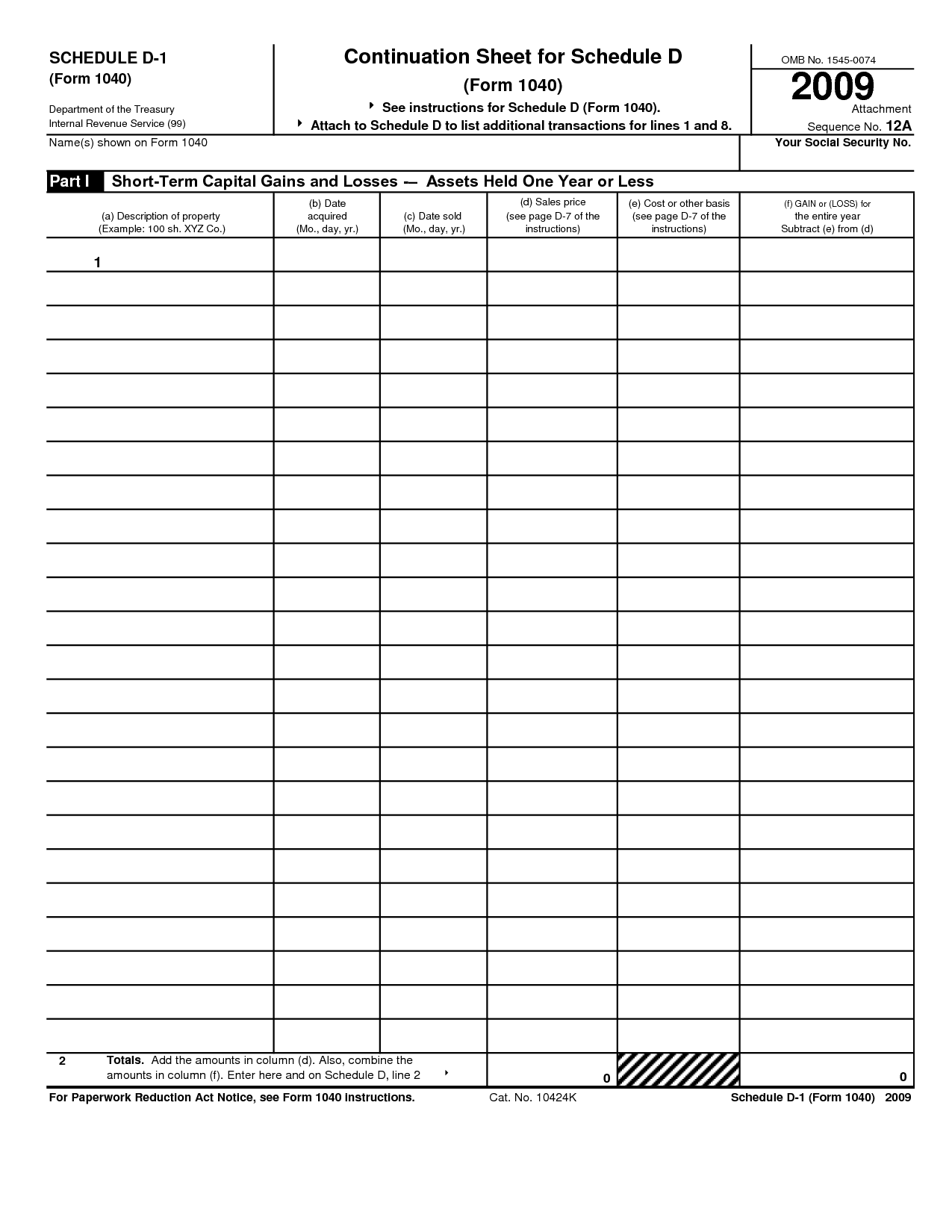

Schedule C Worksheet Misc Exp Other worksSheet list

20++ Simplified Method Worksheet Schedule C Worksheets Decoomo

6 Best Images of Blank Tax Worksheets Blank Personal Monthly

Schedule C Worksheet Form Fill Out and Sign Printable PDF Template

Schedule C Worksheet Excel

schedule c worksheet excel

Schedule c or 1099 Infinings

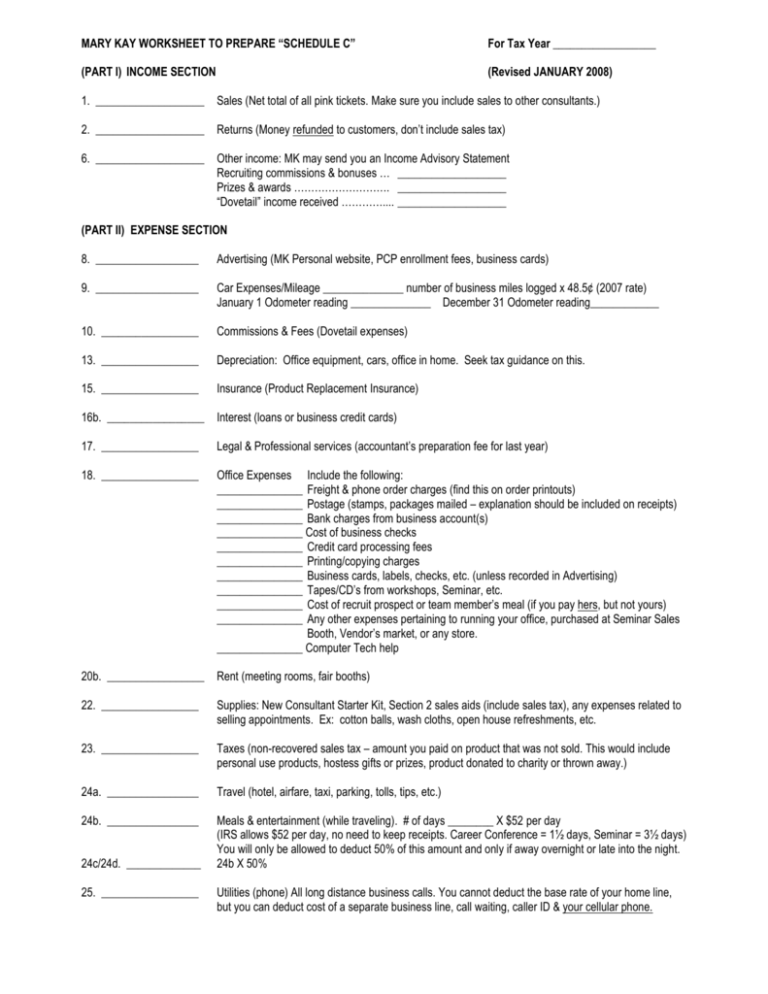

mary kay worksheet to prepare “schedule c”

Schedule C Worksheet Form Alphabet Worksheets

Web Schedule C Worksheet For Self Employed Businesses And/Or Independent Contractors Irs Requires We Have On File Your Own Information To Support All Schedule C’s Business.

Related Post: