Schedule D Tax Worksheet Calculator

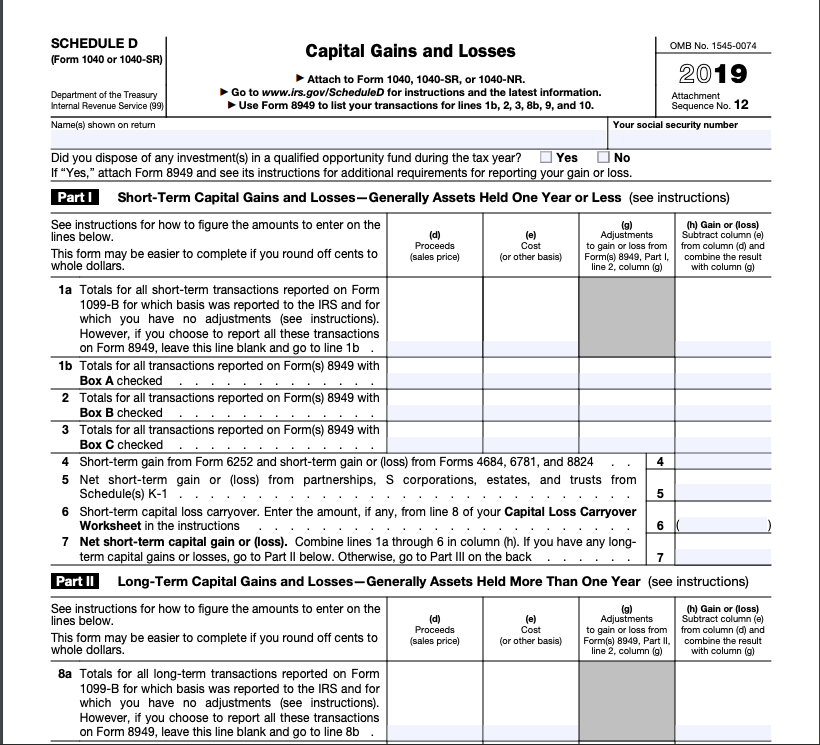

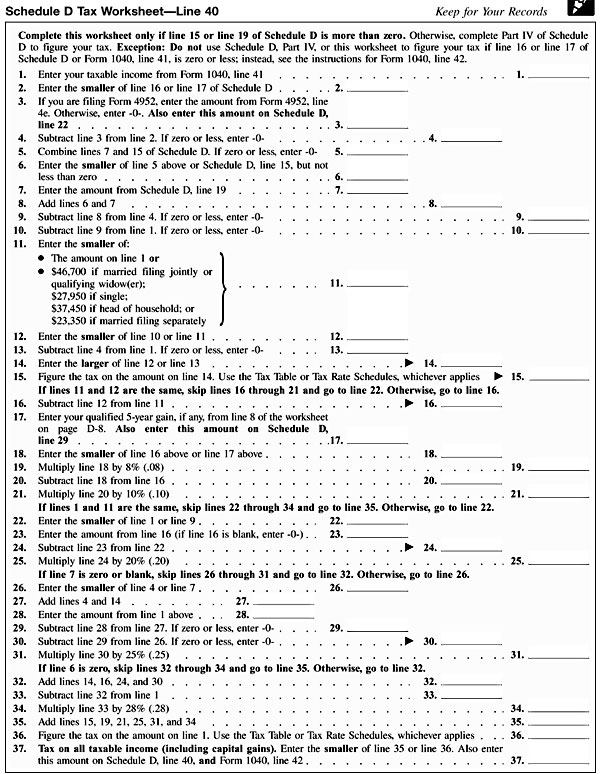

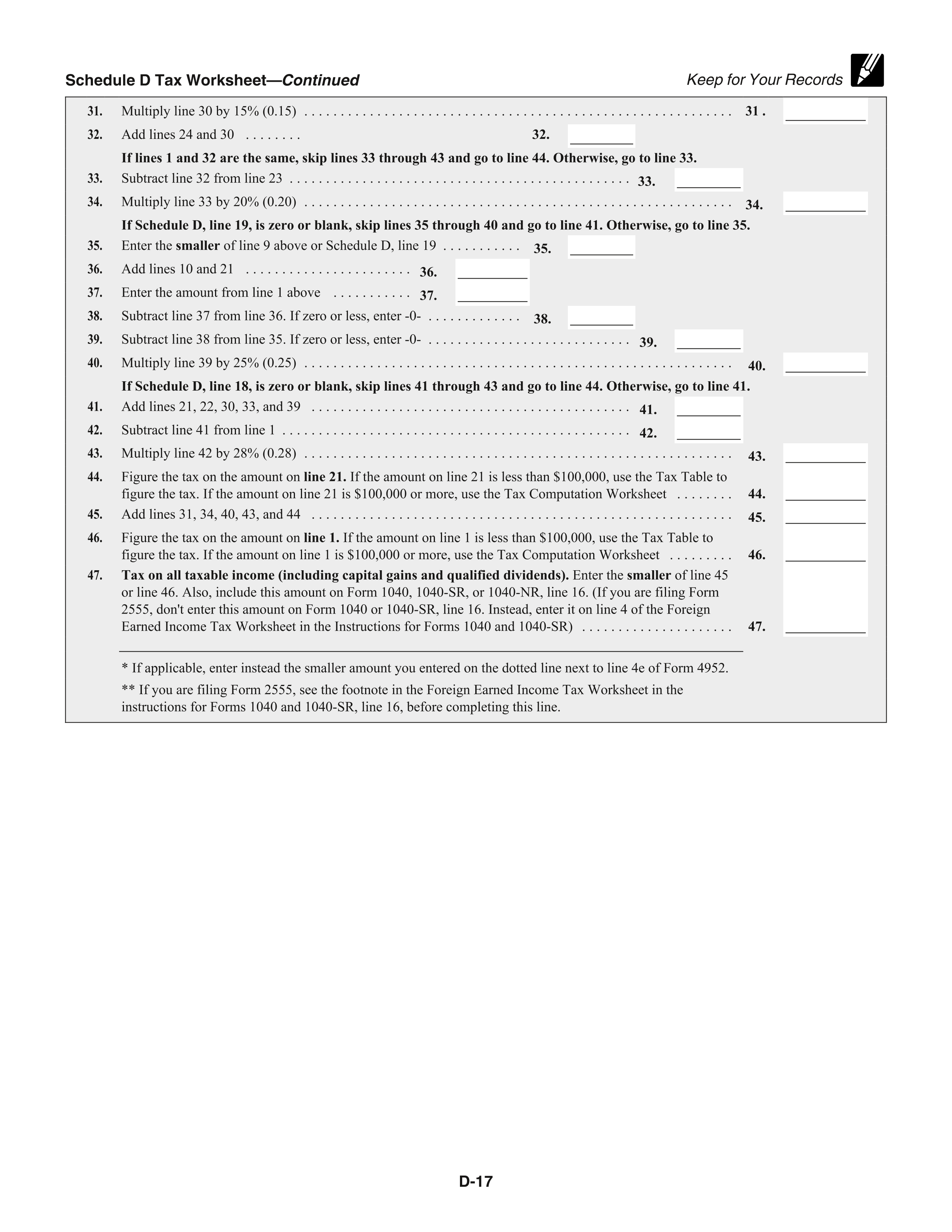

Schedule D Tax Worksheet Calculator - Note that any link in the. Web complete this worksheet only if: • on schedule d, line 14b, column (2), or line 14c, column (2), is more than zero, or • both line 2b(1) of form 1041 and line 4g of form 4952 are. Web and capital gain tax worksheet, the schedule d tax worksheet, schedule j, form 8615, or the foreign earned income tax worksheet, enter the amount from that form or. Web 1040 tax calculator enter your filing status, income, deductions and credits and the tool below can help estimate your total taxes. Web use tax form 1040 schedule d: Web if there is an amount on line 18 (from the 28% rate gain worksheet) or line 19 (from the unrecaptured section 1250 gain worksheet) of schedule d, according to the irs the. Capital gains and losses as a stand alone tax form calculator to quickly calculate specific amounts for your 2019 tax return. Web so you’ve realized a profit on your investments? Web to view the calculation on the schedule d tax worksheet, you need to view the print pdf. Based on your projected tax withholding for the. Web schedule d (form 1040) tax worksheet (2022) complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or if. Buckle up and get ready to report your transactions to the internal revenue service (irs). • on schedule d, line 14b, column (2), or line 14c, column (2), is more than zero, or • both line 2b(1) of form 1041 and line 4g of form 4952 are. Web the irs notified tax software companies that it had discovered an error in the schedule d, capital gains and losses, tax worksheet used to calculate the tax.. Capital gains and losses as a stand alone tax form calculator to quickly calculate specific amounts for your 2019 tax return. If you need help, go to our printing your return and individual forms faq. Web 1040 tax calculator enter your filing status, income, deductions and credits and the tool below can help estimate your total taxes. Web to view. Web if there is an amount on line 18 (from the 28% rate gain worksheet) or line 19 (from the unrecaptured section 1250 gain worksheet) of schedule d, according to the irs the. Note that any link in the. Based on your projected tax withholding for the. Capital gains and losses as a stand alone tax form calculator to quickly. Web and capital gain tax worksheet, the schedule d tax worksheet, schedule j, form 8615, or the foreign earned income tax worksheet, enter the amount from that form or. Web to view the tax calculation on the schedule d tax worksheet which will show the calculation of the tax which flows to form 1040, line 12a or form 1040nr, line. Web the irs notified tax software companies that it had discovered an error in the schedule d, capital gains and losses, tax worksheet used to calculate the tax. Web and capital gain tax worksheet, the schedule d tax worksheet, schedule j, form 8615, or the foreign earned income tax worksheet, enter the amount from that form or. Web if there. If you need help, go to our printing your return and individual forms faq. Note that any link in the. Web to view the calculation on the schedule d tax worksheet, you need to view the print pdf. Web the irs notified tax software companies that it had discovered an error in the schedule d, capital gains and losses, tax. Capital gains and losses as a stand alone tax form calculator to quickly calculate specific amounts for your 2019 tax return. Web so you’ve realized a profit on your investments? Web complete this worksheet only if: Web if there is an amount on line 18 (from the 28% rate gain worksheet) or line 19 (from the unrecaptured section 1250 gain. • on schedule d, line 14b, column (2), or line 14c, column (2), is more than zero, or • both line 2b(1) of form 1041 and line 4g of form 4952 are. Web so you’ve realized a profit on your investments? Buckle up and get ready to report your transactions to the internal revenue service (irs) on schedule d and. Web if there is an amount on line 18 (from the 28% rate gain worksheet) or line 19 (from the unrecaptured section 1250 gain worksheet) of schedule d, according to the irs the. Capital gains and losses as a stand alone tax form calculator to quickly calculate specific amounts for your 2019 tax return. • on schedule d, line 14b,. • on schedule d, line 14b, column (2), or line 14c, column (2), is more than zero, or • both line 2b(1) of form 1041 and line 4g of form 4952 are. Web to view the calculation on the schedule d tax worksheet, you need to view the print pdf. Web to view the tax calculation on the schedule d tax worksheet which will show the calculation of the tax which flows to form 1040, line 12a or form 1040nr, line 42:. Web 1040 tax calculator enter your filing status, income, deductions and credits and the tool below can help estimate your total taxes. Web schedule d (form 1040) tax worksheet (2022) complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or if. Based on your projected tax withholding for the. Note that any link in the. Web use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to 2023 if schedule d, line 20, is a loss and (a) the loss on schedule d, line 19, col. Web if there is an amount on line 18 (from the 28% rate gain worksheet) or line 19 (from the unrecaptured section 1250 gain worksheet) of schedule d, according to the irs the. Buckle up and get ready to report your transactions to the internal revenue service (irs) on schedule d and see. Web so you’ve realized a profit on your investments? Web and capital gain tax worksheet, the schedule d tax worksheet, schedule j, form 8615, or the foreign earned income tax worksheet, enter the amount from that form or. If you need help, go to our printing your return and individual forms faq. Web complete this worksheet only if: Capital gains and losses as a stand alone tax form calculator to quickly calculate specific amounts for your 2019 tax return. Web the irs notified tax software companies that it had discovered an error in the schedule d, capital gains and losses, tax worksheet used to calculate the tax. Web use tax form 1040 schedule d: Web to view the calculation on the schedule d tax worksheet, you need to view the print pdf. Web if there is an amount on line 18 (from the 28% rate gain worksheet) or line 19 (from the unrecaptured section 1250 gain worksheet) of schedule d, according to the irs the. Web to view the tax calculation on the schedule d tax worksheet which will show the calculation of the tax which flows to form 1040, line 12a or form 1040nr, line 42:. If you need help, go to our printing your return and individual forms faq. Web complete this worksheet only if: Web use tax form 1040 schedule d: Note that any link in the. Based on your projected tax withholding for the. Web 1040 tax calculator enter your filing status, income, deductions and credits and the tool below can help estimate your total taxes. • on schedule d, line 14b, column (2), or line 14c, column (2), is more than zero, or • both line 2b(1) of form 1041 and line 4g of form 4952 are. Web schedule d (form 1040) tax worksheet (2022) complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or if. Web and capital gain tax worksheet, the schedule d tax worksheet, schedule j, form 8615, or the foreign earned income tax worksheet, enter the amount from that form or. Buckle up and get ready to report your transactions to the internal revenue service (irs) on schedule d and see.Irs Schedule D Tax Worksheet Fill Out and Sign Printable PDF Template

96 best ideas for coloring Capital Law Schedule

tax worksheet for students

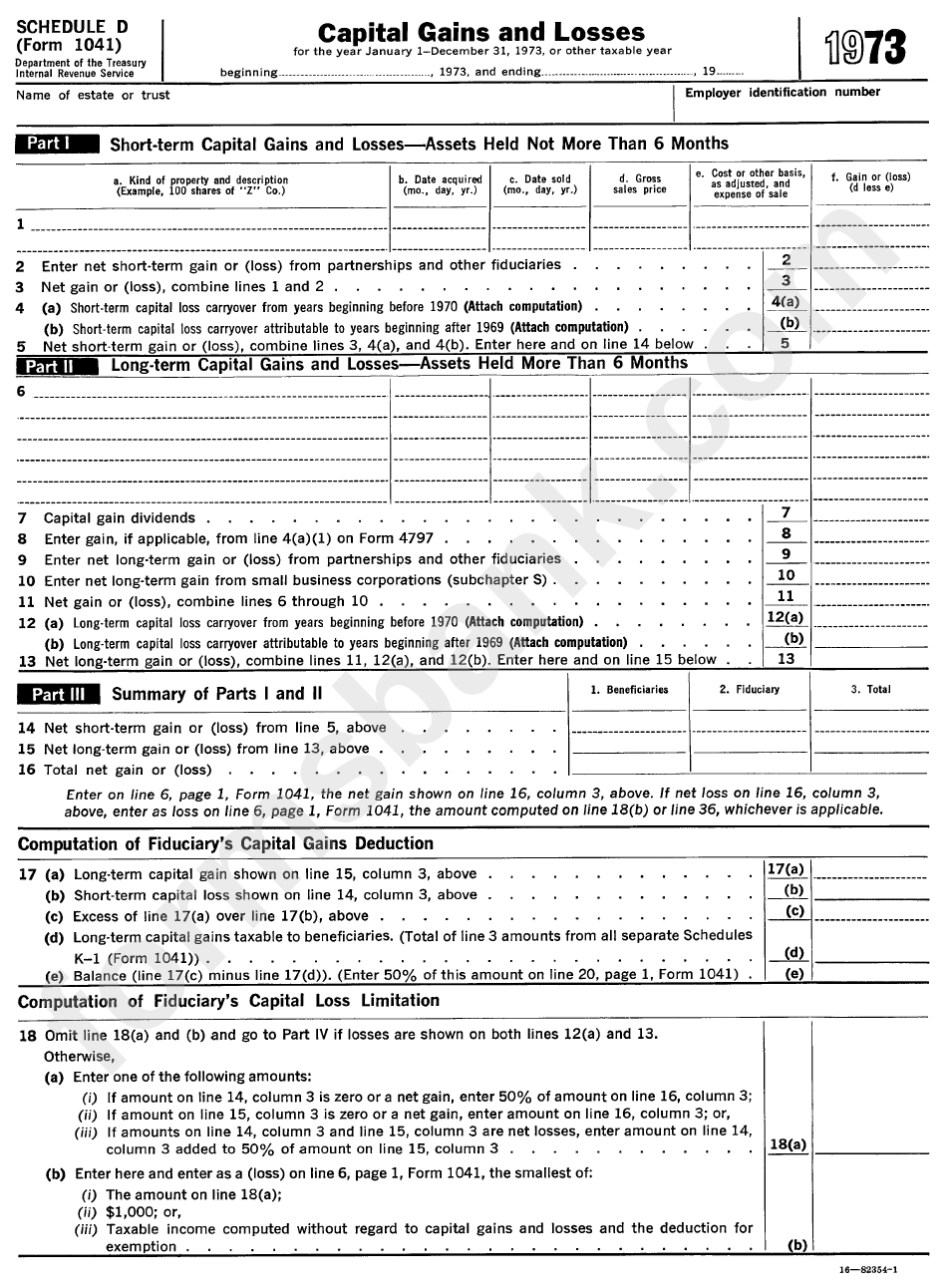

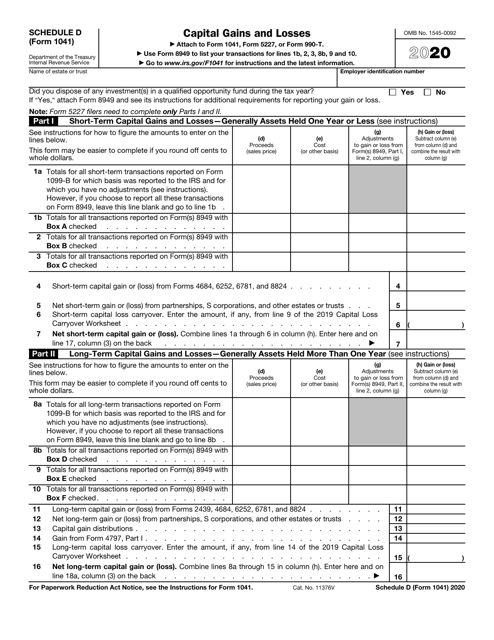

Form 1041 Schedule D

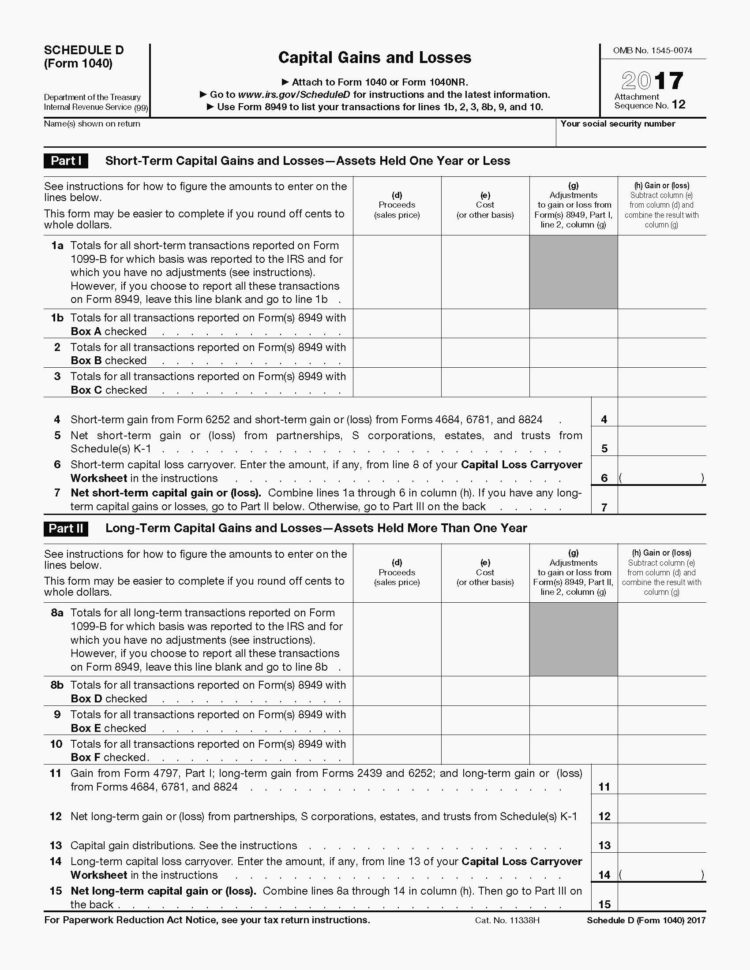

Form 1040, Schedule DCapital Gains and Losses

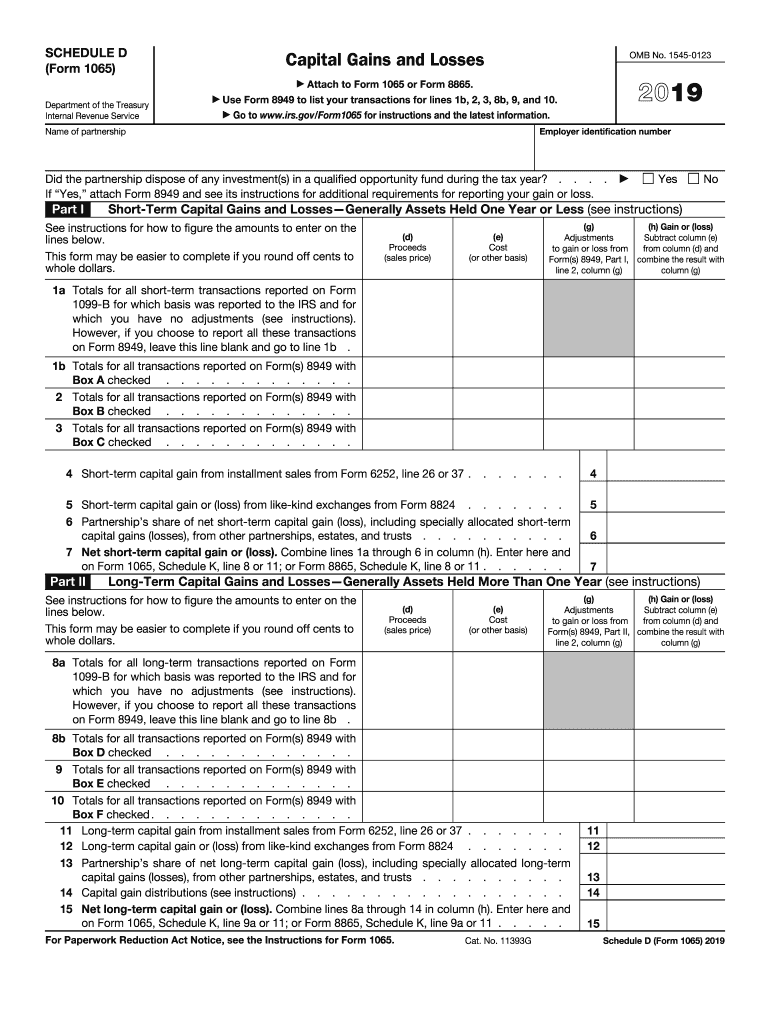

Schedule D Tax Worksheet 2019

Schedule D Worksheet

Schedule D, Tax Worksheet, Line 40

Capital Gains Tax

1041 Schedule D Tax Worksheet

Web So You’ve Realized A Profit On Your Investments?

Web Use This Worksheet To Figure The Estate's Or Trust's Capital Loss Carryovers From 2022 To 2023 If Schedule D, Line 20, Is A Loss And (A) The Loss On Schedule D, Line 19, Col.

Capital Gains And Losses As A Stand Alone Tax Form Calculator To Quickly Calculate Specific Amounts For Your 2019 Tax Return.

Web The Irs Notified Tax Software Companies That It Had Discovered An Error In The Schedule D, Capital Gains And Losses, Tax Worksheet Used To Calculate The Tax.

Related Post: