Schedule E Worksheet Turbotax

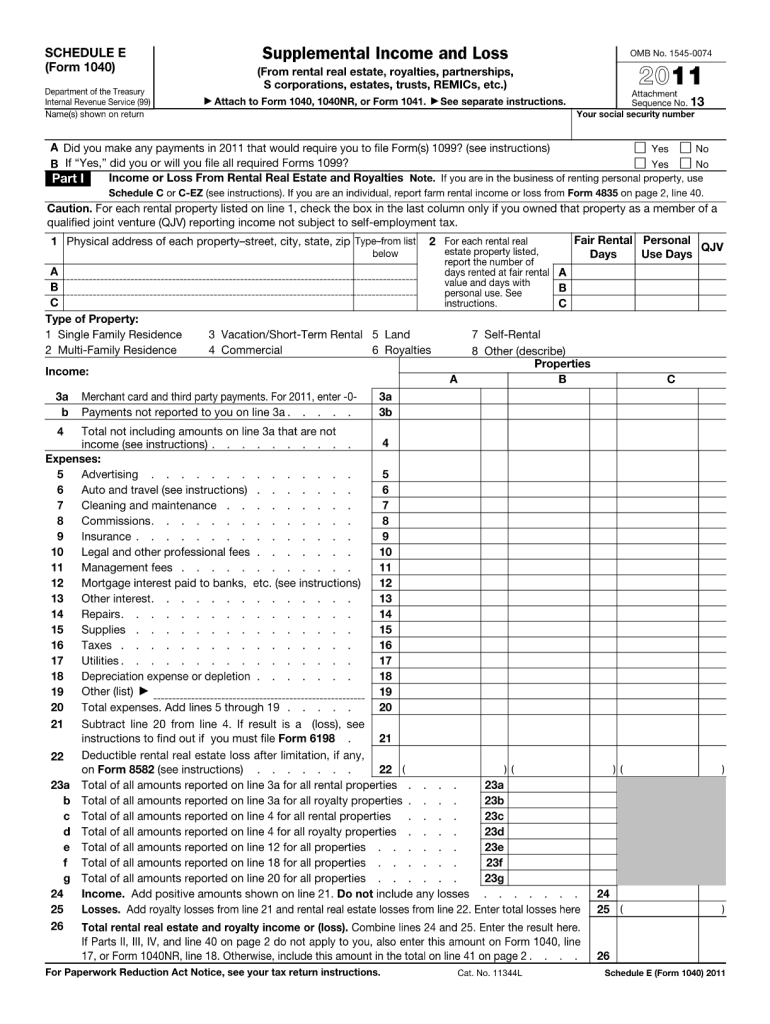

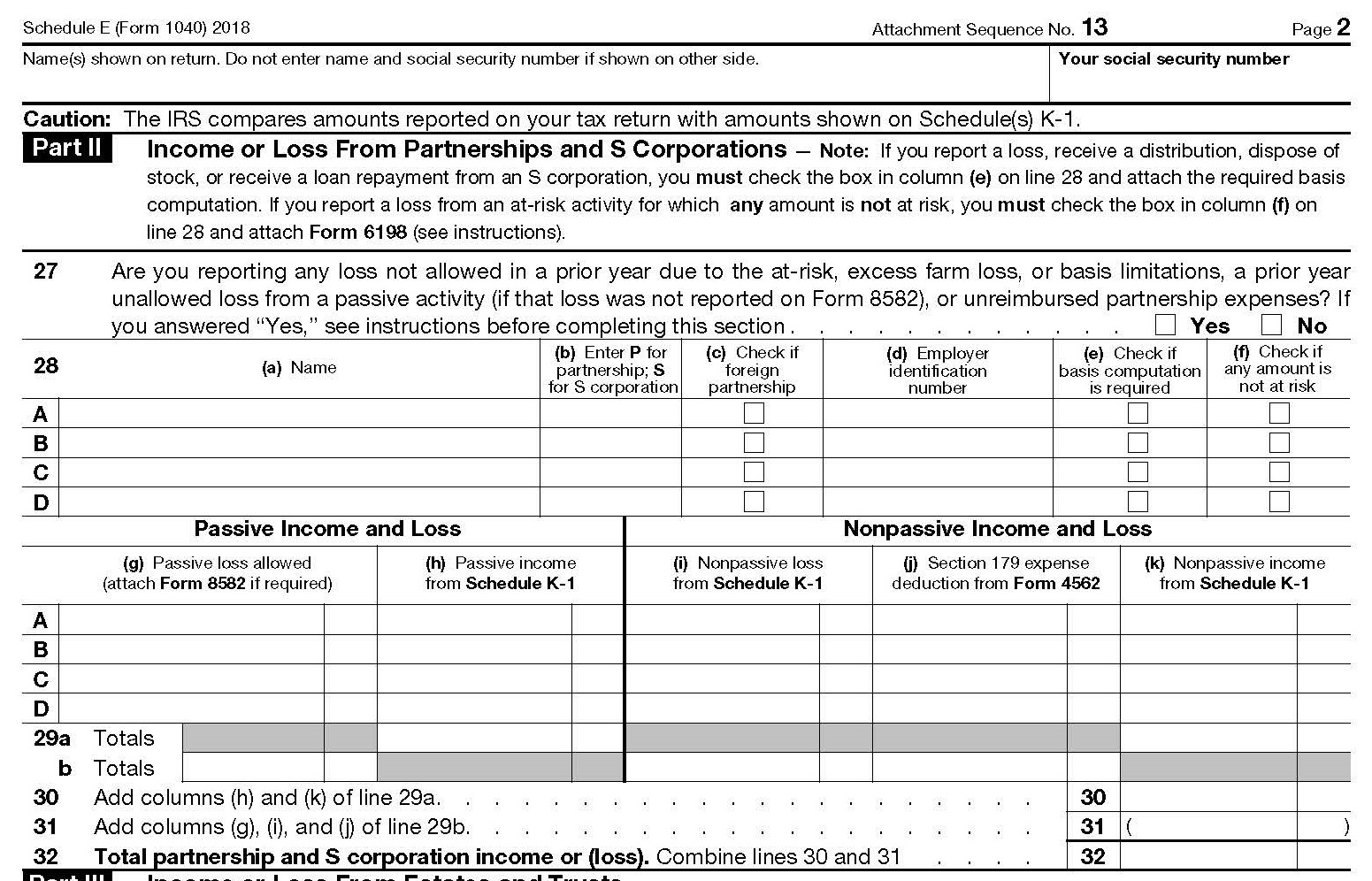

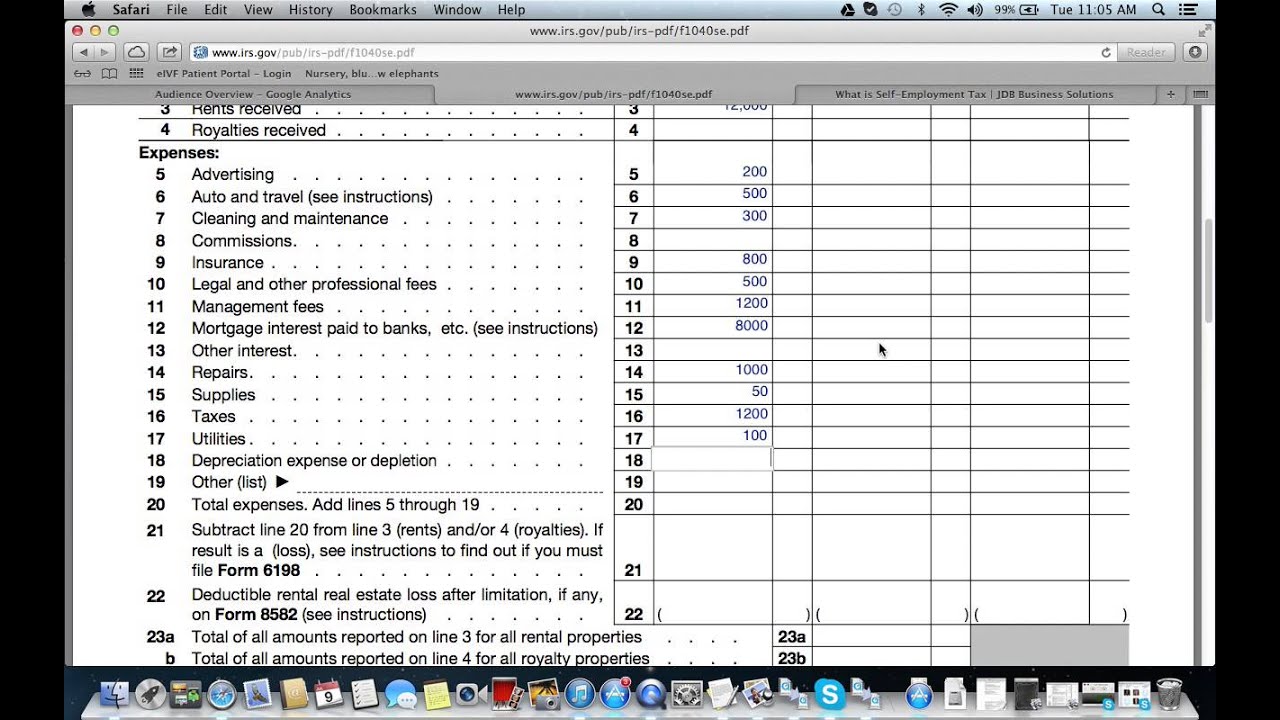

Schedule E Worksheet Turbotax - Click the orange button that says take me to my return. go to my. Web yes, you can edit your entries at any time. Web here is how to delete schedule e in turbotax online. Type ew and select ok to open the schedule e. Web on the e screen, report the number of fair rental days and the personal use days on the income/expenses tab to allow drake tax to calculate the business use percentage. Web information about schedule e (form 1040), supplemental income and loss, including recent updates, related forms, and instructions on how to file. Head into rental and royalty income and. Open your return, if it's not already open. Web at the bottom of the schedule e, review each property in the qualified business income deduction info smart worksheet. Web schedule e worksheet for rental property irs requires us to have your information in hand to support all schedule e’s. Schedule e is used to. Head into rental and royalty income and. Web yes, you can edit your entries at any time. On this worksheet printed name_____. Press f6 to bring up open forms. Web on the e screen, report the number of fair rental days and the personal use days on the income/expenses tab to allow drake tax to calculate the business use percentage. Link each property to a qbi. Click the orange button that says take me to my return. go to my. Use schedule e (form 1040) to report income or. Schedule e is used to. There are two places where you could have entered this for it to show on schedule e: Type ew and select ok to open the schedule e. On this worksheet printed name_____. Click the orange button that says take me to my return. go to my. Open your return, if it's not already open. Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual interests in remics. Web information about schedule e (form 1040), supplemental income and loss, including recent updates, related forms, and instructions on how to file. Type ew and select ok. Press f6 to bring up open forms. Head into rental and royalty income and. Click the orange button that says take me to my return. go to my. Web information about schedule e (form 1040), supplemental income and loss, including recent updates, related forms, and instructions on how to file. Schedule e is used to. Open your return, if it's not already open. Web at the bottom of the schedule e, review each property in the qualified business income deduction info smart worksheet. Press f6 to bring up open forms. Web entering section 179 carryover from a schedule e rentals and royalties: Web schedule e worksheet for rental property irs requires us to have your. There are two places where you could have entered this for it to show on schedule e: Web entering section 179 carryover from a schedule e rentals and royalties: Link each property to a qbi. Web here is how to delete schedule e in turbotax online. Web on the e screen, report the number of fair rental days and the. On this worksheet printed name_____. Head into rental and royalty income and. Web entering section 179 carryover from a schedule e rentals and royalties: Link each property to a qbi. Open your return, if it's not already open. Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual interests in remics. There are two places where you could have entered this for it to show on schedule e: Web at the bottom of the schedule e, review each property in the qualified business income deduction info. Web schedule e worksheet for rental property irs requires us to have your information in hand to support all schedule e’s. On this worksheet printed name_____. Link each property to a qbi. Web at the bottom of the schedule e, review each property in the qualified business income deduction info smart worksheet. Use schedule e (form 1040) to report income. Open your return, if it's not already open. On this worksheet printed name_____. Web here is how to delete schedule e in turbotax online. Web entering section 179 carryover from a schedule e rentals and royalties: Web schedule e worksheet for rental property irs requires us to have your information in hand to support all schedule e’s. Web yes, you can edit your entries at any time. Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual interests in remics. Web information about schedule e (form 1040), supplemental income and loss, including recent updates, related forms, and instructions on how to file. Web on the e screen, report the number of fair rental days and the personal use days on the income/expenses tab to allow drake tax to calculate the business use percentage. Link each property to a qbi. Click the orange button that says take me to my return. go to my. Web at the bottom of the schedule e, review each property in the qualified business income deduction info smart worksheet. Press f6 to bring up open forms. There are two places where you could have entered this for it to show on schedule e: Head into rental and royalty income and. Type ew and select ok to open the schedule e. Schedule e is used to. On this worksheet printed name_____. Schedule e is used to. Click the orange button that says take me to my return. go to my. Web entering section 179 carryover from a schedule e rentals and royalties: Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual interests in remics. Web information about schedule e (form 1040), supplemental income and loss, including recent updates, related forms, and instructions on how to file. Press f6 to bring up open forms. Head into rental and royalty income and. Web schedule e worksheet for rental property irs requires us to have your information in hand to support all schedule e’s. Web at the bottom of the schedule e, review each property in the qualified business income deduction info smart worksheet. Link each property to a qbi. Web yes, you can edit your entries at any time. Web on the e screen, report the number of fair rental days and the personal use days on the income/expenses tab to allow drake tax to calculate the business use percentage.2011 Form IRS 1040 Schedule E Fill Online, Printable, Fillable, Blank

Turbotax Form / Breanna Form 2106 Expense Type Must Be Entered

️Schedule E Worksheet Free Download Goodimg.co

Schedule C Worksheet Turbotax worksheeta

️Schedule E Worksheet Free Download Goodimg.co

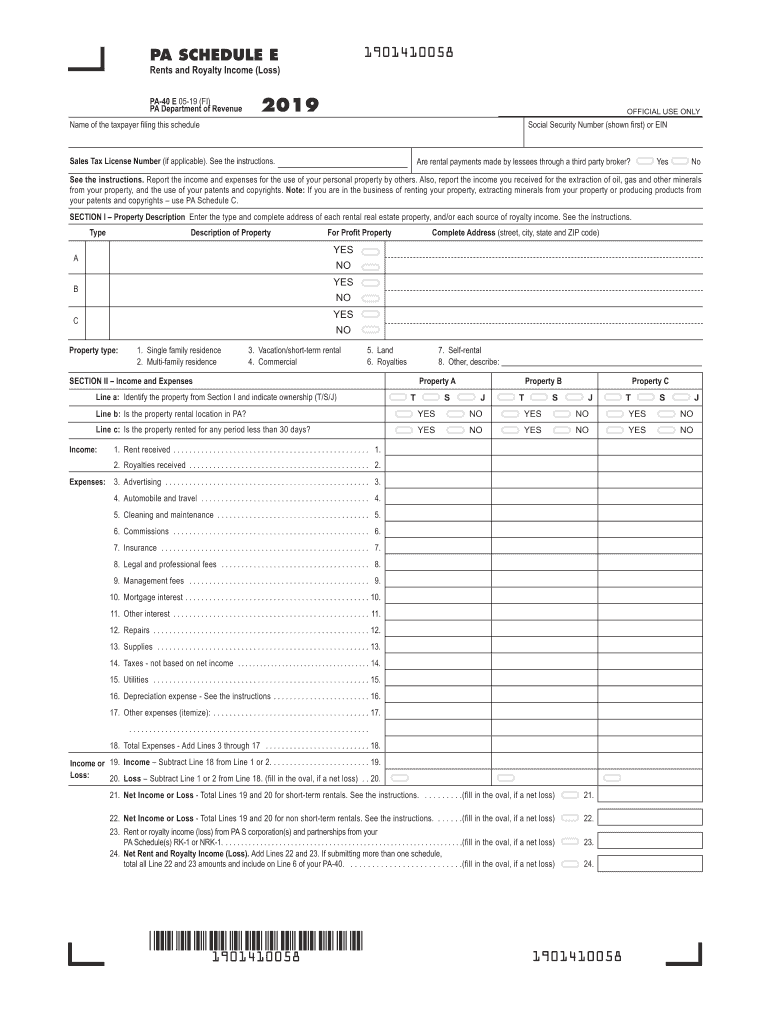

Pa Schedule E 2019 Fill Out and Sign Printable PDF Template signNow

Schedule E "What", "Who", "When" and "How" The Usual Stuff

Credits for Qualifying Children and Other Dependents HNW

How to Fill Out Schedule E for Real Estate Investments YouTube

Turbotax 2017 Deluxe Fill Out and Sign Printable PDF Template signNow

Open Your Return, If It's Not Already Open.

There Are Two Places Where You Could Have Entered This For It To Show On Schedule E:

Web Here Is How To Delete Schedule E In Turbotax Online.

Type Ew And Select Ok To Open The Schedule E.

Related Post: