Section 263A Calculation Worksheet

Section 263A Calculation Worksheet - Web the lb&i practice unit emphasizes key aspects of a reseller's sec. Web section 263a requires taxpayers to capitalize the direct costs and indirect costs that are properly allocable to: The first step that you need to take when calculating 263a is to determine the total amount of indirect purchasing costs for your. Web also known as the uniform capitalization (unicap) rules, section 263a outlines which costs must be capitalized, as well as which costs and businesses are exempt from the rules. Of the many complexities contained within section 263a is the need for separate calculation methodologies for producers and. The treasury department and the irs estimate. Web the final section 263a regulations impose considerable complexity to inventory computations and the new rules will place significant burdens on taxpayers that have no. (1) real or tangible personal property produced by. Web section 263a is one of the more difficult sections of the us tax code, but a basic overview of the calculation process runs thusly: Web the basics of calculating section 263a. The first step of calculating section 263a is to separate all of the company's expenses which appear on its profit and loss statement. 263a computation that may be scrutinized during an irs examination, which include: Web irs code section 263a details the uniform capitalization rules (unicap) that business owners need to use in their calculations for capitalizing their costs for. Web taxpayers subject to section 263a must make a reasonable allocation of indirect costs between production and other activities. The first step that you need to take when calculating 263a is to determine the total amount of indirect purchasing costs for your. (1) real or tangible personal property produced by. The treasury department and the irs estimate. Web section 263a. Web bdo can review existing section 263a calculations to identify what changes must be made to comply with the regulations. Web steps for 263a calculation. Of the many complexities contained within section 263a is the need for separate calculation methodologies for producers and. Determine all indirect purchase costs, which could. (1) real or tangible personal property produced by. Indirect costs are allocated using either a. Of the many complexities contained within section 263a is the need for separate calculation methodologies for producers and. (vii) property produced or property acquired for. The first step that you need to take when calculating 263a is to determine the total amount of indirect purchasing costs for your. Web bdo can review existing. Web the lb&i practice unit emphasizes key aspects of a reseller's sec. Web irs code section 263a details the uniform capitalization rules (unicap) that business owners need to use in their calculations for capitalizing their costs for tax purposes. The first step that you need to take when calculating 263a is to determine the total amount of indirect purchasing costs. Web the lb&i practice unit emphasizes key aspects of a reseller's sec. In many instances, the bdo team is able. Web section 263a for producers. Web section 263a generally requires taxpayers engaged in the production and resale of creative property to capitalize certain costs. 263a computation that may be scrutinized during an irs examination, which include: Indirect costs are allocated using either a. Web steps for 263a calculation. Web bdo can review existing section 263a calculations to identify what changes must be made to comply with the regulations. Web section 263a requires taxpayers to capitalize the direct costs and indirect costs that are properly allocable to: In many instances, the bdo team is able. Web the final section 263a regulations impose considerable complexity to inventory computations and the new rules will place significant burdens on taxpayers that have no. Web taxpayers subject to section 263a must make a reasonable allocation of indirect costs between production and other activities. Web section 263a requires taxpayers to capitalize the direct costs and indirect costs that are properly. Web the lb&i practice unit emphasizes key aspects of a reseller's sec. Web irs code section 263a details the uniform capitalization rules (unicap) that business owners need to use in their calculations for capitalizing their costs for tax purposes. Web section 263a is one of the more difficult sections of the us tax code, but a basic overview of the. (vii) property produced or property acquired for. Web the basics of calculating section 263a. Web section 263a generally requires taxpayers engaged in the production and resale of creative property to capitalize certain costs. Web section 263a for producers. The first step that you need to take when calculating 263a is to determine the total amount of indirect purchasing costs for. Web section 263a requires taxpayers to capitalize the direct costs and indirect costs that are properly allocable to: Web taxpayers subject to section 263a must make a reasonable allocation of indirect costs between production and other activities. (1) real or tangible personal property produced by. 263a computation that may be scrutinized during an irs examination, which include: Web irs code section 263a details the uniform capitalization rules (unicap) that business owners need to use in their calculations for capitalizing their costs for tax purposes. Of the many complexities contained within section 263a is the need for separate calculation methodologies for producers and. Web section 263a is one of the more difficult sections of the us tax code, but a basic overview of the calculation process runs thusly: Indirect costs are allocated using either a. Web section 263a for producers. Determine all indirect purchase costs, which could. Web the final section 263a regulations impose considerable complexity to inventory computations and the new rules will place significant burdens on taxpayers that have no. In many instances, the bdo team is able. Web the basics of calculating section 263a. Web bdo can review existing section 263a calculations to identify what changes must be made to comply with the regulations. The treasury department and the irs estimate. The first step that you need to take when calculating 263a is to determine the total amount of indirect purchasing costs for your. Web also known as the uniform capitalization (unicap) rules, section 263a outlines which costs must be capitalized, as well as which costs and businesses are exempt from the rules. Web the lb&i practice unit emphasizes key aspects of a reseller's sec. Web steps for 263a calculation. Web section 263a generally requires taxpayers engaged in the production and resale of creative property to capitalize certain costs. The first step of calculating section 263a is to separate all of the company's expenses which appear on its profit and loss statement. Web the lb&i practice unit emphasizes key aspects of a reseller's sec. Web also known as the uniform capitalization (unicap) rules, section 263a outlines which costs must be capitalized, as well as which costs and businesses are exempt from the rules. Web bdo can review existing section 263a calculations to identify what changes must be made to comply with the regulations. (vii) property produced or property acquired for. Web irs code section 263a details the uniform capitalization rules (unicap) that business owners need to use in their calculations for capitalizing their costs for tax purposes. Web the basics of calculating section 263a. Web section 263a requires taxpayers to capitalize the direct costs and indirect costs that are properly allocable to: Indirect costs are allocated using either a. Web section 263a is one of the more difficult sections of the us tax code, but a basic overview of the calculation process runs thusly: Of the many complexities contained within section 263a is the need for separate calculation methodologies for producers and. In many instances, the bdo team is able. Web the final section 263a regulations impose considerable complexity to inventory computations and the new rules will place significant burdens on taxpayers that have no. Determine all indirect purchase costs, which could. Web steps for 263a calculation. (1) real or tangible personal property produced by.Form 24 Change To Section We've chosen to wrap it inside a tag in

Printables. Like Kind Exchange Worksheet. Messygracebook Thousands of

PSY7625_U04A1_R_Hale

Ngpf Calculate Completing A 1040 Answer Key Ngpf Activity Bank Taxes

Mole Calculation Worksheet Free Worksheets Samples

Pearson International GCSE in Business 4BS1 Calculation Worksheets

1. These book/tax differences are also separatelystated i...

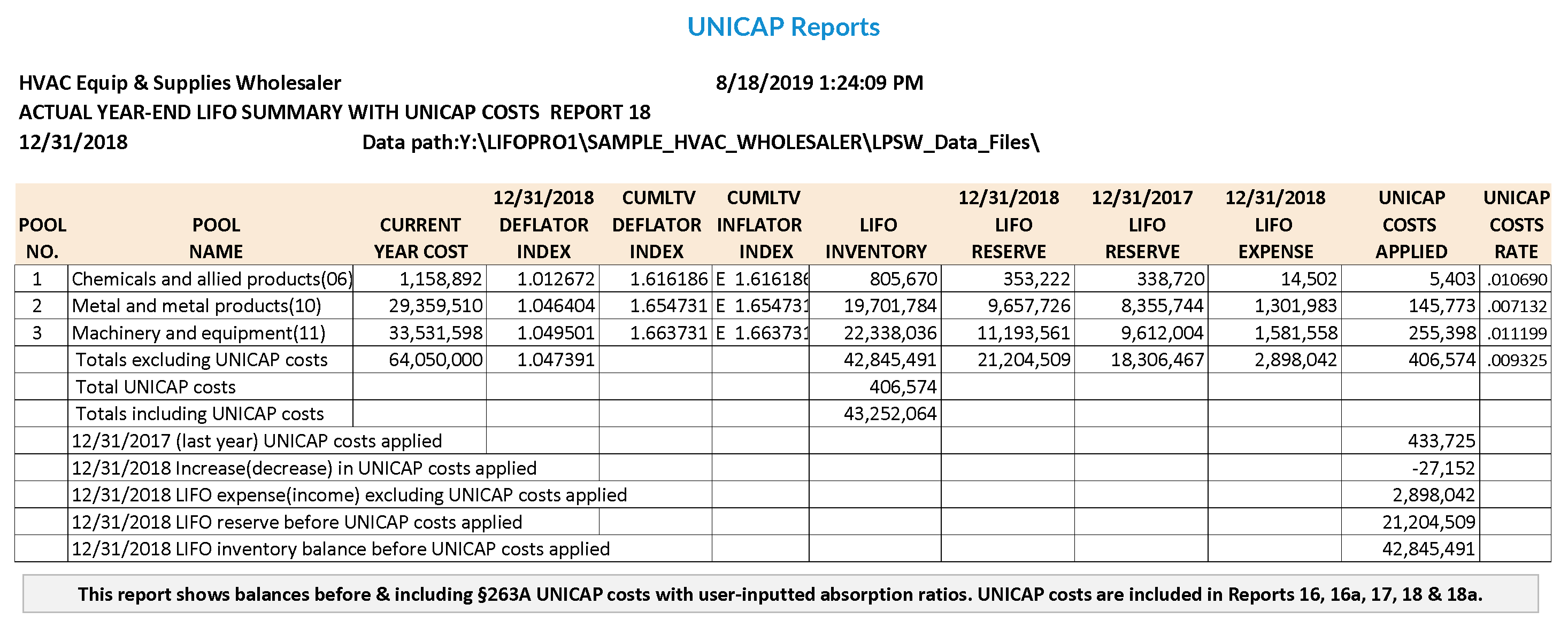

LIFO CPA Firm Offerings

263A

Hvac Load Calculation Spreadsheet Then Worksheet Residential Load

The Treasury Department And The Irs Estimate.

Web Section 263A Generally Requires Taxpayers Engaged In The Production And Resale Of Creative Property To Capitalize Certain Costs.

Web Section 263A For Producers.

263A Computation That May Be Scrutinized During An Irs Examination, Which Include:

Related Post: