Section 754 Calculation Worksheet

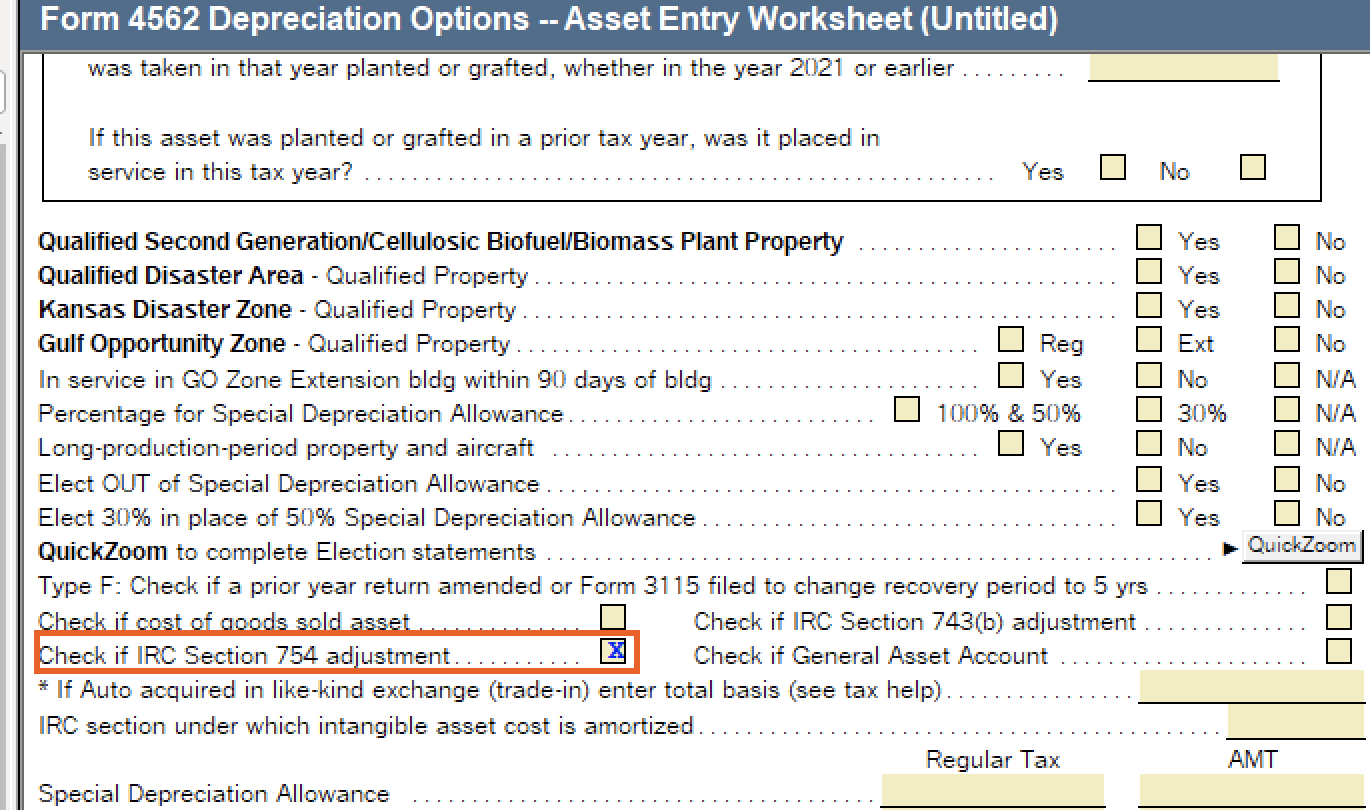

Section 754 Calculation Worksheet - Select the section for depreciation and amortization; Web with section 754 adjustment a.b. This new basis only applies. This number to words converter can also be useful for foreign students of english. Signnow combines ease of use, affordability and security in one online tool, all without forcing. Grade 4 subraction worksheet keywords: Web go to income/ deductions > rent and royalty worksheet. Fmv capital cash a property b sec. Mental subtraction, for exercises that students should attempt to solve in their. Web this template can be used to determine and allocate the basis adjustments resulting from section 754 elections for sales or exchanges occurring on or after 12/15/99. Under section 754, a partnership may elect to adjust the basis of partnership property when. This number to words converter can also be useful for foreign students of english. Web section 754 (manner of electing optional adjustment to basis of partnership property). Signnow combines ease of use, affordability and security in one online tool, all without forcing. Web section 754. Web section 754, a very short provision, simply states that if the partnership makes a §754 election, then the basis of partnership property is adjusted under §734(b) in the case of a. Web perhaps, you have reached us looking for the answer to a question like: 754 none c if i buy a's interest or inherited it, i paid or. Web section 754 (manner of electing optional adjustment to basis of partnership property). Web section 754 of the internal revenue code (irc) deals with complex issues that often arise in connection with assets owned by a partnership. Web new 2019 form 1065 instructions for sections 754, 734(b) and 743(b) reporting. Web perhaps, you have reached us looking for the answer. Web section 754 election, ed’s allocable share of the remaining depreciation deductions is $4,200 (25% of $16,800). Below are six versions of our grade 4 math worksheet on subtracting from 1,000. Web go to income/ deductions > rent and royalty worksheet. Our grade 4 subtraction worksheets are organized into two sections: How to write 754 in words. Web this template can be used to determine and allocate the basis adjustments resulting from section 754 elections for sales or exchanges occurring on or after 12/15/99. Under section 754, a partnership. Our grade 4 subtraction worksheets are organized into two sections: Under section 754, a partnership may elect to adjust the basis of partnership property when. This determination is. This determination is normally done at. Under section 754, a partnership may elect to adjust the basis of partnership property when. Grade 4 subraction worksheet keywords: Web section 754 requires each partner to determine their adjusted basis in order to determine the exact tax liability of the partner. Web section 754 election, ed’s allocable share of the remaining depreciation deductions. Web section 754 election, ed’s allocable share of the remaining depreciation deductions is $4,200 (25% of $16,800). Fmv capital cash a property b sec. How to write 754 in words. Web perhaps, you have reached us looking for the answer to a question like: 754 none c if i buy a's interest or inherited it, i paid or my basis. Below are six versions of our grade 4 math worksheet on subtracting from 1,000. Web go to income/ deductions > rent and royalty worksheet. Web section 754 election, ed’s allocable share of the remaining depreciation deductions is $4,200 (25% of $16,800). Web section 754, a very short provision, simply states that if the partnership makes a §754 election, then the. Web section 754 (manner of electing optional adjustment to basis of partnership property). How to write 754 in words. Web with section 754 adjustment a.b. This number to words converter can also be useful for foreign students of english. Web section 754, a very short provision, simply states that if the partnership makes a §754 election, then the basis of. This new basis only applies. Web section 754 (manner of electing optional adjustment to basis of partnership property). Our grade 4 subtraction worksheets are organized into two sections: Web section 754, a very short provision, simply states that if the partnership makes a §754 election, then the basis of partnership property is adjusted under §734(b) in the case of a.. Web new 2019 form 1065 instructions for sections 754, 734(b) and 743(b) reporting. Fmv capital cash a property b sec. Web with section 754 adjustment a.b. Web section 754 requires each partner to determine their adjusted basis in order to determine the exact tax liability of the partner. This determination is normally done at. Web go to income/ deductions > rent and royalty worksheet. Under section 754, a partnership. This new basis only applies. Web section 754, a very short provision, simply states that if the partnership makes a §754 election, then the basis of partnership property is adjusted under §734(b) in the case of a. Web section 754 of the internal revenue code (irc) deals with complex issues that often arise in connection with assets owned by a partnership. Web perhaps, you have reached us looking for the answer to a question like: Web this template can be used to determine and allocate the basis adjustments resulting from section 754 elections for sales or exchanges occurring on or after 12/15/99. This number to words converter can also be useful for foreign students of english. Our grade 4 subtraction worksheets are organized into two sections: How to write 754 in words. Web section 754 election, ed’s allocable share of the remaining depreciation deductions is $4,200 (25% of $16,800). Web section 754 (manner of electing optional adjustment to basis of partnership property). Select the section for depreciation and amortization; Signnow combines ease of use, affordability and security in one online tool, all without forcing. Grade 4 subraction worksheet keywords: Web go to income/ deductions > rent and royalty worksheet. Web section 754 requires each partner to determine their adjusted basis in order to determine the exact tax liability of the partner. This new basis only applies. Web with section 754 adjustment a.b. Web new 2019 form 1065 instructions for sections 754, 734(b) and 743(b) reporting. Below are six versions of our grade 4 math worksheet on subtracting from 1,000. Web section 754 of the internal revenue code (irc) deals with complex issues that often arise in connection with assets owned by a partnership. Mental subtraction, for exercises that students should attempt to solve in their. Web section 754, a very short provision, simply states that if the partnership makes a §754 election, then the basis of partnership property is adjusted under §734(b) in the case of a. This determination is normally done at. Grade 4 subraction worksheet keywords: How to write 754 in words. Under section 754, a partnership. Web section 754 election, ed’s allocable share of the remaining depreciation deductions is $4,200 (25% of $16,800). Under section 754, a partnership may elect to adjust the basis of partnership property when. Web this template can be used to determine and allocate the basis adjustments resulting from section 754 elections for sales or exchanges occurring on or after 12/15/99.Section 754 Calculation Worksheet Free Kids Maths Worksheets

Scientific Notation Worksheet Answer Key

How to do 754 election for depreciable asset? GROCO

Form 754 Fill Out and Sign Printable PDF Template signNow

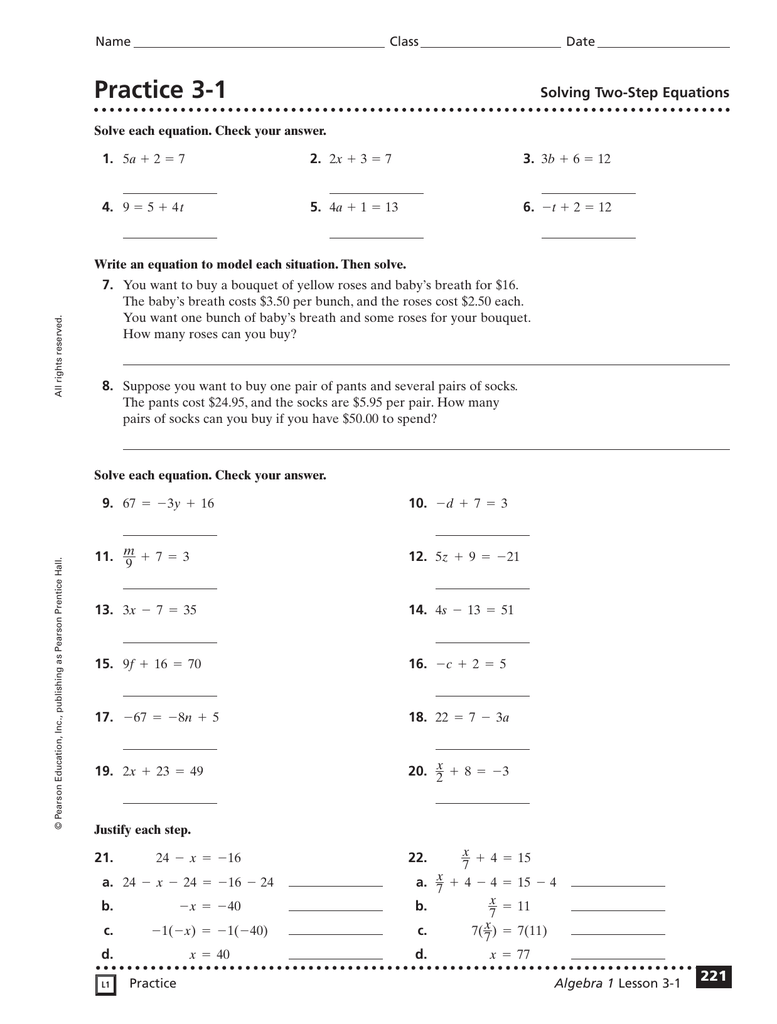

Two Step Equations Worksheet Answers

worksheet. State And Local Tax Refund Worksheet. Grass Fedjp

How to enter special allocations to partners on Form 1065

Section 754 Calculation Worksheet Free Kids Maths Worksheets

Section 754 Calculation Worksheet Double Digit Math Problems Free

calculating work practice worksheet

Web Section 754 (Manner Of Electing Optional Adjustment To Basis Of Partnership Property).

754 None C If I Buy A's Interest Or Inherited It, I Paid Or My Basis Is $11,000.

Fmv Capital Cash A Property B Sec.

Signnow Combines Ease Of Use, Affordability And Security In One Online Tool, All Without Forcing.

Related Post: