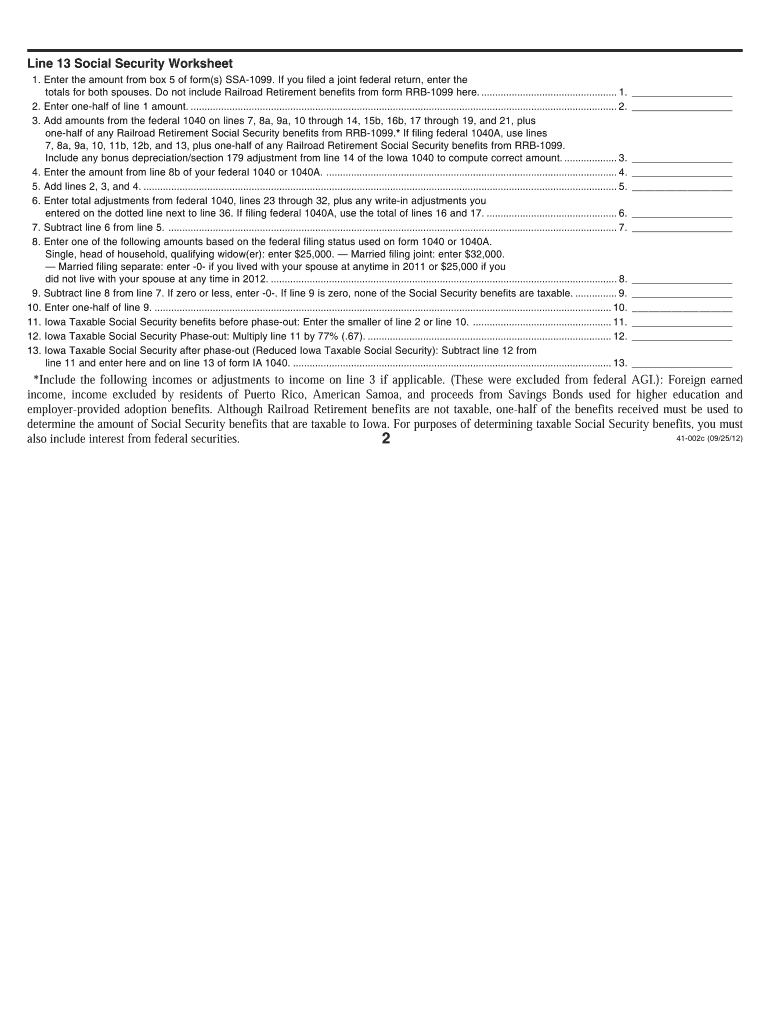

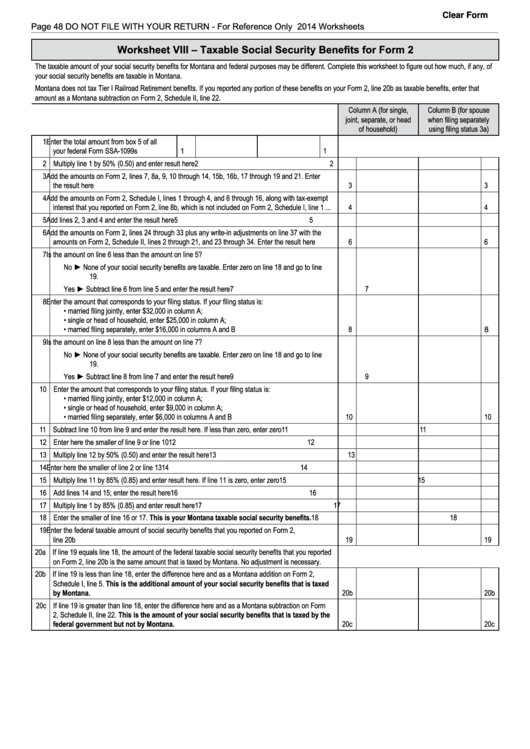

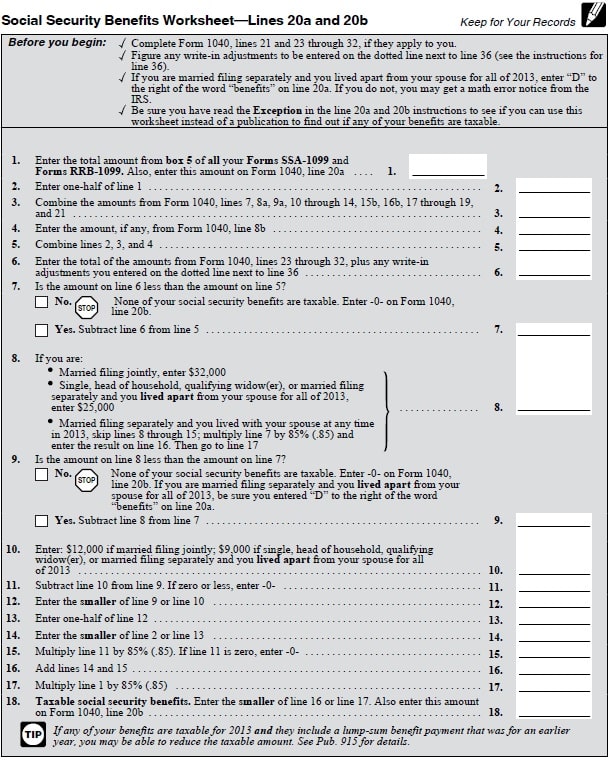

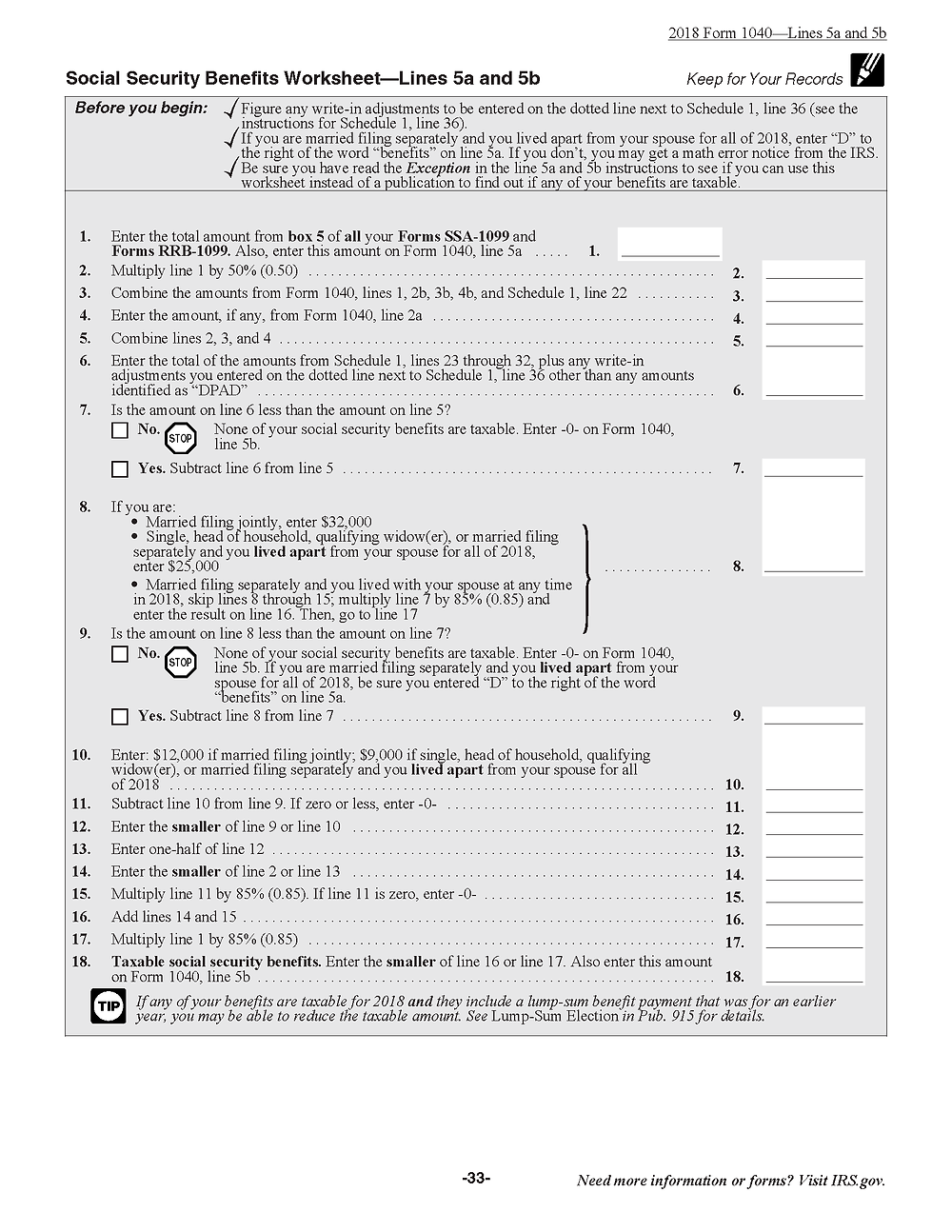

Social Security Taxable Amount Worksheet

Social Security Taxable Amount Worksheet - Web when you calculate how much of your social security benefit is taxable, use the $2,000/month number and multiply that by the number of months to get the annual. More than $34,000, up to 85 percent of your benefits may be taxable. If your income is modest, it is likely that none of your social security benefits are taxable. Web the irs will not have social security worksheets available for tax year 2022 to calculate the amount of benefits that are taxable until late in 2022. Web complete worksheet 1 and worksheets 2 and 3 as appropriate before completing this worksheet. Web up to 85% of your social security benefits are taxable if: More than $34,000, up to 85 percent of your benefits may be taxable. Web between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. You file a federal tax return as an individual and your combined income is more than $34,000. Web as your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85% of your total benefits. You file a federal tax return as an individual and your combined income is more than $34,000. Web if youre an individual filer and had at least $25,000 in gross income including social security for the year, then up to 50% of your social security benefits may be. Web up to 85% of your social security benefits are taxable if:. More than $34,000, up to 85 percent of your benefits may be taxable. Web complete worksheet 1 and worksheets 2 and 3 as appropriate before completing this worksheet. Web between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. Web the irs will not have social security worksheets available for tax. More than $34,000, up to 85 percent of your benefits may be taxable. More than $34,000, up to 85 percent of your benefits may be taxable. Web as your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85% of your total benefits. If a portion of social security benefits is. Web as your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85% of your total benefits. Web up to 85% of your social security benefits are taxable if: More than $34,000, up to 85 percent of your benefits may be taxable. If your income is modest, it is likely that. Web the irs will not have social security worksheets available for tax year 2022 to calculate the amount of benefits that are taxable until late in 2022. More than $34,000, up to 85 percent of your benefits may be taxable. Web complete worksheet 1 and worksheets 2 and 3 as appropriate before completing this worksheet. Web between $25,000 and $34,000,. Web between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. Web if youre an individual filer and had at least $25,000 in gross income including social security for the year, then up to 50% of your social security benefits may be. Web complete worksheet 1 and worksheets 2 and 3. Web between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. Multiply line 1 by 50%. You file a federal tax return as an individual and your combined income is more than $34,000. Web when you calculate how much of your social security benefit is taxable, use the $2,000/month number and. Web the taxable portion of social security benefits is never more than 85% of the net benefits the taxpayer received. If your income is modest, it is likely that none of your social security benefits are taxable. You file a federal tax return as an individual and your combined income is more than $34,000. Web complete worksheet 1 and worksheets. Web between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. Web up to 85% of your social security benefits are taxable if: In many cases, the taxable portion is less than 50%. More than $34,000, up to 85 percent of your benefits may be taxable. Multiply line 1 by 50%. Web between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. You file a federal tax return as an individual and your combined income is more than $34,000. Web as your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85% of. Web between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. Web if youre an individual filer and had at least $25,000 in gross income including social security for the year, then up to 50% of your social security benefits may be. More than $34,000, up to 85 percent of your benefits may be taxable. If your income is modest, it is likely that none of your social security benefits are taxable. In many cases, the taxable portion is less than 50%. Web between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. Web as your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85% of your total benefits. More than $34,000, up to 85 percent of your benefits may be taxable. Web the taxable portion of social security benefits is never more than 85% of the net benefits the taxpayer received. Web when you calculate how much of your social security benefit is taxable, use the $2,000/month number and multiply that by the number of months to get the annual. Web complete worksheet 1 and worksheets 2 and 3 as appropriate before completing this worksheet. Web as your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85% of your total benefits. Multiply line 1 by 50%. Web up to 85% of your social security benefits are taxable if: You file a federal tax return as an individual and your combined income is more than $34,000. If a portion of social security benefits is taxable for 2019 and includes benefits received in 2019 that were for an earlier year, the taxable portion shown on this. Web the irs will not have social security worksheets available for tax year 2022 to calculate the amount of benefits that are taxable until late in 2022. In many cases, the taxable portion is less than 50%. If your income is modest, it is likely that none of your social security benefits are taxable. Multiply line 1 by 50%. Web between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. More than $34,000, up to 85 percent of your benefits may be taxable. Web as your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85% of your total benefits. Web if youre an individual filer and had at least $25,000 in gross income including social security for the year, then up to 50% of your social security benefits may be. Web up to 85% of your social security benefits are taxable if: More than $34,000, up to 85 percent of your benefits may be taxable. Web the irs will not have social security worksheets available for tax year 2022 to calculate the amount of benefits that are taxable until late in 2022. You file a federal tax return as an individual and your combined income is more than $34,000. Web complete worksheet 1 and worksheets 2 and 3 as appropriate before completing this worksheet. Web as your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85% of your total benefits.Social Security Benefits Formula 2021

Social Security Tax Worksheet Calculator kamberlawgroup

tax worksheet for students

Social Security 1040 Worksheet Form Fill Out and Sign Printable PDF

Fillable Worksheet Viii Taxable Social Security Benefits For Form 2

1040x2.pdf Irs Tax Forms Social Security (United States)

Is Social Security Tax Deductible

What Is The Taxable Amount On Your Social Security Benefits?

Irs Social Security Worksheet / Irs social Security Worksheet

20++ Social Security Benefits Worksheet 2020 Pdf

If A Portion Of Social Security Benefits Is Taxable For 2019 And Includes Benefits Received In 2019 That Were For An Earlier Year, The Taxable Portion Shown On This.

Web Between $25,000 And $34,000, You May Have To Pay Income Tax On Up To 50 Percent Of Your Benefits.

Web When You Calculate How Much Of Your Social Security Benefit Is Taxable, Use The $2,000/Month Number And Multiply That By The Number Of Months To Get The Annual.

Web The Taxable Portion Of Social Security Benefits Is Never More Than 85% Of The Net Benefits The Taxpayer Received.

Related Post: