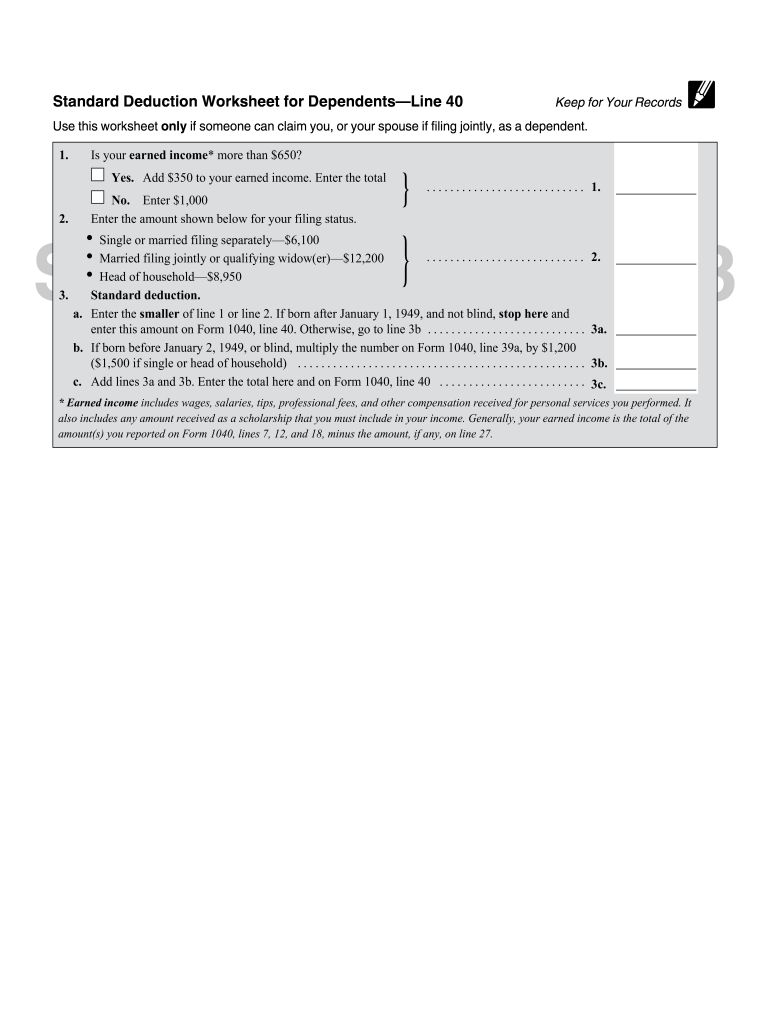

Standard Deduction Worksheet For Dependents

Standard Deduction Worksheet For Dependents - Which of the following would you use to figure her standard deduction?. Web standard deduction worksheet for dependents (2020) use this worksheet only if someone can claim the taxpayer, or spouse if filing jointly, as a dependent. Web basic income information including amounts and adjusted gross income. Web the california standard deduction amounts are less than the federal standard deduction amounts. If someone else claims you on their tax return, use this calculation. Web standard deduction worksheet for dependents (2022) use this worksheet only if someone can claim the taxpayer, or spouse if filing jointly, as a dependent. California standard deduction worksheet for. The tool is designed for taxpayers who were u.s. Web standard deduction for dependents. Taxact calculates the standard deduction worksheet for dependents, but there is not a viewable. The tool is designed for taxpayers who were u.s. Web standard deduction worksheet for dependents (2022) use this worksheet only if someone can claim the taxpayer, or spouse if filing jointly, as a dependent. Taxact calculates the standard deduction worksheet for dependents, but there is not a viewable. Web basic income information including amounts and adjusted gross income. The irs. Web standard deduction worksheet for dependents (2022) use this worksheet only if someone can claim the taxpayer, or spouse if filing jointly, as a dependent. Citizens or resident aliens for the entire tax. Web basic income information including amounts and adjusted gross income. (1) $1,150, or (2) your. Web standard deduction for dependents. The irs standard deduction is the portion of income that is not subject to tax and that can be used to reduce a taxpayer's tax bill. Citizens or resident aliens for the entire tax. Web standard deduction worksheet for dependents (2020) use this worksheet only if someone can claim the taxpayer, or spouse if filing jointly, as a dependent. (1). The irs standard deduction is the portion of income that is not subject to tax and that can be used to reduce a taxpayer's tax bill. Web basic income information including amounts and adjusted gross income. Taxact calculates the standard deduction worksheet for dependents, but there is not a viewable. If someone else claims you on their tax return, use. Web basic income information including amounts and adjusted gross income. Web standard deduction for dependents. Web standard deduction worksheet for dependents (2022) use this worksheet only if someone can claim the taxpayer, or spouse if filing jointly, as a dependent. The tool is designed for taxpayers who were u.s. Taxact calculates the standard deduction worksheet for dependents, but there is. The tool is designed for taxpayers who were u.s. Web standard deduction for dependents. (1) $1,150, or (2) your. Web standard deduction worksheet for dependents (2020) use this worksheet only if someone can claim the taxpayer, or spouse if filing jointly, as a dependent. The irs standard deduction is the portion of income that is not subject to tax and. Which of the following would you use to figure her standard deduction?. Taxact calculates the standard deduction worksheet for dependents, but there is not a viewable. Web standard deduction for dependents. Citizens or resident aliens for the entire tax. If someone else claims you on their tax return, use this calculation. Web the california standard deduction amounts are less than the federal standard deduction amounts. Line 2 of the standard deduction. Which of the following would you use to figure her standard deduction?. Citizens or resident aliens for the entire tax. Taxact calculates the standard deduction worksheet for dependents, but there is not a viewable. Citizens or resident aliens for the entire tax. The irs standard deduction is the portion of income that is not subject to tax and that can be used to reduce a taxpayer's tax bill. Web the california standard deduction amounts are less than the federal standard deduction amounts. If someone else claims you on their tax return, use this calculation.. The irs standard deduction is the portion of income that is not subject to tax and that can be used to reduce a taxpayer's tax bill. Line 2 of the standard deduction. Which of the following would you use to figure her standard deduction?. Citizens or resident aliens for the entire tax. California standard deduction worksheet for. Web basic income information including amounts and adjusted gross income. The tool is designed for taxpayers who were u.s. If someone else claims you on their tax return, use this calculation. Web standard deduction worksheet for dependents (2020) use this worksheet only if someone can claim the taxpayer, or spouse if filing jointly, as a dependent. Taxact calculates the standard deduction worksheet for dependents, but there is not a viewable. The irs standard deduction is the portion of income that is not subject to tax and that can be used to reduce a taxpayer's tax bill. California standard deduction worksheet for. Web standard deduction worksheet for dependents (2022) use this worksheet only if someone can claim the taxpayer, or spouse if filing jointly, as a dependent. Which of the following would you use to figure her standard deduction?. Line 2 of the standard deduction. (1) $1,150, or (2) your. Web standard deduction for dependents. Citizens or resident aliens for the entire tax. Web the california standard deduction amounts are less than the federal standard deduction amounts. Web the california standard deduction amounts are less than the federal standard deduction amounts. Web standard deduction worksheet for dependents (2022) use this worksheet only if someone can claim the taxpayer, or spouse if filing jointly, as a dependent. California standard deduction worksheet for. (1) $1,150, or (2) your. Which of the following would you use to figure her standard deduction?. The tool is designed for taxpayers who were u.s. Line 2 of the standard deduction. Web standard deduction worksheet for dependents (2020) use this worksheet only if someone can claim the taxpayer, or spouse if filing jointly, as a dependent. Web basic income information including amounts and adjusted gross income. Web standard deduction for dependents. Citizens or resident aliens for the entire tax.16 Best Images of Financial Organizer Worksheet Free Printable Bill

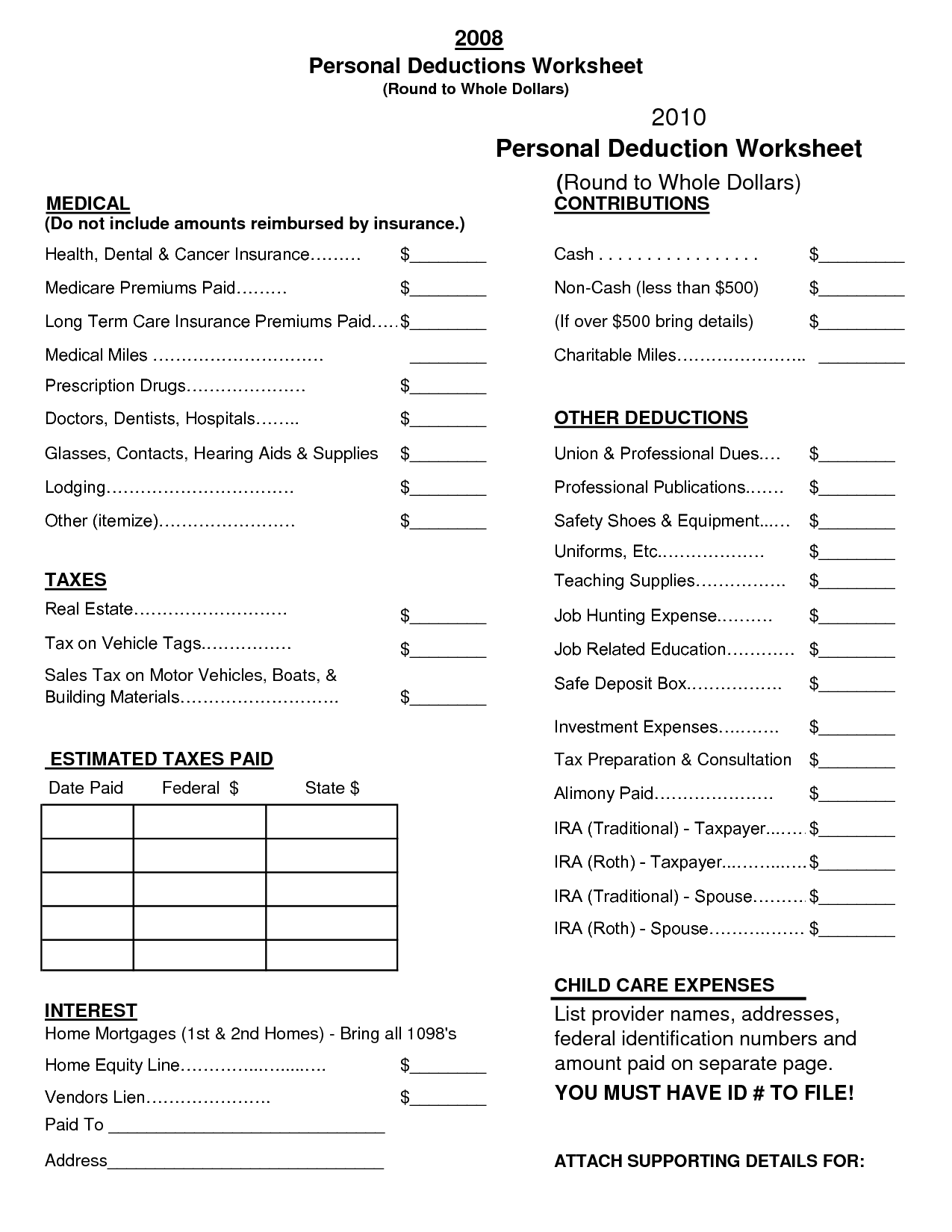

30++ Itemized Deduction Small Business Tax Deductions Worksheet

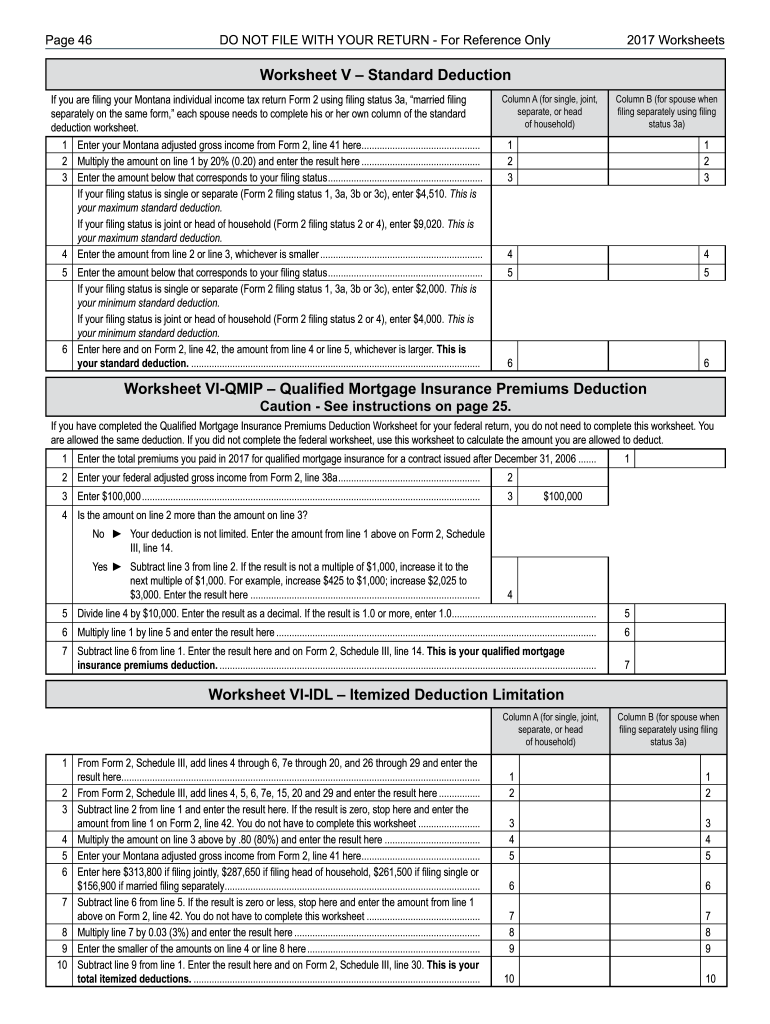

Montana Deduction Fill Out and Sign Printable PDF Template signNow

IRS Standard Deduction Worksheet for Dependents Line 40 Fill out

Publication 17 Your Federal Tax; Standard Deduction for Dependents

Standard Deduction Worksheet for Dependents

10++ Standard Deduction Worksheet For Dependents 2020 Worksheets Decoomo

W4

The New Withholding Calculator is Here! Julie Grandstaff

2021 W4 Guide How to Fill Out a W4 This Year Gusto

Taxact Calculates The Standard Deduction Worksheet For Dependents, But There Is Not A Viewable.

The Irs Standard Deduction Is The Portion Of Income That Is Not Subject To Tax And That Can Be Used To Reduce A Taxpayer's Tax Bill.

If Someone Else Claims You On Their Tax Return, Use This Calculation.

Related Post: