State Tax Refund Worksheet Item B

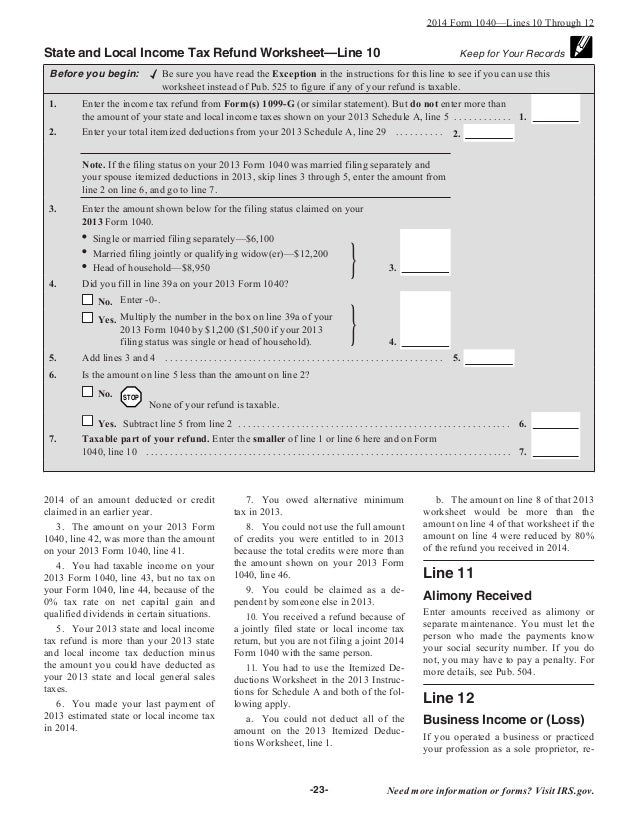

State Tax Refund Worksheet Item B - To find out how the. Web do i need to complete the state refund worksheet? Web this article will help you understand how the state and local refunds taxable worksheet for form 1040 is calculated in intuit proconnect. Web you paid 75% ($3,000 ÷ $4,000) of the estimated tax in 2020, so 75% of the $400 refund, or $300, is for amounts you paid in 2020 and is a recovery item. Web state or local income tax refund. Web solved•by intuit•39•updated july 14, 2022. For more specific information about the status of your refund after the. None of your refund is taxable if, in the year you paid the tax, you either: See the instructions for line 16 for. • secretary of state or corporation commissionregistration documents •. (a) didn’t itemize deductions, or (b) elected to deduct state and local. • secretary of state or corporation commissionregistration documents •. But do not enter more than the amount of state and local income taxes shown on line 5d of the 2021. To find out if the illinois department of revenue has initiated the refund process. Web you paid 75%. Web • federal or state tax return (only acceptable with a preprinted label) or a preprinted tax coupon. To find out if the illinois department of revenue has initiated the refund process. But do not enter more than the amount of state and local income taxes shown on line 5d of the 2021. Web state or local income tax refund.. Web solved•by intuit•39•updated july 14, 2022. Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. Web you paid 75% ($3,000 ÷ $4,000) of the estimated tax in 2020, so 75% of the $400 refund, or $300, is for amounts you paid in 2020 and is a recovery. Web state or local income tax refund. (a) didn’t itemize deductions, or (b) elected to deduct state and local. None of your refund is taxable if, in the year you paid the tax, you either: Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. To find out. Web state or local income tax refund. Web do i need to complete the state refund worksheet? Web you paid 75% ($3,000 ÷ $4,000) of the estimated tax in 2020, so 75% of the $400 refund, or $300, is for amounts you paid in 2020 and is a recovery item. See the instructions for line 16 for. For more specific. But do not enter more than the amount of state and local income taxes shown on line 5d of the 2021. (a) didn’t itemize deductions, or (b) elected to deduct state and local. • secretary of state or corporation commissionregistration documents •. None of your refund is taxable if, in the year you paid the tax, you either: Web use. For more specific information about the status of your refund after the. Web solved•by intuit•39•updated july 14, 2022. Web you paid 75% ($3,000 ÷ $4,000) of the estimated tax in 2020, so 75% of the $400 refund, or $300, is for amounts you paid in 2020 and is a recovery item. Go to screen 14.2, state tax refunds,. But do. To find out how the. Web use where's my refund? Web state or local income tax refund. Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. Web this article will help you understand how the state and local refunds taxable worksheet for form 1040 is calculated in. For more specific information about the status of your refund after the. None of your refund is taxable if, in the year you paid the tax, you either: But do not enter more than the amount of state and local income taxes shown on line 5d of the 2021. Web this article will help you understand how the state and. Web use where's my refund? (a) didn’t itemize deductions, or (b) elected to deduct state and local. Web you paid 75% ($3,000 ÷ $4,000) of the estimated tax in 2020, so 75% of the $400 refund, or $300, is for amounts you paid in 2020 and is a recovery item. See the instructions for line 16 for. To find out. But do not enter more than the amount of state and local income taxes shown on line 5d of the 2021. To find out how the. If all of the $300 is a. Web use where's my refund? Web this article will help you understand how the state and local refunds taxable worksheet for form 1040 is calculated in intuit proconnect. For more specific information about the status of your refund after the. • secretary of state or corporation commissionregistration documents •. Go to screen 14.2, state tax refunds,. Web • federal or state tax return (only acceptable with a preprinted label) or a preprinted tax coupon. Web state or local income tax refund. Web do i need to complete the state refund worksheet? Web solved•by intuit•39•updated july 14, 2022. To find out if the illinois department of revenue has initiated the refund process. Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. (a) didn’t itemize deductions, or (b) elected to deduct state and local. Web you paid 75% ($3,000 ÷ $4,000) of the estimated tax in 2020, so 75% of the $400 refund, or $300, is for amounts you paid in 2020 and is a recovery item. See the instructions for line 16 for. None of your refund is taxable if, in the year you paid the tax, you either: To find out how the taxable portion of state and local refunds is calculated: Web you paid 75% ($3,000 ÷ $4,000) of the estimated tax in 2020, so 75% of the $400 refund, or $300, is for amounts you paid in 2020 and is a recovery item. Web state or local income tax refund. (a) didn’t itemize deductions, or (b) elected to deduct state and local. To find out how the taxable portion of state and local refunds is calculated: • secretary of state or corporation commissionregistration documents •. If all of the $300 is a. But do not enter more than the amount of state and local income taxes shown on line 5d of the 2021. None of your refund is taxable if, in the year you paid the tax, you either: To find out if the illinois department of revenue has initiated the refund process. To find out how the. See the instructions for line 16 for. Web • federal or state tax return (only acceptable with a preprinted label) or a preprinted tax coupon. Web this article will help you understand how the state and local refunds taxable worksheet for form 1040 is calculated in intuit proconnect. For more specific information about the status of your refund after the. Web solved•by intuit•39•updated july 14, 2022.36 Irs Form 886 A Worksheet support worksheet

Aarp Overpayment Refund Form Form Resume Examples

Tax Refund Worksheet 2014 Worksheet Resume Examples

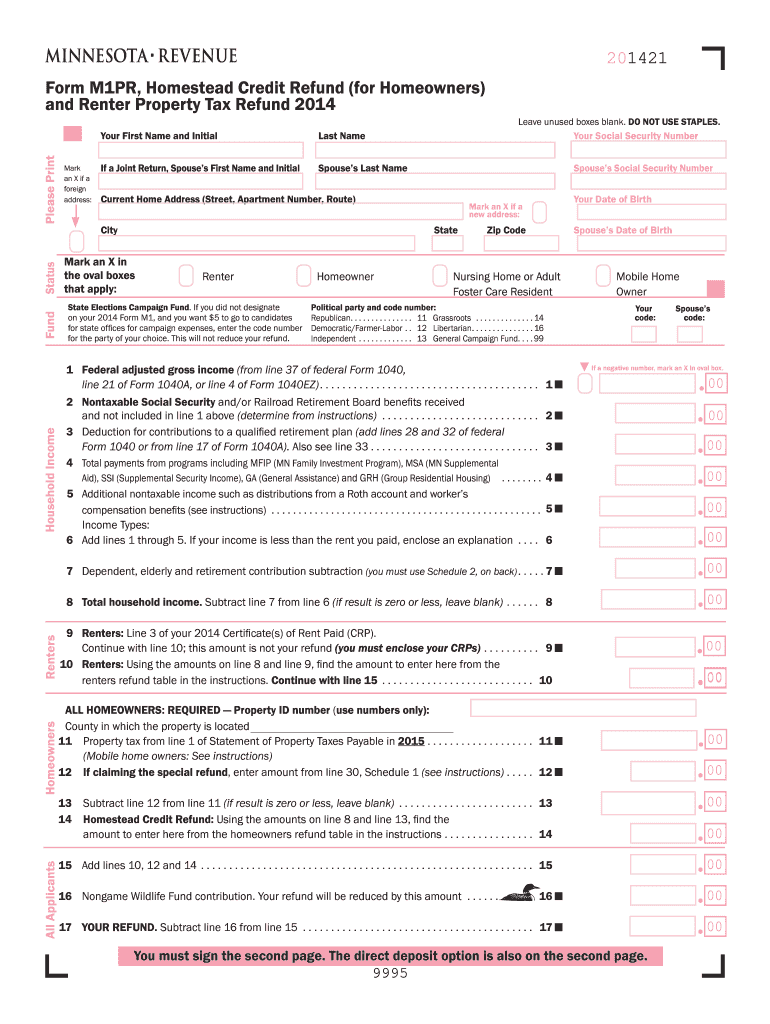

2014 Form MN DoR M1PR Fill Online, Printable, Fillable, Blank PDFfiller

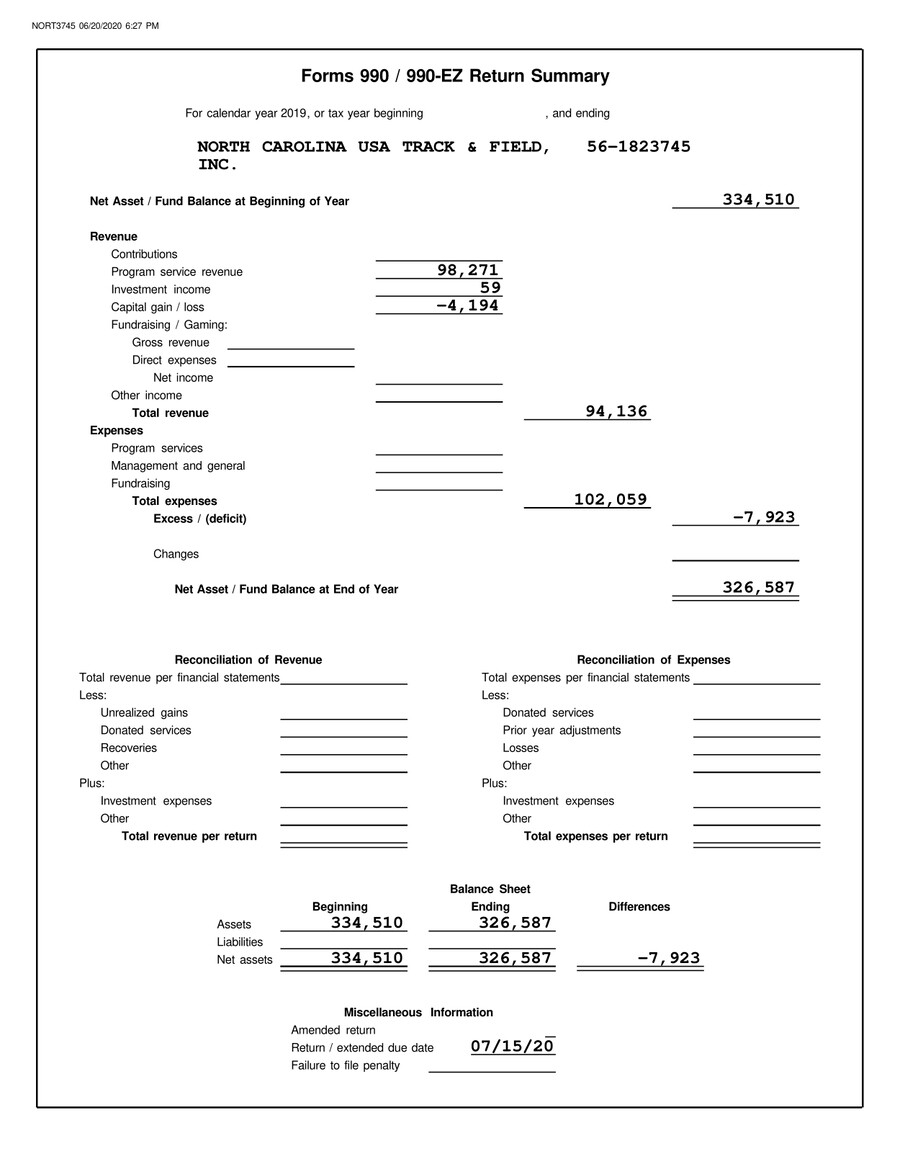

2019 USATF North Carolina Tax Return by USATF Flipsnack

basic number work free worksheets powerpoints and other standard form

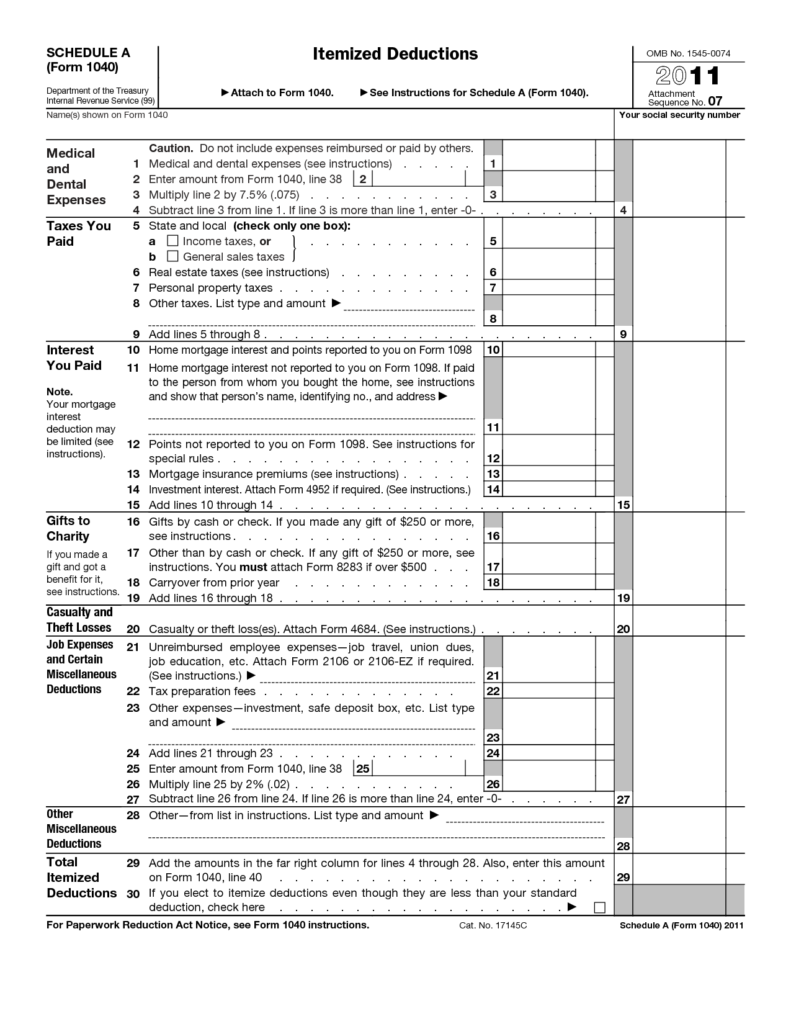

Form 1040 State And Local Tax Refund Worksheet 1040 Form Printable

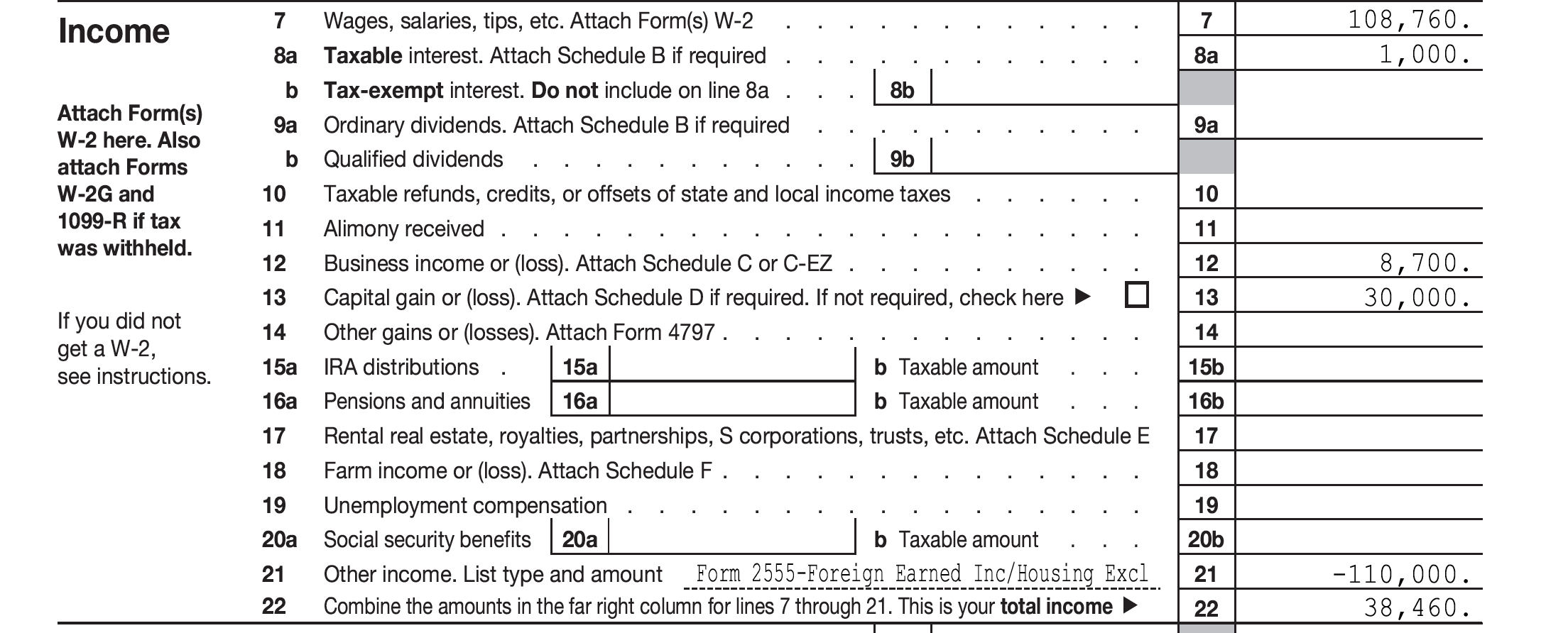

1040 INSTRUCTIONS

City of Cleveland, Ohio Refund Worksheet Download Printable PDF

Form 9 9a Tax Table Most Effective Ways To Form 9 9a Tax Table

Web Use Where's My Refund?

Web Use The Qualified Dividends And Capital Gain Tax Worksheet Or The Schedule D Tax Worksheet, Whichever Applies, To Figure Your Tax.

Go To Screen 14.2, State Tax Refunds,.

Web Do I Need To Complete The State Refund Worksheet?

Related Post: