State Tax Refund Worksheet Item Q Line 1

State Tax Refund Worksheet Item Q Line 1 - Web the state refund worksheet reflects the calculation of the amount (if any) of the state income tax refund received that would be taxable and transferred to line 1 of irs. Web 19 rows 1: Do not enter more than the amount of your state and. Web do i need to complete the state refund worksheet? Refunds attributable to post 12/31/20xx payments per irs pub. Web if none of the localities in which you lived during 2022 imposed a local general sales tax, enter $467 on line 1 of your worksheet. State and local income tax refunds (prior year) income tax refunds, credits or offsets (2) 2: Other gains or (losses) line 7. Web state and local income tax refund worksheet—schedule 1, line 1; Web state and local refund worksheet. Otherwise, complete a separate worksheet for. State and local income tax refunds (prior year) income tax refunds, credits or offsets (2) 2: Web if none of the localities in which you lived during 2022 imposed a local general sales tax, enter $467 on line 1 of your worksheet. Additional fees may apply for. Do not enter more than the amount. Refunds attributable to post 12/31/20xx payments per irs pub. Do not enter more than the amount of your state and. Use this worksheet only if the taxpayer itemized. Web state and local income tax refund worksheet—schedule 1, line 1; Web (form 1040), from the amount of state and local income taxes (or general sales taxes), real estate taxes, and personal. Web state and local income tax refund worksheet—schedule 1, line 1; Use this worksheet only if the taxpayer itemized. Do not enter more than the amount of your state and. Refunds attributable to post 12/31/20xx payments per irs pub. Web 19 rows 1: Web the state refund worksheet reflects the calculation of the amount (if any) of the state income tax refund received that would be taxable and transferred to line 1 of irs. Web state and local refund worksheet. Do not enter more than the amount of your state and. Web 19 rows 1: State and local income tax refunds (prior year). State and local income tax refunds (prior year) income tax refunds, credits or offsets (2) 2: Web state and local income tax refund worksheet—schedule 1, line 1; Additional fees may apply for. Web 19 rows 1: Web state and local refund worksheet. State and local income tax refunds (prior year) income tax refunds, credits or offsets (2) 2: Use this worksheet only if the taxpayer itemized. Do not enter more than the amount of your state and. Refunds attributable to post 12/31/20xx payments per irs pub. Web state and local income tax refund worksheet—schedule 1, line 1; Web state and local income tax refund worksheet—schedule 1, line 1; Web (form 1040), from the amount of state and local income taxes (or general sales taxes), real estate taxes, and personal property taxes paid in 2021 [line 5d of the 2021 schedule a. Web the state refund worksheet reflects the calculation of the amount (if any) of the state. Web (form 1040), from the amount of state and local income taxes (or general sales taxes), real estate taxes, and personal property taxes paid in 2021 [line 5d of the 2021 schedule a. Web state and local income tax refund worksheet—schedule 1, line 1; Additional fees may apply for. Other gains or (losses) line 7. Use this worksheet only if. Web (form 1040), from the amount of state and local income taxes (or general sales taxes), real estate taxes, and personal property taxes paid in 2021 [line 5d of the 2021 schedule a. Use this worksheet only if the taxpayer itemized. Web state and local refund worksheet. Web the state refund worksheet reflects the calculation of the amount (if any). Web the state refund worksheet reflects the calculation of the amount (if any) of the state income tax refund received that would be taxable and transferred to line 1 of irs. Otherwise, complete a separate worksheet for. Web if none of the localities in which you lived during 2022 imposed a local general sales tax, enter $467 on line 1. Use this worksheet only if the taxpayer itemized. Web 19 rows 1: Other gains or (losses) line 7. Refunds attributable to post 12/31/20xx payments per irs pub. Additional fees may apply for. Web do i need to complete the state refund worksheet? Otherwise, complete a separate worksheet for. State and local income tax refunds (prior year) income tax refunds, credits or offsets. Do not enter more than the amount of your state and. Web state and local income tax refund worksheet—schedule 1, line 1; State and local income tax refunds (prior year) income tax refunds, credits or offsets (2) 2: Web the state refund worksheet reflects the calculation of the amount (if any) of the state income tax refund received that would be taxable and transferred to line 1 of irs. Web (form 1040), from the amount of state and local income taxes (or general sales taxes), real estate taxes, and personal property taxes paid in 2021 [line 5d of the 2021 schedule a. Web if none of the localities in which you lived during 2022 imposed a local general sales tax, enter $467 on line 1 of your worksheet. Web state and local refund worksheet. Additional fees may apply for. Web 19 rows 1: Other gains or (losses) line 7. Web do i need to complete the state refund worksheet? State and local income tax refunds (prior year) income tax refunds, credits or offsets (2) 2: Refunds attributable to post 12/31/20xx payments per irs pub. Web state and local income tax refund worksheet—schedule 1, line 1; Web if none of the localities in which you lived during 2022 imposed a local general sales tax, enter $467 on line 1 of your worksheet. Web state and local refund worksheet. State and local income tax refunds (prior year) income tax refunds, credits or offsets. Otherwise, complete a separate worksheet for. Web (form 1040), from the amount of state and local income taxes (or general sales taxes), real estate taxes, and personal property taxes paid in 2021 [line 5d of the 2021 schedule a.Tax Refund Worksheet 2014 Worksheet Resume Examples

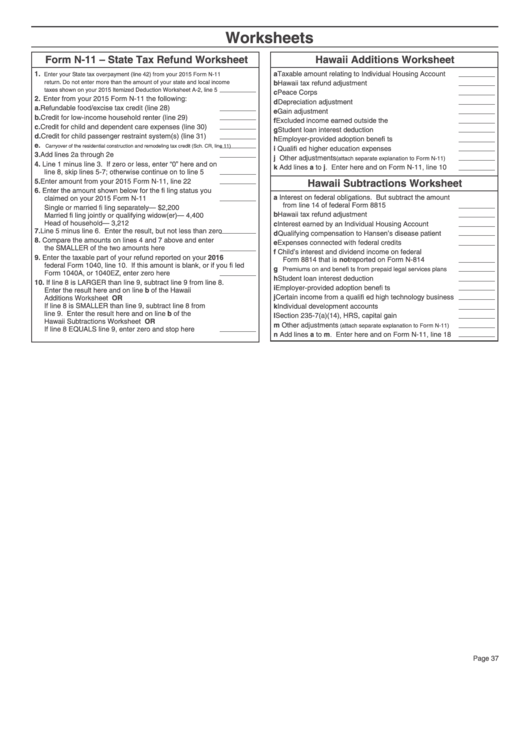

Form N11 State Tax Refund Worksheet 2016 printable pdf download

Publication 972 (2020), Child Tax Credit and Credit for Other

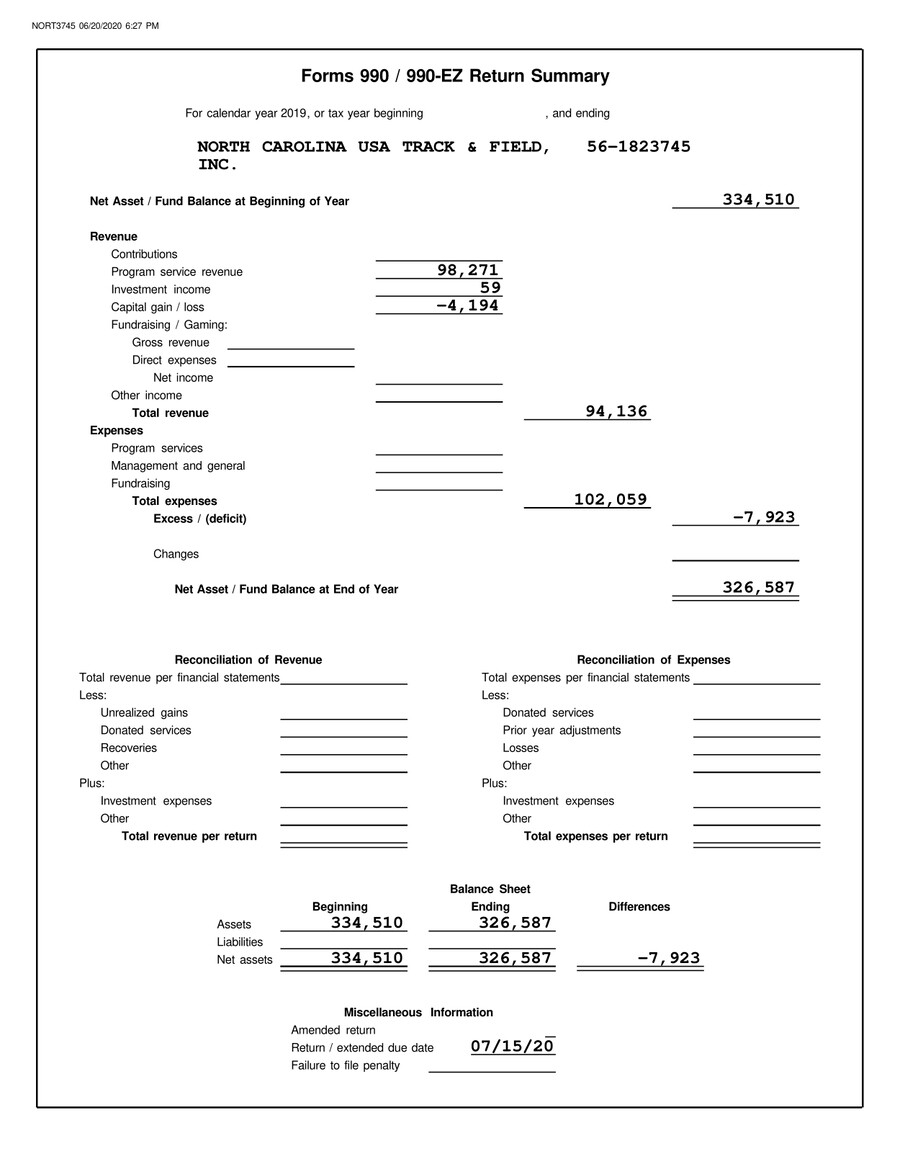

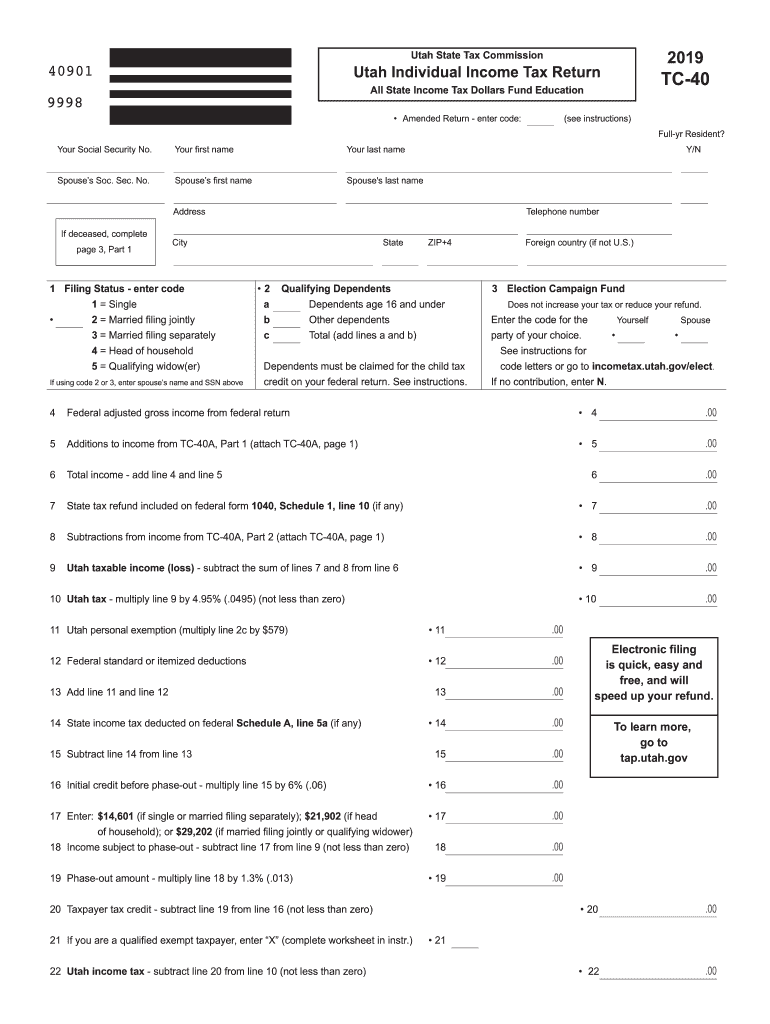

2019 USATF North Carolina Tax Return by USATF Flipsnack

worksheet. State And Local Tax Refund Worksheet. Grass Fedjp

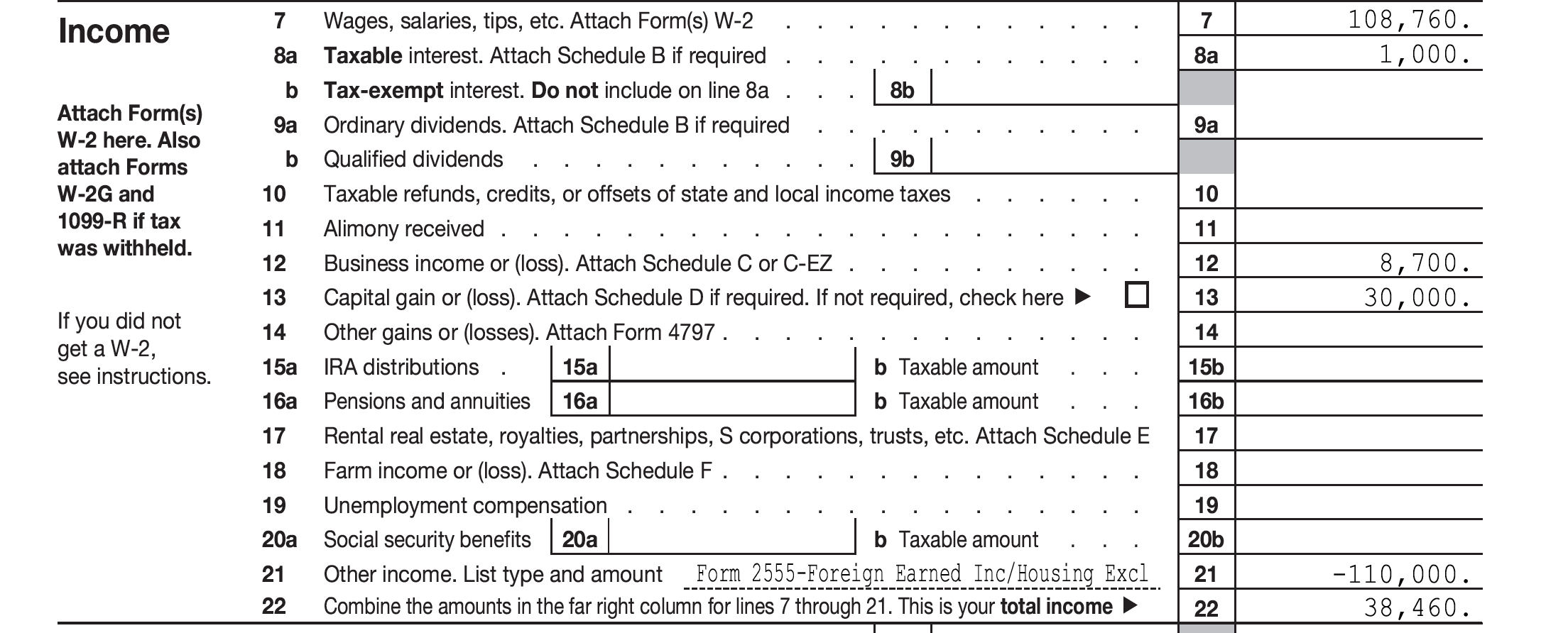

Form 1040 State And Local Tax Refund Worksheet 1040 Form Printable

2018 Tax Computation Worksheet

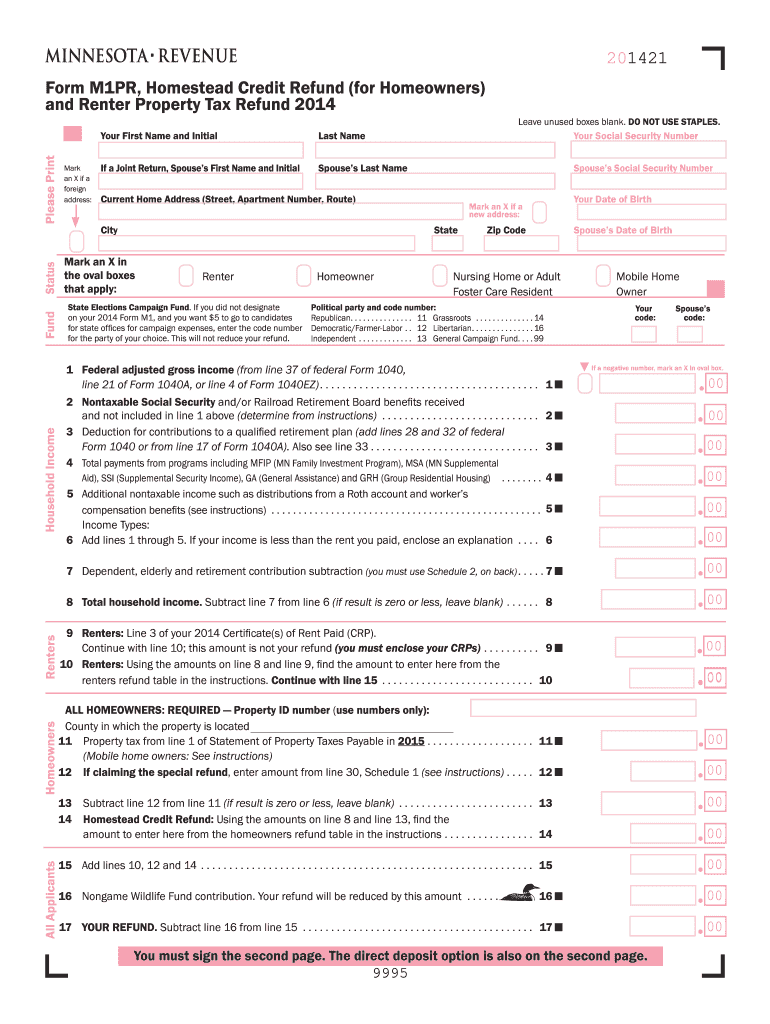

2014 Form MN DoR M1PR Fill Online, Printable, Fillable, Blank PDFfiller

Tax Payments Worksheet State Id Uncategorized Resume Examples

utah 2015 individual tax return form Fill out & sign online DocHub

Web The State Refund Worksheet Reflects The Calculation Of The Amount (If Any) Of The State Income Tax Refund Received That Would Be Taxable And Transferred To Line 1 Of Irs.

Do Not Enter More Than The Amount Of Your State And.

Use This Worksheet Only If The Taxpayer Itemized.

Related Post: