Tax Basis Capital Account Worksheet

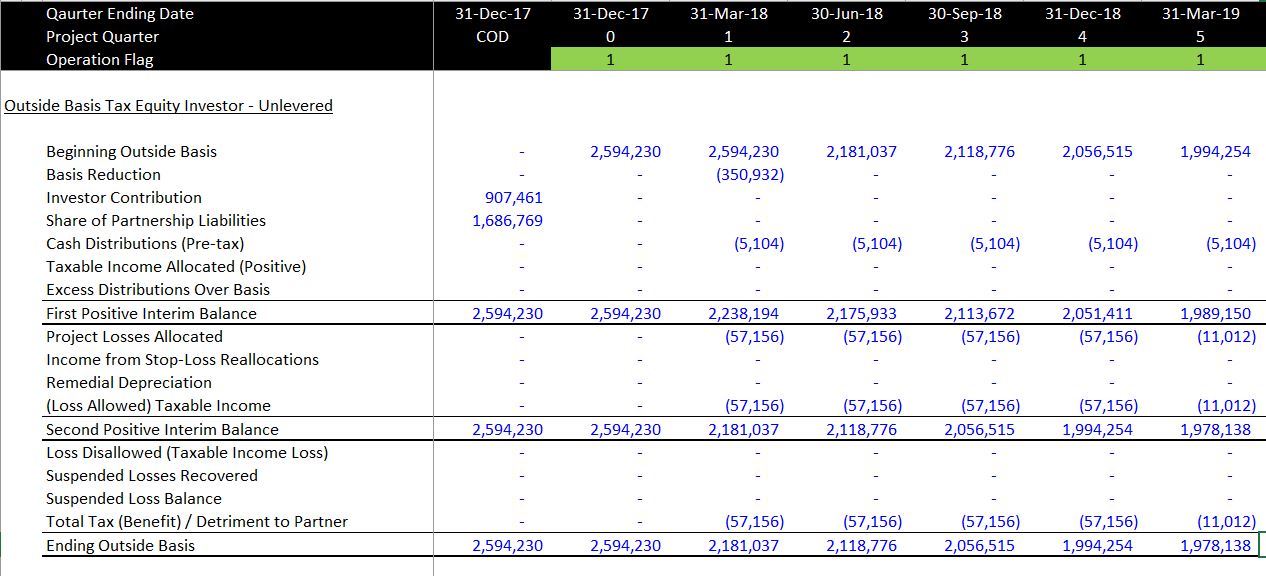

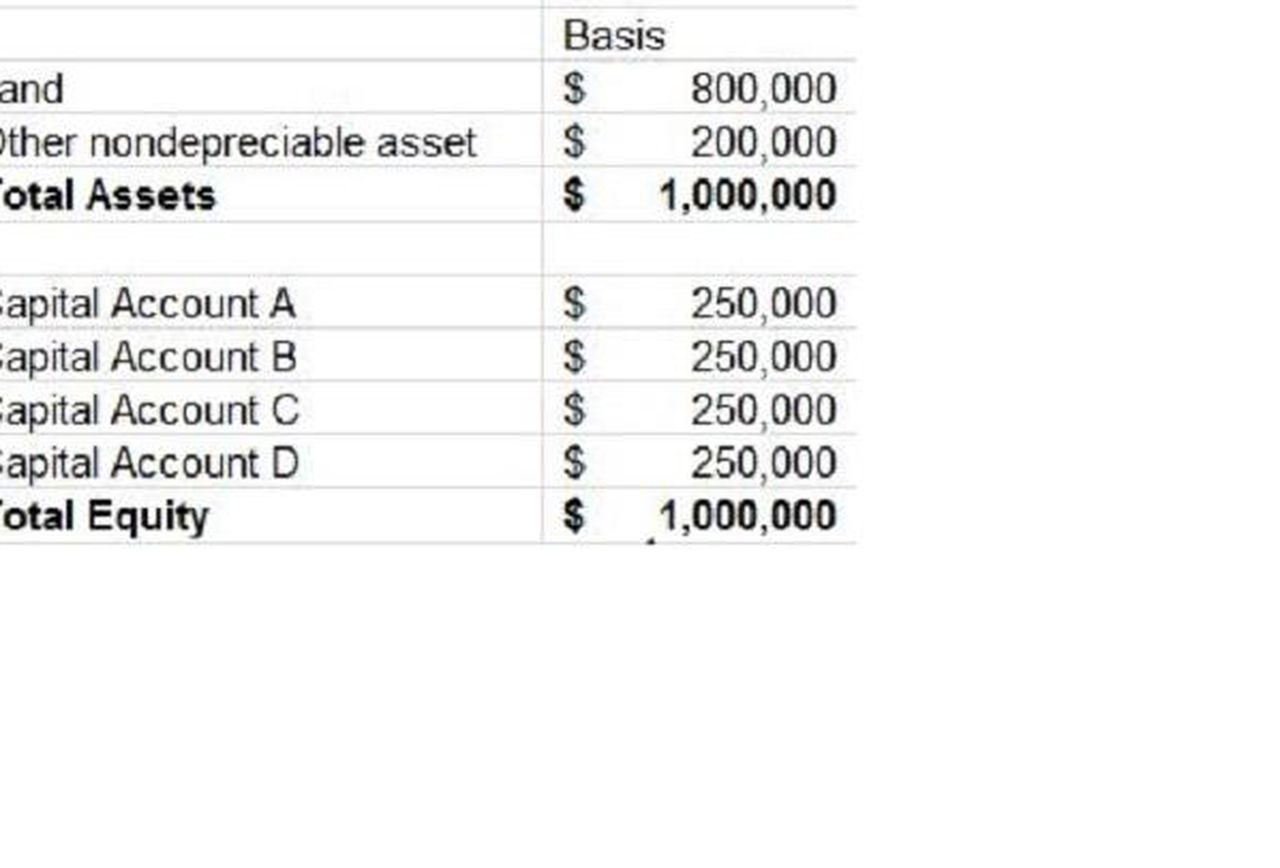

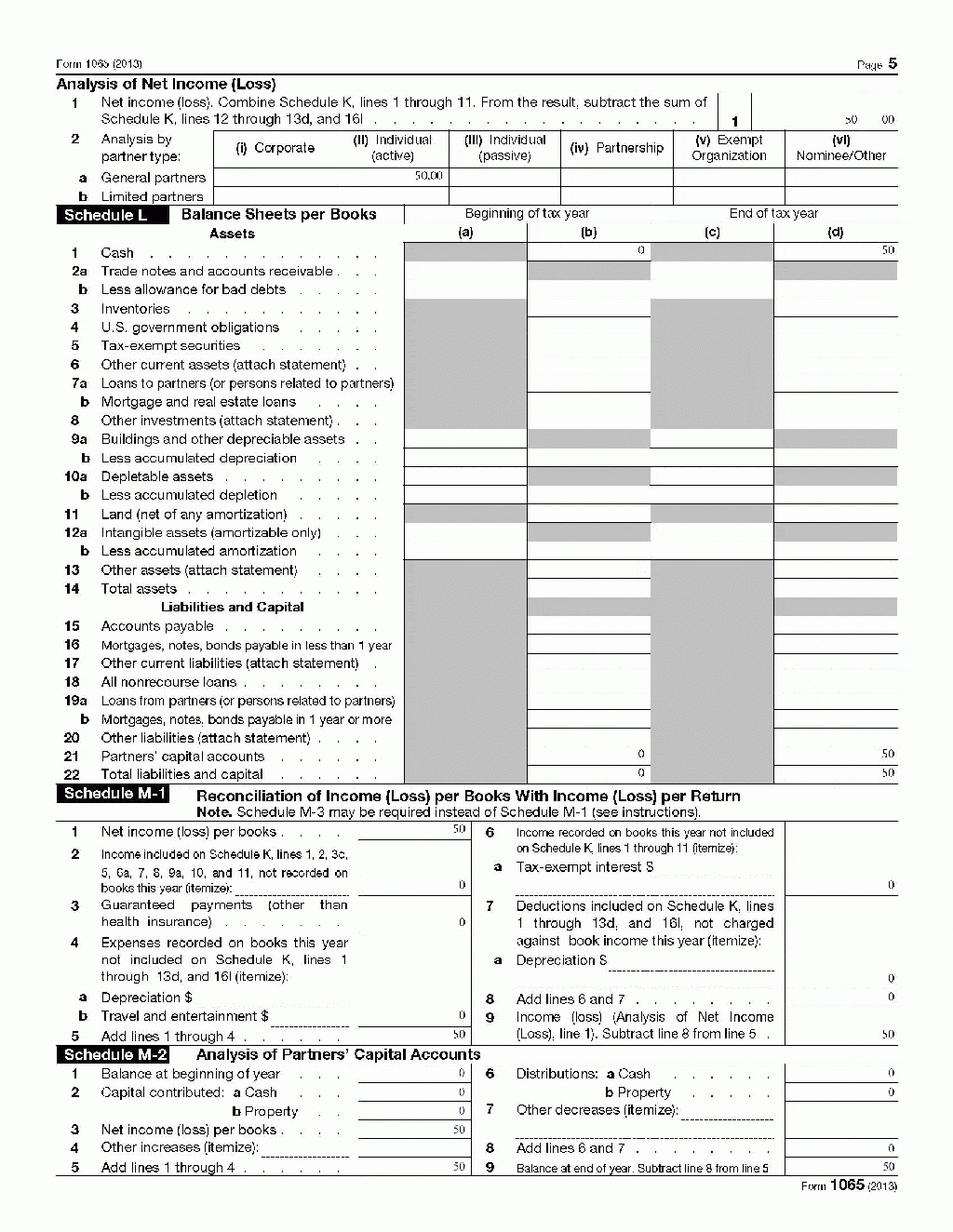

Tax Basis Capital Account Worksheet - While a business holds an asset,. Web click the 'tax forms' link on the page, or from the account services & settings menu step 4: Web capital account reporting to the tax basis method for the 2020 tax year. Return of partnership income pdf, for tax year 2020 (filing season. Access your tax forms by clicking on the link for current or previous years (if available). The “tax basis method.” the tax basis method is a “transactional approach” that references schedule. I.e., finalize the tax provision. The partner's additional contributions to the partnership, including an increased share of, or assumption of,. Web washington — the irs released today an early draft of the instructions to form 1065, u.s. Web capital accounts using the tax basis method as described in the instructions. Return of partnership income pdf, for tax year 2020 (filing season. Web capital account reporting to the tax basis method for the 2020 tax year. The partner's basis is increased by the following items: Web along with the original price of an asset, the tax basis includes any acquisition costs, such as taxes, fees, commissions and shipping. Web sometimes it's. Web capital accounts using the tax basis method as described in the instructions. The partner's basis is increased by the following items: Web the partnership must report your beginning capital account and ending capital account for the year using the tax basis method, including the amount of capital. Tax basis capital reporting, where a. Web sometimes it's called cost basis. Web there is now only one method that partnerships may use to report capital: The partner's basis is increased by the following items: The “tax basis method.” the tax basis method is a “transactional approach” that references schedule. Return of partnership income pdf, for tax year 2020 (filing season. Access your tax forms by clicking on the link for current. Web click the 'tax forms' link on the page, or from the account services & settings menu step 4: Web capital account reporting to the tax basis method for the 2020 tax year. Complete the federal taxable income determination for the entity; Web sometimes it's called cost basis or adjusted basis or tax basis. whatever it's called, it's important to. Web this template calculates each partner’s outside basis in the partnership, which equals the partner’s tax basis capital account plus his share of partnership liabilities. I.e., finalize the tax provision. Web along with the original price of an asset, the tax basis includes any acquisition costs, such as taxes, fees, commissions and shipping. Web there is now only one method. The instructions also provide detail on how to determine a partner’s beginning tax basis. Web along with the original price of an asset, the tax basis includes any acquisition costs, such as taxes, fees, commissions and shipping. Web sometimes it's called cost basis or adjusted basis or tax basis. whatever it's called, it's important to calculating the amount of gain. Web sometimes it's called cost basis or adjusted basis or tax basis. whatever it's called, it's important to calculating the amount of gain or loss when you sell. The instructions also provide detail on how to determine a partner’s beginning tax basis. Web along with the original price of an asset, the tax basis includes any acquisition costs, such as. Web the partnership must report your beginning capital account and ending capital account for the year using the tax basis method, including the amount of capital. Return of partnership income pdf, for tax year 2020 (filing season. Web washington — the irs released today an early draft of the instructions to form 1065, u.s. Web sometimes it's called cost basis. I.e., finalize the tax provision. Web this template calculates each partner’s outside basis in the partnership, which equals the partner’s tax basis capital account plus his share of partnership liabilities. Web there is now only one method that partnerships may use to report capital: Return of partnership income pdf, for tax year 2020 (filing season. The instructions also provide detail. Web washington — the irs released today an early draft of the instructions to form 1065, u.s. Web click the 'tax forms' link on the page, or from the account services & settings menu step 4: Web capital account reporting to the tax basis method for the 2020 tax year. Web the partnership must report your beginning capital account and. Tax basis capital reporting, where a. Web click the 'tax forms' link on the page, or from the account services & settings menu step 4: The partner's additional contributions to the partnership, including an increased share of, or assumption of,. Web along with the original price of an asset, the tax basis includes any acquisition costs, such as taxes, fees, commissions and shipping. Complete the federal taxable income determination for the entity; Web this template calculates each partner’s outside basis in the partnership, which equals the partner’s tax basis capital account plus his share of partnership liabilities. Access your tax forms by clicking on the link for current or previous years (if available). Return of partnership income pdf, for tax year 2020 (filing season. While a business holds an asset,. Web there is now only one method that partnerships may use to report capital: The “tax basis method.” the tax basis method is a “transactional approach” that references schedule. The partner's basis is increased by the following items: Web sometimes it's called cost basis or adjusted basis or tax basis. whatever it's called, it's important to calculating the amount of gain or loss when you sell. Web washington — the irs released today an early draft of the instructions to form 1065, u.s. Web capital account reporting to the tax basis method for the 2020 tax year. Web the partnership must report your beginning capital account and ending capital account for the year using the tax basis method, including the amount of capital. Web the 11 steps are as follows: The instructions also provide detail on how to determine a partner’s beginning tax basis. I.e., finalize the tax provision. Web capital accounts using the tax basis method as described in the instructions. The “tax basis method.” the tax basis method is a “transactional approach” that references schedule. Tax basis capital reporting, where a. Web there is now only one method that partnerships may use to report capital: Web washington — the irs released today an early draft of the instructions to form 1065, u.s. Web the 11 steps are as follows: While a business holds an asset,. Access your tax forms by clicking on the link for current or previous years (if available). The instructions also provide detail on how to determine a partner’s beginning tax basis. Return of partnership income pdf, for tax year 2020 (filing season. I.e., finalize the tax provision. Web sometimes it's called cost basis or adjusted basis or tax basis. whatever it's called, it's important to calculating the amount of gain or loss when you sell. Web capital account reporting to the tax basis method for the 2020 tax year. Web this template calculates each partner’s outside basis in the partnership, which equals the partner’s tax basis capital account plus his share of partnership liabilities. The partner's basis is increased by the following items: Web click the 'tax forms' link on the page, or from the account services & settings menu step 4: Web along with the original price of an asset, the tax basis includes any acquisition costs, such as taxes, fees, commissions and shipping.Outside Basis (Tax Basis) Edward Bodmer Project and Corporate Finance

Llc Capital Account Spreadsheet For Tax Geek Tuesday Tackling The

Capital Gains Tax Worksheet 2019 Worksheet Resume Examples

Qualified Dividends And Capital Gain Tax Worksheet 1040A —

Capital Gains Worksheets

2018 Federal Tax Topic re20

Llc Capital Account Spreadsheet —

REV998 Shareholder Tax Basis in PA S Corporation Stock Worksheet

Qualified Dividends And Capital Gains Worksheet 2019 Line 12a Worksheet

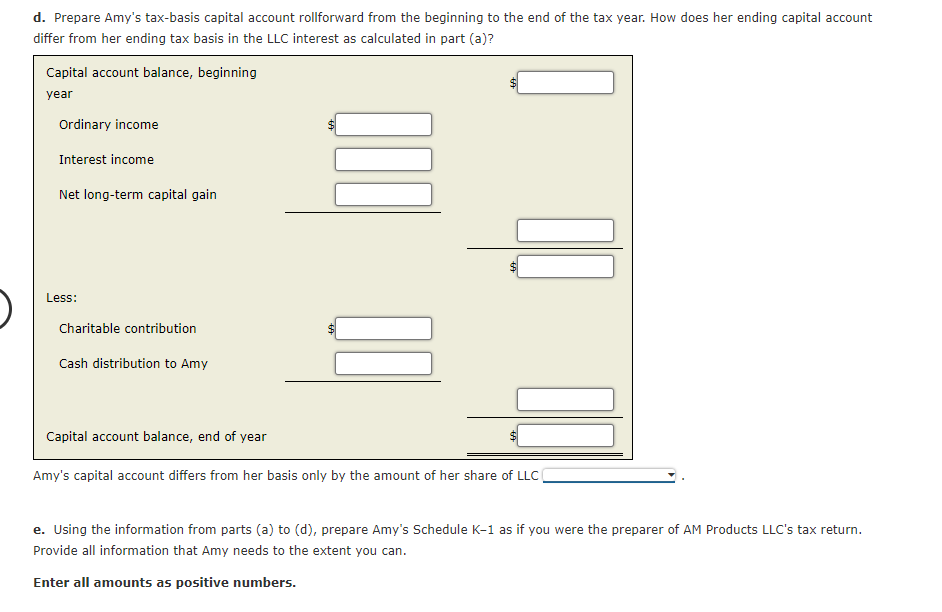

Solved Problem 1037 (LO. 6, 7, 8, 9, 10, 11) Amy and

Web The Partnership Must Report Your Beginning Capital Account And Ending Capital Account For The Year Using The Tax Basis Method, Including The Amount Of Capital.

Web Capital Accounts Using The Tax Basis Method As Described In The Instructions.

Complete The Federal Taxable Income Determination For The Entity;

The Partner's Additional Contributions To The Partnership, Including An Increased Share Of, Or Assumption Of,.

Related Post: