Tax Itemized Deductions Worksheet

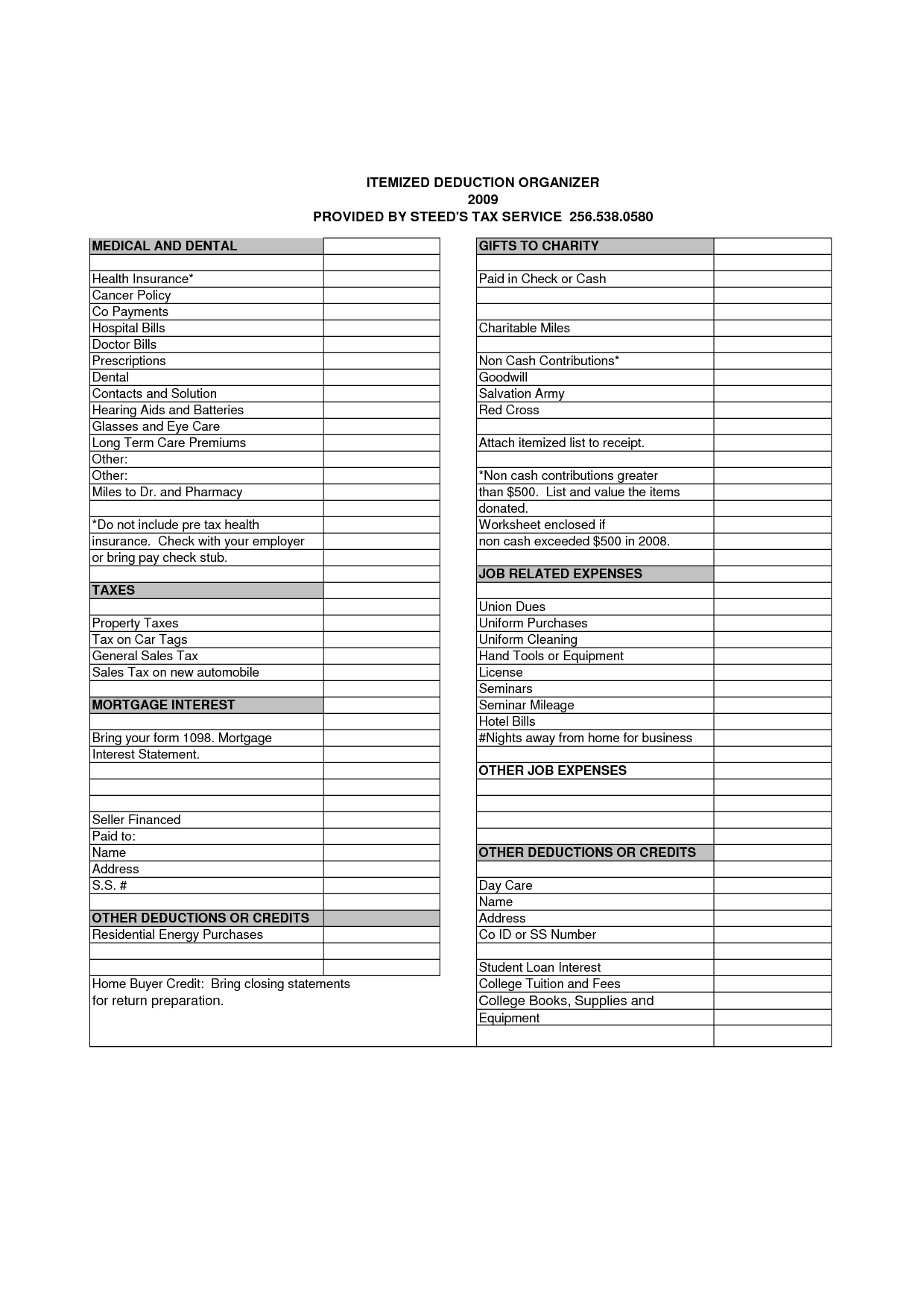

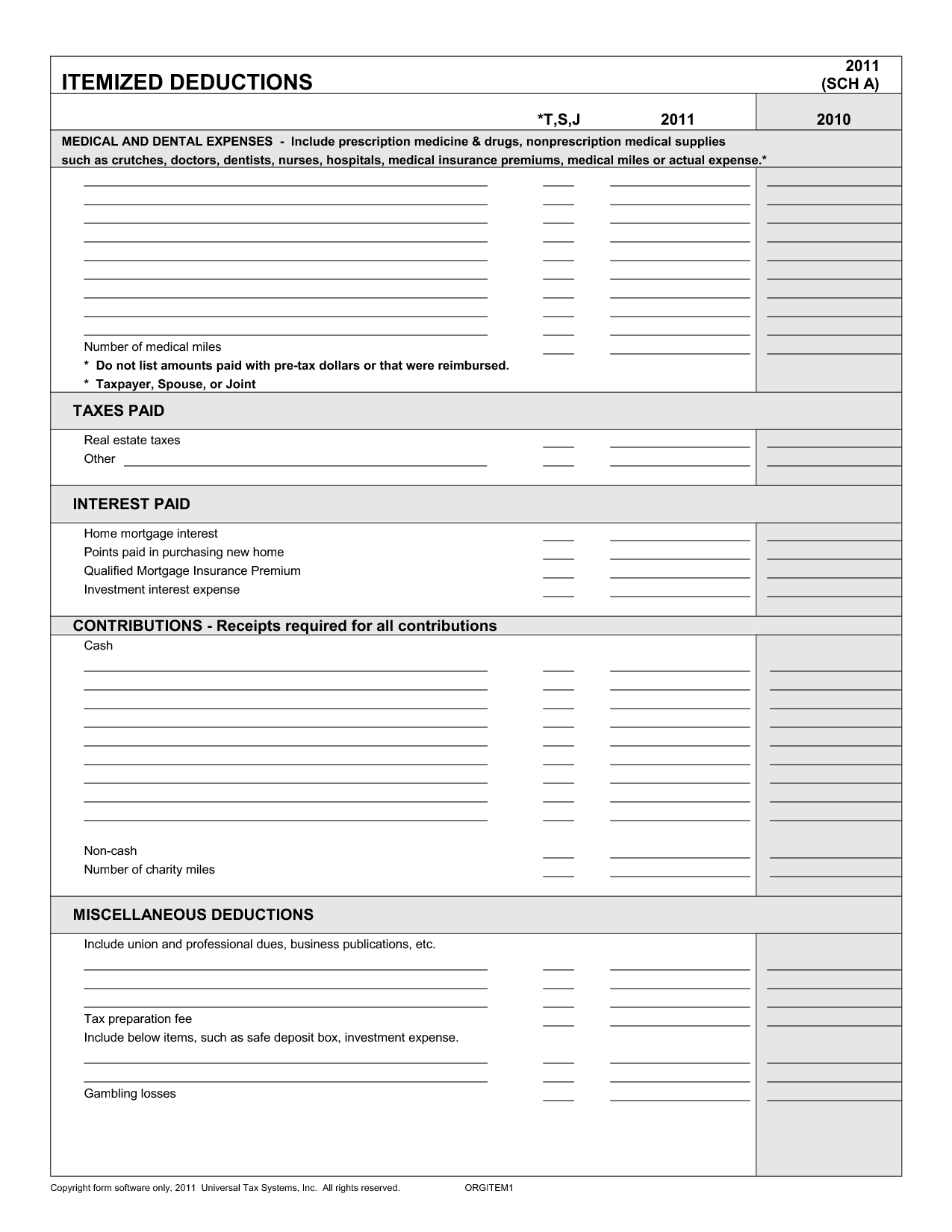

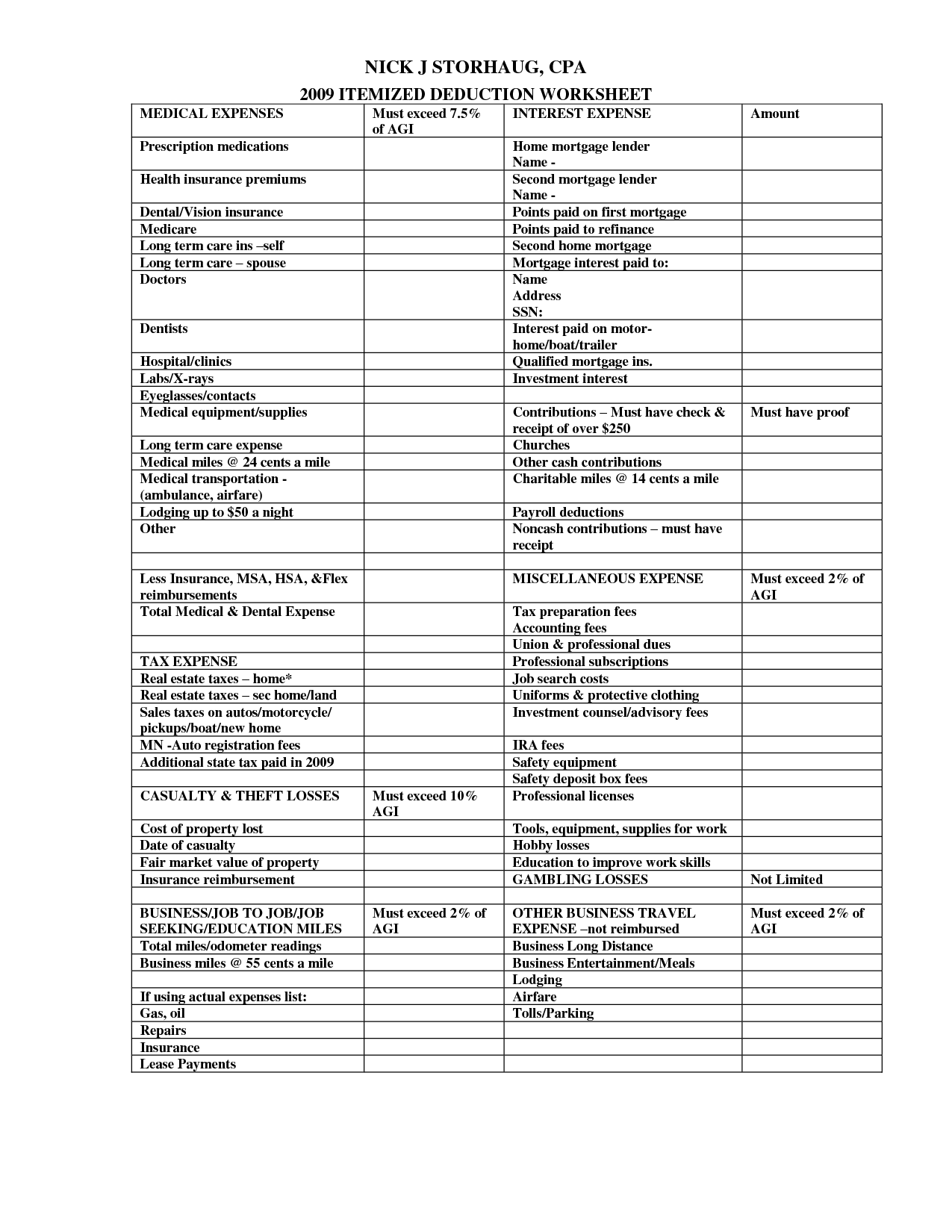

Tax Itemized Deductions Worksheet - Must exceed 7.5% of income to be a benefit. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. Sign in to the editor with your credentials or. Mortgage interest you pay on. Web itemized deductions are specific types of expenses the taxpayer incurred that may reduce taxable income. Interest and taxes spouse prescriptions equity line. Sign up and log in to your account. This worksheet allows you to itemize your tax deductions for a given year. Web for federal purposes, your total itemized deduction for state and local taxes paid in 2022 is limited to a combined amount not to exceed $10,000 ($5,000 if married. Worksheets are schedule a itemized deductions, deductions form 1040 itemized,. Web itemized deductions include a range of expenses that are only deductible when you choose to itemize. Types of itemized deductions include mortgage. Must exceed 7.5% of income to be a benefit. The amount of underpayment of estimated tax interest is computed at a rate. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through. Web if the standard deduction that you qualify for is higher than your itemized deductions, you should choose the standard deduction. Sign up and log in to your account. Web follow these fast steps to change the pdf list of itemized deductions worksheet online for free: The source information that is required for each tax. Mortgage interest you pay on. Sign up and log in to your account. Web follow these fast steps to change the pdf list of itemized deductions worksheet online for free: Mortgage interest you pay on. Web if the standard deduction that you qualify for is higher than your itemized deductions, you should choose the standard deduction. Must exceed 7.5% of income to be a benefit. Web itemized deductions include a range of expenses that are only deductible when you choose to itemize. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): Interest and taxes spouse prescriptions equity line. Web itemized deductions are specific types of expenses the taxpayer incurred. Web enter your standard deduction on line 17 of form 502 or line 2 of form 503. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. Tax deductions for calendar year 2 0 ___ ___ hired help space. $ insurance $ equipment $ prescriptions. Web tax due less all credits except amounts paid on withholding, estimated tax and extension payments. Web for federal purposes, your total itemized deduction for state and local taxes paid in 2022 is limited to a combined amount not to exceed $10,000 ($5,000 if married. Web up to $40 cash back personal tax organizer itemized deductions and credits name: $. This worksheet allows you to itemize your tax deductions for a given year. Web itemized deductions are specific types of expenses the taxpayer incurred that may reduce taxable income. Sign in to the editor with your credentials or. Web download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. Web we’ll use your 2022. Must exceed 7.5% of income to be a benefit. Web itemized deductions are specific types of expenses the taxpayer incurred that may reduce taxable income. Interest and taxes spouse prescriptions equity line. The amount of underpayment of estimated tax interest is computed at a rate. Web for federal purposes, your total itemized deduction for state and local taxes paid in. Tax deductions for calendar year 2 0 ___ ___ hired help space. Must exceed 7.5% of income to be a benefit. Web download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in. Web itemized deductions include a range of expenses that are only deductible when you choose to itemize. Web up to $40 cash back personal tax organizer itemized deductions and credits name: Tax deductions for calendar year 2 0 ___ ___ hired help space. The source information that is required for each tax. Web itemized deductions are specific types of expenses. This worksheet allows you to itemize your tax deductions for a given year. Mortgage interest you pay on. Web itemized deduction worksheet medical expenses. Worksheets are schedule a itemized deductions, deductions form 1040 itemized,. Types of itemized deductions include mortgage. Web itemized deductions include a range of expenses that are only deductible when you choose to itemize. The amount of underpayment of estimated tax interest is computed at a rate. Tax deductions for calendar year 2 0 ___ ___ hired help space. Web up to $40 cash back personal tax organizer itemized deductions and credits name: Sign in to the editor with your credentials or. Web if the standard deduction that you qualify for is higher than your itemized deductions, you should choose the standard deduction. Web for federal purposes, your total itemized deduction for state and local taxes paid in 2022 is limited to a combined amount not to exceed $10,000 ($5,000 if married. Web itemized deductions are specific types of expenses the taxpayer incurred that may reduce taxable income. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): Web enter your standard deduction on line 17 of form 502 or line 2 of form 503. Sign up and log in to your account. Web download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. The source information that is required for each tax. $ insurance $ equipment $ prescriptions $. Web tax due less all credits except amounts paid on withholding, estimated tax and extension payments. Types of itemized deductions include mortgage. Web itemized deductions include a range of expenses that are only deductible when you choose to itemize. Must exceed 7.5% of income to be a benefit. Web if the standard deduction that you qualify for is higher than your itemized deductions, you should choose the standard deduction. Sign up and log in to your account. The source information that is required for each tax. $ insurance $ equipment $ prescriptions $. Worksheets are schedule a itemized deductions, deductions form 1040 itemized,. Web up to $40 cash back personal tax organizer itemized deductions and credits name: Mortgage interest you pay on. The amount of underpayment of estimated tax interest is computed at a rate. Web tax due less all credits except amounts paid on withholding, estimated tax and extension payments. Sign in to the editor with your credentials or. Web itemized deductions are specific types of expenses the taxpayer incurred that may reduce taxable income. Web follow these fast steps to change the pdf list of itemized deductions worksheet online for free: Web enter your standard deduction on line 17 of form 502 or line 2 of form 503.Itemized Deductions Worksheet 2018 Printable Worksheets and

10++ Itemized Deductions Worksheet Worksheets Decoomo

8 Tax Itemized Deduction Worksheet /

Printable yearly itemized tax deduction worksheet Fill out & sign

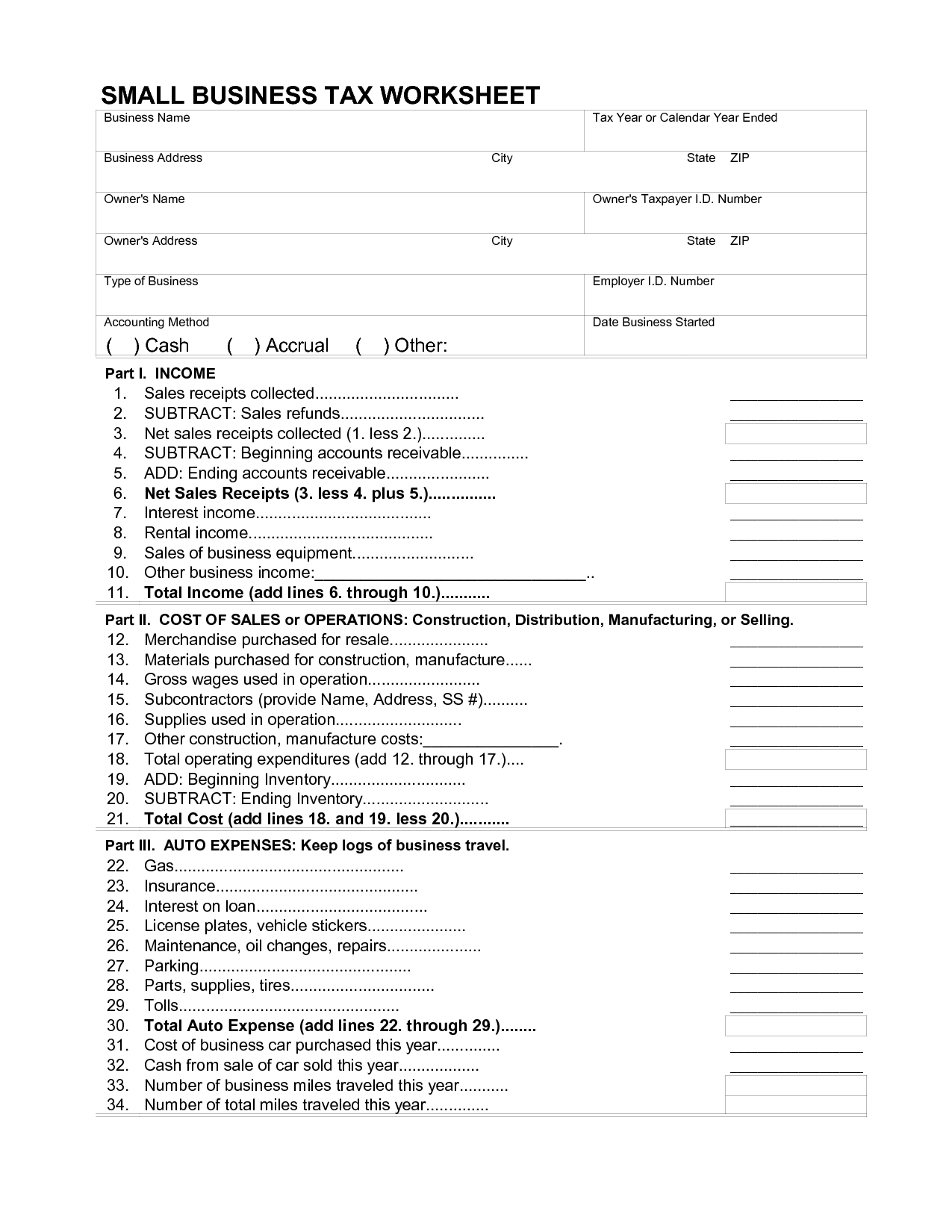

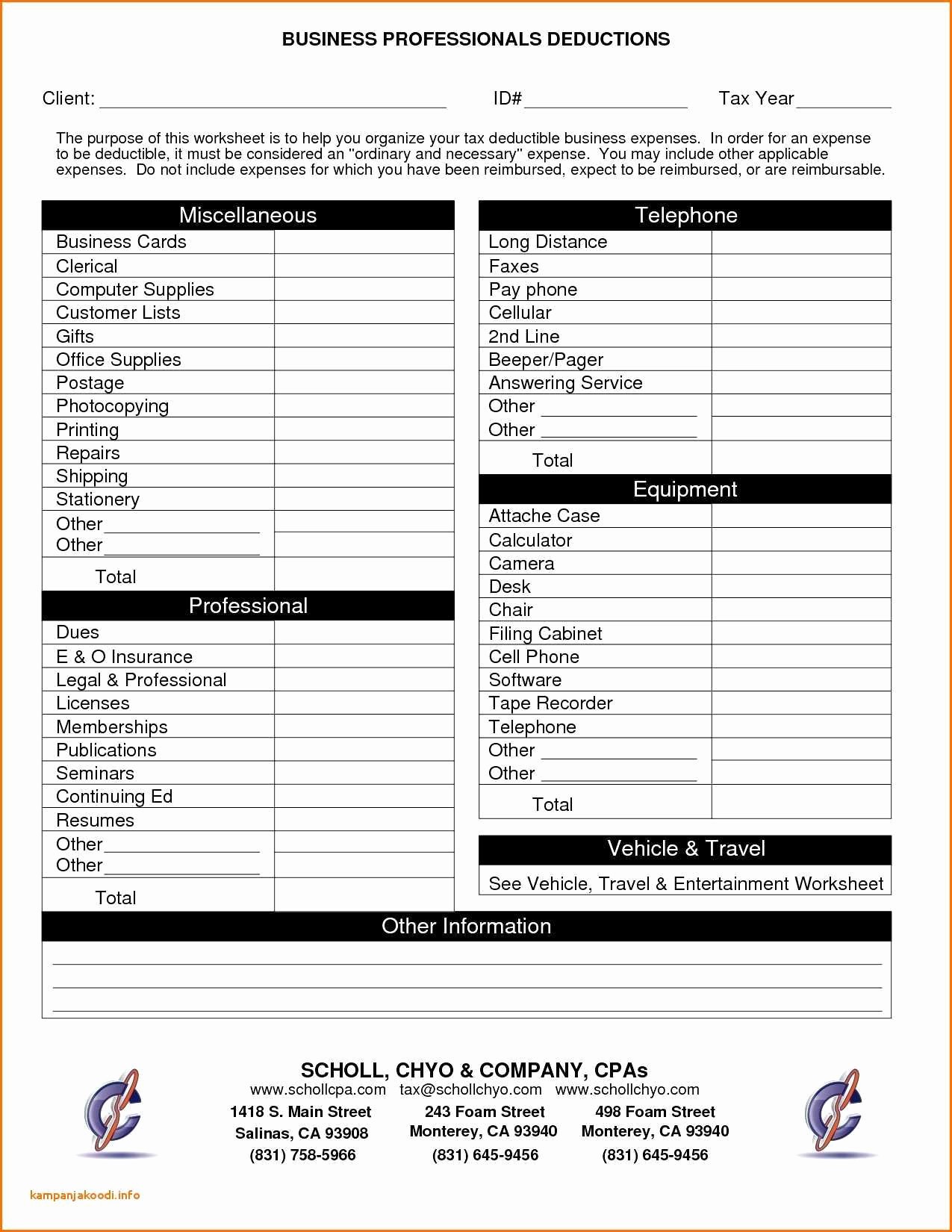

Beautiful Business Tax Worksheet Background Small Letter Worksheet

17 Schedule C Deductions Worksheet /

10 Business Tax Deductions Worksheet /

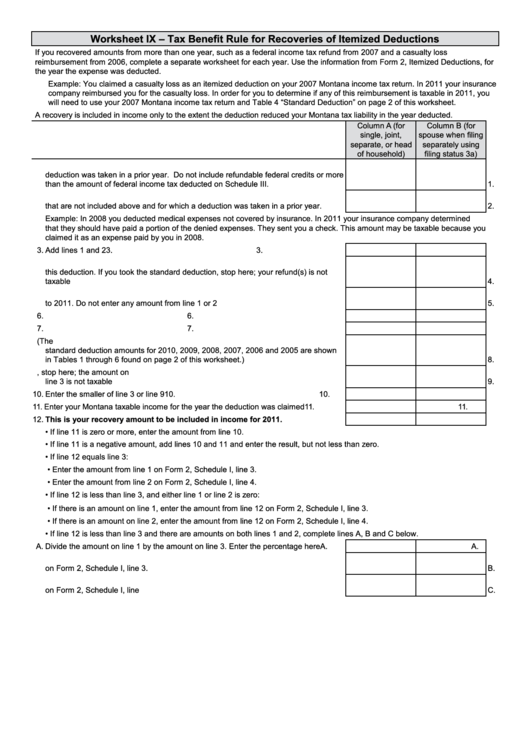

Worksheet Ix Tax Benefit Rule For Recoveries Of Itemized Deductions

8 Tax Itemized Deduction Worksheet /

Small Business Deductions Worksheet petermcfarland.us

Web Download These Income Tax Worksheets And Organizers To Maximize Your Deductions And Minimize Errors And Omissions.

Interest And Taxes Spouse Prescriptions Equity Line.

Web We’ll Use Your 2022 Federal Standard Deduction Shown Below If More Than Your Itemized Deductions Above (If Blind, Add $1,750 Or $1,400 If Married):

Web Itemized Deduction Worksheet Medical Expenses.

Related Post: