Taxation Worksheet

Taxation Worksheet - This worksheet provides 8 consumer math real world problems on sales tax and tip, as well as 2 enrichment problems. Be sure that the amount shown on line 21 of. 2 entry not required (and will be. Worksheets are teachers guide, work calculating marginal average taxes, teacher lesson plan, income taxes who pays and. Income for irs sales tax calculator. Revenueis a fancy word for income. Taxation (4.5.2) model answers included. A worksheet about the types of taxes and how they are applied. Web how to compute estimated tax a worksheet is included with the coupon for use in computing estimated tax liability. Web many of the materials that are part of the understanding taxes program can be downloaded as adobe acrobat™ pdfs. Web social security benefits worksheet—lines 5a and 5b. Use the proportions in the. Students will calculate tax and total price.worksheet 2: This is tailored for the. This worksheet provides 8 consumer math real world problems on sales tax and tip, as well as 2 enrichment problems. Use the proportions in the. Word problems and thousands of other math skills. Web how to compute estimated tax a worksheet is included with the coupon for use in computing estimated tax liability. Worksheets are teachers guide, work calculating marginal average taxes, teacher lesson plan, income taxes who pays and. Web file a federal tax return as an individual and. 2 entry not required (and will be. Web use the california estimated tax worksheet and your 2022 california income tax return as a guide for figuring your 2023 estimated tax. Use the proportions in the. This is tailored for the. For example, you can download teacher lesson plans,. Web many of the materials that are part of the understanding taxes program can be downloaded as adobe acrobat™ pdfs. A worksheet about the types of taxes and how they are applied. This is tailored for the. Web file a federal tax return as an individual and your combined income* is. A level economics worksheet activity containing questions about the. This bundle includes a property tax, sales tax, and. Taxation (4.5.2) model answers included. Web use the california estimated tax worksheet and your 2022 california income tax return as a guide for figuring your 2023 estimated tax. Web daniel anderson middle school math. Web this is set of 2 worksheets on percents and calculating discounts and final price.worksheet 1: Worksheets are teachers guide, work calculating marginal average taxes, teacher lesson plan, income taxes who pays and. This bundle includes a property tax, sales tax, and. Web the answer is attached in the explanation below. Use the proportions in the. Web docx, 36.86 kb. Word problems and thousands of other math skills. This worksheet provides 8 consumer math real world problems on sales tax and tip, as well as 2 enrichment problems. Web many of the materials that are part of the understanding taxes program can be downloaded as adobe acrobat™ pdfs. For example, you can download teacher lesson plans,. Web improve your math. This bundle includes a property tax, sales tax, and. 2 entry not required (and will be. Use the proportions in the. Web social security benefits worksheet—lines 5a and 5b. Web many of the materials that are part of the understanding taxes program can be downloaded as adobe acrobat™ pdfs. A level economics worksheet activity containing questions about the lesson: Web social security benefits worksheet—lines 5a and 5b. Web file a federal tax return as an individual and your combined income* is. Be sure that the amount shown on line 21 of. Web daniel anderson middle school math. Between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. This worksheet provides 8 consumer math real world problems on sales tax and tip, as well as 2 enrichment problems. Revenueis a fancy word for income. Use the proportions in the. A level economics worksheet activity containing questions about the lesson: Web the answer is attached in the explanation below. Worksheets are teachers guide, work calculating marginal average taxes, teacher lesson plan, income taxes who pays and. This worksheet provides 8 consumer math real world problems on sales tax and tip, as well as 2 enrichment problems. Students will calculate tax and total price.worksheet 2: Between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. This is tailored for the. Web improve your math knowledge with free questions in income and payroll taxes: Use the proportions in the. This bundle includes a property tax, sales tax, and. Web how to compute estimated tax a worksheet is included with the coupon for use in computing estimated tax liability. Revenueis a fancy word for income. A worksheet about the types of taxes and how they are applied. A level economics worksheet activity containing questions about the lesson: Web use the california estimated tax worksheet and your 2022 california income tax return as a guide for figuring your 2023 estimated tax. Word problems and thousands of other math skills. For example, you can download teacher lesson plans,. Web docx, 36.86 kb. Taxation (4.5.2) model answers included. 2 entry not required (and will be. Income for irs sales tax calculator. Web use the california estimated tax worksheet and your 2022 california income tax return as a guide for figuring your 2023 estimated tax. Web this is set of 2 worksheets on percents and calculating discounts and final price.worksheet 1: This is tailored for the. Worksheets are teachers guide, work calculating marginal average taxes, teacher lesson plan, income taxes who pays and. Web social security benefits worksheet—lines 5a and 5b. A level economics worksheet activity containing questions about the lesson: This bundle includes a property tax, sales tax, and. Use the proportions in the. Web file a federal tax return as an individual and your combined income* is. Word problems and thousands of other math skills. A worksheet about the types of taxes and how they are applied. Taxation (4.5.2) model answers included. Revenueis a fancy word for income. Between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. Web how to compute estimated tax a worksheet is included with the coupon for use in computing estimated tax liability. Web many of the materials that are part of the understanding taxes program can be downloaded as adobe acrobat™ pdfs.Top 25 Tax Worksheet Templates free to download in PDF format

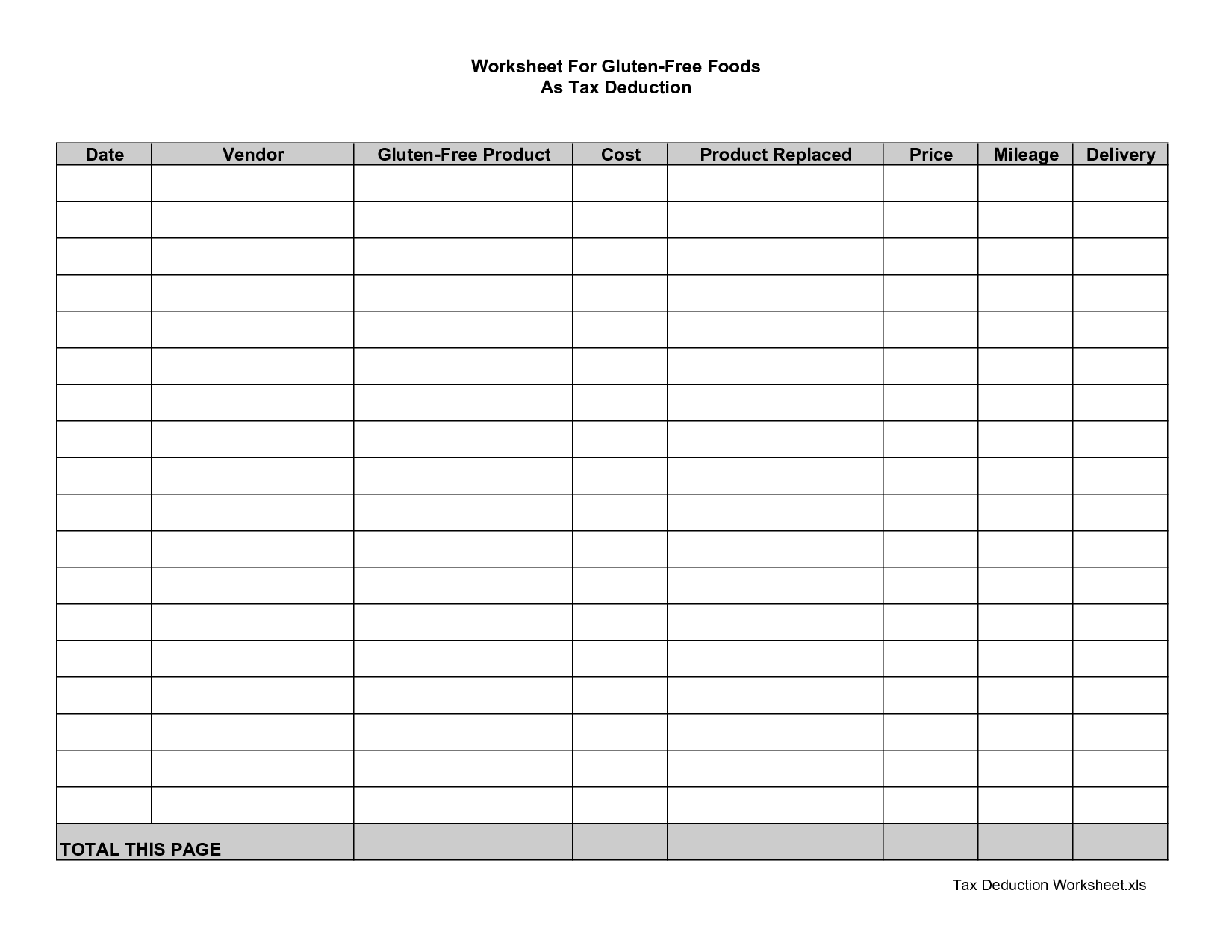

8 Best Images of Profit And Loss Worksheet Business Tax Deductions

Free Sales Tax Worksheets Teaching money, Money math worksheets, Real

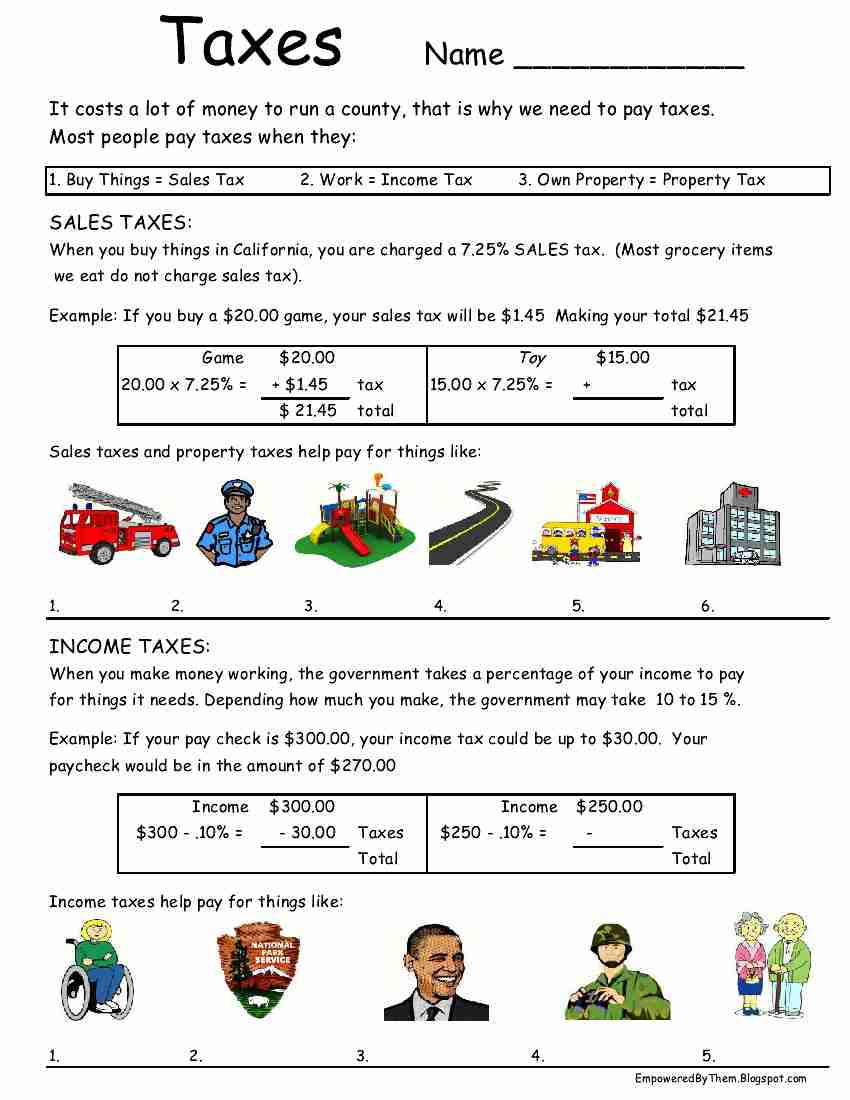

types of taxes worksheet

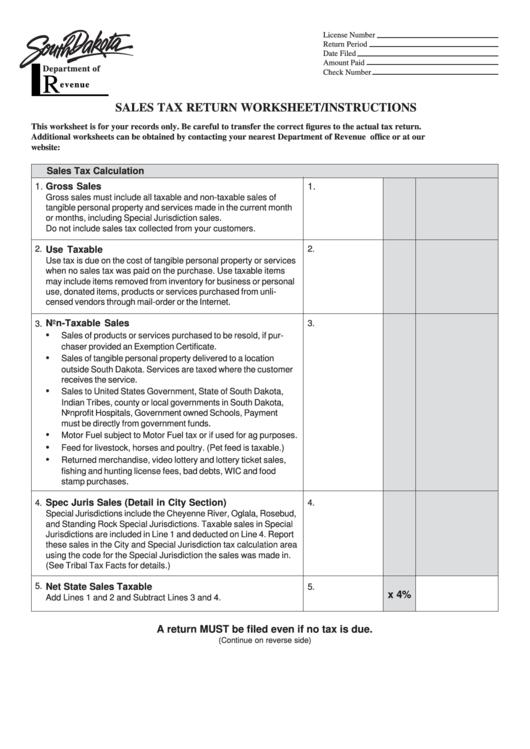

Sales Tax Return Worksheet printable pdf download

taxes worksheet idea Life skills lessons, Teaching life skills, Life

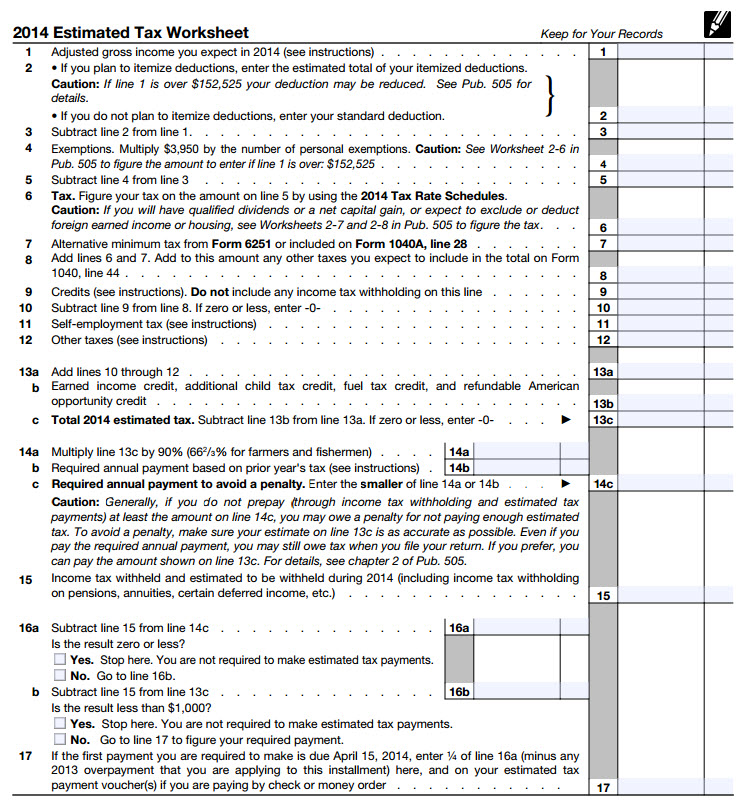

How to Calculate and Pay Quarterly Estimated Taxes Young Adult Money

30 Calculating Sales Tax Worksheet Education Template

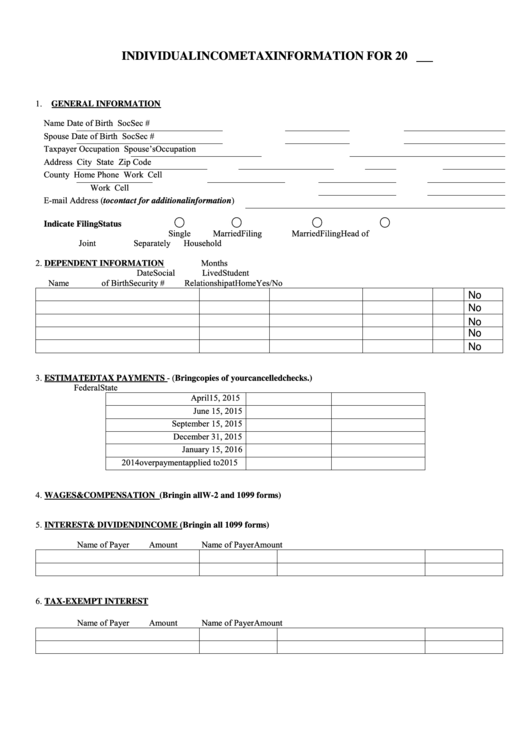

Federal Tax Worksheet —

Sales Tax Worksheets with Editable Sales Tax Rates 2 Differentiated

This Worksheet Provides 8 Consumer Math Real World Problems On Sales Tax And Tip, As Well As 2 Enrichment Problems.

Web Docx, 36.86 Kb.

Students Will Calculate Tax And Total Price.worksheet 2:

Be Sure That The Amount Shown On Line 21 Of.

Related Post: