Turbotax Car And Truck Expenses Worksheet

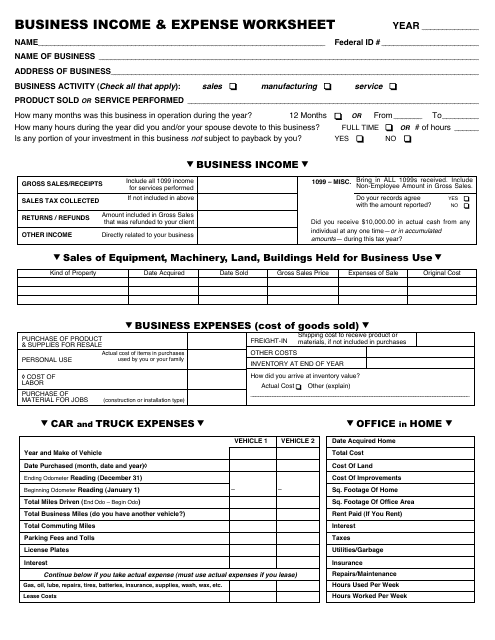

Turbotax Car And Truck Expenses Worksheet - The worksheet will not permit an entry for personal miles. Instead, it adds up business. Vehicle loan and loan interest; You must use actual expenses if you used five or more vehicles. Web you can deduct the actual expenses of operating your car or truck or take the standard mileage rate. This is true even if you used your vehicle for hire (such as a taxicab). Web you can categorize these types of expenses as car and truck: Web you can deduct the actual expenses of operating your car or truck or take the standard mileage rate. Web car and truck expense worksheet. Web you can categorize these types of expenses as car and truck: Web you can deduct the actual expenses of operating your car or truck or take the standard mileage rate. The worksheet will not permit an entry for personal miles. This is true even if you used your vehicle for hire (such as a taxicab). Vehicle loan and loan. You must use actual expenses if you used five or more vehicles. This is true even if you used your vehicle for hire (such as a taxicab). Vehicle loan and loan interest; Web you can deduct the actual expenses of operating your car or truck or take the standard mileage rate. Instead, it adds up business. Web you can deduct the actual expenses of operating your car or truck or take the standard mileage rate. Vehicle loan and loan interest; Web car and truck expense worksheet. Web you can categorize these types of expenses as car and truck: This is true even if you used your vehicle for hire (such as a taxicab). The worksheet will not permit an entry for personal miles. This is true even if you used your vehicle for hire (such as a taxicab). Web you can deduct the actual expenses of operating your car or truck or take the standard mileage rate. You must use actual expenses if you used five or more vehicles. Web you can categorize. You must use actual expenses if you used five or more vehicles. Web you can categorize these types of expenses as car and truck: This is true even if you used your vehicle for hire (such as a taxicab). Web you can deduct the actual expenses of operating your car or truck or take the standard mileage rate. Instead, it. The worksheet will not permit an entry for personal miles. Vehicle loan and loan interest; Web you can categorize these types of expenses as car and truck: This is true even if you used your vehicle for hire (such as a taxicab). You must use actual expenses if you used five or more vehicles. Vehicle loan and loan interest; This is true even if you used your vehicle for hire (such as a taxicab). Web you can deduct the actual expenses of operating your car or truck or take the standard mileage rate. Web you can deduct the actual expenses of operating your car or truck or take the standard mileage rate. You must. This is true even if you used your vehicle for hire (such as a taxicab). Web you can deduct the actual expenses of operating your car or truck or take the standard mileage rate. You must use actual expenses if you used five or more vehicles. Web you can categorize these types of expenses as car and truck: The worksheet. This is true even if you used your vehicle for hire (such as a taxicab). You must use actual expenses if you used five or more vehicles. The worksheet will not permit an entry for personal miles. Instead, it adds up business. Vehicle loan and loan interest; Web you can deduct the actual expenses of operating your car or truck or take the standard mileage rate. This is true even if you used your vehicle for hire (such as a taxicab). Web you can deduct the actual expenses of operating your car or truck or take the standard mileage rate. Instead, it adds up business. Vehicle loan. This is true even if you used your vehicle for hire (such as a taxicab). You must use actual expenses if you used five or more vehicles. Instead, it adds up business. Vehicle loan and loan interest; Web you can deduct the actual expenses of operating your car or truck or take the standard mileage rate. Web you can categorize these types of expenses as car and truck: Web you can deduct the actual expenses of operating your car or truck or take the standard mileage rate. The worksheet will not permit an entry for personal miles. Web car and truck expense worksheet. You must use actual expenses if you used five or more vehicles. Web you can deduct the actual expenses of operating your car or truck or take the standard mileage rate. Web car and truck expense worksheet. Web you can deduct the actual expenses of operating your car or truck or take the standard mileage rate. Web you can categorize these types of expenses as car and truck: Instead, it adds up business. The worksheet will not permit an entry for personal miles.Truck Driver Expenses Worksheet —

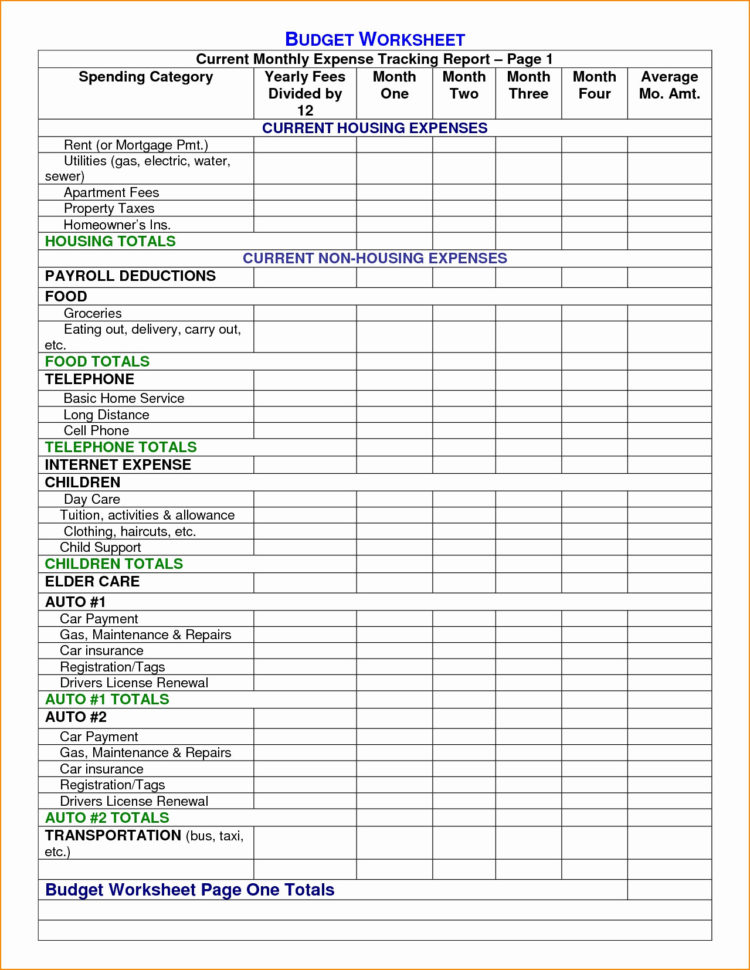

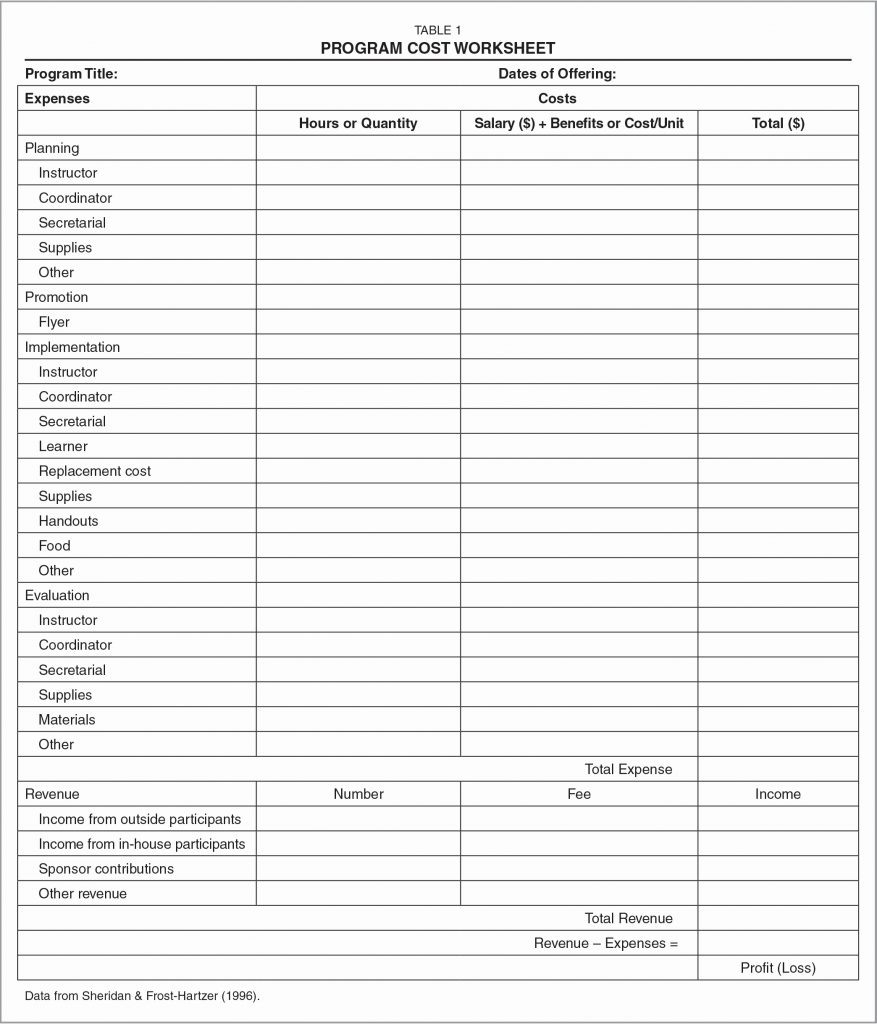

Car And Truck Expenses Worksheet —

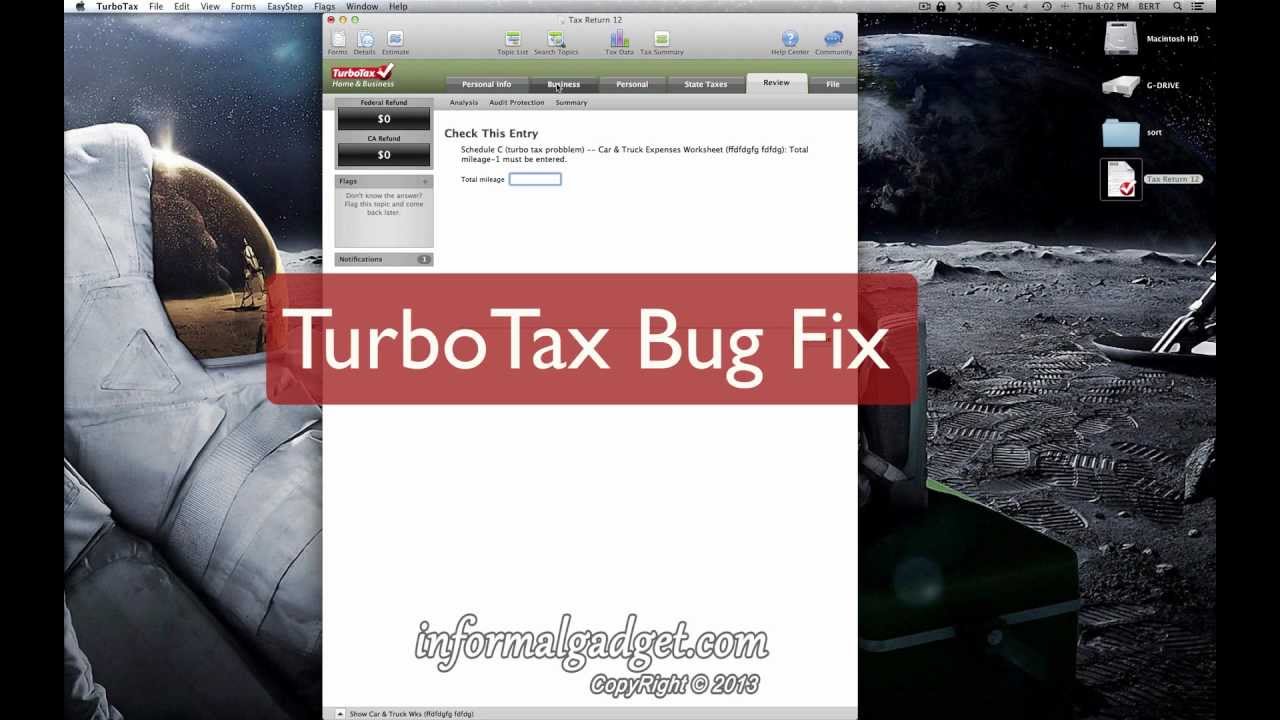

TurboTax Car and Truck Expense Bug HowTo Fix Editing Problem/Issue in

20++ Car And Truck Expenses Worksheet

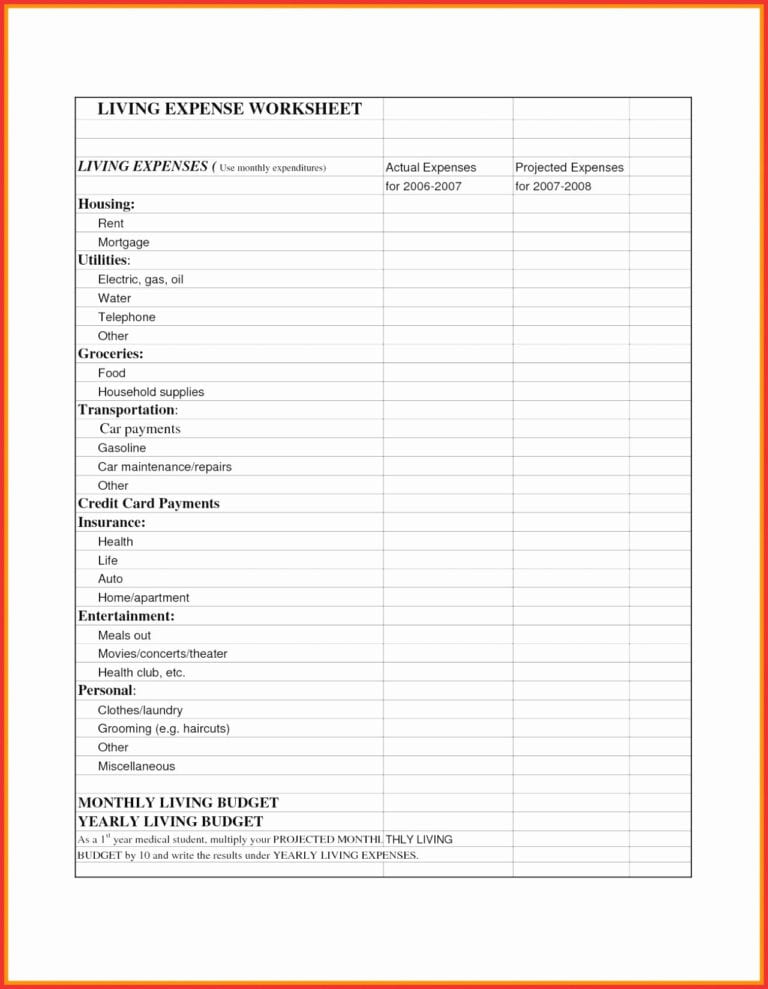

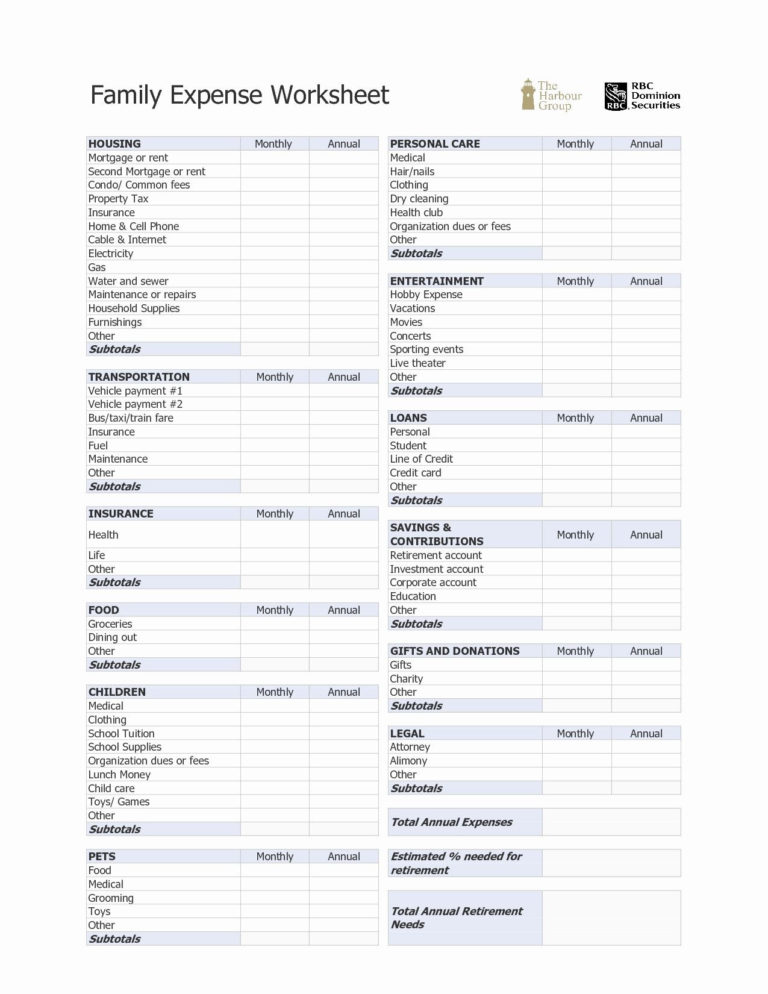

Monthly Living Expenses Spreadsheet Budget spreadsheet, Budgeting

Truck Driver Tax Deductions Worksheet —

43 car and truck expenses worksheet Worksheet Information

Truck Driver Expenses Worksheet —

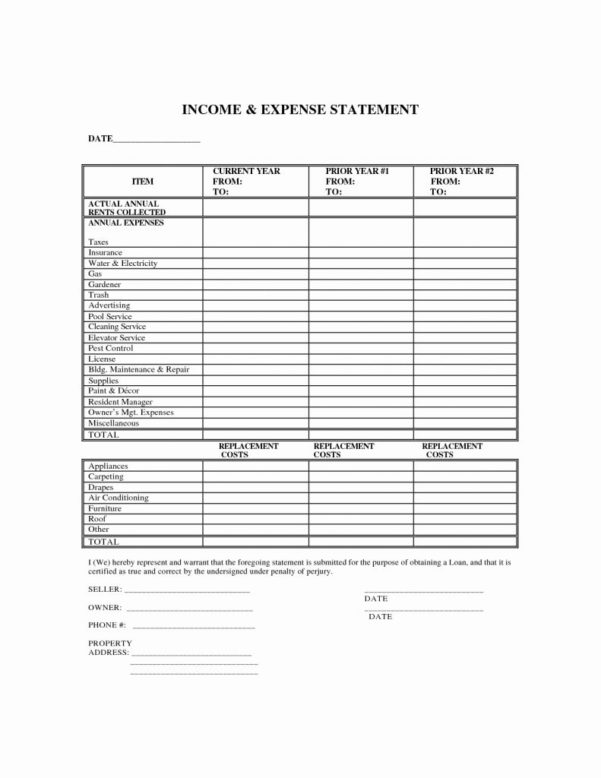

Trucking And Expense Spreadsheet Google Spreadshee trucking

Listing Vehicle Expenses UltimateTax Solution Center

This Is True Even If You Used Your Vehicle For Hire (Such As A Taxicab).

Vehicle Loan And Loan Interest;

Related Post: