Turbotax Carryover Worksheet

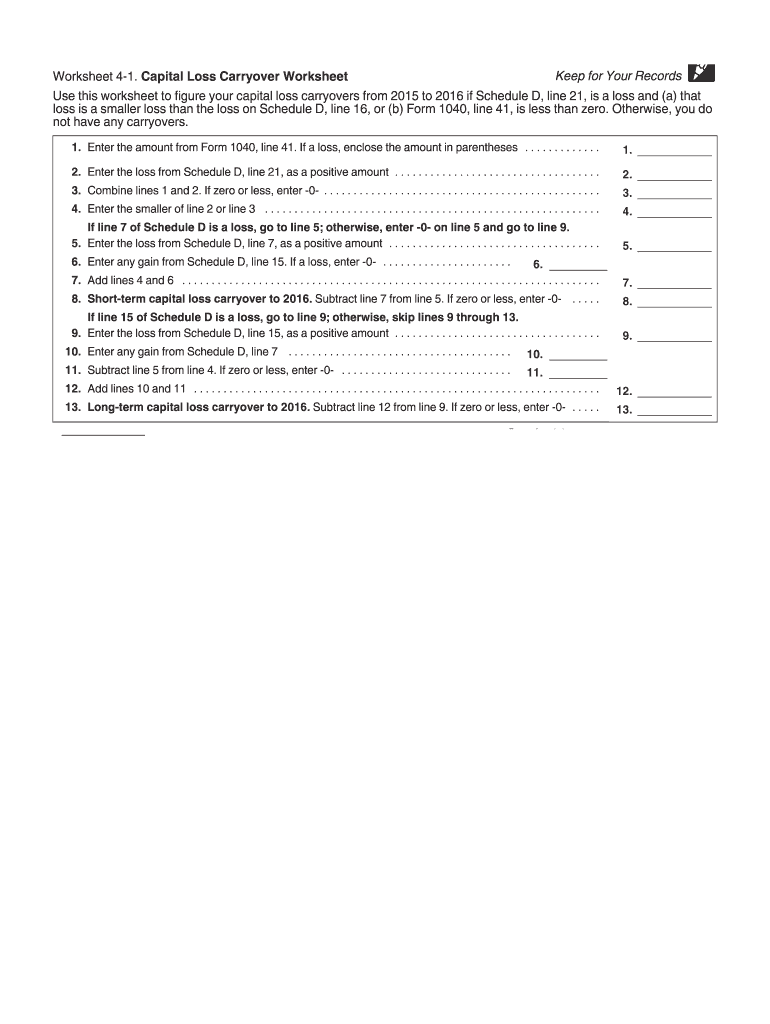

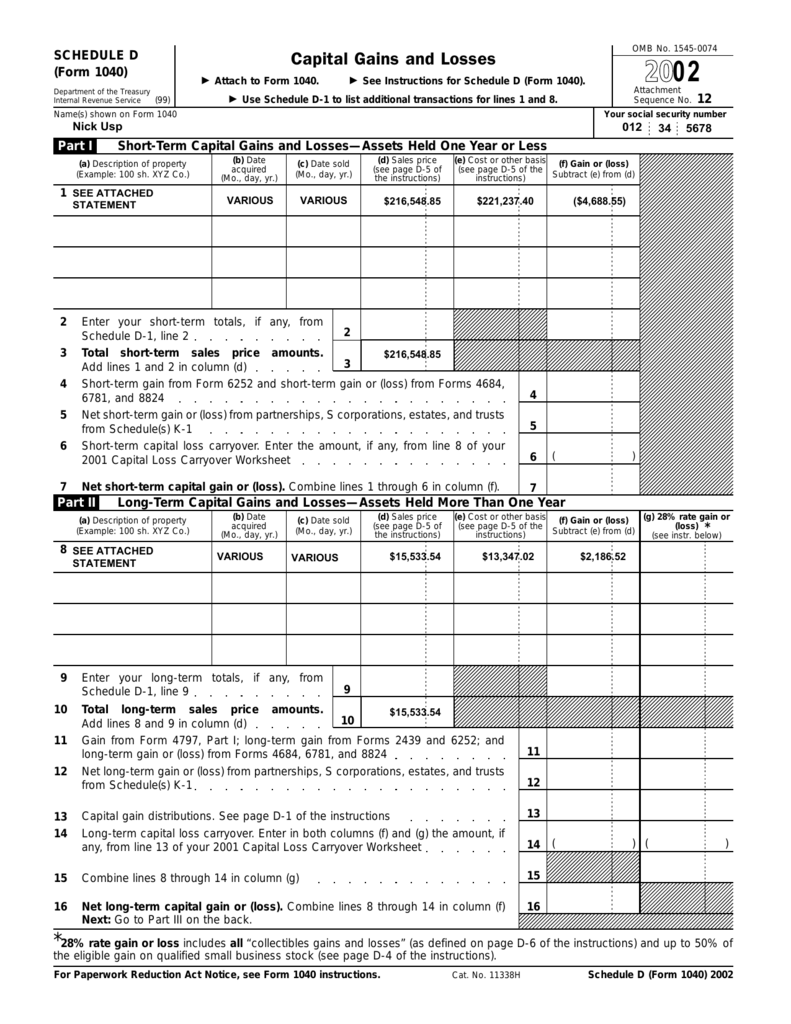

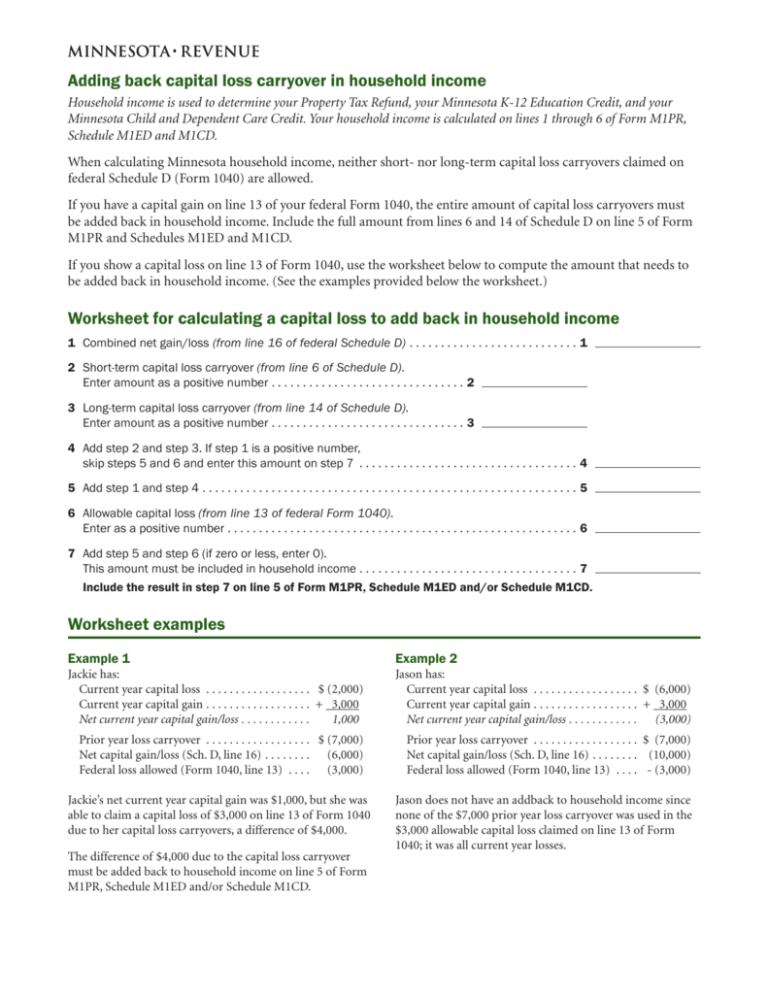

Turbotax Carryover Worksheet - Entering section 179 carryover from a schedule f:. Web use this worksheet to figure your capital loss carryovers from 2021 to 2022 if your 2021 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. Web scroll down to the carryovers to 2022 smart worksheet. Web to update/correct the unused net capital losses amount (per your latest notice of assessment(s)) from what was carried forward by turbo tax from the previous year's. Use the ' form 380 0' in search, and 'jump to form 3800' to get there. Web this will take you back to the 2021 online tax return. Enter the section 179 as a positive number on line a. You will be asked for. Click on tax tools on the left side of the online program screen. Click on tax tools on the left side of the online program screen. Web to update/correct the unused net capital losses amount (per your latest notice of assessment(s)) from what was carried forward by turbo tax from the previous year's. Web in turbotax desktop, form 3800, part ii, line 34 shows carryovers. Web see what tax forms are included in. Enter the section 179 as a positive number on line a. Use the ' form 380 0' in search, and 'jump to form 3800' to get there. Then click on print center. Web in turbotax desktop, form 3800, part ii, line 34 shows carryovers. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business. Web use this worksheet to figure your capital loss carryovers from 2021 to 2022 if your 2021 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your. Web this will take you back to the 2021 online tax return. Web to update/correct the unused net capital losses amount (per your. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. Easily sort by irs forms to find the product that best fits your tax situation. Web use this worksheet to figure your capital loss carryovers from 2021 to 2022 if your 2021 schedule d, line 21, is a loss and (a) that. Entering section 179 carryover from a schedule f:. Web scroll down to the carryovers to 2022 smart worksheet. Easily sort by irs forms to find the product that best fits your tax situation. Web in turbotax desktop, form 3800, part ii, line 34 shows carryovers. Use the ' form 380 0' in search, and 'jump to form 3800' to get. Web this will take you back to the 2021 online tax return. Use the ' form 380 0' in search, and 'jump to form 3800' to get there. Easily sort by irs forms to find the product that best fits your tax situation. Click on tax tools on the left side of the online program screen. Web in turbotax desktop,. Web use this worksheet to figure your capital loss carryovers from 2021 to 2022 if your 2021 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your. Enter the section 179 as a positive number on line a. Then click on print center. Web this will take you back to. Web use this worksheet to figure your capital loss carryovers from 2021 to 2022 if your 2021 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your. Entering section 179 carryover from a schedule f:. Web in turbotax desktop, form 3800, part ii, line 34 shows carryovers. Click on tax. Enter the section 179 as a positive number on line a. Entering section 179 carryover from a schedule f:. You will be asked for. Easily sort by irs forms to find the product that best fits your tax situation. Web to update/correct the unused net capital losses amount (per your latest notice of assessment(s)) from what was carried forward by. You will be asked for. Click on tax tools on the left side of the online program screen. Web in turbotax desktop, form 3800, part ii, line 34 shows carryovers. Web this will take you back to the 2021 online tax return. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. You will be asked for. Enter the section 179 as a positive number on line a. Then click on print center. Use the ' form 380 0' in search, and 'jump to form 3800' to get there. Web to update/correct the unused net capital losses amount (per your latest notice of assessment(s)) from what was carried forward by turbo tax from the previous year's. Web use this worksheet to figure your capital loss carryovers from 2021 to 2022 if your 2021 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. Click on tax tools on the left side of the online program screen. Web this will take you back to the 2021 online tax return. Easily sort by irs forms to find the product that best fits your tax situation. Web in turbotax desktop, form 3800, part ii, line 34 shows carryovers. Web scroll down to the carryovers to 2022 smart worksheet. Entering section 179 carryover from a schedule f:. Web in turbotax desktop, form 3800, part ii, line 34 shows carryovers. Then click on print center. Web use this worksheet to figure your capital loss carryovers from 2021 to 2022 if your 2021 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your. Web scroll down to the carryovers to 2022 smart worksheet. You will be asked for. Click on tax tools on the left side of the online program screen. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. Easily sort by irs forms to find the product that best fits your tax situation. Enter the section 179 as a positive number on line a. Use the ' form 380 0' in search, and 'jump to form 3800' to get there.Carryover Worksheet Form Fill Out and Sign Printable PDF Template

Federal Carryover Worksheet Balancing Equations Worksheet

Tax help Turbotax carrying over 2010 Foreign Tax Credit?

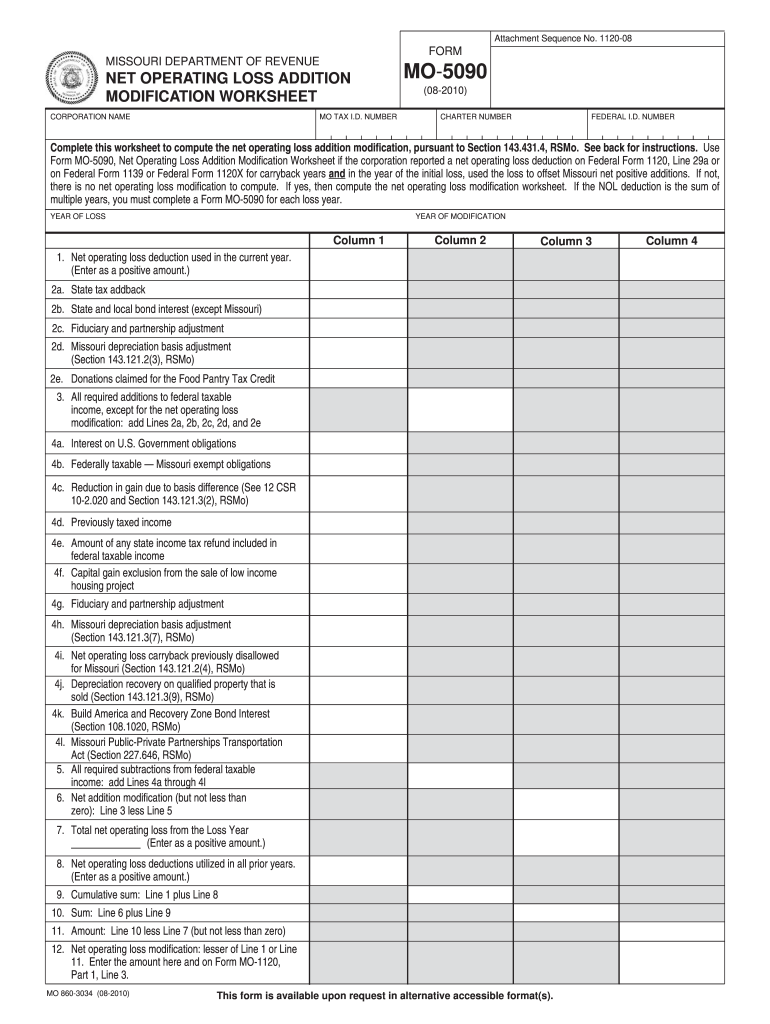

Form 1120 line 29a net operating loss worksheet Fill out & sign online

TurboTax Deluxe 2014 Fed + State + Fed Efile Tax Software

Capital Loss Carryover Worksheet slidesharedocs

Federal Carryover Worksheet Balancing Equations Worksheet

Turbotax Form / Breanna Form 2106 Expense Type Must Be Entered

Turbo Tax Charitable Donations Worksheet And Charitable Qualads

1040 capital loss carryover worksheet

Web To Update/Correct The Unused Net Capital Losses Amount (Per Your Latest Notice Of Assessment(S)) From What Was Carried Forward By Turbo Tax From The Previous Year's.

Web This Will Take You Back To The 2021 Online Tax Return.

Entering Section 179 Carryover From A Schedule F:.

Related Post: