Understanding Your Paycheck Worksheet

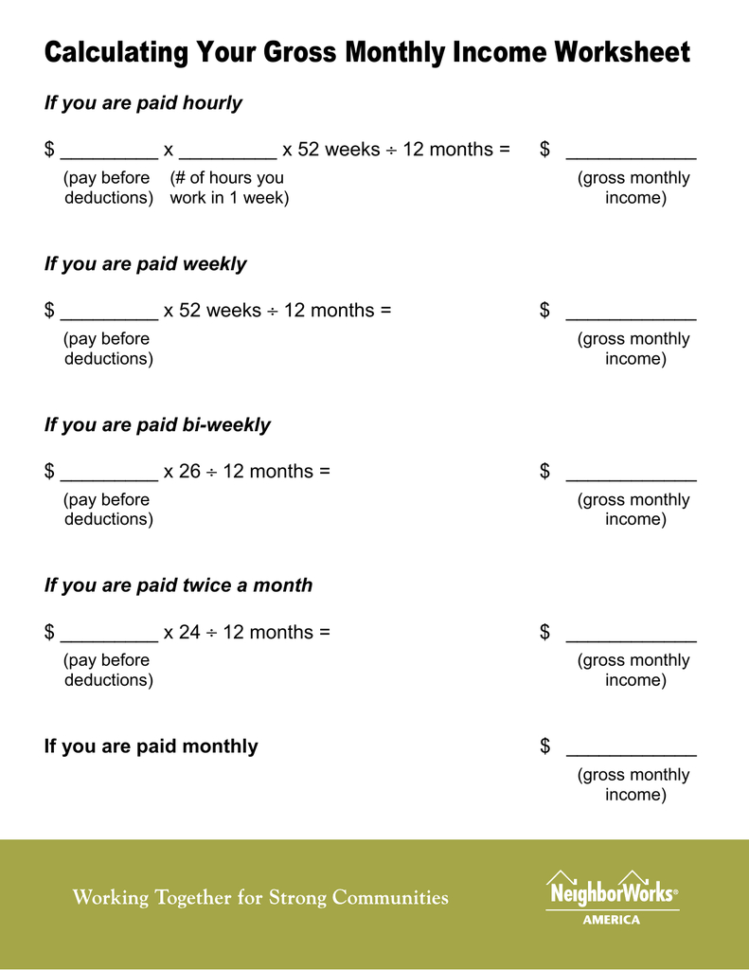

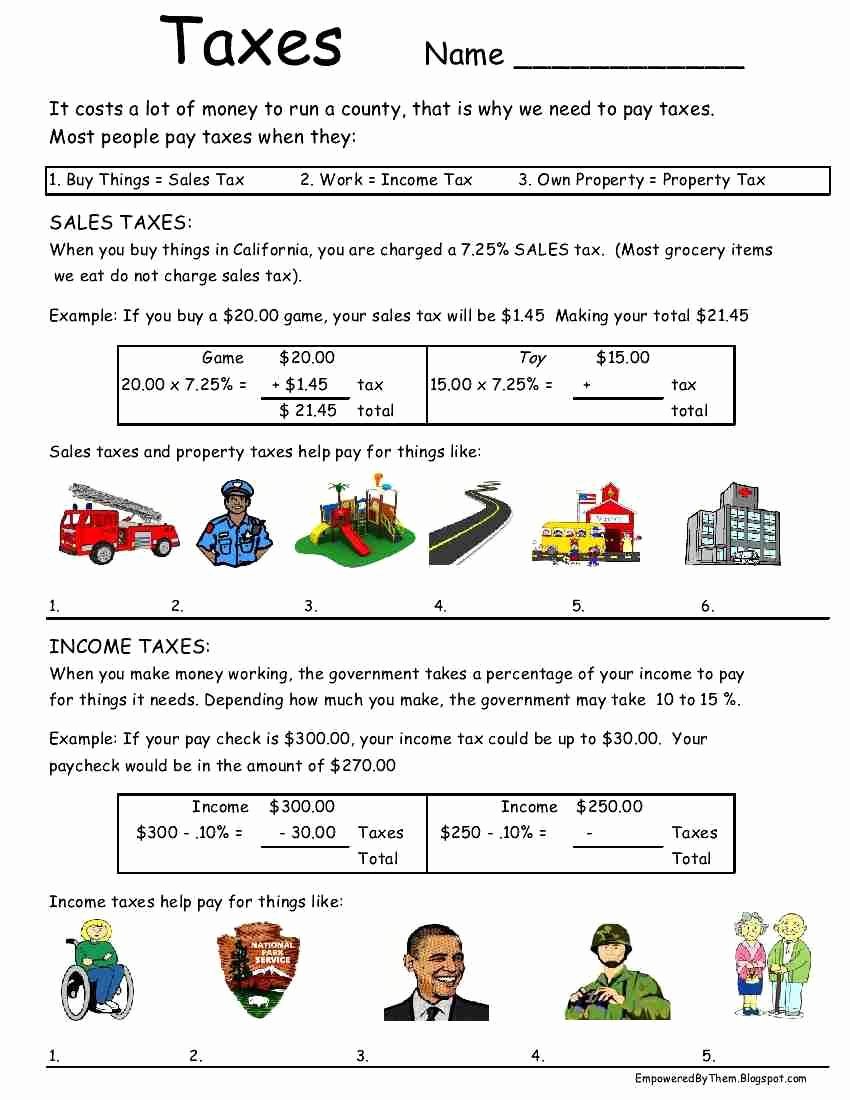

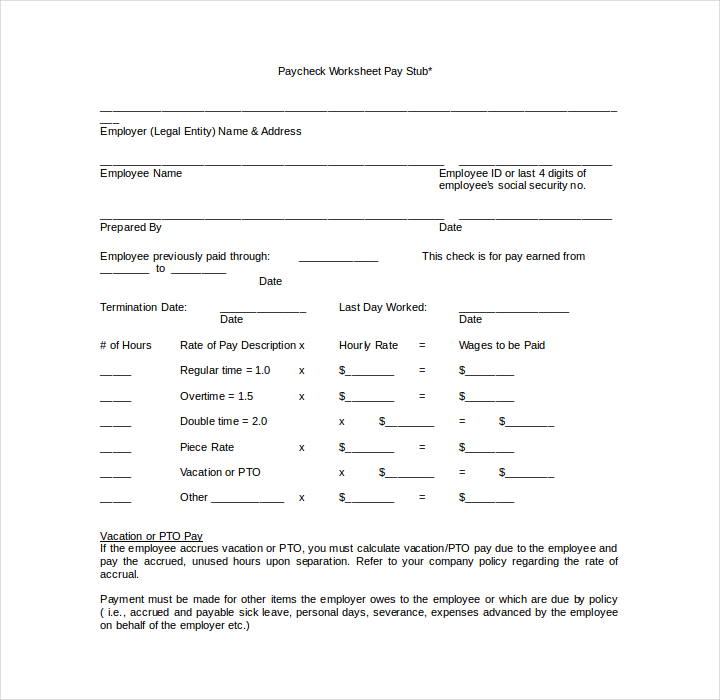

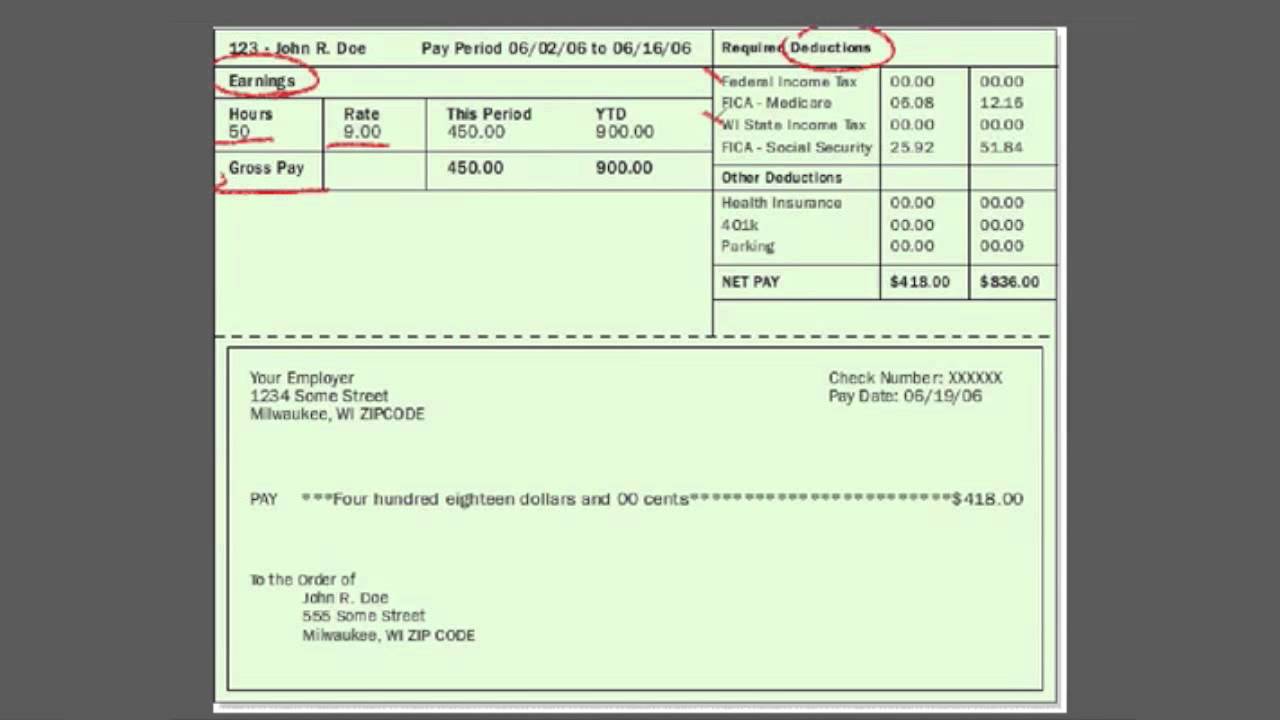

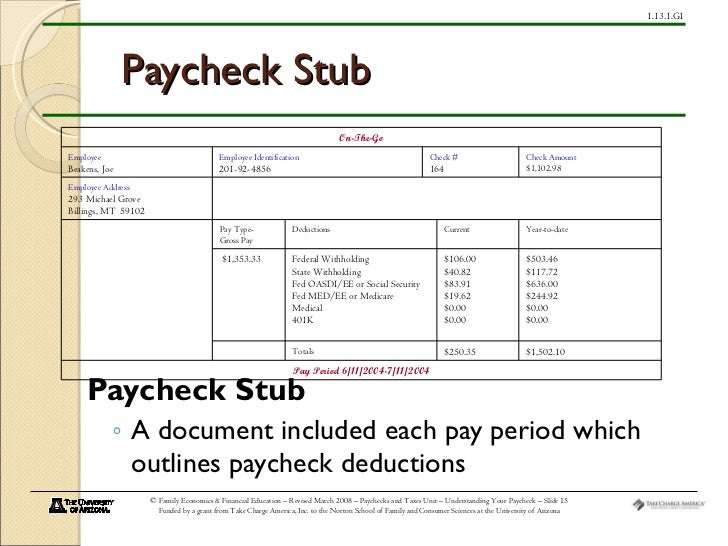

Understanding Your Paycheck Worksheet - Understanding your paycheck (with related pretest) 2. Web calculating the numbers in your paycheck. Web understanding why and how taxes and other items are deducted from a worker’s paycheck is an important step toward gaining financial knowledge. $_____ (answer to #1) x.062= 3. Web understanding your pay, benefits, and paycheck. $_____ social security deduction calculate joe’s medicare deduction, which is 1.45% of his gross pay. With any job, it can be difficult to decipher everything on your paycheck and figure out what various benefits provide for. Web easy prep lesson uses realistic paystubs to teach students how to understand their paycheck including gross vs. The curriculum includes 9 lessons. Understand the difference between an employee and a contractor. Web understanding why and how taxes and other items are deducted from a worker’s paycheck is an important step toward gaining financial knowledge. Web calculating the numbers in your paycheck. Web understanding your pay, benefits, and paycheck. Understanding your paycheck (with related pretest) 2. Learn the purpose of taxes. When determining gross wages, employers must also consider. Understanding your paycheck (with related pretest) 2. The lessons employ various teaching strategies to. Learn the purpose of taxes. Web understanding why and how taxes and other items are deducted from a worker’s paycheck is an important step toward gaining financial knowledge. Web easy prep lesson uses realistic paystubs to teach students how to understand their paycheck including gross vs. $_____ social security deduction calculate joe’s medicare deduction, which is 1.45% of his gross pay. Web • list the elements of a pay stub • define withholdings • identify advantages and disadvantages of direct deposit and check cashing language objectives • use.. The curriculum includes 9 lessons. Web understanding your pay, benefits, and paycheck. Net pay, deductions, income taxes and more! $512 = 32 x $16. Is designed for use in high school personal finance classes. The lessons employ various teaching strategies to. $_____ (answer to #1) x.062= 3. Understand the difference between an employee and a contractor. Some of the worksheets for this concept are understanding taxes. Web gross wages (hourly employee): Is designed for use in high school personal finance classes. Web understanding why and how taxes and other items are deducted from a worker’s paycheck is an important step toward gaining financial knowledge. When determining gross wages, employers must also consider. Net pay, deductions, income taxes and more! Understanding your paycheck (with related pretest) 2. $_____ (answer to #1) x.062= 3. Web easy prep lesson uses realistic paystubs to teach students how to understand their paycheck including gross vs. $512 = 32 x $16. Is designed for use in high school personal finance classes. Hours worked within pay period x hourly rate. With any job, it can be difficult to decipher everything on your paycheck and figure out what various benefits provide for. Web calculating the numbers in your paycheck. Understand the difference between an employee and a contractor. Is designed for use in high school personal finance classes. Understanding your paycheck (with related pretest) 2. Hours worked within pay period x hourly rate. Learn the purpose of taxes. Is designed for use in high school personal finance classes. Net pay, deductions, income taxes and more! Understanding your paycheck (with related pretest) 2. Web understanding why and how taxes and other items are deducted from a worker’s paycheck is an important step toward gaining financial knowledge. Web understanding your pay, benefits, and paycheck. Web • list the elements of a pay stub • define withholdings • identify advantages and disadvantages of direct deposit and check cashing language objectives • use. Some of the. Understanding your paycheck (with related pretest) 2. Net pay, deductions, income taxes and more! Understand the difference between an employee and a contractor. $_____ social security deduction calculate joe’s medicare deduction, which is 1.45% of his gross pay. Web understanding your pay, benefits, and paycheck. Web gross wages (hourly employee): When determining gross wages, employers must also consider. Web easy prep lesson uses realistic paystubs to teach students how to understand their paycheck including gross vs. $512 = 32 x $16. Web understanding why and how taxes and other items are deducted from a worker’s paycheck is an important step toward gaining financial knowledge. Is designed for use in high school personal finance classes. Hours worked within pay period x hourly rate. The lessons employ various teaching strategies to. $_____ (answer to #1) x.062= 3. Web calculating the numbers in your paycheck. The curriculum includes 9 lessons. With any job, it can be difficult to decipher everything on your paycheck and figure out what various benefits provide for. Web • list the elements of a pay stub • define withholdings • identify advantages and disadvantages of direct deposit and check cashing language objectives • use. Some of the worksheets for this concept are understanding taxes. Learn the purpose of taxes. Web easy prep lesson uses realistic paystubs to teach students how to understand their paycheck including gross vs. With any job, it can be difficult to decipher everything on your paycheck and figure out what various benefits provide for. $512 = 32 x $16. Web gross wages (hourly employee): $_____ social security deduction calculate joe’s medicare deduction, which is 1.45% of his gross pay. When determining gross wages, employers must also consider. Understanding your paycheck (with related pretest) 2. Net pay, deductions, income taxes and more! Is designed for use in high school personal finance classes. The lessons employ various teaching strategies to. Some of the worksheets for this concept are understanding taxes. Understand the difference between an employee and a contractor. Web • list the elements of a pay stub • define withholdings • identify advantages and disadvantages of direct deposit and check cashing language objectives • use. The curriculum includes 9 lessons. Hours worked within pay period x hourly rate. $_____ (answer to #1) x.062= 3.Paycheck Budget Worksheet Etsy

Calculating Your Paycheck Salary Worksheet 1 Answer Key —

50 Reading A Pay Stub Worksheet Chessmuseum Template Library

️Understanding Paycheck Worksheet Free Download Goodimg.co

Understanding Your Paycheck Worksheet Answers / Understanding Your

Understanding Your Paycheck Worksheet Answer Key Fill Online

Paycheck Budgeting (Printable Worksheet) (1) Mint Notion

maxresdefault.jpg

Paycheck Budget Planner Printable Budget by Paycheck Worksheet

43 understanding your paycheck worksheet Worksheet Was Here

Web Calculating The Numbers In Your Paycheck.

Web Understanding Your Pay, Benefits, And Paycheck.

Learn The Purpose Of Taxes.

Web Understanding Why And How Taxes And Other Items Are Deducted From A Worker’s Paycheck Is An Important Step Toward Gaining Financial Knowledge.

Related Post: