Virginia Worksheet For Amended Returns

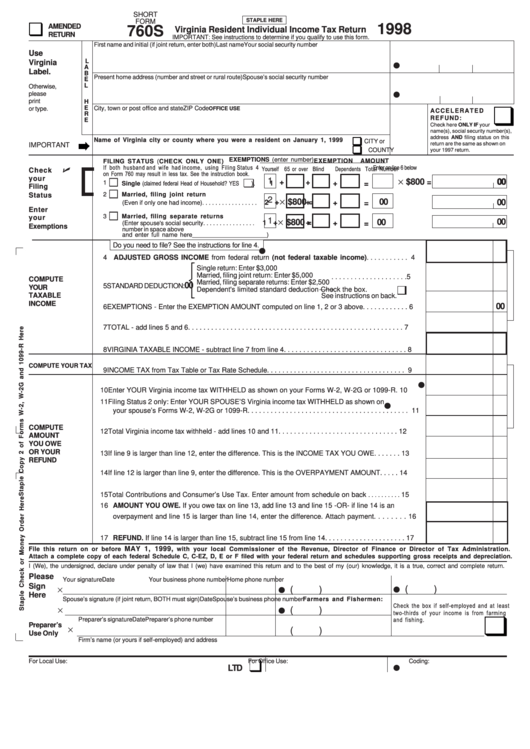

Virginia Worksheet For Amended Returns - Web detailed step by step guide on what to changing your virginia income tax return with guss 760 by tax year. Web use this form to notify your employer whether you are subject to virginia income tax withholding and how many exemptions you are allowed to claim. Head of household filing status schedule : If amending state returns, go to the state worksheet for the state that you want to amend. You must file this form. Web the following forms and their supporting schedules must be included with the amended return. Web address or to notify the department that you are no longer liable for virginia employer income tax withholding, use business online services at. Net operating loss modification worksheet or facsimile. Web enter the reason that the federal return is being amended. Individual income tax return, for this year and up to three prior years. Web detailed step by step guide on what to changing your virginia income tax return with guss 760 by tax year. Head of household filing status schedule : If amending state returns, go to the state worksheet for the state that you want to amend. Web the following forms and their supporting schedules must be included with the amended return.. Web detailed step by step guide on what to changing your virginia income tax return with guss 760 by tax year. Web the following forms and their supporting schedules must be included with the amended return. Web the amended return information can be accessed in the program from the main menu of the virginia return by selecting personal information >. Net operating loss modification worksheet or facsimile. Web check if this is an amended return. If amending state returns, go to the state worksheet for the state that you want to amend. Individual income tax return, for this year and up to three prior years. Web the following forms and their supporting schedules must be included with the amended return. If amending state returns, go to the state worksheet for the state that you want to amend. Web address or to notify the department that you are no longer liable for virginia employer income tax withholding, use business online services at. Head of household filing status schedule : Net operating loss modification worksheet or facsimile. Web use this form to. 1546001745 at present, virginia tax does not support. Web 2021 virginia form 765 virginia department of taxation p.o. Web detailed step by step guide on what to changing your virginia income tax return with guss 760 by tax year. California explanation of amended return changes : Web the amended return information can be accessed in the program from the main. Web enter the reason that the federal return is being amended. Web after amending a virginia individual tax return (form 760 or 763) that originally had a balance due, the return may show a lower balance due and. If amending state returns, go to the state worksheet for the state that you want to amend. Net operating loss modification worksheet. Individual income tax return, for this year and up to three prior years. Net operating loss modification worksheet or facsimile. Please enter your payment details below. Web the following forms and their supporting schedules must be included with the amended return. You must file this form. California explanation of amended return changes : 1546001745 at present, virginia tax does not support. Please enter your payment details below. You must file this form. Individual income tax return, for this year and up to three prior years. Web use this form to notify your employer whether you are subject to virginia income tax withholding and how many exemptions you are allowed to claim. Web the amended return information can be accessed in the program from the main menu of the virginia return by selecting personal information > other categories. Web address or to notify the department that. Head of household filing status schedule : Web the following forms and their supporting schedules must be included with the amended return. Please enter your payment details below. Individual income tax return, for this year and up to three prior years. Web 2021 virginia form 765 virginia department of taxation p.o. California explanation of amended return changes : Web after amending a virginia individual tax return (form 760 or 763) that originally had a balance due, the return may show a lower balance due and. Web 2021 virginia form 765 virginia department of taxation p.o. 1546001745 at present, virginia tax does not support. Web address or to notify the department that you are no longer liable for virginia employer income tax withholding, use business online services at. Please enter your payment details below. Web enter the reason that the federal return is being amended. Head of household filing status schedule : Web the amended return information can be accessed in the program from the main menu of the virginia return by selecting personal information > other categories. You must file this form. Web check if this is an amended return. Web use this form to notify your employer whether you are subject to virginia income tax withholding and how many exemptions you are allowed to claim. If amending state returns, go to the state worksheet for the state that you want to amend. Net operating loss modification worksheet or facsimile. Web the following forms and their supporting schedules must be included with the amended return. Web detailed step by step guide on what to changing your virginia income tax return with guss 760 by tax year. Individual income tax return, for this year and up to three prior years. Please enter your payment details below. California explanation of amended return changes : Web the amended return information can be accessed in the program from the main menu of the virginia return by selecting personal information > other categories. Web after amending a virginia individual tax return (form 760 or 763) that originally had a balance due, the return may show a lower balance due and. If amending state returns, go to the state worksheet for the state that you want to amend. Head of household filing status schedule : 1546001745 at present, virginia tax does not support. Web use this form to notify your employer whether you are subject to virginia income tax withholding and how many exemptions you are allowed to claim. Individual income tax return, for this year and up to three prior years. Net operating loss modification worksheet or facsimile. Web the following forms and their supporting schedules must be included with the amended return. Web address or to notify the department that you are no longer liable for virginia employer income tax withholding, use business online services at. Web enter the reason that the federal return is being amended.Fillable Short Form 760s Virginia Resident Individual Tax

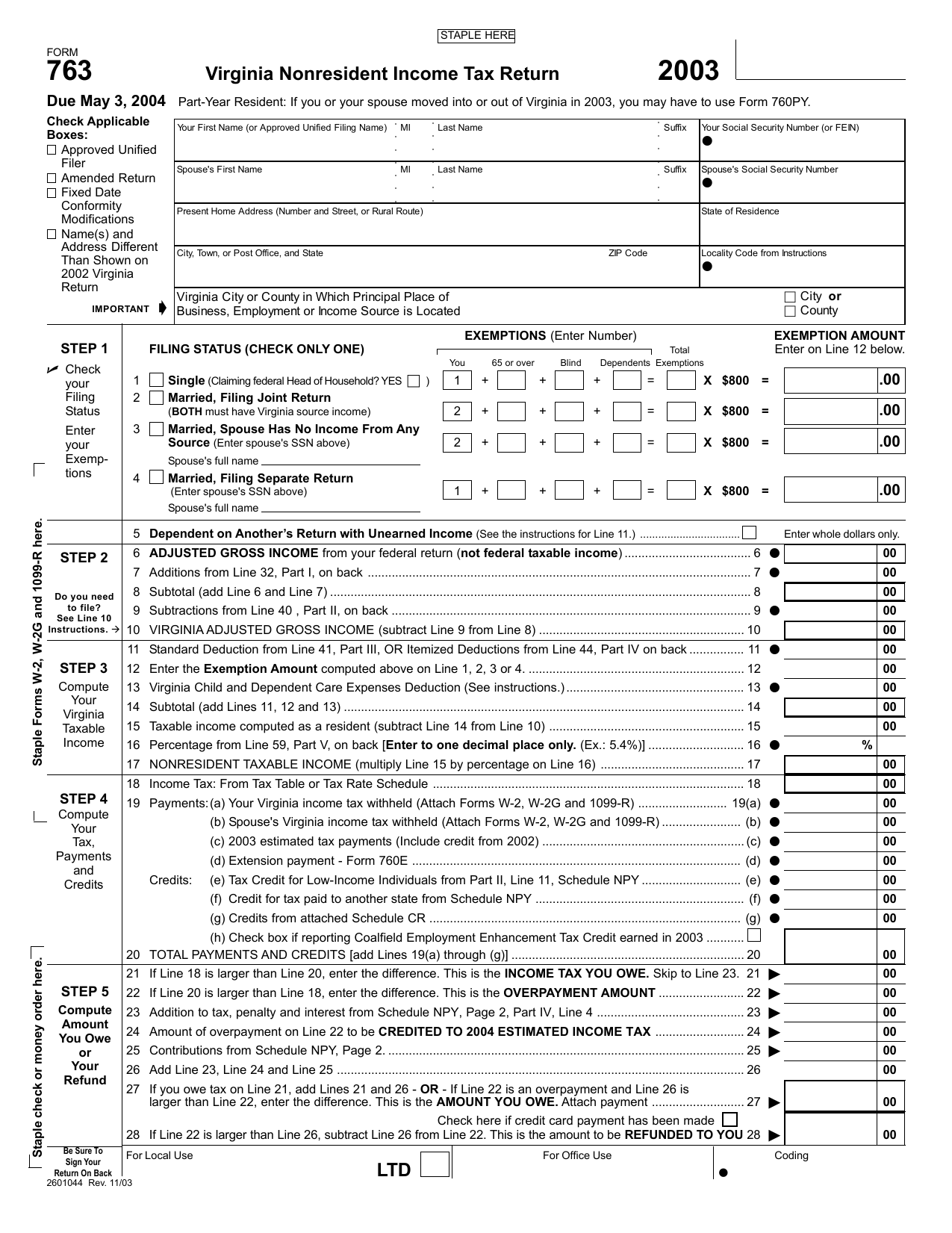

Virginia Form 763 designingreflections

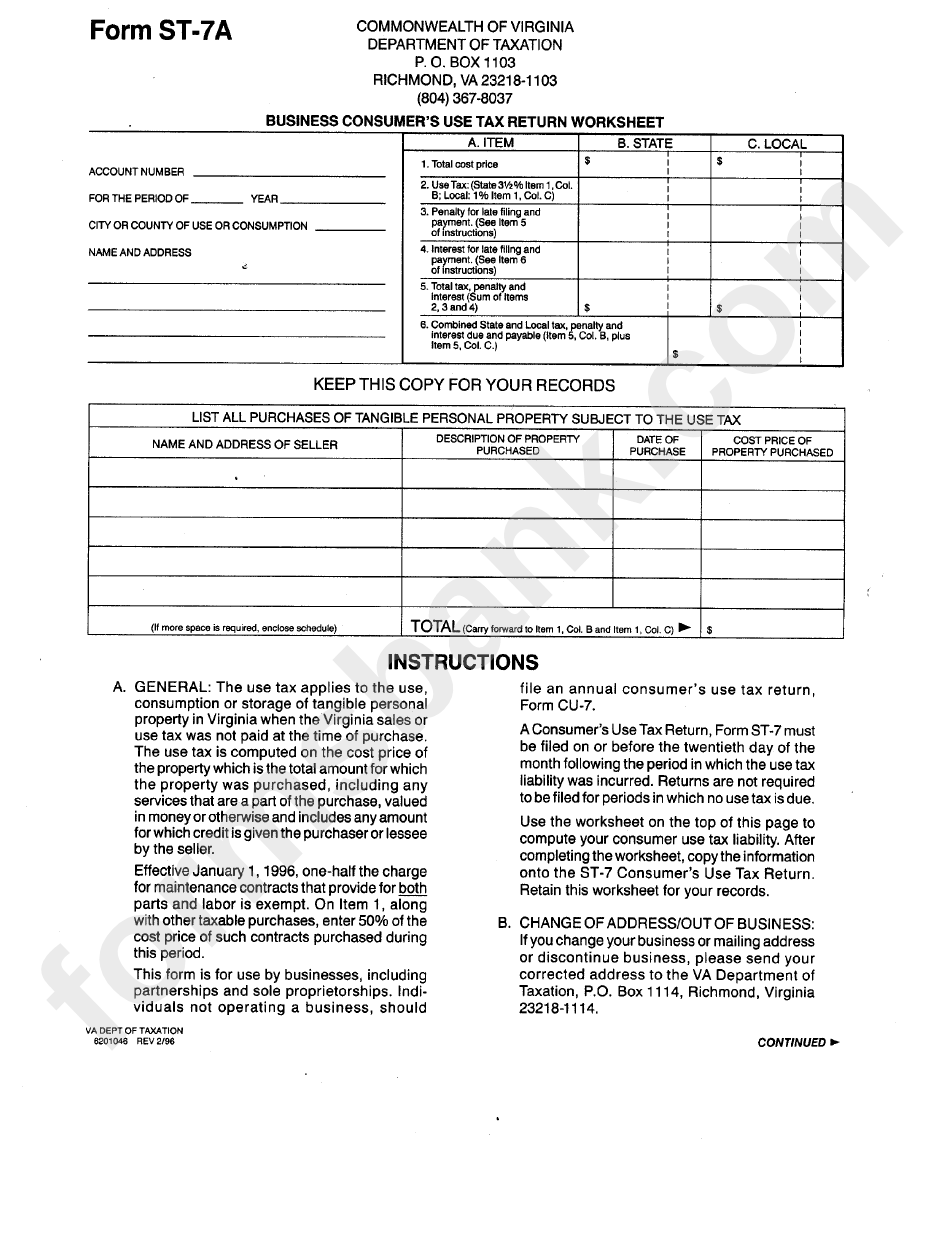

Form St7a Business Consumer'S Use Tax Return Worksheet Virginia

Virginia Vocabulary Worksheet for 3rd 6th Grade Lesson

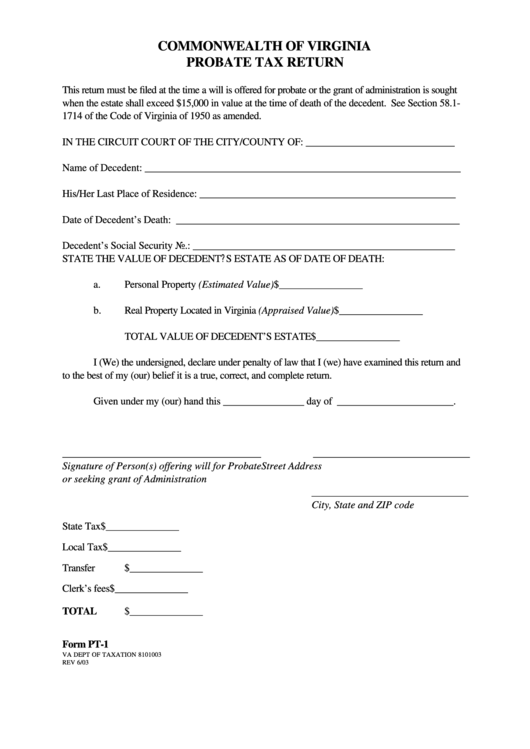

Fillable Form Pt1 Commonwealth Of Virginia Probate Tax Return

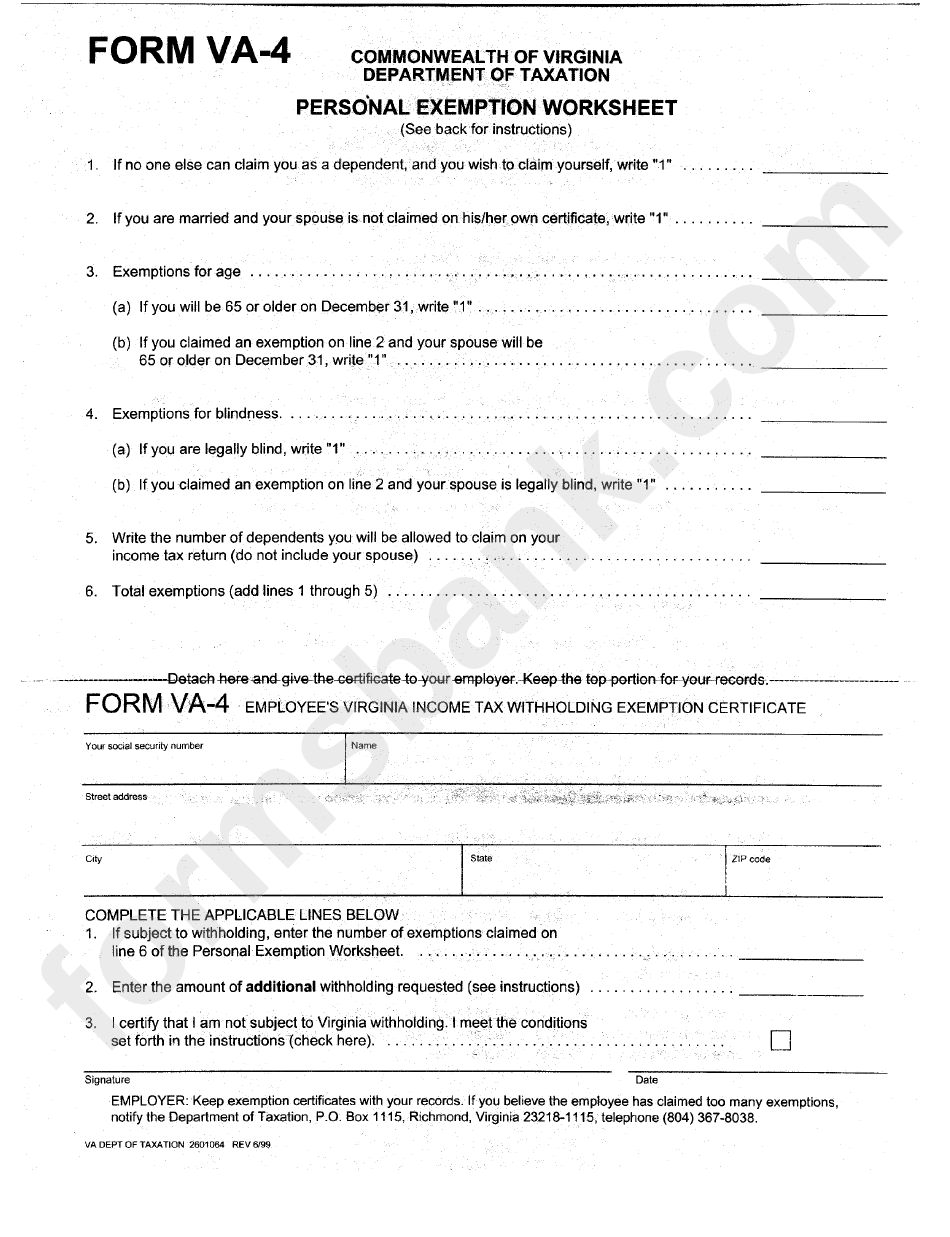

Form Va4 Personal Exemption Worksheet printable pdf download

️5 Regions Of Virginia Worksheet Free Download Gmbar.co

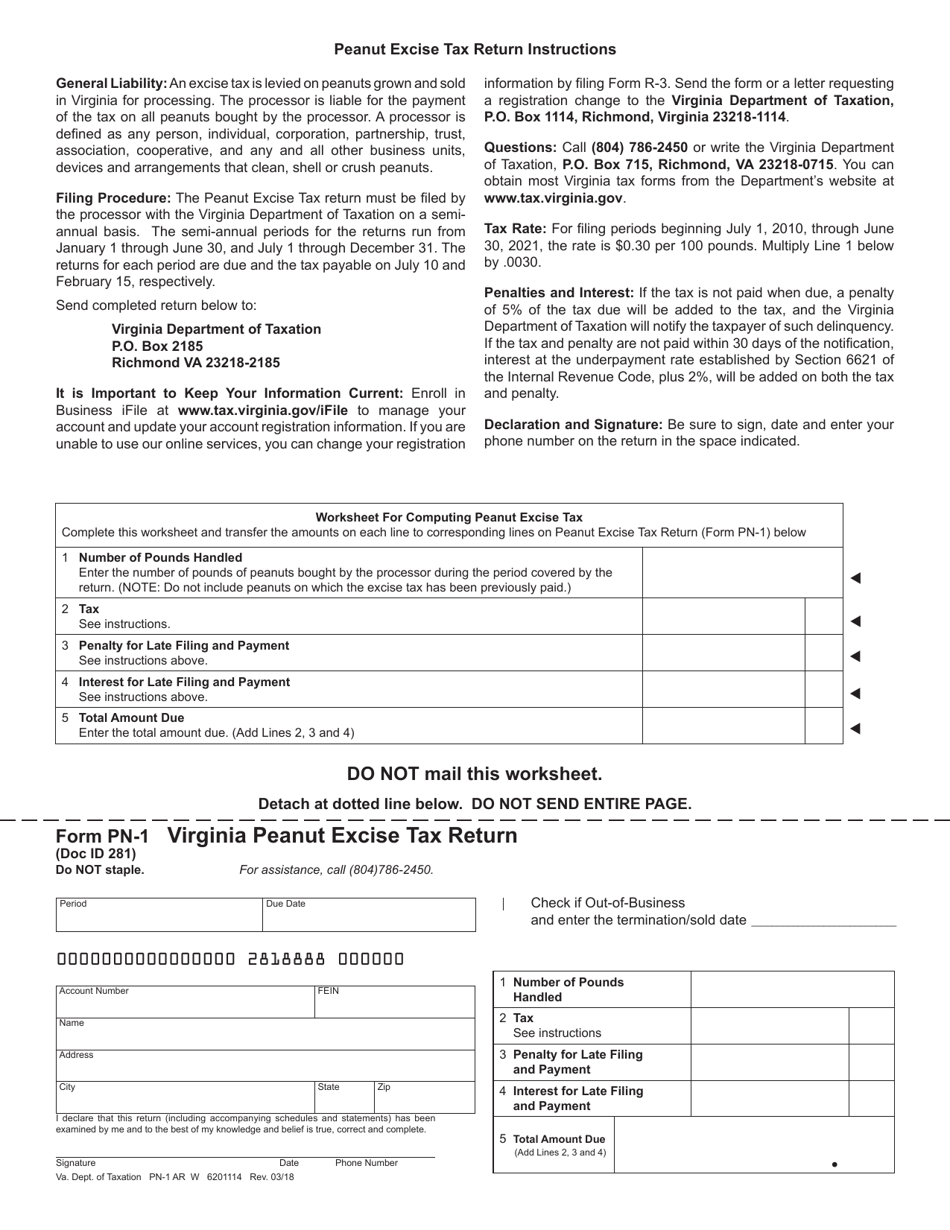

Form PN1 Download Fillable PDF or Fill Online Virginia Peanut Excise

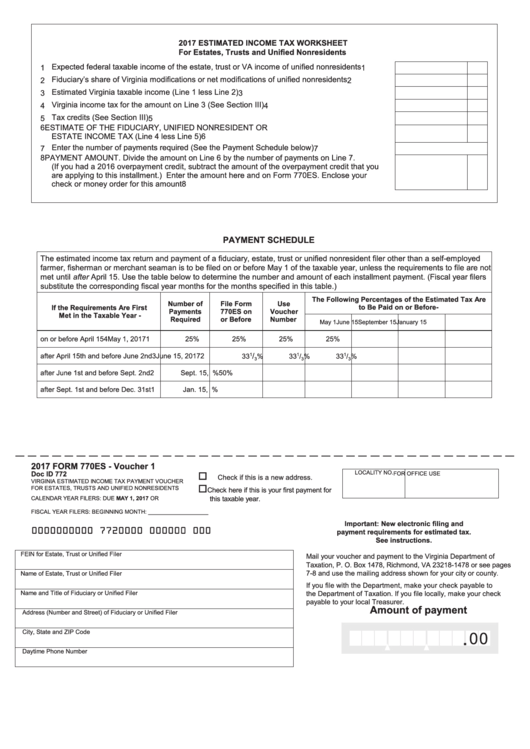

Fillable Form 770es Virginia Estimated Tax Worksheet

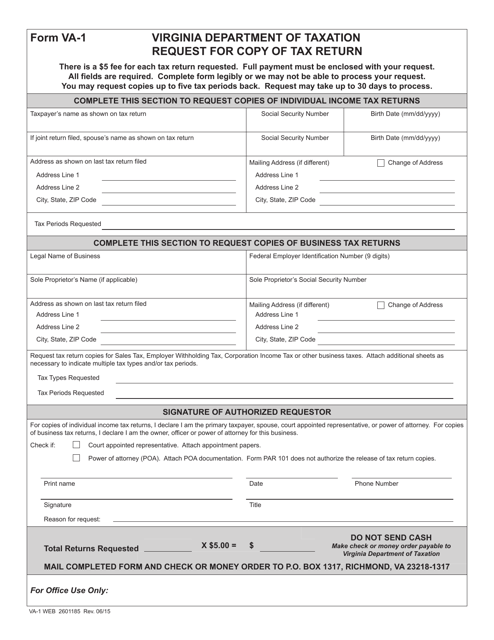

Form VA1 Download Fillable PDF or Fill Online Request for Copy of Tax

Web Check If This Is An Amended Return.

Web 2021 Virginia Form 765 Virginia Department Of Taxation P.o.

You Must File This Form.

Web Detailed Step By Step Guide On What To Changing Your Virginia Income Tax Return With Guss 760 By Tax Year.

Related Post: