What Is A 1040-Sr Worksheet

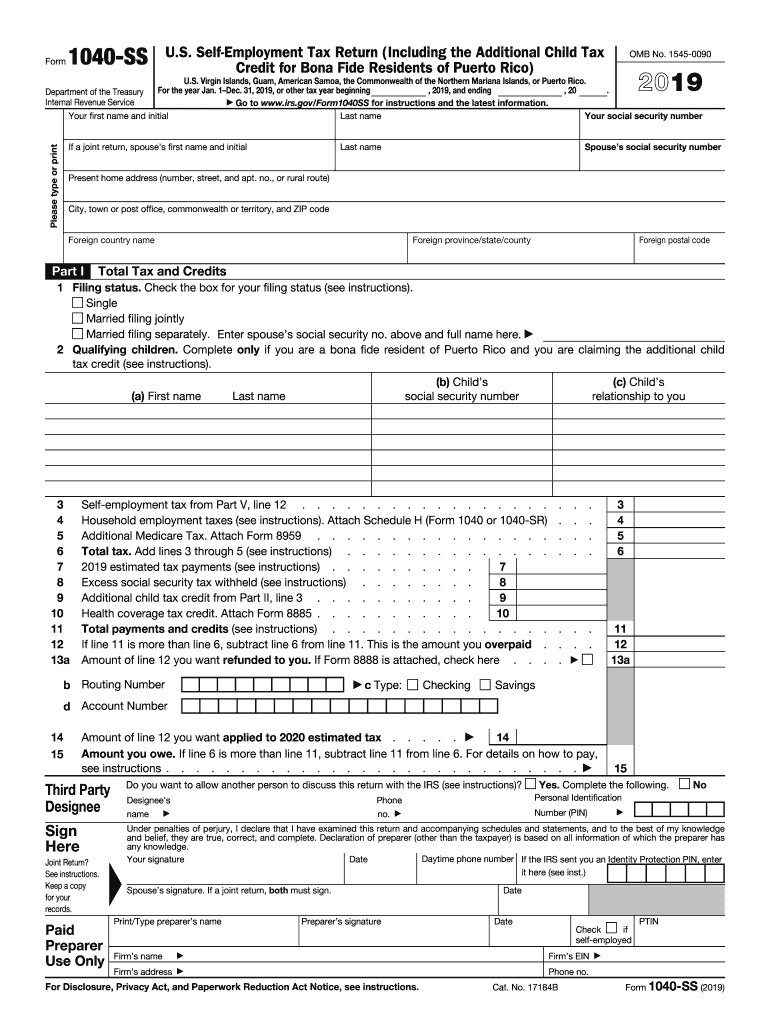

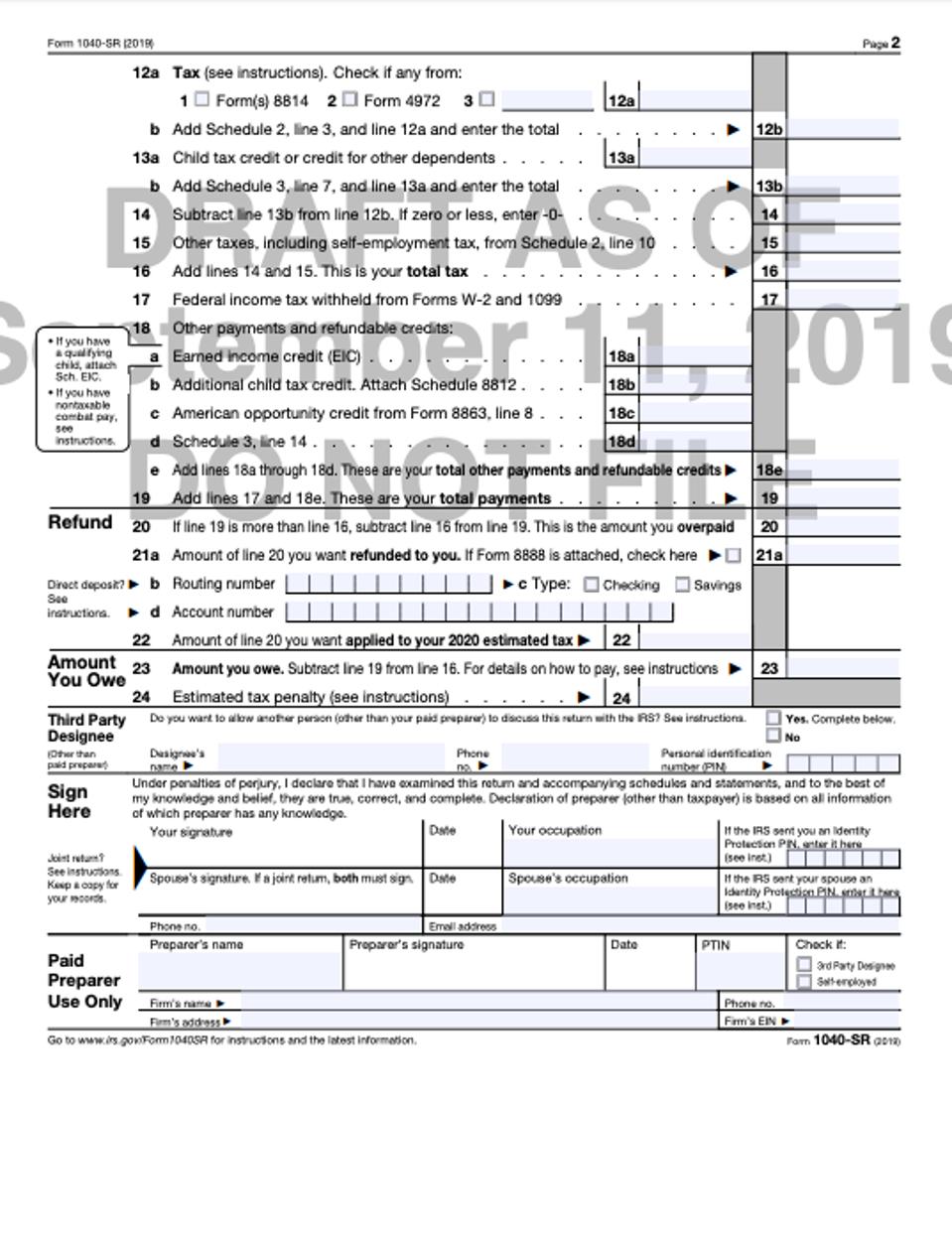

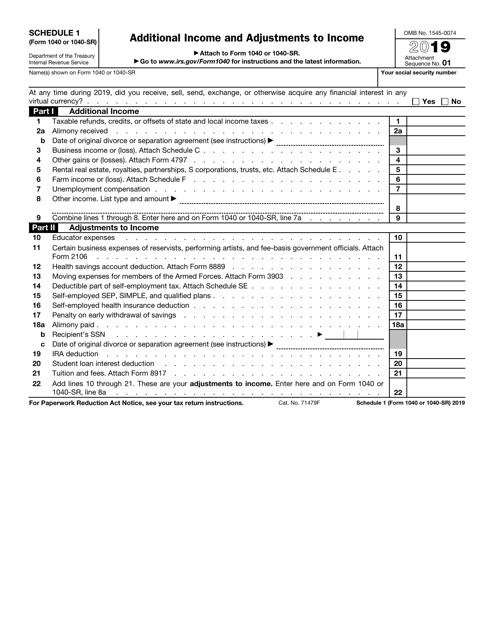

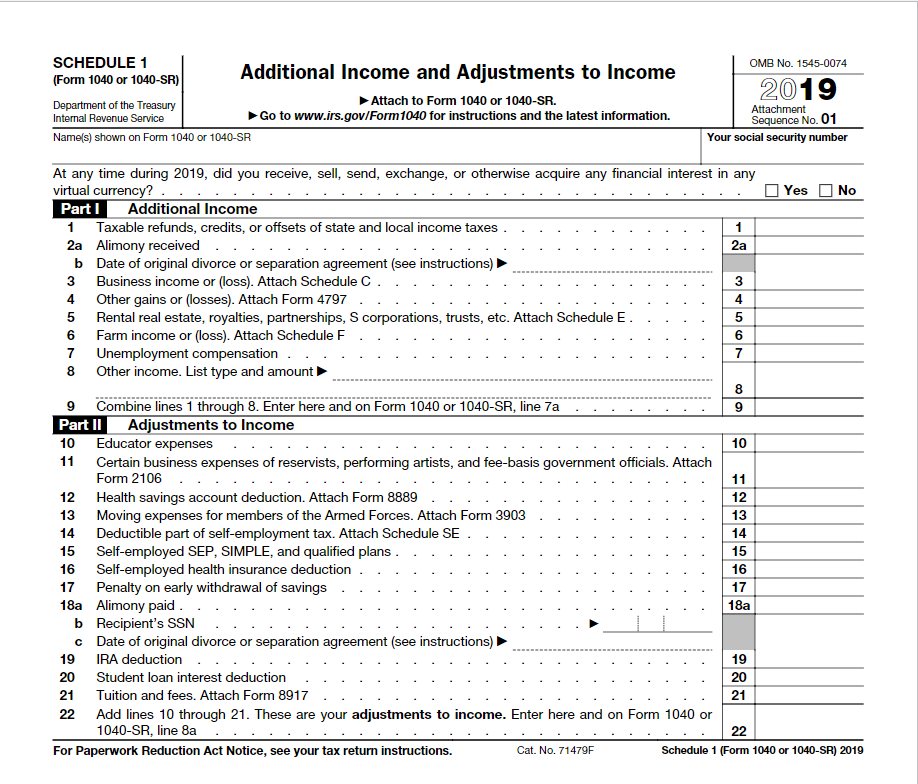

What Is A 1040-Sr Worksheet - Calculating taxable benefits before filling out this worksheet: Web social security taxable benefits worksheet (2022) worksheet 1. Credit for the elderly or the disabled. J don't use this worksheet if you repaid benefits in 2020 and your total repayments (box 4 of forms ssa. Web use this worksheet only if someone else can claim you (or your spouse if filing jointly) as a dependent. And the schedule a (form. 501 page is at irs.gov/pub501; Blind is defined in tab r, glossary and index. For example, the form 1040 page is at irs.gov/form1040; Enter the amount from the credit limit worksheet in the instructions. Blind is defined in tab r, glossary and index. J don't use this worksheet if you repaid benefits in 2020 and your total repayments (box 4 of forms ssa. Web use this worksheet only if someone else can claim you (or your spouse if filing jointly) as a dependent. Web social security taxable benefits worksheet (2022) worksheet 1. And the. Calculating taxable benefits before filling out this worksheet: And the schedule a (form. Web use this worksheet only if someone else can claim you (or your spouse if filing jointly) as a dependent. J don't use this worksheet if you repaid benefits in 2020 and your total repayments (box 4 of forms ssa. 501 page is at irs.gov/pub501; Credit for the elderly or the disabled. Blind is defined in tab r, glossary and index. And the schedule a (form. Web social security taxable benefits worksheet (2022) worksheet 1. For example, the form 1040 page is at irs.gov/form1040; Credit for the elderly or the disabled. Calculating taxable benefits before filling out this worksheet: Enter the amount from the credit limit worksheet in the instructions. For example, the form 1040 page is at irs.gov/form1040; Web social security taxable benefits worksheet (2022) worksheet 1. 501 page is at irs.gov/pub501; Web use this worksheet only if someone else can claim you (or your spouse if filing jointly) as a dependent. And the schedule a (form. Credit for the elderly or the disabled. Calculating taxable benefits before filling out this worksheet: Web use this worksheet only if someone else can claim you (or your spouse if filing jointly) as a dependent. Enter the amount from the credit limit worksheet in the instructions. Credit for the elderly or the disabled. For example, the form 1040 page is at irs.gov/form1040; 501 page is at irs.gov/pub501; 501 page is at irs.gov/pub501; J don't use this worksheet if you repaid benefits in 2020 and your total repayments (box 4 of forms ssa. For example, the form 1040 page is at irs.gov/form1040; Calculating taxable benefits before filling out this worksheet: Web social security taxable benefits worksheet (2022) worksheet 1. Blind is defined in tab r, glossary and index. Web social security taxable benefits worksheet (2022) worksheet 1. J don't use this worksheet if you repaid benefits in 2020 and your total repayments (box 4 of forms ssa. And the schedule a (form. Calculating taxable benefits before filling out this worksheet: 501 page is at irs.gov/pub501; Enter the amount from the credit limit worksheet in the instructions. For example, the form 1040 page is at irs.gov/form1040; And the schedule a (form. Web social security taxable benefits worksheet (2022) worksheet 1. 501 page is at irs.gov/pub501; And the schedule a (form. Blind is defined in tab r, glossary and index. For example, the form 1040 page is at irs.gov/form1040; Web use this worksheet only if someone else can claim you (or your spouse if filing jointly) as a dependent. J don't use this worksheet if you repaid benefits in 2020 and your total repayments (box 4 of forms ssa. 501 page is at irs.gov/pub501; Credit for the elderly or the disabled. And the schedule a (form. For example, the form 1040 page is at irs.gov/form1040; Web use this worksheet only if someone else can claim you (or your spouse if filing jointly) as a dependent. Calculating taxable benefits before filling out this worksheet: Enter the amount from the credit limit worksheet in the instructions. Web social security taxable benefits worksheet (2022) worksheet 1. Blind is defined in tab r, glossary and index. Web use this worksheet only if someone else can claim you (or your spouse if filing jointly) as a dependent. Credit for the elderly or the disabled. 501 page is at irs.gov/pub501; Calculating taxable benefits before filling out this worksheet: And the schedule a (form. Web social security taxable benefits worksheet (2022) worksheet 1. Enter the amount from the credit limit worksheet in the instructions. J don't use this worksheet if you repaid benefits in 2020 and your total repayments (box 4 of forms ssa.Irs Fillable Form 1040Sr Form 1040 Sr U S Tax Return For Seniors

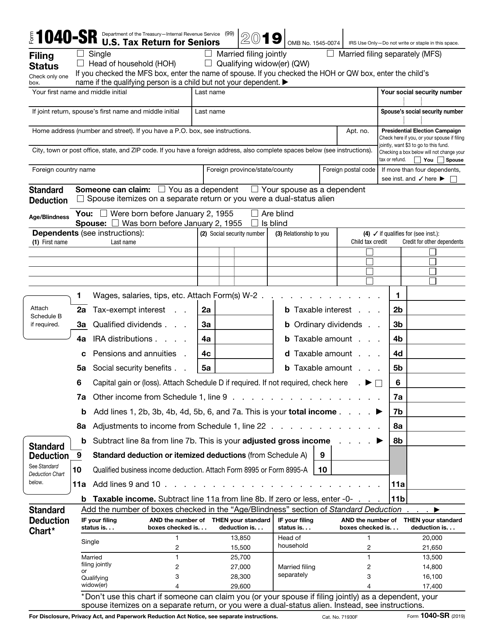

Formulaire 1040SR les personnes âgées reçoivent un nouveau

IRS Form 1040SR Download Fillable PDF or Fill Online U.S. Tax Return

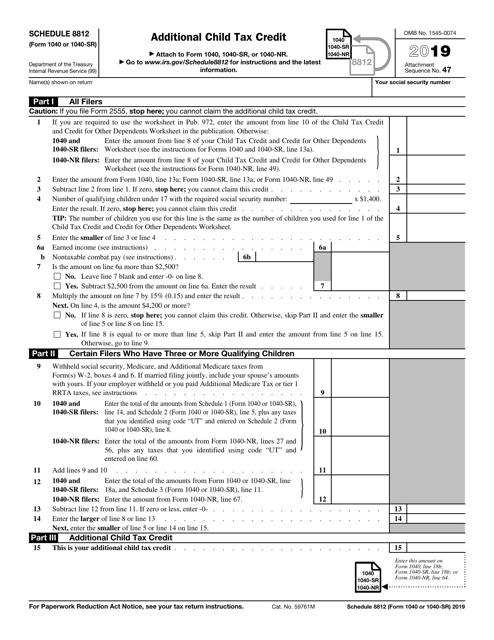

IRS Form 1040 (1040SR) Schedule 8812 Download Fillable PDF or Fill

Irs Fillable Form 1040 IRS Form 1040 (1040SR) Schedule EIC Download

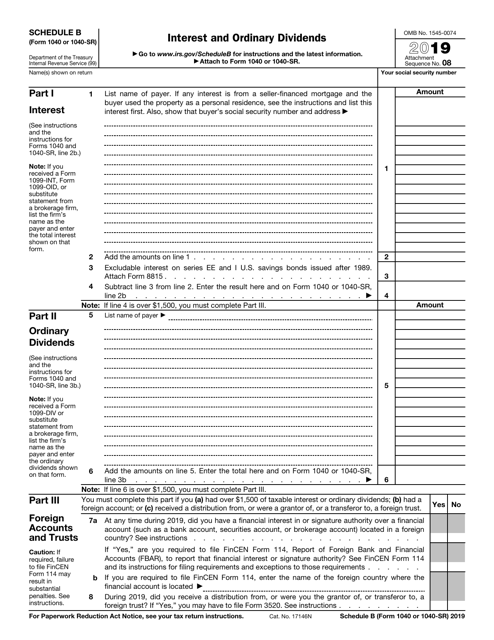

IRS Form 1040 (1040SR) Schedule B Download Fillable PDF or Fill Online

Irs Fillable Form 1040Sr IRS Form 1040 (1040SR) Schedule F Download

IRS Offers New Look At Form 1040SR (U.S. Tax Return for Seniors) Taxgirl

IRS Form 1040 (1040SR) Schedule 1 Download Fillable PDF or Fill Online

PLEASE USE THIS INFORMATION TO FILL OUT 1) Indivi...

Blind Is Defined In Tab R, Glossary And Index.

For Example, The Form 1040 Page Is At Irs.gov/Form1040;

Related Post:

:max_bytes(150000):strip_icc()/1040-SR-TaxReturnforSeniors-1-ccfefd6fef7b4798a50037db30a91193.png)