What Is The Credit Limit Worksheet A For Form 8812

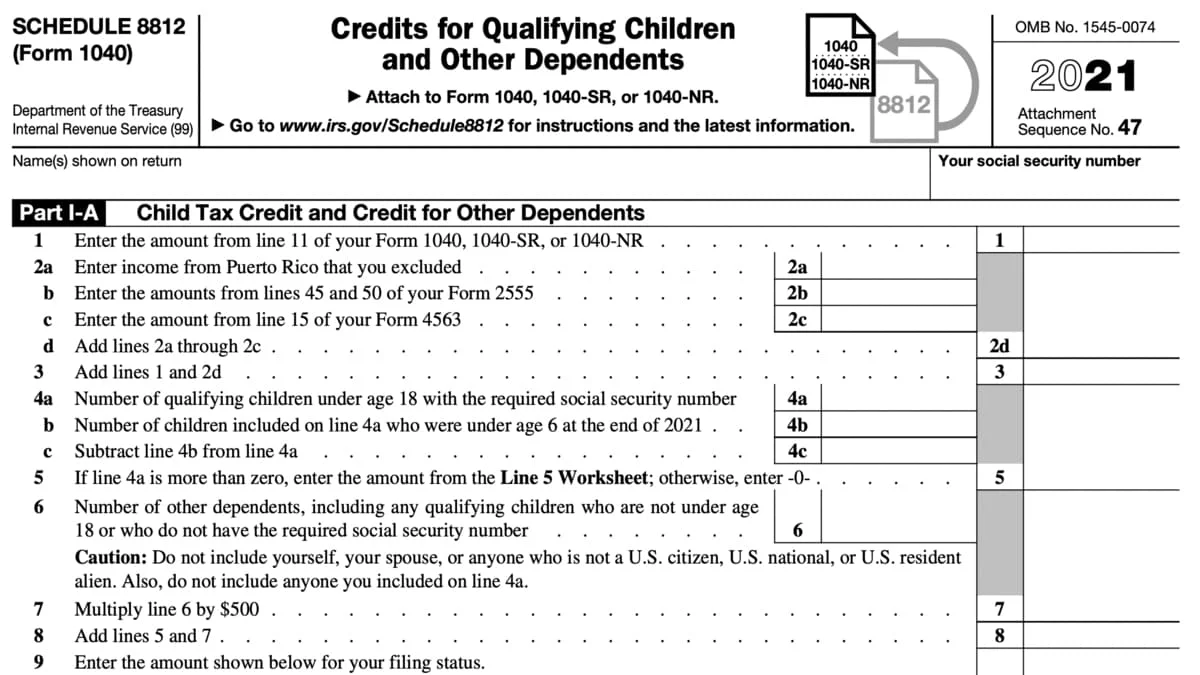

What Is The Credit Limit Worksheet A For Form 8812 - Child tax credit and credit for other dependents. Web march 30, 2023 11:45 am. Web after you have completed the child tax credit worksheet, use form 8812 to determine if you can take the additional credit. The schedule 8812 (form 1040) and its instructions have been revised to be the single source for figuring and reporting the child tax credits and. Web schedule 8812 (form 1040). If you are using turbotax, you will not have to make the entries on form 8812. Web you'll use form 8812 to calculate your additional child tax credit. Common questions about the child tax credit and 8812 in proseries. The additional child tax credit is only available to. Should be completed by all filers to claim the. Solved•by intuit•90•updated january 10, 2023. Web march 30, 2023 11:45 am. Web schedule 8812 (form 1040). The schedule 8812 (form 1040) and its instructions have been revised to be the single source for figuring and reporting the child tax credits and. Web you'll use form 8812 to calculate your additional child tax credit. Web march 30, 2023 11:45 am. Web schedule 8812 (form 1040). Common questions about the child tax credit and 8812 in proseries. As @thomasm125 explained, the worksheet, credit. The schedule 8812 (form 1040) and its instructions have been revised to be the single source for figuring and reporting the child tax credits and. Solved•by intuit•90•updated january 10, 2023. For 2022, there are two parts to this form: The schedule 8812 (form 1040) and its instructions have been revised to be the single source for figuring and reporting the child tax credits and. Web you'll use form 8812 to calculate your additional child tax credit. Maximum credit is $3,600 per qualifying child under. For 2022, there are two parts to this form: Should be completed by all filers to claim the. Web after you have completed the child tax credit worksheet, use form 8812 to determine if you can take the additional credit. Common questions about the child tax credit and 8812 in proseries. Web schedule 8812 (form 1040). Should be completed by all filers to claim the. If you are using turbotax, you will not have to make the entries on form 8812. Maximum credit is $3,600 per qualifying child under. Web after you have completed the child tax credit worksheet, use form 8812 to determine if you can take the additional credit. Child tax credit and credit. Maximum credit is $3,600 per qualifying child under. As @thomasm125 explained, the worksheet, credit. The schedule 8812 (form 1040) and its instructions have been revised to be the single source for figuring and reporting the child tax credits and. If you are using turbotax, you will not have to make the entries on form 8812. Solved•by intuit•90•updated january 10, 2023. Web you'll use form 8812 to calculate your additional child tax credit. Child tax credit and credit for other dependents. Should be completed by all filers to claim the. Common questions about the child tax credit and 8812 in proseries. As @thomasm125 explained, the worksheet, credit. Maximum credit is $3,600 per qualifying child under. Child tax credit and credit for other dependents. Web march 30, 2023 11:45 am. The schedule 8812 (form 1040) and its instructions have been revised to be the single source for figuring and reporting the child tax credits and. The additional child tax credit is only available to. If you are using turbotax, you will not have to make the entries on form 8812. The additional child tax credit is only available to. Should be completed by all filers to claim the. Web schedule 8812 (form 1040). Web 2021 schedule 8812 credit limit worksheet a keep for your records 1. The schedule 8812 (form 1040) and its instructions have been revised to be the single source for figuring and reporting the child tax credits and. For 2022, there are two parts to this form: Common questions about the child tax credit and 8812 in proseries. Web schedule 8812 (form 1040). Maximum credit is $3,600 per qualifying child under. Web after you have completed the child tax credit worksheet, use form 8812 to determine if you can take the additional credit. Maximum credit is $3,600 per qualifying child under. As @thomasm125 explained, the worksheet, credit. Common questions about the child tax credit and 8812 in proseries. Web schedule 8812 (form 1040). If you are using turbotax, you will not have to make the entries on form 8812. The schedule 8812 (form 1040) and its instructions have been revised to be the single source for figuring and reporting the child tax credits and. Child tax credit and credit for other dependents. Solved•by intuit•90•updated january 10, 2023. The additional child tax credit is only available to. Web you'll use form 8812 to calculate your additional child tax credit. For 2022, there are two parts to this form: Web 2021 schedule 8812 credit limit worksheet a keep for your records 1. Web march 30, 2023 11:45 am. Should be completed by all filers to claim the. The additional child tax credit is only available to. Common questions about the child tax credit and 8812 in proseries. Child tax credit and credit for other dependents. Web schedule 8812 (form 1040). Web after you have completed the child tax credit worksheet, use form 8812 to determine if you can take the additional credit. The schedule 8812 (form 1040) and its instructions have been revised to be the single source for figuring and reporting the child tax credits and. Web 2021 schedule 8812 credit limit worksheet a keep for your records 1. Web you'll use form 8812 to calculate your additional child tax credit. If you are using turbotax, you will not have to make the entries on form 8812. Web march 30, 2023 11:45 am. Solved•by intuit•90•updated january 10, 2023. Should be completed by all filers to claim the.Form 8812, Additional Child Tax Credit printable pdf download

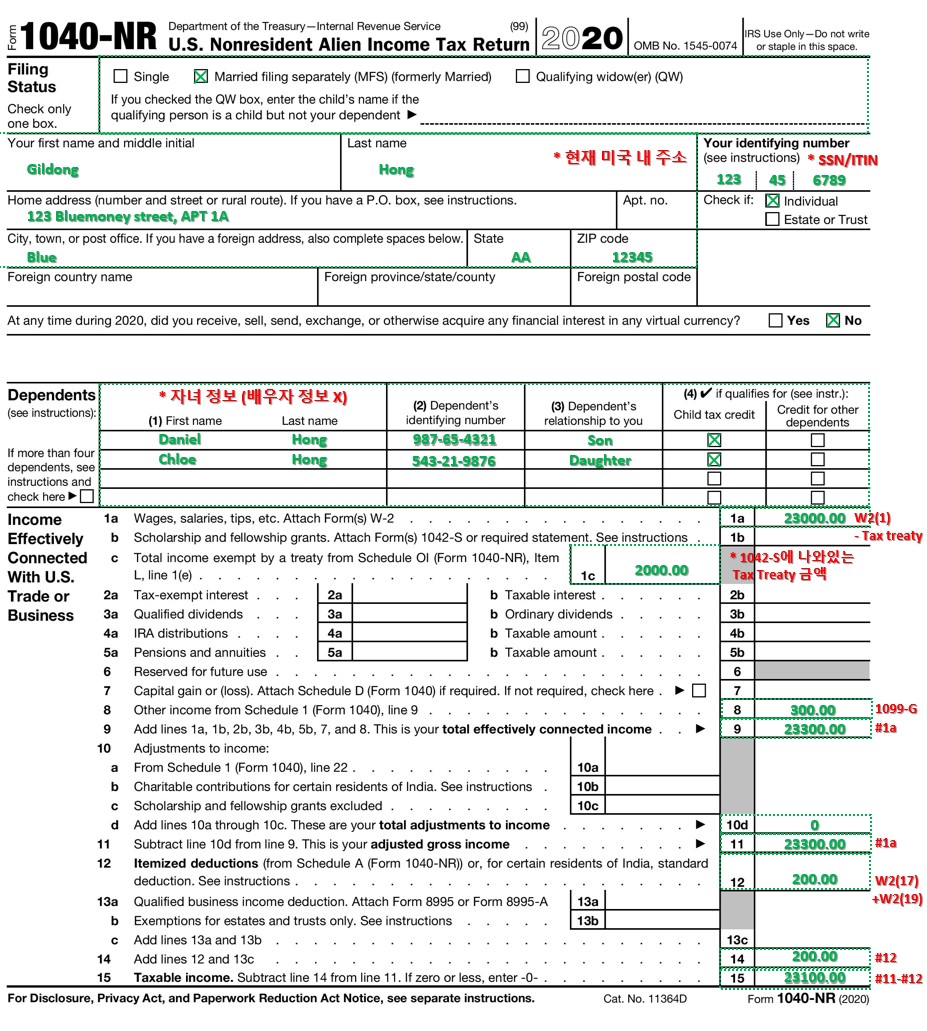

'IRS' 태그의 글 목록 Bluemoneyzone

Schedule 8812 What is IRS Form Schedule 8812 & Filing Instructions

2021 Instructions for Schedule 8812 (2021) Internal Revenue Service

Read PDF form 8863 credit limit worksheet (PDF) vcon.duhs.edu.pk

Schedule 8812 2022 for Child Tax Credit File Online Schedules TaxUni

Read PDF form 8863 credit limit worksheet (PDF) vcon.duhs.edu.pk

Credit limit worksheet Fill online, Printable, Fillable Blank

Child Tax Credit Worksheet Form 8812 Additional Child Tax Credit

Form 8812Additional Child Tax Credit

Maximum Credit Is $3,600 Per Qualifying Child Under.

As @Thomasm125 Explained, The Worksheet, Credit.

For 2022, There Are Two Parts To This Form:

Related Post: