Worksheet 2 941X

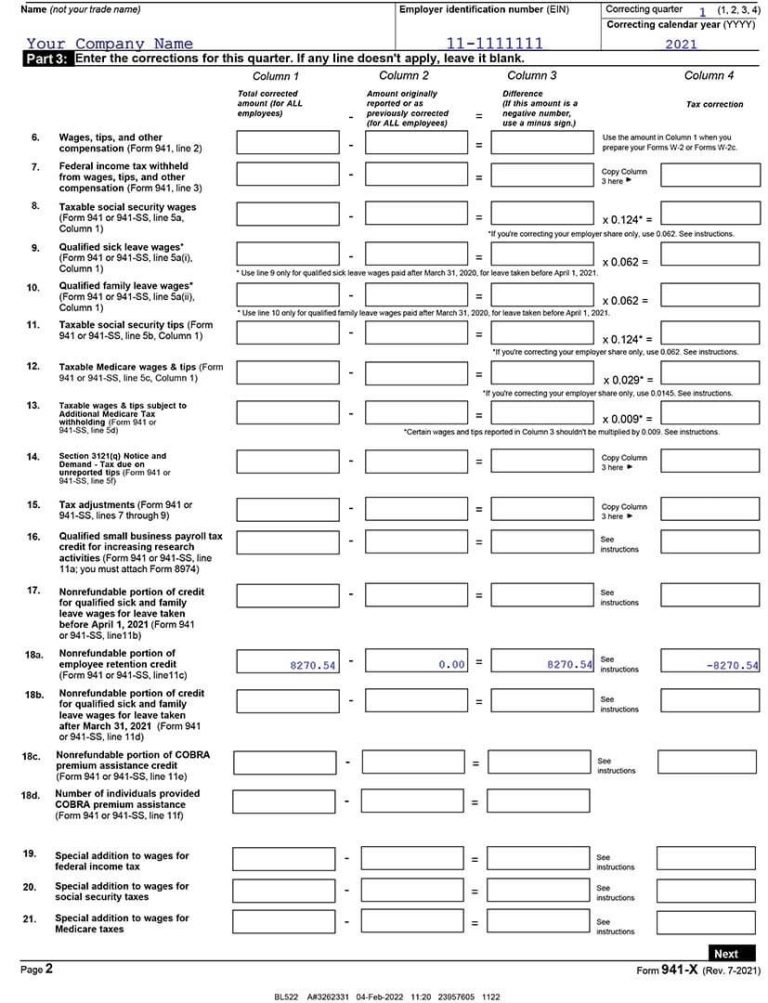

Worksheet 2 941X - Click the link to load the instructions from the irs website. The 941 ertc worksheets for the 2q 2021 have changed. Web after the second quarter of 2021, employers should no longer use 941 worksheet 2 to calculate the employee retention credit. Web generate 941 worksheet 2 (formerly worksheet 1) 2q 2021 for ertc? Web ertc calculation worksheet 2020 & 2021 (excel) irs links & ertc resources. Adjusted employee retention credit for qualified wages paid after march 12, 2020, and before july 1, 2021 keep for your records. You must use this worksheet if you claimed the employee retention credit for qualified wages paid after march 12, 2020, and before july 1, 2021, on. 9 steps to file for the ertc: Web the new form 941 worksheet 2 for q2 2021 should be completed by all employers that paid qualified wages for the employee retention credit after april 1, 2021. For the second quarter of. You must use this worksheet if you claimed the employee retention credit for qualified wages paid after march 12, 2020, and before july 1, 2021, on. Adjusted employee retention credit for qualified wages paid after march 12, 2020, and before july 1, 2021 keep for your records. Web generate 941 worksheet 2 (formerly worksheet 1) 2q 2021 for ertc? Web. Web ertc calculation worksheet 2020 & 2021 (excel) irs links & ertc resources. For the second quarter of. 9 steps to file for the ertc: You must use this worksheet if you claimed the employee retention credit for qualified wages paid after march 12, 2020, and before july 1, 2021, on. Web after the second quarter of 2021, employers should. The 941 ertc worksheets for the 2q 2021 have changed. Web generate 941 worksheet 2 (formerly worksheet 1) 2q 2021 for ertc? Web ertc calculation worksheet 2020 & 2021 (excel) irs links & ertc resources. 9 steps to file for the ertc: Adjusted employee retention credit for qualified wages paid after march 12, 2020, and before july 1, 2021 keep. For the second quarter of. Adjusted employee retention credit for qualified wages paid after march 12, 2020, and before july 1, 2021 keep for your records. Web ertc calculation worksheet 2020 & 2021 (excel) irs links & ertc resources. Web after the second quarter of 2021, employers should no longer use 941 worksheet 2 to calculate the employee retention credit.. You must use this worksheet if you claimed the employee retention credit for qualified wages paid after march 12, 2020, and before july 1, 2021, on. Web after the second quarter of 2021, employers should no longer use 941 worksheet 2 to calculate the employee retention credit. Web generate 941 worksheet 2 (formerly worksheet 1) 2q 2021 for ertc? Adjusted. Web ertc calculation worksheet 2020 & 2021 (excel) irs links & ertc resources. Web after the second quarter of 2021, employers should no longer use 941 worksheet 2 to calculate the employee retention credit. For the second quarter of. Web the new form 941 worksheet 2 for q2 2021 should be completed by all employers that paid qualified wages for. Click the link to load the instructions from the irs website. Web the new form 941 worksheet 2 for q2 2021 should be completed by all employers that paid qualified wages for the employee retention credit after april 1, 2021. Adjusted employee retention credit for qualified wages paid after march 12, 2020, and before july 1, 2021 keep for your. Click the link to load the instructions from the irs website. For the second quarter of. Web generate 941 worksheet 2 (formerly worksheet 1) 2q 2021 for ertc? Web after the second quarter of 2021, employers should no longer use 941 worksheet 2 to calculate the employee retention credit. 9 steps to file for the ertc: Web the new form 941 worksheet 2 for q2 2021 should be completed by all employers that paid qualified wages for the employee retention credit after april 1, 2021. Web generate 941 worksheet 2 (formerly worksheet 1) 2q 2021 for ertc? Adjusted employee retention credit for qualified wages paid after march 12, 2020, and before july 1, 2021 keep for. Adjusted employee retention credit for qualified wages paid after march 12, 2020, and before july 1, 2021 keep for your records. The 941 ertc worksheets for the 2q 2021 have changed. Web after the second quarter of 2021, employers should no longer use 941 worksheet 2 to calculate the employee retention credit. For the third and fourth quarters. Web the. Web generate 941 worksheet 2 (formerly worksheet 1) 2q 2021 for ertc? Web the new form 941 worksheet 2 for q2 2021 should be completed by all employers that paid qualified wages for the employee retention credit after april 1, 2021. The 941 ertc worksheets for the 2q 2021 have changed. For the third and fourth quarters. You must use this worksheet if you claimed the employee retention credit for qualified wages paid after march 12, 2020, and before july 1, 2021, on. Adjusted employee retention credit for qualified wages paid after march 12, 2020, and before july 1, 2021 keep for your records. 9 steps to file for the ertc: For the second quarter of. Web ertc calculation worksheet 2020 & 2021 (excel) irs links & ertc resources. Web after the second quarter of 2021, employers should no longer use 941 worksheet 2 to calculate the employee retention credit. Click the link to load the instructions from the irs website. Web the new form 941 worksheet 2 for q2 2021 should be completed by all employers that paid qualified wages for the employee retention credit after april 1, 2021. Web after the second quarter of 2021, employers should no longer use 941 worksheet 2 to calculate the employee retention credit. For the third and fourth quarters. You must use this worksheet if you claimed the employee retention credit for qualified wages paid after march 12, 2020, and before july 1, 2021, on. For the second quarter of. Web generate 941 worksheet 2 (formerly worksheet 1) 2q 2021 for ertc? Click the link to load the instructions from the irs website. The 941 ertc worksheets for the 2q 2021 have changed.Указания от формуляр 941 и данъчна ставка FICA 2019 [+ пощенски адрес

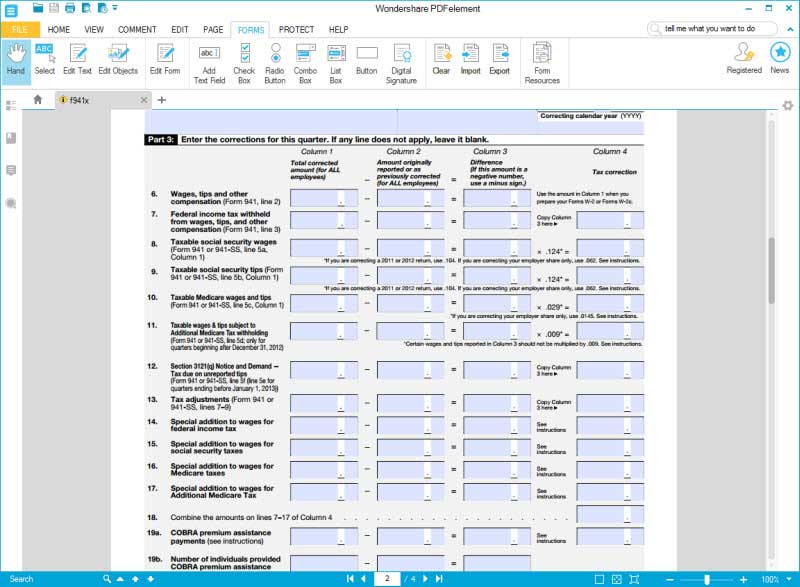

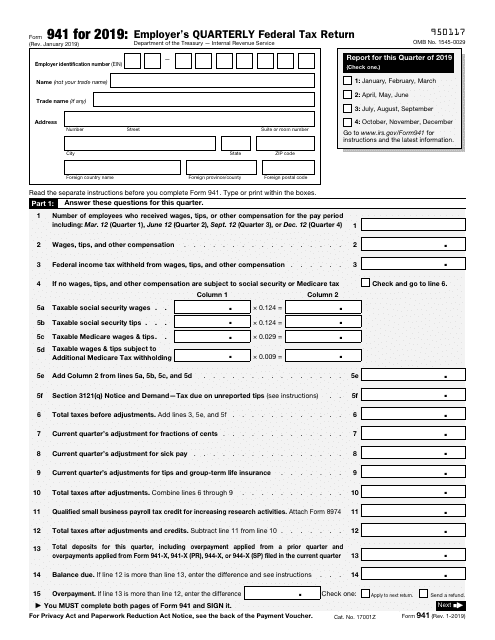

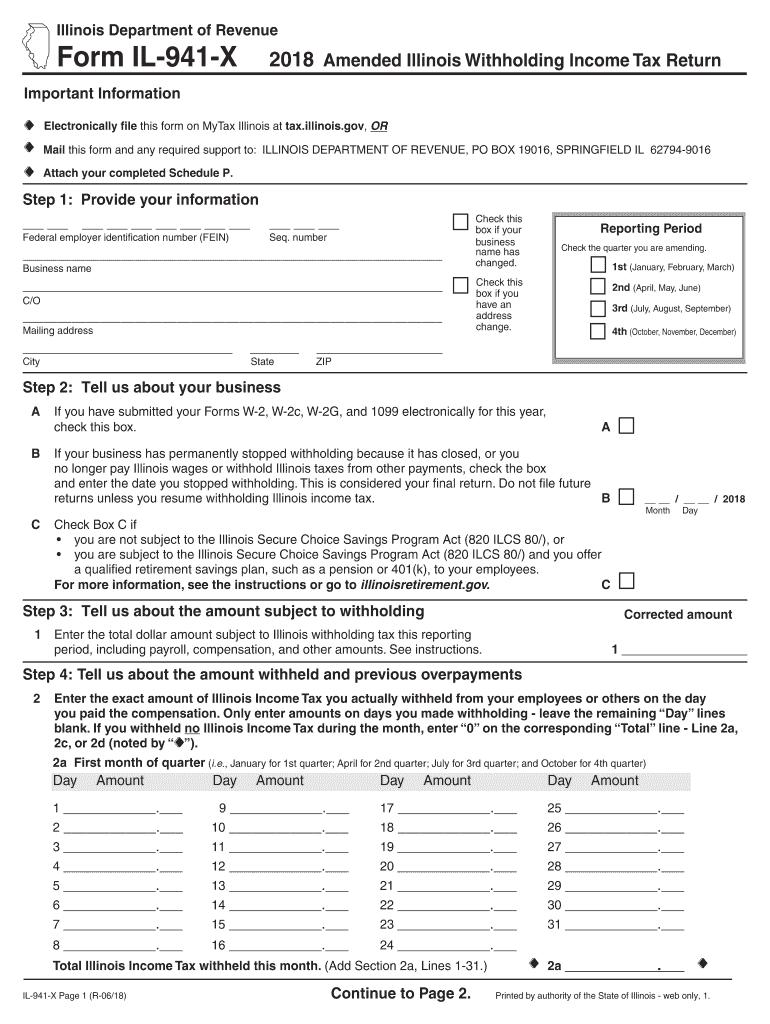

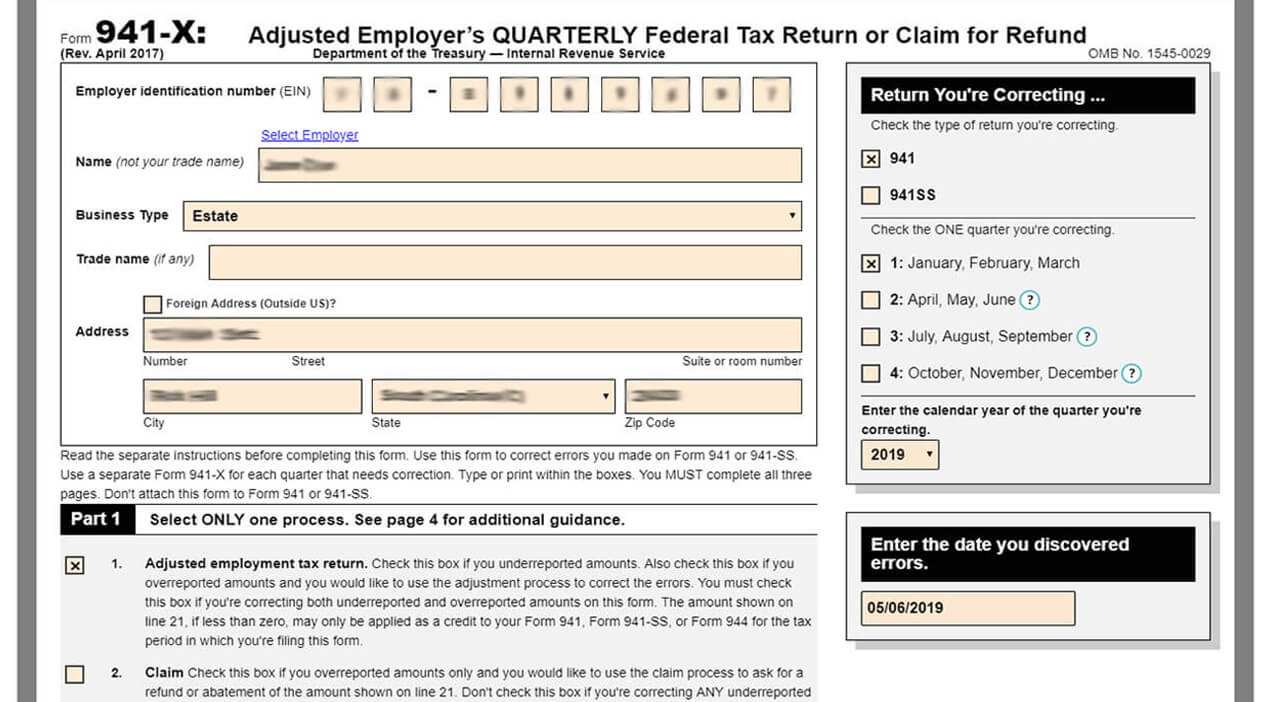

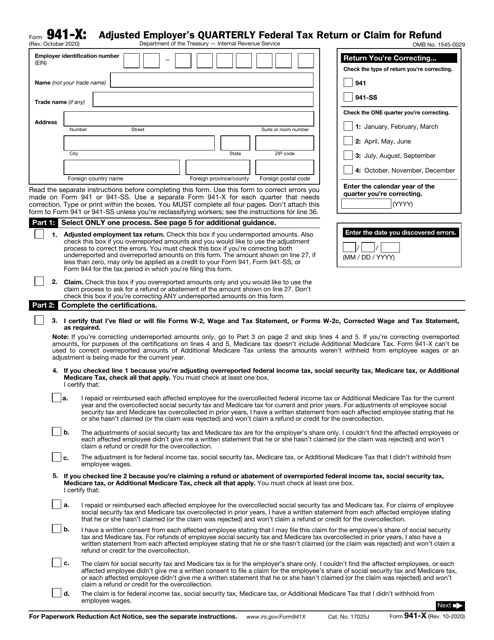

IRS Form 941X Learn How to Fill it Easily

IRS Form 941X Complete & Print 941X for 2022

form 941 worksheet 1 employee retention credit

Create And Download Form 941 X Fillable And Printable

How To Fill Out 941x For Employee Retention Credit TAX

2020 ezAccounting Business Software Offers New 941 Form For Coronavirus

How to Complete & Download Form 941X (Amended Form 941)?

IRS Form 941X Download Fillable PDF or Fill Online Adjusted Employer's

941 X Worksheet 2 Fillable Form Fillable Form 2022

Web Ertc Calculation Worksheet 2020 & 2021 (Excel) Irs Links & Ertc Resources.

Adjusted Employee Retention Credit For Qualified Wages Paid After March 12, 2020, And Before July 1, 2021 Keep For Your Records.

9 Steps To File For The Ertc:

Related Post: