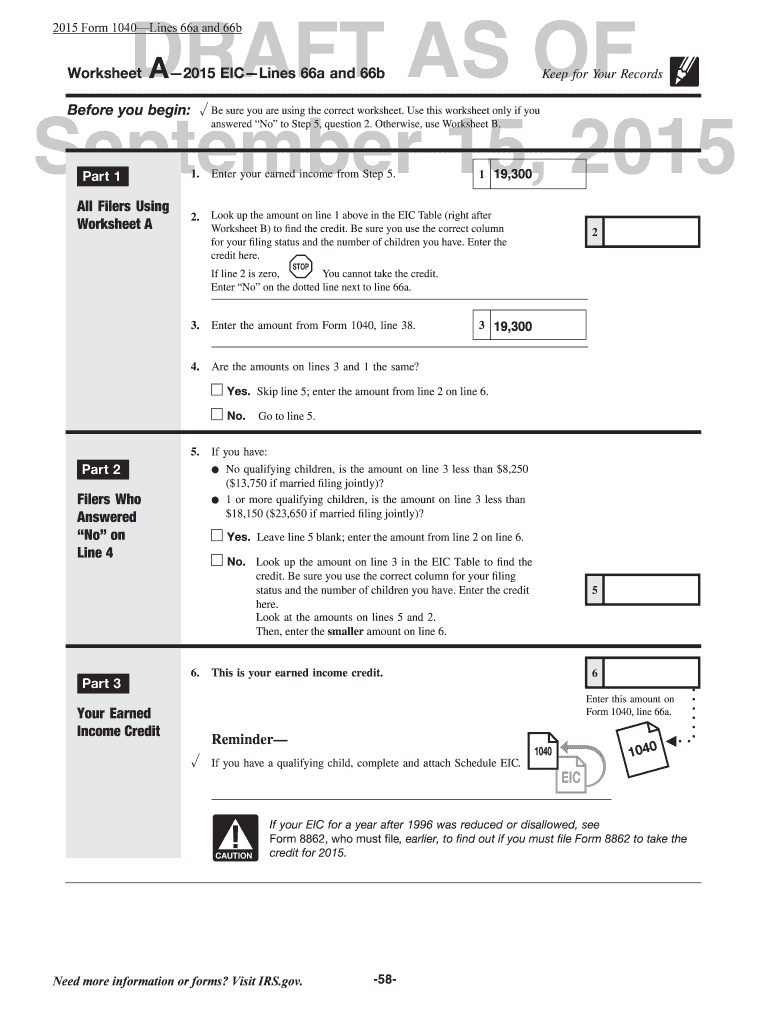

Worksheet For Earned Income Tax Credit

Worksheet For Earned Income Tax Credit - Once completed you can sign your fillable form or send for signing. Web earned income tax credit worksheet for tax year 2021. Could you, or your spouse if. Web if you were married filing jointly and earned less than $59,187 ($53,057 for individuals, surviving spouses or heads of household) in 2022, you may qualify for this. Income for irs sales tax calculator. Click forms in the top left corner of the screen. The irs sent cp27 to determine. Web you filed a tax return with the irs. Web the earned income credit (eic) is a refundable tax credit for most people who work but do not earn high incomes. All forms are printable and. The purpose of the eic is to reduce the tax burden and to. The irs sent cp27 to determine. 2 entry not required (and will be. Click to expand the federal folder, then click to expand the worksheets folder. This is set of 2 worksheets on percents and calculating discounts and final price.worksheet 1: The credit for nonresidents may not reduce the maine income tax to less than zero. Web you filed a tax return with the irs. Web the earned income credit (eic) is a refundable tax credit for most people who work but do not earn high incomes. 2 entry not required (and will be. The irs sent cp27 to determine. Web the earned income credit (eic) is a refundable tax credit for most people who work but do not earn high incomes. Based on your income, the irs determined that you may qualify for the earned income tax credit (eitc). Click forms in the top left corner of the screen. Web you filed a tax return with the irs. Income. Were you a nonresident alien for any part of the year? Once completed you can sign your fillable form or send for signing. Students will calculate tax and total price.worksheet 2:. Web earned income tax credit worksheet for tax year 2021. All forms are printable and. The irs sent cp27 to determine. Click forms in the top left corner of the screen. Web earned income tax credit worksheet for tax year 2021. The credit for nonresidents may not reduce the maine income tax to less than zero. If you qualify, you can use the credit to reduce the. This is set of 2 worksheets on percents and calculating discounts and final price.worksheet 1: Based on your income, the irs determined that you may qualify for the earned income tax credit (eitc). Students will calculate tax and total price.worksheet 2:. The credit for nonresidents may not reduce the maine income tax to less than zero. The purpose of the. Web tax due less all credits except amounts paid on withholding, estimated tax and extension payments. Students will calculate tax and total price.worksheet 2:. This is set of 2 worksheets on percents and calculating discounts and final price.worksheet 1: 2 entry not required (and will be. If you qualify, you can use the credit to reduce the. The amount of underpayment of estimated tax interest is computed at a rate. Based on your income, the irs determined that you may qualify for the earned income tax credit (eitc). Once completed you can sign your fillable form or send for signing. The purpose of the eic is to reduce the tax burden and to. Could you, or your. Web the earned income credit (eic) is a refundable tax credit for most people who work but do not earn high incomes. Click forms in the top left corner of the screen. Were you a nonresident alien for any part of the year? Web tax due less all credits except amounts paid on withholding, estimated tax and extension payments. Based. Income for irs sales tax calculator. Web the earned income credit (eic) is a refundable tax credit for most people who work but do not earn high incomes. Click to expand the federal folder, then click to expand the worksheets folder. Once completed you can sign your fillable form or send for signing. Web earned income tax credit worksheet for. The amount of underpayment of estimated tax interest is computed at a rate. Once completed you can sign your fillable form or send for signing. Could you, or your spouse if. Web use fill to complete blank online thetaxbook pdf forms for free. This is set of 2 worksheets on percents and calculating discounts and final price.worksheet 1: Income for irs sales tax calculator. All forms are printable and. Based on your income, the irs determined that you may qualify for the earned income tax credit (eitc). Web earned income tax credit worksheet for tax year 2021. Were you a nonresident alien for any part of the year? Web if you were married filing jointly and earned less than $59,187 ($53,057 for individuals, surviving spouses or heads of household) in 2022, you may qualify for this. 2 entry not required (and will be. Students will calculate tax and total price.worksheet 2:. Web you filed a tax return with the irs. Click to expand the federal folder, then click to expand the worksheets folder. If you qualify, you can use the credit to reduce the. Click forms in the top left corner of the screen. Web the earned income credit (eic) is a refundable tax credit for most people who work but do not earn high incomes. The purpose of the eic is to reduce the tax burden and to. The credit for nonresidents may not reduce the maine income tax to less than zero. This is set of 2 worksheets on percents and calculating discounts and final price.worksheet 1: Web tax due less all credits except amounts paid on withholding, estimated tax and extension payments. Web if you were married filing jointly and earned less than $59,187 ($53,057 for individuals, surviving spouses or heads of household) in 2022, you may qualify for this. Students will calculate tax and total price.worksheet 2:. Based on your income, the irs determined that you may qualify for the earned income tax credit (eitc). Web use fill to complete blank online thetaxbook pdf forms for free. If you qualify, you can use the credit to reduce the. Click forms in the top left corner of the screen. The irs sent cp27 to determine. Once completed you can sign your fillable form or send for signing. The credit for nonresidents may not reduce the maine income tax to less than zero. The amount of underpayment of estimated tax interest is computed at a rate. Web earned income tax credit worksheet for tax year 2021. Click to expand the federal folder, then click to expand the worksheets folder. Web the earned income credit (eic) is a refundable tax credit for most people who work but do not earn high incomes. All forms are printable and.Earned Credit Worksheet • Worksheetforall —

Earned Credit Worksheet 2016 Multiplication Worksheets Grade

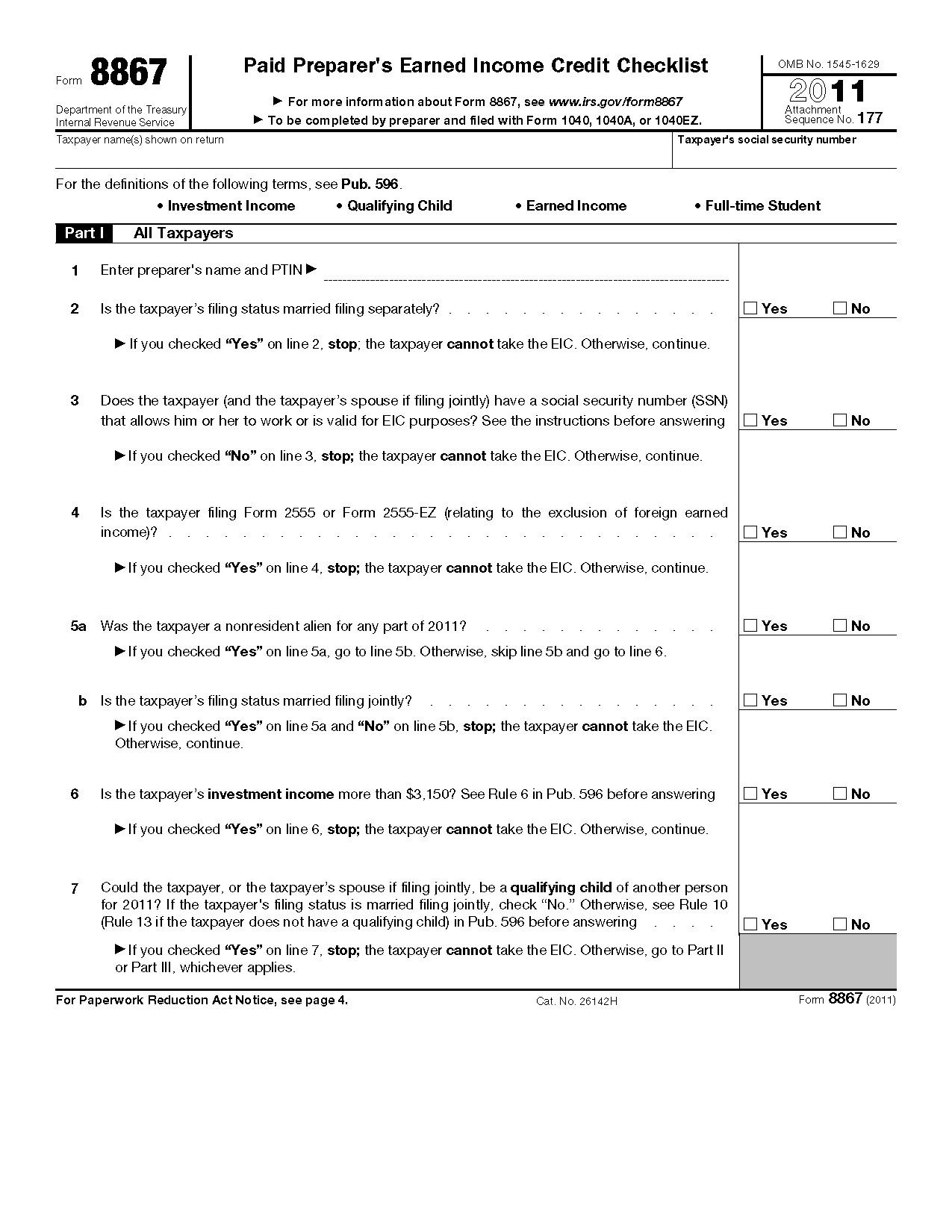

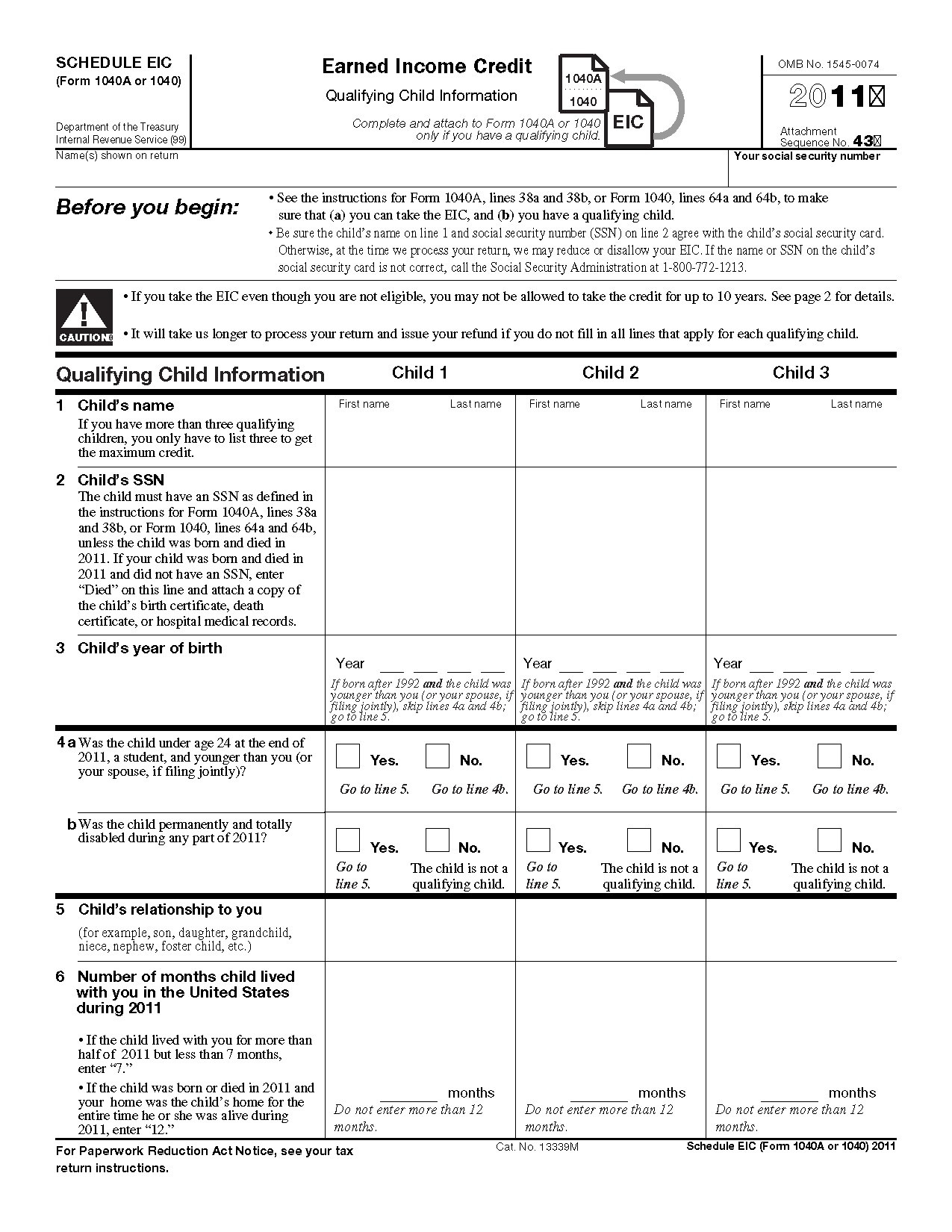

5 Printable EIC Worksheet /

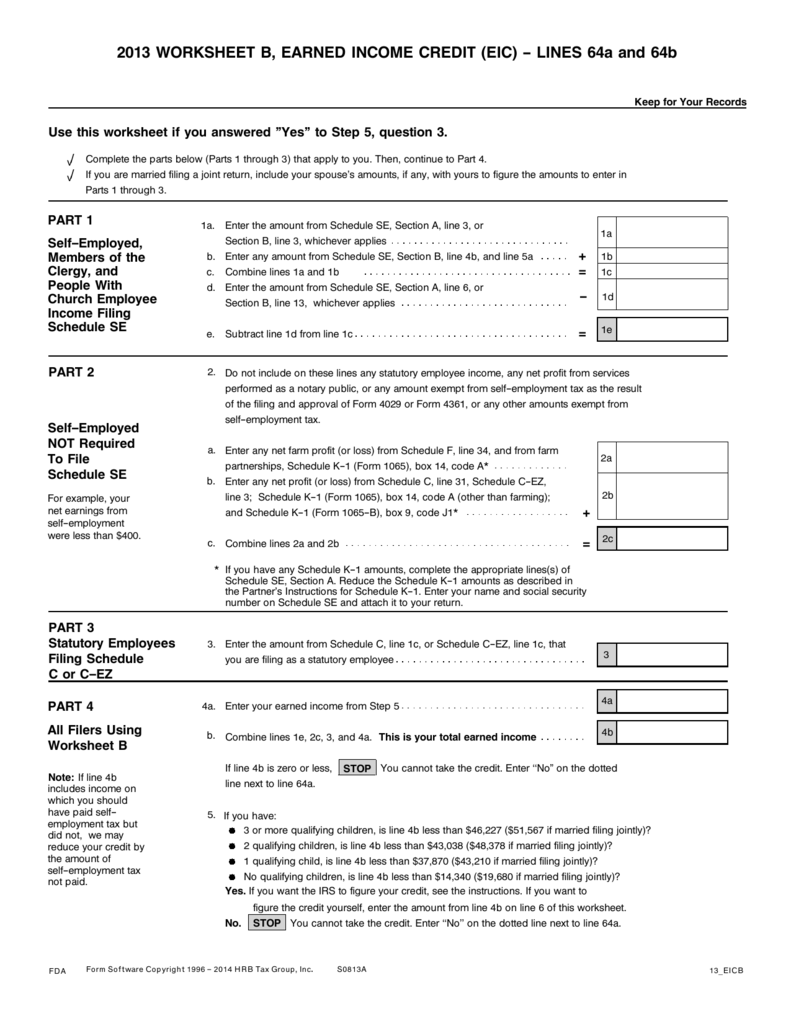

2013 WORKSHEET B, EARNED CREDIT (EIC)

10++ Child Tax Credit Worksheet Worksheets Decoomo

Earned Credit Worksheet 2016 worksheet

Publication 972 Child Tax Credit; Child Tax Credit Worksheet

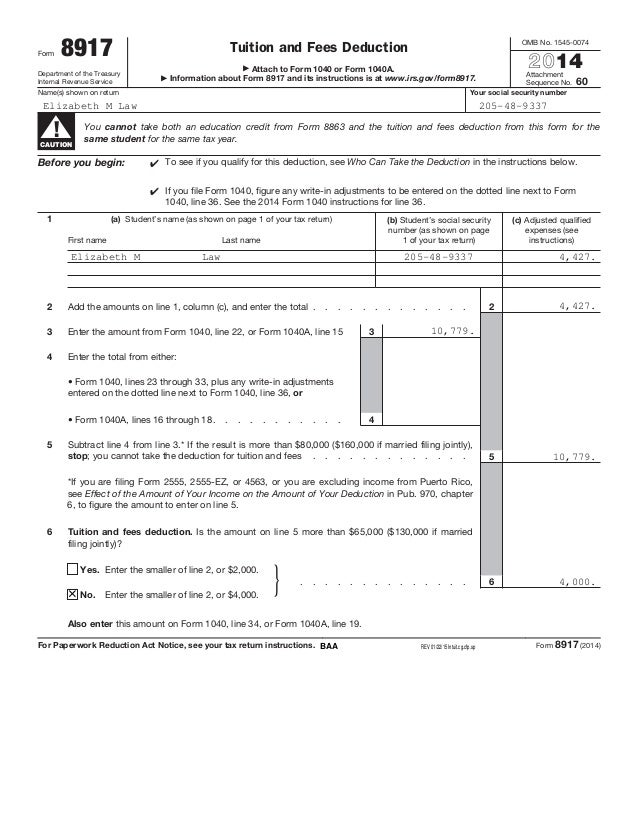

Earned Credit 2014 Worksheet Adriaticatoursrl Worksheet

1040 (2022) Internal Revenue Service

Earned Credit Worksheet —

The Purpose Of The Eic Is To Reduce The Tax Burden And To.

Could You, Or Your Spouse If.

Web You Filed A Tax Return With The Irs.

Were You A Nonresident Alien For Any Part Of The Year?

Related Post: