Worksheet For Form 8812

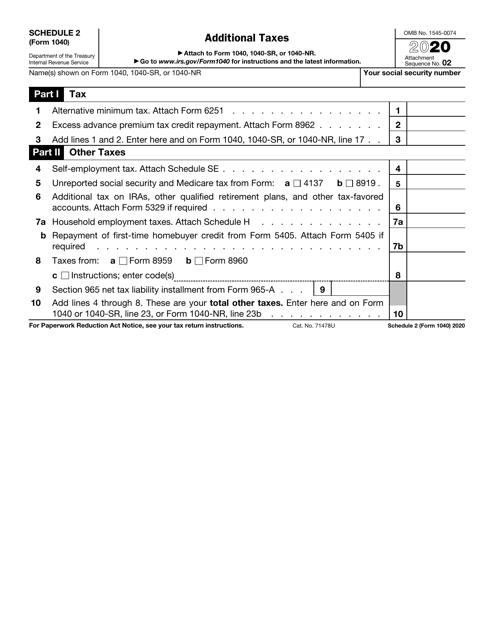

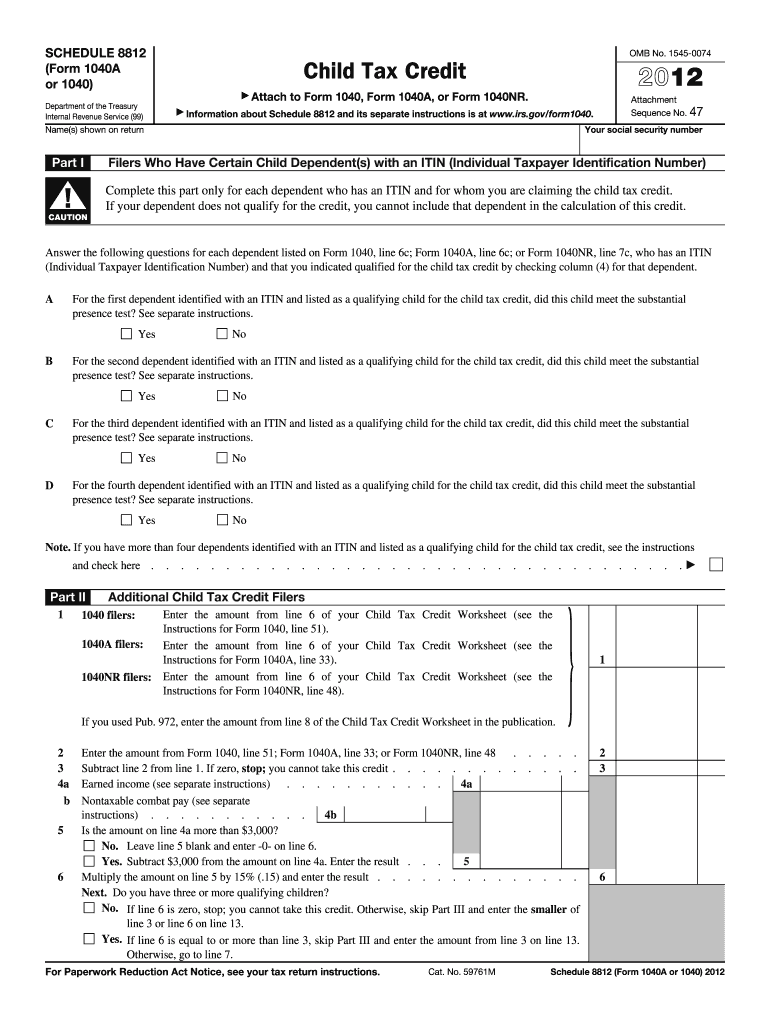

Worksheet For Form 8812 - Web taxpayer may be able to qualify for the refundable additional child tax credit on schedule 8812, credits. Send filled & signed form 8812 worksheet or save. I can't find the line 5 worksheet for schedule 8812 anywhere in my turbotax output. Under file \ print, i selected the option. You cannot claim the additional child tax credit. Why isn't the child tax credit calculating? Go digital and save time with signnow, the best. I discuss the 3,600 and 3,000 child tax credit amo. In this chapter, we will. Easily sign the 8812 form with your finger. Open the irs child tax credit 2019 and follow the instructions. In this chapter, we will. Printing and scanning is no longer the best way to manage documents. Web schedule 8812 (form 1040). I discuss the 3,600 and 3,000 child tax credit amo. If the child tax credit isn't. Web schedule 8812, which can be found on form 1040, is used to evaluate the additional repayable credit recognized as “the additional child tax credit.”. Easily sign the 8812 form with your finger. Web handy tips for filling out 8812 instructions tax form online. You cannot claim the additional child tax credit. I can't find the line 5 worksheet for schedule 8812 anywhere in my turbotax output. I discuss the 3,600 and 3,000 child tax credit amo. Easily sign the 8812 form with your finger. Open the irs child tax credit 2019 and follow the instructions. The calculation of the additional child tax credit is dependent on the amount of your 'earned. For qualifying children and other dependents. Why isn't the child tax credit calculating? The calculation of the additional child tax credit is dependent on the amount of your 'earned income' and the number of qualifying children you have. If you file form 2555, stop here; Web schedule 8812 (form 1040). Printing and scanning is no longer the best way to manage documents. In this chapter, we will. I can't find the line 5 worksheet for schedule 8812 anywhere in my turbotax output. I discuss the 3,600 and 3,000 child tax credit amo. Go digital and save time with signnow, the best. Easily sign the 8812 form with your finger. If the child tax credit isn't. If you file form 2555, stop here; I can't find the line 5 worksheet for schedule 8812 anywhere in my turbotax output. The calculation of the additional child tax credit is dependent on the amount of your 'earned income' and the number of qualifying children you. For qualifying children and other dependents. If the child tax credit isn't. Web schedule 8812 (form 1040). You cannot claim the additional child tax credit. If you file form 2555, stop here; The calculation of the additional child tax credit is dependent on the amount of your 'earned income' and the number of qualifying children you have. Go digital and save time with signnow, the best. I can't find the line 5 worksheet for schedule 8812 anywhere in my turbotax output. If you file form 2555, stop here; Under file \ print,. Web schedule 8812, which can be found on form 1040, is used to evaluate the additional repayable credit recognized as “the additional child tax credit.”. Send filled & signed form 8812 worksheet or save. Why isn't the child tax credit calculating? Web schedule 8812 (form 1040). If you file form 2555, stop here; If the child tax credit isn't. Web schedule 8812, which can be found on form 1040, is used to evaluate the additional repayable credit recognized as “the additional child tax credit.”. You cannot claim the additional child tax credit. Web 8812 ` name(s) shown on return your social security number part i all filers caution: I can't find the line. Printing and scanning is no longer the best way to manage documents. If you file form 2555, stop here; You cannot claim the additional child tax credit. Go digital and save time with signnow, the best. I discuss the 3,600 and 3,000 child tax credit amo. Open the irs child tax credit 2019 and follow the instructions. Send filled & signed form 8812 worksheet or save. In this chapter, we will. Web taxpayer may be able to qualify for the refundable additional child tax credit on schedule 8812, credits. Web schedule 8812, which can be found on form 1040, is used to evaluate the additional repayable credit recognized as “the additional child tax credit.”. If the child tax credit isn't. Web handy tips for filling out 8812 instructions tax form online. For qualifying children and other dependents. Web schedule 8812 (form 1040). Why isn't the child tax credit calculating? I can't find the line 5 worksheet for schedule 8812 anywhere in my turbotax output. The calculation of the additional child tax credit is dependent on the amount of your 'earned income' and the number of qualifying children you have. Web schedule 8812 line 5 worksheet. Web 8812 ` name(s) shown on return your social security number part i all filers caution: Web in this video i discuss how to fill out out the child tax credit schedule, schedule 8812 on the form 1040. Send filled & signed form 8812 worksheet or save. If you file form 2555, stop here; Web schedule 8812 (form 1040). Web handy tips for filling out 8812 instructions tax form online. Easily sign the 8812 form with your finger. Open the irs child tax credit 2019 and follow the instructions. Go digital and save time with signnow, the best. Why isn't the child tax credit calculating? Web 8812 ` name(s) shown on return your social security number part i all filers caution: Printing and scanning is no longer the best way to manage documents. I discuss the 3,600 and 3,000 child tax credit amo. If the child tax credit isn't. You cannot claim the additional child tax credit. Web schedule 8812 line 5 worksheet. Web in this video i discuss how to fill out out the child tax credit schedule, schedule 8812 on the form 1040. Web schedule 8812, which can be found on form 1040, is used to evaluate the additional repayable credit recognized as “the additional child tax credit.”.Child Tax Credit 2020 Form 8812 Child Tax Credit 2020 Federal Tax

Form 8812 Line 5 Worksheet ideas 2022

2021 Instructions for Schedule 8812 (2021) Internal Revenue Service

Publication 17 Your Federal Tax; Additional Child Tax Credit

Child Tax Credit Worksheet Form 8812 Additional Child Tax Credit

8812 Schedule Form Fill Out and Sign Printable PDF Template signNow

10++ Child Tax Credit Worksheet Worksheets Decoomo

Form 8812 Worksheet Download Child Tax Credit Calculator Excel

Form 8812Additional Child Tax Credit

Form 8812 Fill Out and Sign Printable PDF Template signNow

In This Chapter, We Will.

I Can't Find The Line 5 Worksheet For Schedule 8812 Anywhere In My Turbotax Output.

For Qualifying Children And Other Dependents.

Web Taxpayer May Be Able To Qualify For The Refundable Additional Child Tax Credit On Schedule 8812, Credits.

Related Post: