28 Rate Gain Worksheet Requirements

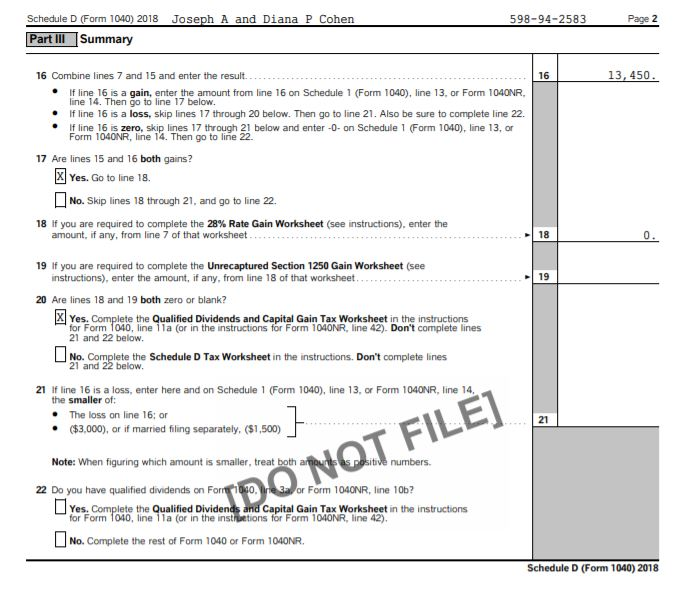

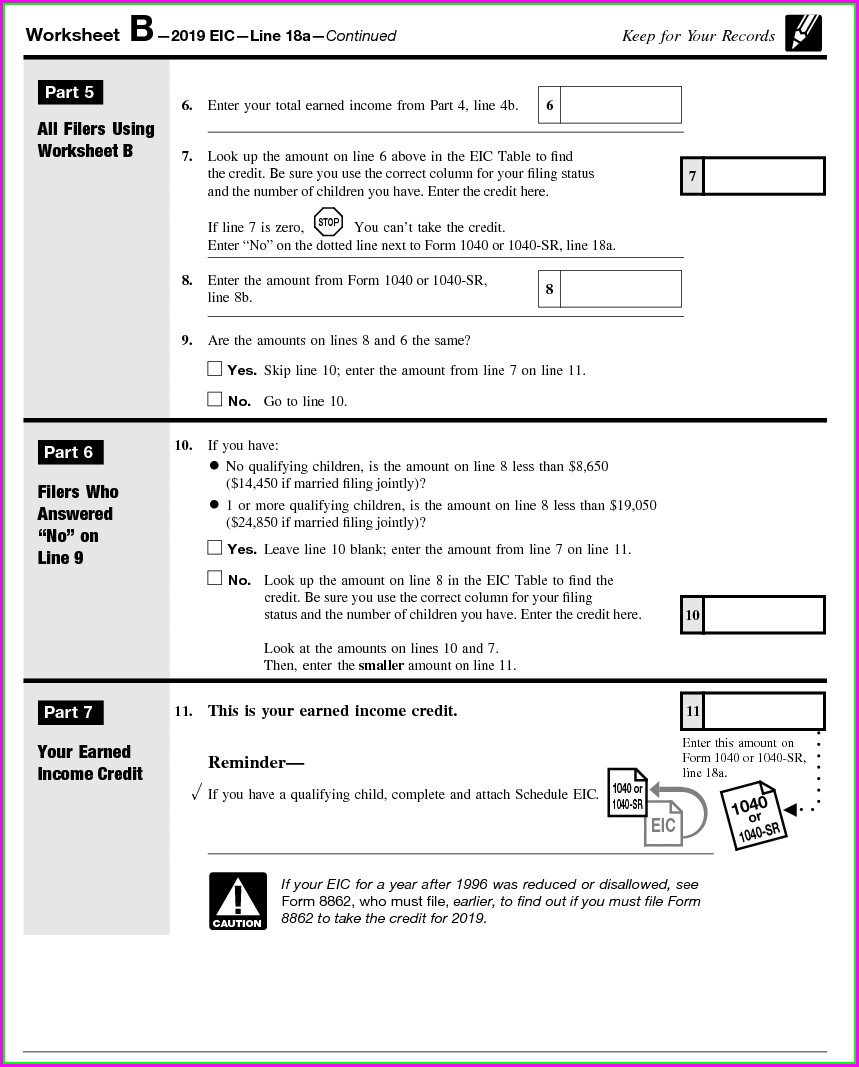

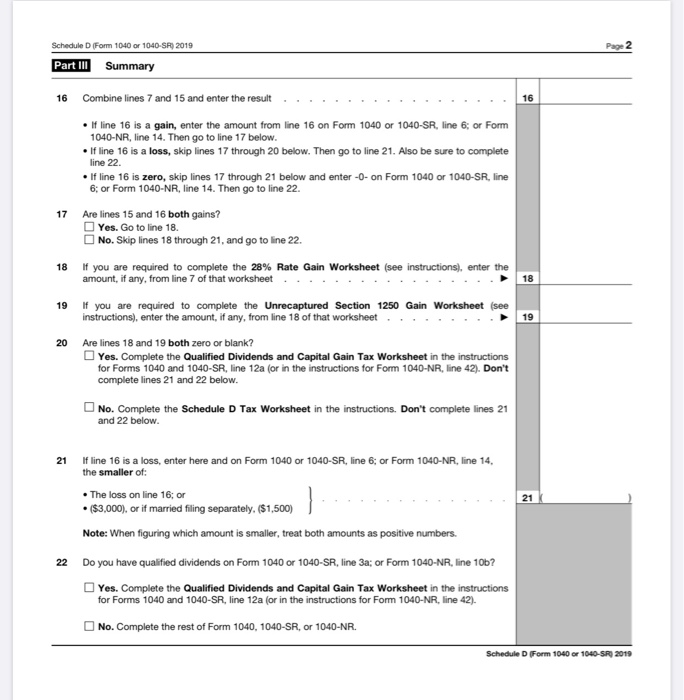

28 Rate Gain Worksheet Requirements - Web on lines 10 and 11 of worksheet b, the owner taxpayer must report the total amount of collectibles gain and/or unrecaptured section 1250 gain for the taxable year that the. Enter the total of all collectibles gain or (loss) from items you reported on form 8949, part ii. If required, use this amount when completing the 28% rate. Web to access the both worksheets in taxslayer pro, from the main menu of the tax return (form 1040) select: Lacerte calculates the 28% rate on capital gains. Web 28% rate gain worksheet—line 18 keep for your records 1. Web a capital gain rate of 28% applies if your taxable income is more than $40,400 but less than or equal to $445,850 for single; On line 18 & 19 of. 2d.collectibles (28%) gain—shows 28% rate gain from sales or exchanges of collectibles. Amounts entered on this line will automatically flow to a 28 rate gain worksheet line. Web a capital gain rate of 28% applies if your taxable income is more than $40,400 but less than or equal to $445,850 for single; Amounts entered on this line will automatically flow to a 28 rate gain worksheet line. If required, use this amount when completing the 28% rate. On line 18 & 19 of. 2d.collectibles (28%) gain—shows 28%. On line 18 & 19 of. Web a capital gain rate of 28% applies if your taxable income is more than $40,400 but less than or equal to $445,850 for single; 2d.collectibles (28%) gain—shows 28% rate gain from sales or exchanges of collectibles. How do i know if i am required to complete the unrecaptured section 1250 gain worksheet? Section. 28% rate gain and unrecapture 1250 worksheet capital loss carryover forced. Amounts entered on this line will automatically flow to a 28 rate gain worksheet line. Web on lines 10 and 11 of worksheet b, the owner taxpayer must report the total amount of collectibles gain and/or unrecaptured section 1250 gain for the taxable year that the. Web a capital. Web section 1202 gain to report. Enter the total of all collectibles gain or (loss) from items you reported on form 8949, part ii. Web a capital gain rate of 28% applies if your taxable income is more than $40,400 but less than or equal to $445,850 for single; Web the answer was zero. 28% rate gain and unrecapture 1250. If required, use this amount when completing the 28% rate. Web calculating the capital gains 28% rate in lacerte. Web section 1202 gain to report. Amounts entered on this line will automatically flow to a 28 rate gain worksheet line. Web 28% rate gain worksheet—line 18 keep for your records 1. 28% rate gain and unrecapture 1250 worksheet capital loss carryover forced. Web the 28 rate gain worksheet is a powerful financial tool developed by the national association of realtors® to help real estate investors maximize their investment. I believe both lines 18 or 19 are zero. Enter the total of all collectibles gain or (loss) from items you reported on. Web section 1202 gain to report. Web calculating the capital gains 28% rate in lacerte. Web you will need to complete the 28% rate gain worksheet in the schedule d instructions. Web 28% rate gain worksheet—line 18 keep for your records 1. Web the answer was zero. If required, use this amount when completing the 28% rate. Web on lines 10 and 11 of worksheet b, the owner taxpayer must report the total amount of collectibles gain and/or unrecaptured section 1250 gain for the taxable year that the. Amounts entered on this line will automatically flow to a 28 rate gain worksheet line. Enter the total of. Web calculating the capital gains 28% rate in lacerte. 2d.collectibles (28%) gain—shows 28% rate gain from sales or exchanges of collectibles. How do i know if i am required to complete the unrecaptured section 1250 gain worksheet? Capital gain/loss (sch d) other. Web the 28 rate gain worksheet is a powerful financial tool developed by the national association of realtors®. Web to access the both worksheets in taxslayer pro, from the main menu of the tax return (form 1040) select: Web the 28 rate gain worksheet is a powerful financial tool developed by the national association of realtors® to help real estate investors maximize their investment. Web 28% rate gain worksheet—line 18 keep for your records 1. 2d.collectibles (28%) gain—shows. Enter the total of all collectibles gain or (loss) from items you reported on form 8949, part ii. Web the answer was zero. Web a capital gain rate of 28% applies if your taxable income is more than $40,400 but less than or equal to $445,850 for single; Lacerte calculates the 28% rate on capital gains. How do i know if i am required to complete the unrecaptured section 1250 gain worksheet? Capital gain/loss (sch d) other. I believe both lines 18 or 19 are zero. Web 28% rate gain worksheet—line 18 keep for your records 1. If required, use this amount when completing the 28% rate. Amounts entered on this line will automatically flow to a 28 rate gain worksheet line. Section 1202 gain will appear in box 2(c) of the form and will be reported on schedule d, line 13, of your individual tax return. More than $80,800 but less than or. Web you will need to complete the 28% rate gain worksheet in the schedule d instructions. Web section 1202 gain to report. 28% rate gain and unrecapture 1250 worksheet capital loss carryover forced. 2d.collectibles (28%) gain—shows 28% rate gain from sales or exchanges of collectibles. Web on lines 10 and 11 of worksheet b, the owner taxpayer must report the total amount of collectibles gain and/or unrecaptured section 1250 gain for the taxable year that the. On line 18 & 19 of. Web the 28 rate gain worksheet is a powerful financial tool developed by the national association of realtors® to help real estate investors maximize their investment. Solved•by intuit•48•updated november 14, 2022. More than $80,800 but less than or. Web calculating the capital gains 28% rate in lacerte. Solved•by intuit•48•updated november 14, 2022. Web a capital gain rate of 28% applies if your taxable income is more than $40,400 but less than or equal to $445,850 for single; 2d.collectibles (28%) gain—shows 28% rate gain from sales or exchanges of collectibles. Web on lines 10 and 11 of worksheet b, the owner taxpayer must report the total amount of collectibles gain and/or unrecaptured section 1250 gain for the taxable year that the. If required, use this amount when completing the 28% rate. Amounts entered on this line will automatically flow to a 28 rate gain worksheet line. 28% rate gain and unrecapture 1250 worksheet capital loss carryover forced. I believe both lines 18 or 19 are zero. Lacerte calculates the 28% rate on capital gains. Enter the total of all collectibles gain or (loss) from items you reported on form 8949, part ii. Web the answer was zero. Web section 1202 gain to report. On line 18 & 19 of. Web to access the both worksheets in taxslayer pro, from the main menu of the tax return (form 1040) select:Play The Script Till The End Cbt

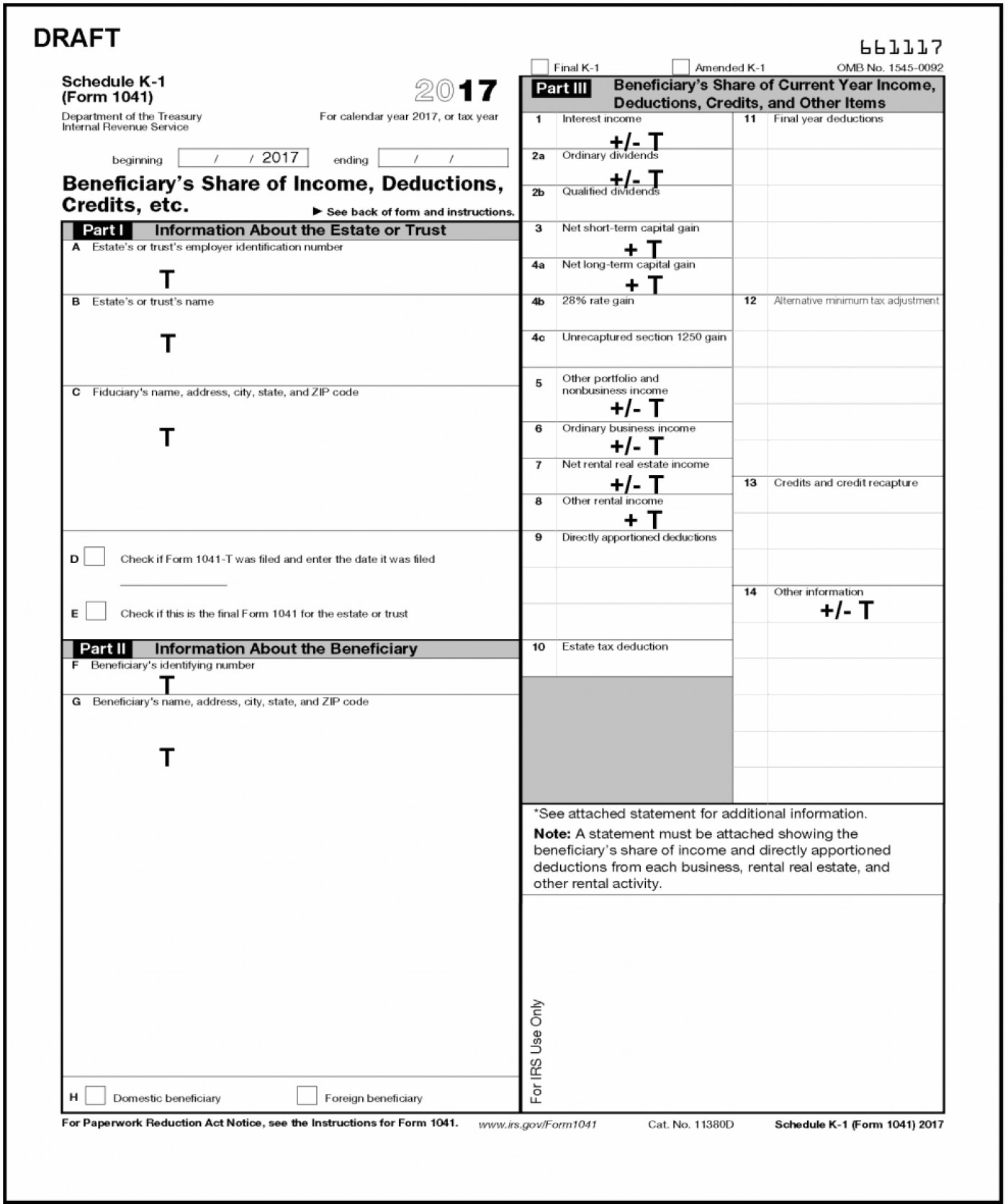

tax worksheet for students

Qualified Dividends and Capital Gain Tax Worksheet 2016

1040 28 Rate Gain Worksheet Worksheet Template Design

10++ 28 Rate Gain Worksheet Worksheets Decoomo

28 Rate Gain Worksheet 2016

Capital Gains Worksheet Part 3 Line 1 Worksheet Resume Examples

1040 28 Rate Gain Worksheet Worksheet Template Design

1040 28 Rate Gain Worksheet Worksheet Template Design

28 Rate Gain Worksheet 2016 —

Web You Will Need To Complete The 28% Rate Gain Worksheet In The Schedule D Instructions.

Capital Gain/Loss (Sch D) Other.

Section 1202 Gain Will Appear In Box 2(C) Of The Form And Will Be Reported On Schedule D, Line 13, Of Your Individual Tax Return.

Web 28% Rate Gain Worksheet—Line 18 Keep For Your Records 1.

Related Post: