Nebraska Inheritance Tax Worksheet

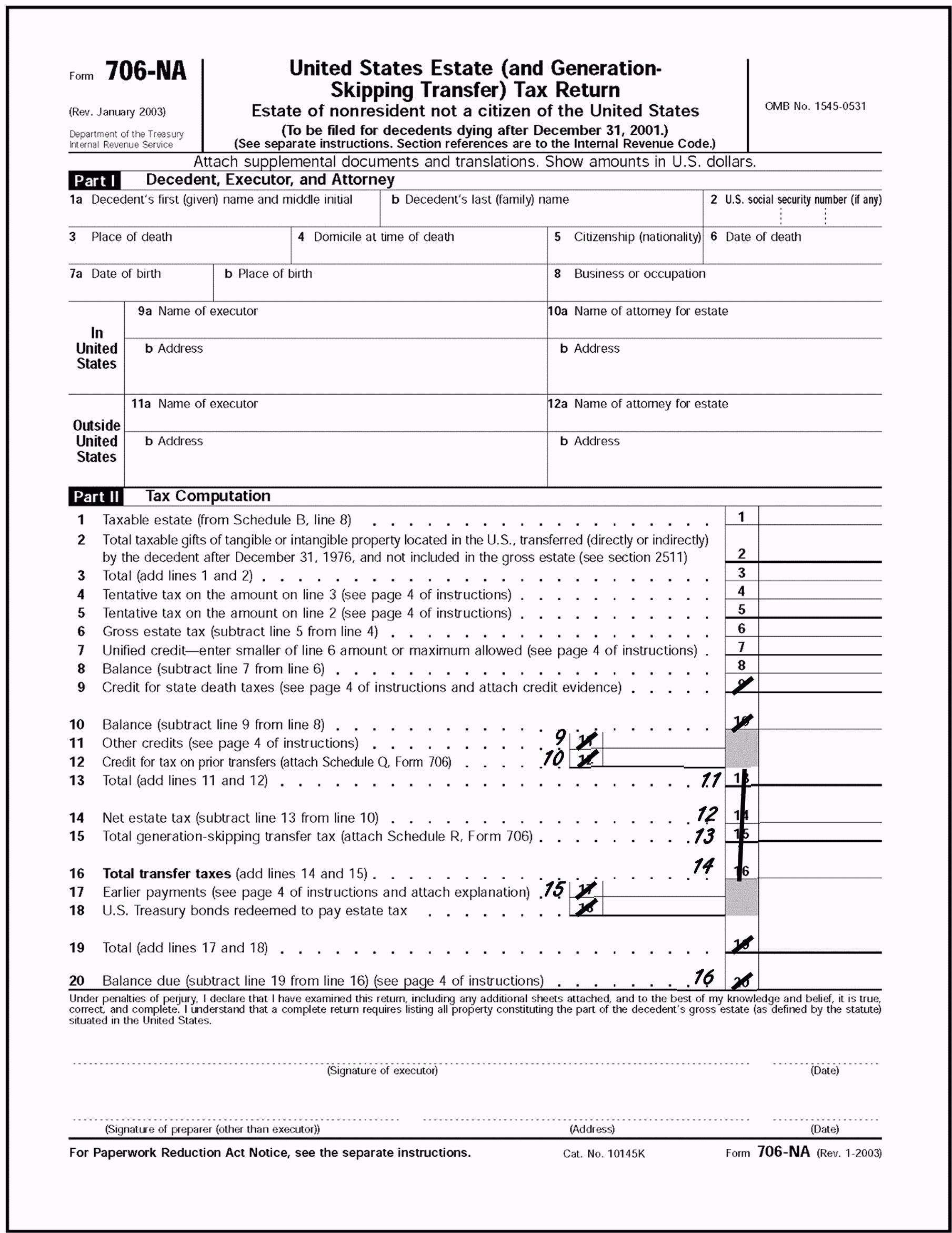

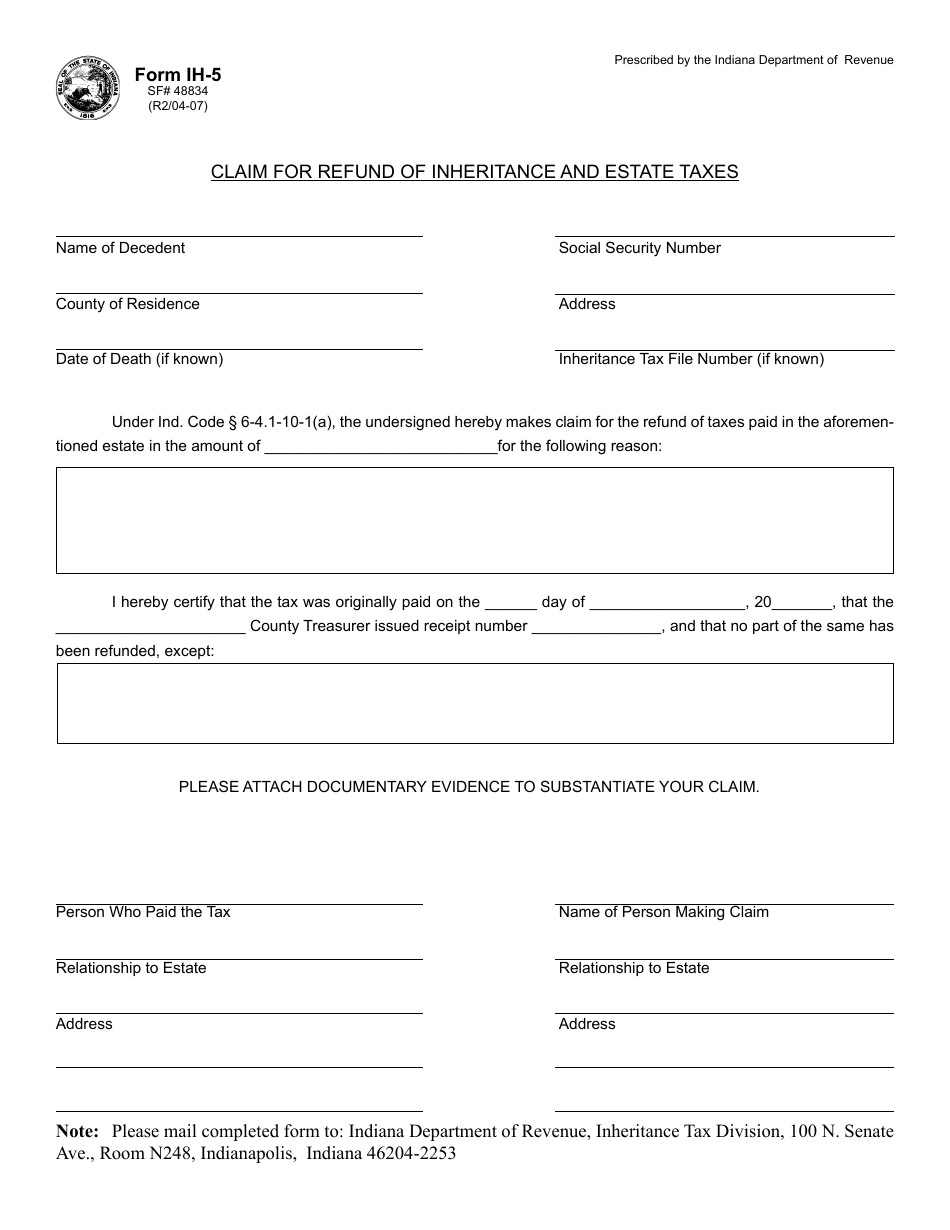

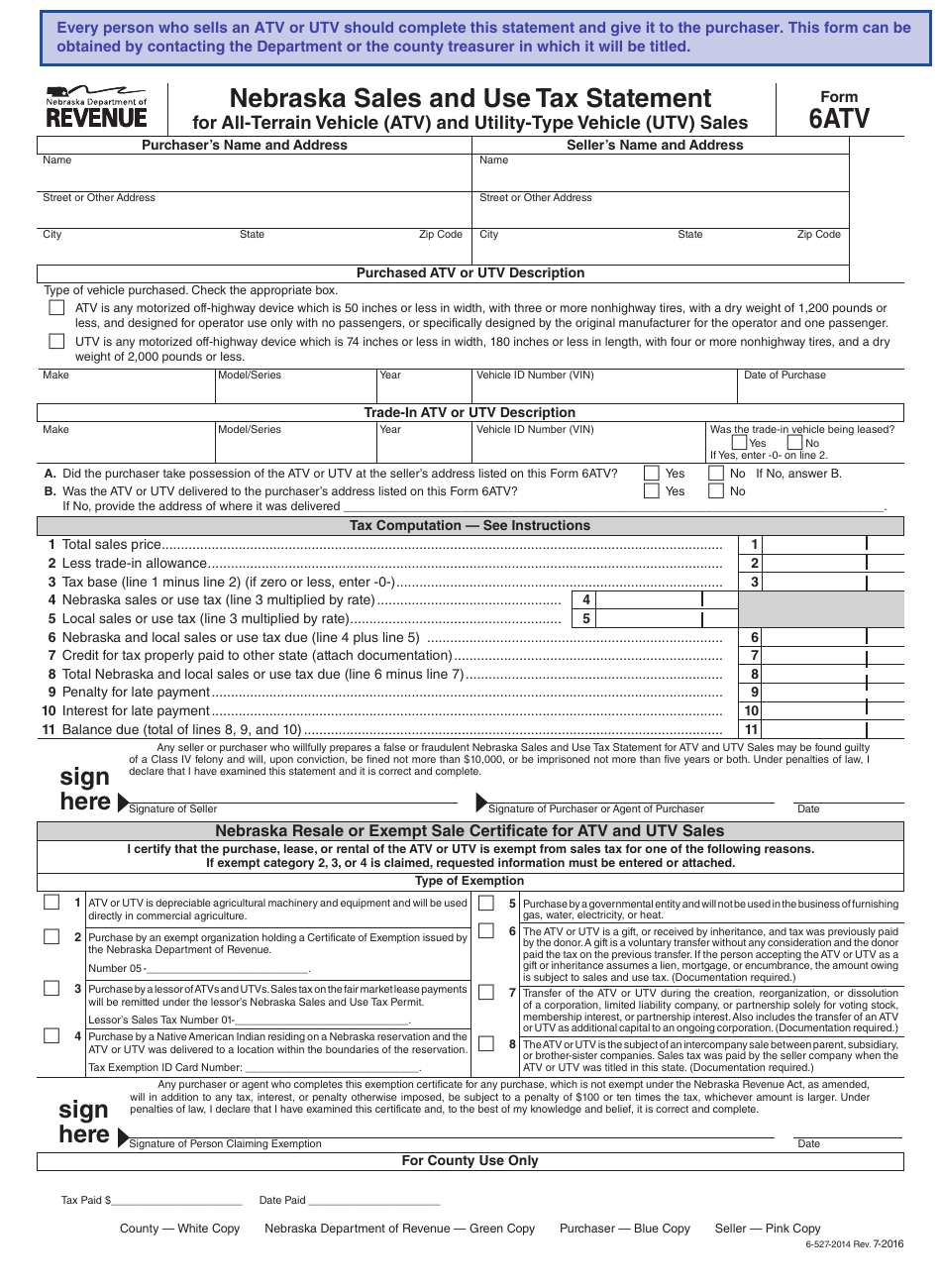

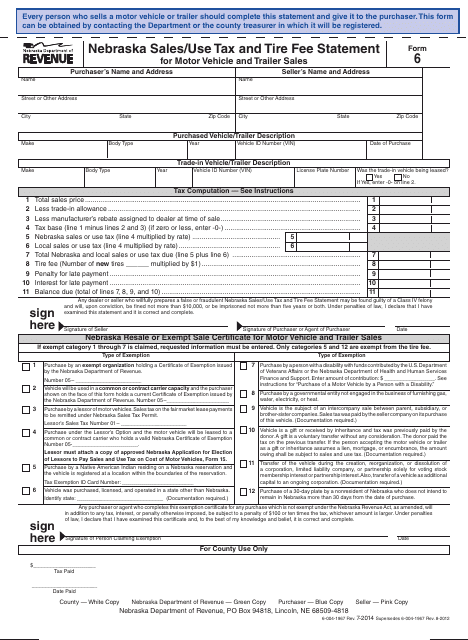

Nebraska Inheritance Tax Worksheet - Get your online template and fill it in using progressive features. Web any inheritance tax due must be paid within one year of the decedent’s date of death. Web complete nebraska inheritance tax worksheet form online with us legal forms. Web the tax is a state of nebraska inheritance tax but the county receives the money. Web the burden of paying nebraska’s inheritance tax ultimately falls upon those who inherit the property, not the estate. Easily sign the nebraska inheritance tax form with your finger. This excel file assists lawyers with calculating inheritance tax. Web how to fill out and sign inheritance tax worksheet nebraska online? Numeric listing of all current nebraska tax forms. Beneficiaries inheriting property pay an. Easily fill out pdf blank, edit, and sign them. Enjoy smart fillable fields and. Get your online template and fill it in using progressive features. Web the tax is a state of nebraska inheritance tax but the county receives the money. Web how to fill out and sign inheritance tax worksheet nebraska online? The tax is paid to the county of the deceased person’s residence or, in the case of real estate, to. Web complete nebraska inheritance tax worksheet form online with us legal forms. Certificate of mailing, annual budget reporting forms :. Previous years' income tax forms. Web inheritance tax rates by twenty percent each year beginning january 1, 2021 through december. Web the inheritance tax is levied on money already passed from an estate to a person’s heirs. Beneficiaries are responsible for paying the inheritance tax on the. Easily sign the nebraska inheritance tax form with your finger. If the tax is not timely paid, then interest starts accruing at a rate of 14% per. Web how to fill out and. Beneficiaries inheriting property pay an. How is this changed by lb310?. If the tax is not timely paid, then interest starts accruing at a rate of 14% per. Web the tax is a state of nebraska inheritance tax but the county receives the money. Get your online template and fill it in using progressive features. Get your online template and fill it in using progressive features. Although nebraska does not currently have an estate tax, it does still impose an inheritance tax. Numeric listing of all current nebraska tax forms. Web 001.01 nebraska inheritance tax applies to bequests, devises, or transfers of property or any other interest in trust or otherwise having characteristics of annuities,. The tax is paid to the county of the deceased person’s residence or, in the case of real estate, to. Easily sign the nebraska inheritance tax form with your finger. Web any inheritance tax due must be paid within one year of the decedent’s date of death. Easily fill out pdf blank, edit, and sign them. Web how to fill. Beneficiaries are responsible for paying the inheritance tax on the. Web the tax is a state of nebraska inheritance tax but the county receives the money. Web 001.01 nebraska inheritance tax applies to bequests, devises, or transfers of property or any other interest in trust or otherwise having characteristics of annuities, life estates,. Unlike a typical estate tax, nebraska inheritance. Web complete nebraska inheritance tax worksheet form online with us legal forms. In all proceedings for the determination of inheritance tax, the following deductions from the. How is this changed by lb310?. Web 001.01 nebraska inheritance tax applies to bequests, devises, or transfers of property or any other interest in trust or otherwise having characteristics of annuities, life estates,. Web. If the tax is not timely paid, then interest starts accruing at a rate of 14% per. Web how to fill out and sign inheritance tax worksheet nebraska online? Beneficiaries are responsible for paying the inheritance tax on the. Enjoy smart fillable fields and. Although nebraska does not currently have an estate tax, it does still impose an inheritance tax. Beneficiaries are responsible for paying the inheritance tax on the. Web currently the first $15,000 of the inheritance is not taxed. The tax is paid to the county of the deceased person’s residence or, in the case of real estate, to. This excel file assists lawyers with calculating inheritance tax. Numeric listing of all current nebraska tax forms. Web the nebraska inheritance tax worksheet is an important form for individuals who are responsible for calculating inheritance taxes. Previous years' income tax forms. Web certificate of mailing a notice of filing a petition for the determination of inheritance tax: Web 001.01 nebraska inheritance tax applies to bequests, devises, or transfers of property or any other interest in trust or otherwise having characteristics of annuities, life estates,. Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents. Get your online template and fill it in using progressive features. Although nebraska does not currently have an estate tax, it does still impose an inheritance tax. This excel file assists lawyers with calculating inheritance tax. How is this changed by lb310?. Enjoy smart fillable fields and. The tax is paid to the county of the deceased person’s residence or, in the case of real estate, to. Easily sign the nebraska inheritance tax form with your finger. Web how to fill out and sign inheritance tax worksheet nebraska online? In all proceedings for the determination of inheritance tax, the following deductions from the. Web inheritance tax rates by twenty percent each year beginning january 1, 2021 through december 31, 2024; The inheritance tax is repealed as of january 1, 2025. Numeric listing of all current nebraska tax forms. Certificate of mailing, annual budget reporting forms :. Web the tax is a state of nebraska inheritance tax but the county receives the money. Web inheritance tax rates by twenty percent each year beginning january 1, 2021 through december 31, 2024; Web currently the first $15,000 of the inheritance is not taxed. Beneficiaries are responsible for paying the inheritance tax on the. The inheritance tax is repealed as of january 1, 2025. Web the tax is a state of nebraska inheritance tax but the county receives the money. Numeric listing of all current nebraska tax forms. This excel file assists lawyers with calculating inheritance tax. Although nebraska does not currently have an estate tax, it does still impose an inheritance tax. Unlike a typical estate tax, nebraska inheritance tax is measured by the value of the portion of a decedent’s estate that will be received by a. Save or instantly send your ready documents. Web certificate of mailing a notice of filing a petition for the determination of inheritance tax: Web the burden of paying nebraska’s inheritance tax ultimately falls upon those who inherit the property, not the estate. Web complete nebraska inheritance tax worksheet form online with us legal forms. Web any inheritance tax due must be paid within one year of the decedent’s date of death. Web open the nebraska inheritance tax worksheet instructions and follow the instructions. Web the nebraska inheritance tax worksheet is an important form for individuals who are responsible for calculating inheritance taxes.Nebraska Inheritance Tax Worksheet 2021

Nebraska Inheritance Tax Worksheet Resume Examples

Nebraska Inheritance Tax Worksheet 2020 » Veche.info 11

Estate Executor Spreadsheet For Nebraska Inheritance Tax Worksheet

43 nebraska inheritance tax worksheet Worksheet Live

Nebraska Inheritance Tax Worksheet Printable qualified dividends and

43 nebraska inheritance tax worksheet Worksheet Live

Nebraska Inheritance Tax Worksheet Printable qualified dividends and

Nebraska Inheritance Tax Worksheet Printable qualified dividends and

Nebraska Inheritance Tax Worksheet Master of Documents

In All Proceedings For The Determination Of Inheritance Tax, The Following Deductions From The.

Certificate Of Mailing, Annual Budget Reporting Forms :.

Get Your Online Template And Fill It In Using Progressive Features.

How Is This Changed By Lb310?.

Related Post: