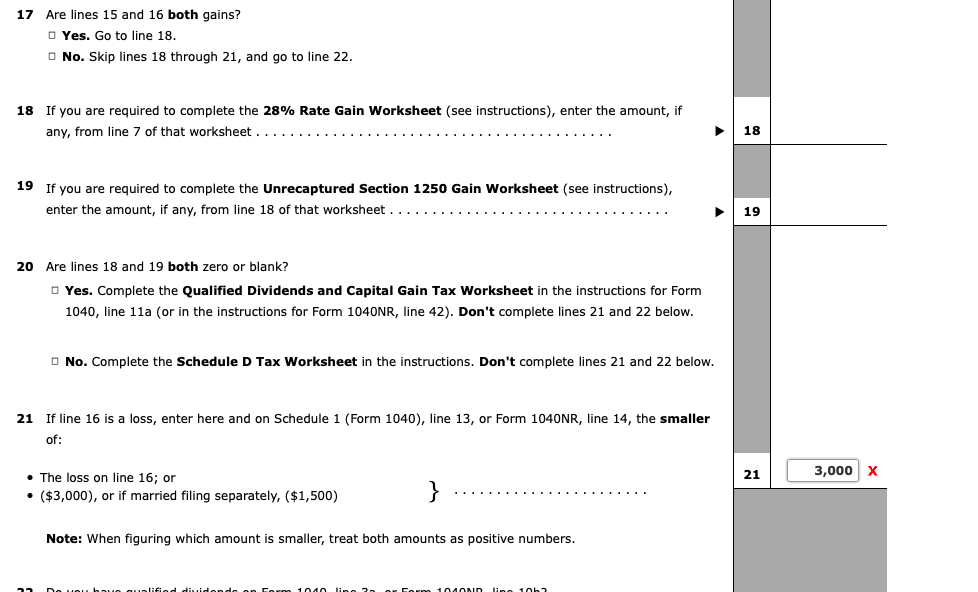

28 Rate Gain Worksheet

28 Rate Gain Worksheet - Before completing this worksheet, complete form. Web the maximum tax rate on collectibles gain is 28 percent. This form may be outdated. D inst) ( ) ⚠️ notice: Web what is the 28 rate gain worksheet used for? Web you will need to complete the 28% rate gain worksheet in the schedule d instructions. Graph proportional relationships, interpreting the unit rate as the slope of the graph. In taxslayer pro, the 28% rate gain worksheet and the unrecaptured section 1250 gain worksheet are produced. Per the instructions, the 28% rate will generate if an amount is present on. Web if there is an amount on line 18 (from the 28% rate gain worksheet) or line 19 (from the unrecaptured section 1250 gain worksheet) of schedule d (form 1040) capital gains. Web 28% rate gain worksheet. This form may be outdated. Enter the total of all collectibles gain or (loss) from form. Web you will need to complete the 28% rate gain worksheet in the schedule d instructions. Web 28% rate gain worksheet—line 18 keep for your records 1. D inst) ( ) ⚠️ notice: Before completing this worksheet, complete form. Web you will need to complete the 28% rate gain worksheet in the schedule d instructions. Enter the total of all collectibles gain or (loss) from items you reported on form 8949, part ii. If there is an amount on line 18 (from the 28% rate gain worksheet). Web the maximum tax rate on collectibles gain is 28 percent. Web 28% rate gain worksheet. Web what is the 28 rate gain worksheet used for? Web lacerte calculates the 28% rate on capital gains according to the irs form instructions. Enter the total of all collectibles gain or (loss) from form. In taxslayer pro, the 28% rate gain worksheet and the unrecaptured section 1250 gain worksheet are produced. Enter the total of all collectibles gain or (loss) from items you reported on form 8949, part ii. Web 28% rate gain worksheet 1) enter the total of all collectibles gain or (loss) from items reported on form 8949,. Web you will need. This form may be outdated. Web if there is an amount on line 18 (from the 28% rate gain worksheet) or line 19 (from the unrecaptured section 1250 gain worksheet) of schedule d (form 1040) capital gains. Web 28% rate gain worksheet 1) enter the total of all collectibles gain or (loss) from items reported on form 8949,. Web 28%. Web 28% rate gain worksheet 1) enter the total of all collectibles gain or (loss) from items reported on form 8949,. Web 28% rate gain worksheet. Graph proportional relationships, interpreting the unit rate as the slope of the graph. Enter the total of all collectibles gain or (loss) from form. Web the maximum tax rate on collectibles gain is 28. This form may be outdated. Enter the total of all collectibles gain or (loss) from form. If there is an amount on line 18 (from the 28% rate gain worksheet) or line 19 (from the unrecaptured section 1250 gain worksheet) of. Before completing this worksheet, complete form. Web what is the 28 rate gain worksheet used for? Web 28% rate gain worksheet—line 18 keep for your records 1. Compare two different proportional relationships. If there is an amount on line 18 (from the 28% rate gain worksheet) or line 19 (from the unrecaptured section 1250 gain worksheet) of. Web what is the 28 rate gain worksheet used for? Web 28% rate gain worksheet. This form may be outdated. D inst) ( ) ⚠️ notice: Web 28% rate gain worksheet—line 18 keep for your records 1. If there is an amount on line 18 (from the 28% rate gain worksheet) or line 19 (from the unrecaptured section 1250 gain worksheet) of. Compare two different proportional relationships. Web if there is an amount on line 18 (from the 28% rate gain worksheet) or line 19 (from the unrecaptured section 1250 gain worksheet) of schedule d (form 1040) capital gains. 28% rate gain worksheet (sch. Compare two different proportional relationships. Per the instructions, the 28% rate will generate if an amount is present on. Enter the total of. Web the maximum tax rate on collectibles gain is 28 percent. This form may be outdated. Per the instructions, the 28% rate will generate if an amount is present on. If there is an amount on line 18 (from the 28% rate gain worksheet) or line 19 (from the unrecaptured section 1250 gain worksheet) of. Graph proportional relationships, interpreting the unit rate as the slope of the graph. Web what is the 28 rate gain worksheet used for? Web lacerte calculates the 28% rate on capital gains according to the irs form instructions. 28% rate gain worksheet (sch. Compare two different proportional relationships. D inst) ( ) ⚠️ notice: Web 28% rate gain worksheet. Enter the total of all collectibles gain or (loss) from items you reported on form 8949, part ii. Web 28% rate gain worksheet 1) enter the total of all collectibles gain or (loss) from items reported on form 8949,. Enter the total of all collectibles gain or (loss) from form. In taxslayer pro, the 28% rate gain worksheet and the unrecaptured section 1250 gain worksheet are produced. Web you will need to complete the 28% rate gain worksheet in the schedule d instructions. Web if there is an amount on line 18 (from the 28% rate gain worksheet) or line 19 (from the unrecaptured section 1250 gain worksheet) of schedule d (form 1040) capital gains. Web 28% rate gain worksheet—line 18 keep for your records 1. Before completing this worksheet, complete form. If there is an amount on line 18 (from the 28% rate gain worksheet) or line 19 (from the unrecaptured section 1250 gain worksheet) of. Enter the total of all collectibles gain or (loss) from items you reported on form 8949, part ii. Web if there is an amount on line 18 (from the 28% rate gain worksheet) or line 19 (from the unrecaptured section 1250 gain worksheet) of schedule d (form 1040) capital gains. Web 28% rate gain worksheet. Web 28% rate gain worksheet—line 18 keep for your records 1. Enter the total of all collectibles gain or (loss) from form. This form may be outdated. 28% rate gain worksheet (sch. Per the instructions, the 28% rate will generate if an amount is present on. Before completing this worksheet, complete form. In taxslayer pro, the 28% rate gain worksheet and the unrecaptured section 1250 gain worksheet are produced. D inst) ( ) ⚠️ notice: Web you will need to complete the 28% rate gain worksheet in the schedule d instructions. Graph proportional relationships, interpreting the unit rate as the slope of the graph. Compare two different proportional relationships.Mecha Wiring 28 Rate Gain Worksheet 2017

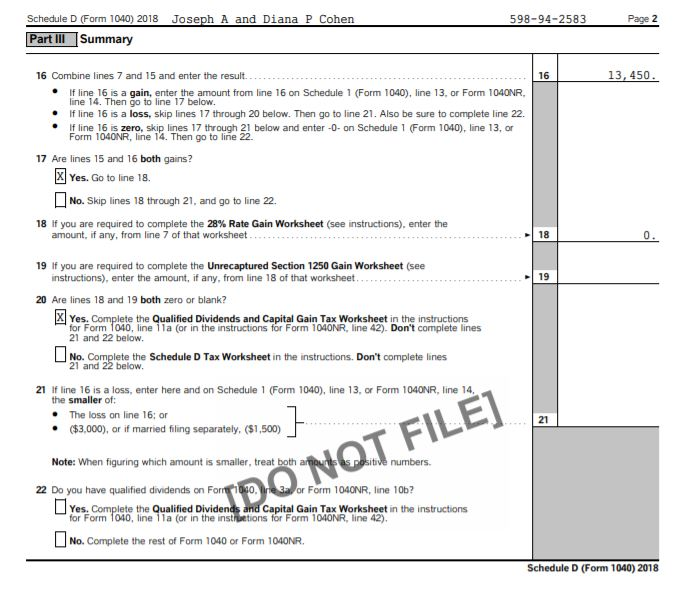

Qualified Dividends and Capital Gain Tax Worksheet 2016

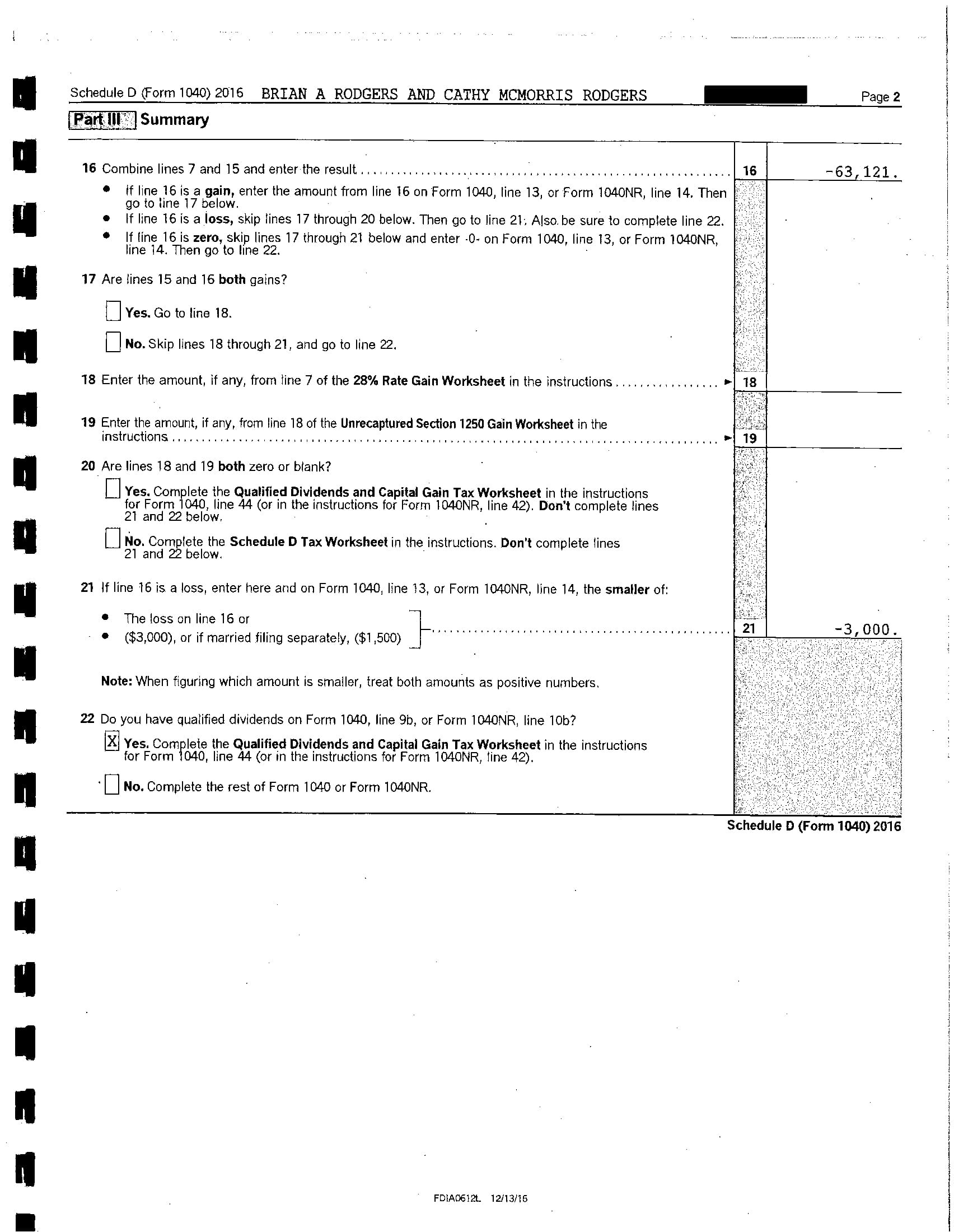

28 Tax Gain Worksheet Worksheet Resume Examples

28 Rate Gain Worksheet

30++ Schedule D Tax Worksheet Worksheets Decoomo

Capital Gains Worksheet Part 3 Line 1 Worksheet Resume Examples

1040 28 Rate Gain Worksheet Worksheet Template Design

28 Rate Gain Worksheet 2016 —

Federal Tax Rates For 28 Rate Gain Worksheet 2016 —

1040 28 Rate Gain Worksheet Worksheet Template Design

Web 28% Rate Gain Worksheet 1) Enter The Total Of All Collectibles Gain Or (Loss) From Items Reported On Form 8949,.

Web Lacerte Calculates The 28% Rate On Capital Gains According To The Irs Form Instructions.

Web The Maximum Tax Rate On Collectibles Gain Is 28 Percent.

Web What Is The 28 Rate Gain Worksheet Used For?

Related Post: