Form 8812 Worksheet

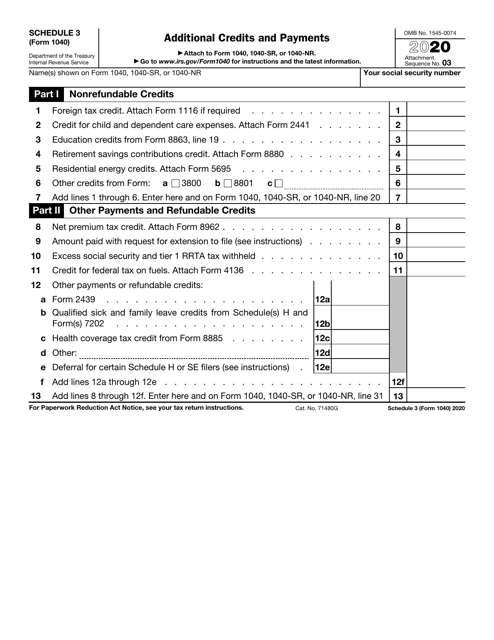

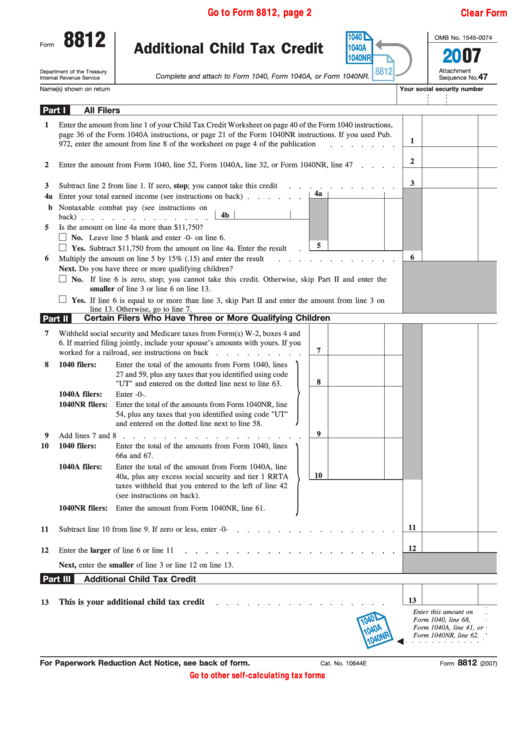

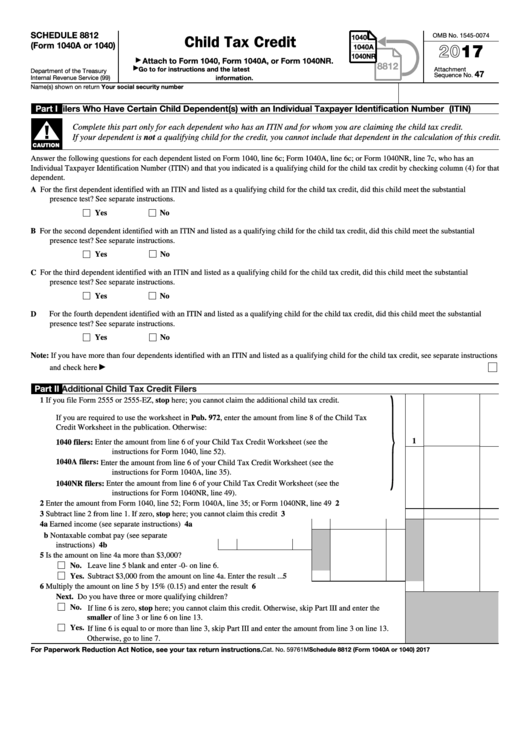

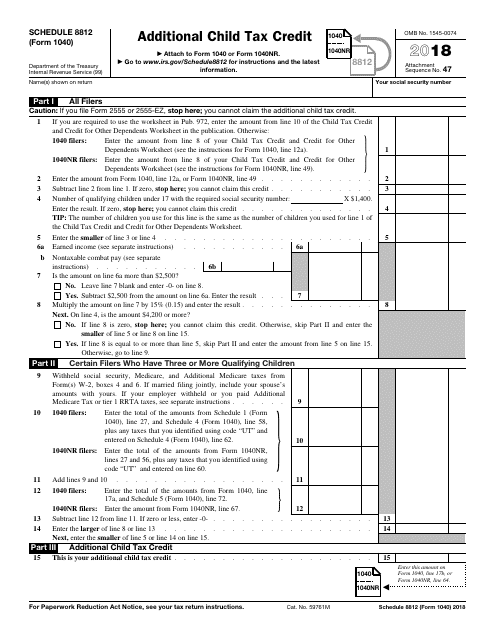

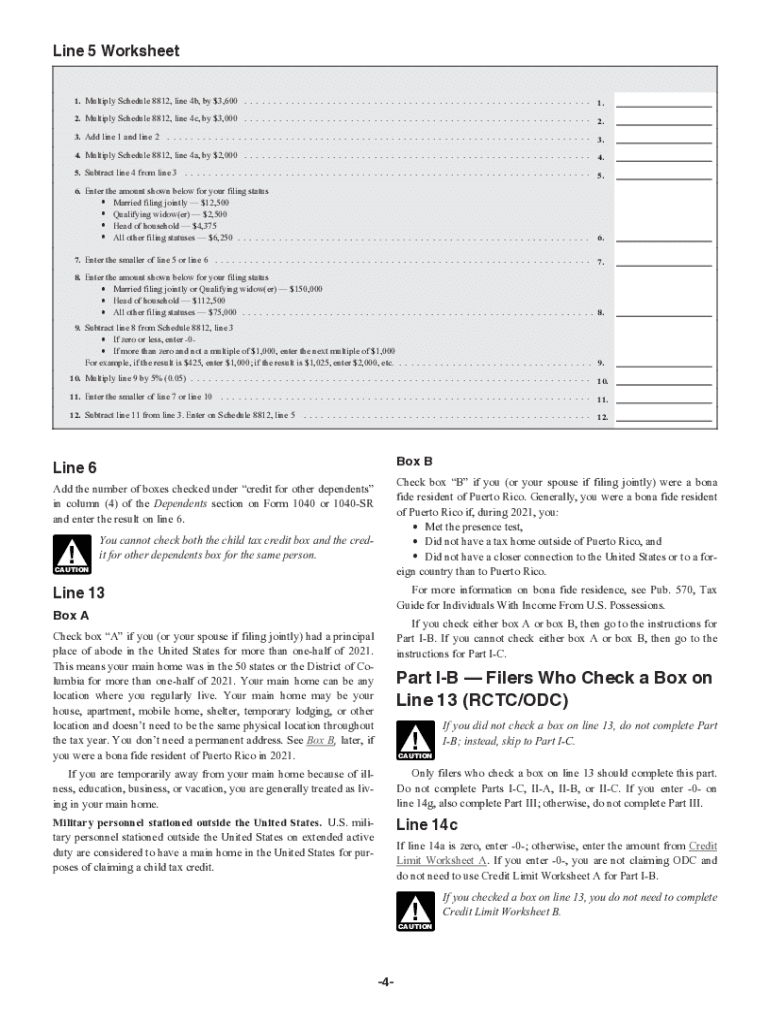

Form 8812 Worksheet - Web form 8812 is generated automatically based on information present in the return. Open the irs child tax credit 2019 and follow the instructions. Use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). Easily sign the 8812 form with your finger. Go digital and save time with signnow, the best. Web schedule 8812 (form 1040). If you have at least one qualifying child, you can claim a credit of up to 15% of your earned income in excess of. If the child tax credit isn't. The ctc and odc are. Web you must have three or more qualifying children. The ctc and odc are. There is no line 5 worksheet to be found. Use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). Since the irs calculated amount is exactly half of what the worksheet for line 5 has calculated, the irs may be reducing. If. The schedule 8812 (form 1040) and its instructions have been revised to be the single source for figuring and reporting the child tax credits and. There is no line 5 worksheet to be found. If the child tax credit isn't. Use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child. The schedule 8812 (form 1040) and its instructions have been revised to be the single source for figuring and reporting the child tax credits and. Printing and scanning is no longer the best way to manage documents. Web under file \ print, i selected the option to have turbotax generate tax return, all calculation worksheets. Since the irs calculated amount. Easily sign the 8812 form with your finger. There is no line 5 worksheet to be found. Open the irs child tax credit 2019 and follow the instructions. Why isn't the child tax credit calculating? See the instructions for form 1040, line 52; Web handy tips for filling out 8812 instructions tax form online. Easily sign the 8812 form with your finger. Web form 8812 is generated automatically based on information present in the return. Web you must have three or more qualifying children. If you have at least one qualifying child, you can claim a credit of up to 15% of your. Web handy tips for filling out 8812 instructions tax form online. Since the irs calculated amount is exactly half of what the worksheet for line 5 has calculated, the irs may be reducing. Send filled & signed form 8812 worksheet or save. If you have at least one qualifying child, you can claim a credit of up to 15% of. Printing and scanning is no longer the best way to manage documents. Web under file \ print, i selected the option to have turbotax generate tax return, all calculation worksheets. See the instructions for form 1040, line 52; The ctc and odc are. Go digital and save time with signnow, the best. If the child tax credit isn't. Open the irs child tax credit 2019 and follow the instructions. To see the computation of the child tax credit (form 1040 line 52) and the additional child tax credit. See the instructions for form 1040, line 52; Easily sign the 8812 form with your finger. Go digital and save time with signnow, the best. Web schedule 8812 (form 1040). Web you must have three or more qualifying children. The schedule 8812 (form 1040) and its instructions have been revised to be the single source for figuring and reporting the child tax credits and. Web under file \ print, i selected the option to have turbotax. Since the irs calculated amount is exactly half of what the worksheet for line 5 has calculated, the irs may be reducing. If the child tax credit isn't. Easily sign the 8812 form with your finger. The schedule 8812 (form 1040) and its instructions have been revised to be the single source for figuring and reporting the child tax credits. Printing and scanning is no longer the best way to manage documents. Since the irs calculated amount is exactly half of what the worksheet for line 5 has calculated, the irs may be reducing. Web form 8812 is generated automatically based on information present in the return. The schedule 8812 (form 1040) and its instructions have been revised to be the single source for figuring and reporting the child tax credits and. See the instructions for form 1040, line 52; Web under file \ print, i selected the option to have turbotax generate tax return, all calculation worksheets. There is no line 5 worksheet to be found. Web you must have three or more qualifying children. To see the computation of the child tax credit (form 1040 line 52) and the additional child tax credit. If the child tax credit isn't. Why isn't the child tax credit calculating? Go digital and save time with signnow, the best. Send filled & signed form 8812 worksheet or save. The ctc and odc are. Easily sign the 8812 form with your finger. Web schedule 8812 (form 1040). Use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). Web handy tips for filling out 8812 instructions tax form online. Open the irs child tax credit 2019 and follow the instructions. December 14, 2022 2:05 pm. If the child tax credit isn't. Easily sign the 8812 form with your finger. Why isn't the child tax credit calculating? Use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). The ctc and odc are. Web under file \ print, i selected the option to have turbotax generate tax return, all calculation worksheets. Web you must have three or more qualifying children. To see the computation of the child tax credit (form 1040 line 52) and the additional child tax credit. Web form 8812 is generated automatically based on information present in the return. Since the irs calculated amount is exactly half of what the worksheet for line 5 has calculated, the irs may be reducing. See the instructions for form 1040, line 52; December 14, 2022 2:05 pm. Web schedule 8812 (form 1040). Open the irs child tax credit 2019 and follow the instructions. Send filled & signed form 8812 worksheet or save. If you have at least one qualifying child, you can claim a credit of up to 15% of your earned income in excess of.Child Tax Credit 2020 Form 8812 Child Tax Credit 2020 Federal Tax

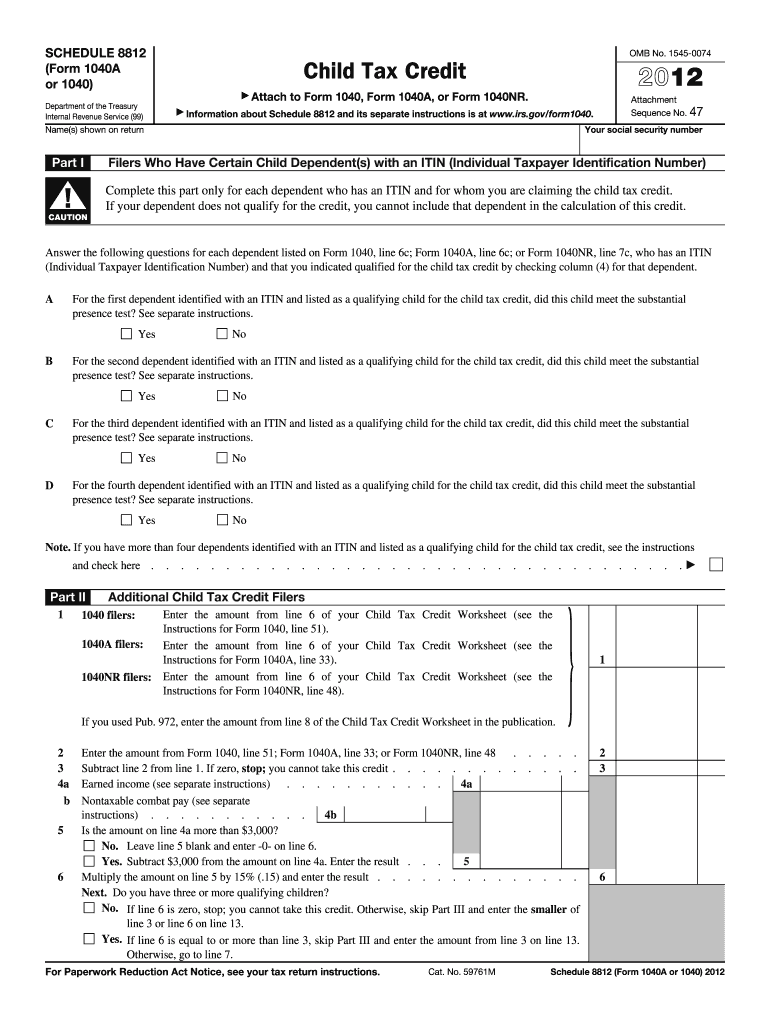

Child Tax Credit Worksheet Form 8812 Additional Child Tax Credit

Publication 17, Your Federal Tax; Part 6 Figuring Your Taxes

Form 8812Additional Child Tax Credit

Top 8 Form 8812 Templates free to download in PDF format

Fillable Schedule 8812 (Form 1040a Or 1040) Child Tax Credit 2017

8812 Schedule Form Fill Out and Sign Printable PDF Template signNow

IRS Form 1040 Schedule 8812 Download Fillable PDF or Fill Online

8812 Instructions Tax Form Fill Out and Sign Printable PDF Template

Form 8812, Additional Child Tax Credit printable pdf download

There Is No Line 5 Worksheet To Be Found.

Printing And Scanning Is No Longer The Best Way To Manage Documents.

Go Digital And Save Time With Signnow, The Best.

Web Handy Tips For Filling Out 8812 Instructions Tax Form Online.

Related Post: