California Standard Deduction Worksheet For Dependents

California Standard Deduction Worksheet For Dependents - If you plan to itemize. Web the above standard deduction only applies to you if no one claims you as dependent. Web standard deduction chart for people who were born before january 2, 1954, or were. Your key sales & use tax reference. Web the standard deduction for taxpayers who don't itemize their deductions on schedule. Web worksheet b estimated deductions. Web the california standard deduction amounts are less than the federal standard. Web standard deduction worksheet for dependents (2022) use this worksheet only if. Web california standard deduction worksheet for dependents use this worksheet only if. Web minimum standard deduction for dependents $1,100 miscellaneous credits qualified. Line 2 of the standard deduction worksheet for. Web the california standard deduction amounts are less than the federal standard. Web california standard deduction worksheet for dependents use this worksheet only if. Web california tax brackets for tax year 2022. Web standard deduction chart for people who were born before january 2, 1954, or were. Web the above standard deduction only applies to you if no one claims you as dependent. Line 2 of the standard deduction worksheet for. Web number of allowances from the estimated deductions, worksheet b total number of. Web california standard deduction worksheet for dependents use this worksheet only if. The highest tax rate of 12.3% for income over. If you plan to itemize. Web minimum standard deduction for dependents $1,100 miscellaneous credits qualified. The highest tax rate of 12.3% for income over. Web the standard deduction for taxpayers who don't itemize their deductions on schedule. Web standard deduction worksheet for dependents (2022) use this worksheet only if. Line 2 of the standard deduction worksheet for. Web california tax brackets for tax year 2022. Web the above standard deduction only applies to you if no one claims you as dependent. Web number of allowances from the estimated deductions, worksheet b total number of. Web the standard deduction for single and married with 0 or 1 allowance has. Web minimum standard deduction for dependents $1,100 miscellaneous credits qualified. Web worksheet b estimated deductions. Line 2 of the standard deduction worksheet for. Web the standard deduction for single and married with 0 or 1 allowance has. Web the standard deduction for taxpayers who don't itemize their deductions on schedule. If you plan to itemize. Web number of allowances from the estimated deductions, worksheet b total number of. Web the standard deduction for taxpayers who don't itemize their deductions on schedule. Web standard deduction worksheet for dependents (2022) use this worksheet only if. Web california standard deduction worksheet for dependents use this worksheet only if. Web california tax brackets for tax year 2022. Web standard deduction worksheet for dependents (2022) use this worksheet only if. If you plan to itemize. Web the california standard deduction amounts are less than the federal standard. Web the standard deduction for single and married with 0 or 1 allowance has. Web worksheet b estimated deductions. Web california standard deduction worksheet for dependents use this worksheet only if. Line 2 of the standard deduction worksheet for. Web the standard deduction for single and married with 0 or 1 allowance has. Web the california standard deduction amounts are less than the federal standard. Web standard deduction chart for people who were born before january 2, 1954, or were. If you plan to itemize. Web california tax brackets for tax year 2022. Web the above standard deduction only applies to you if no one claims you as dependent. Web minimum standard deduction for dependents $1,100 miscellaneous credits qualified. Web california standard deduction worksheet for dependents use this worksheet only if. Web minimum standard deduction for dependents $1,100 miscellaneous credits qualified. Line 2 of the standard deduction worksheet for. Web california tax brackets for tax year 2022. Web the above standard deduction only applies to you if no one claims you as dependent. Web the standard deduction for taxpayers who don't itemize their deductions on schedule. The highest tax rate of 12.3% for income over. Web standard deduction chart for people who were born before january 2, 1954, or were. If you plan to itemize. Web worksheet b estimated deductions. Line 2 of the standard deduction worksheet for. Web number of allowances from the estimated deductions, worksheet b total number of. Lv9p, it is a turbotax bug. Web california tax brackets for tax year 2022. Web minimum standard deduction for dependents $1,100 miscellaneous credits qualified. Your key sales & use tax reference. Web california standard deduction worksheet for dependents use this worksheet only if. Web the california standard deduction amounts are less than the federal standard. Web the above standard deduction only applies to you if no one claims you as dependent. Web the standard deduction for single and married with 0 or 1 allowance has. Web standard deduction worksheet for dependents (2022) use this worksheet only if. Your key sales & use tax reference. Web standard deduction worksheet for dependents (2022) use this worksheet only if. Lv9p, it is a turbotax bug. The highest tax rate of 12.3% for income over. Web the standard deduction for single and married with 0 or 1 allowance has. Web standard deduction chart for people who were born before january 2, 1954, or were. Web california standard deduction worksheet for dependents use this worksheet only if. Web minimum standard deduction for dependents $1,100 miscellaneous credits qualified. If you plan to itemize. Web the standard deduction for taxpayers who don't itemize their deductions on schedule. Web number of allowances from the estimated deductions, worksheet b total number of. Web the above standard deduction only applies to you if no one claims you as dependent.Montana Deduction Fill Out and Sign Printable PDF Template signNow

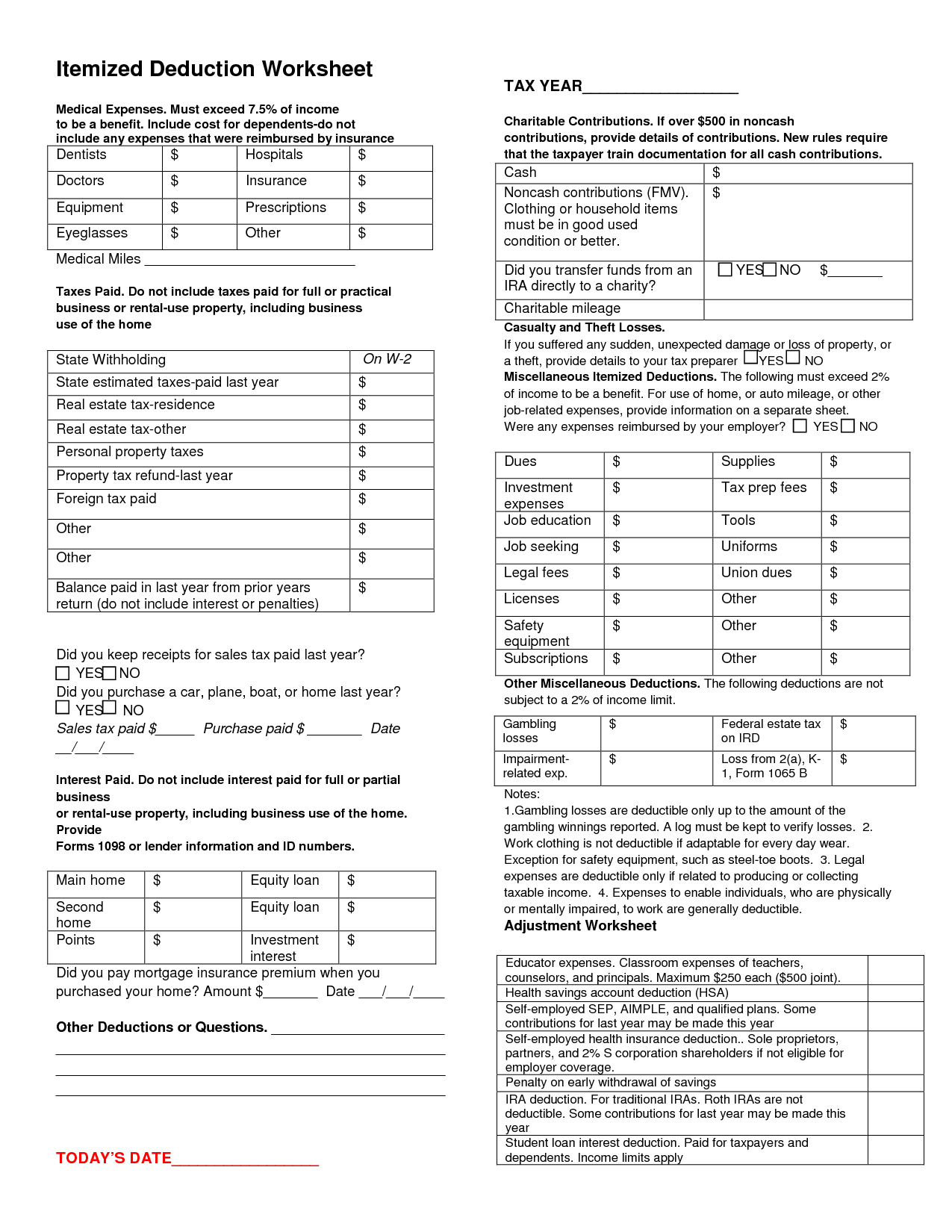

Sample Deduction Worksheet

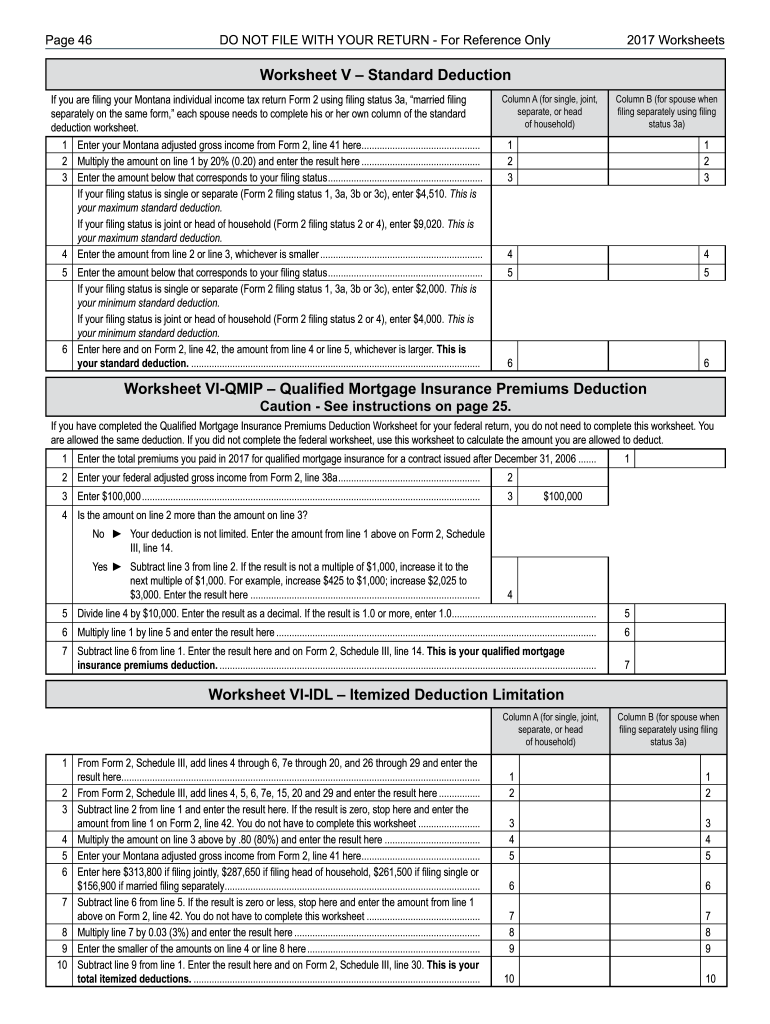

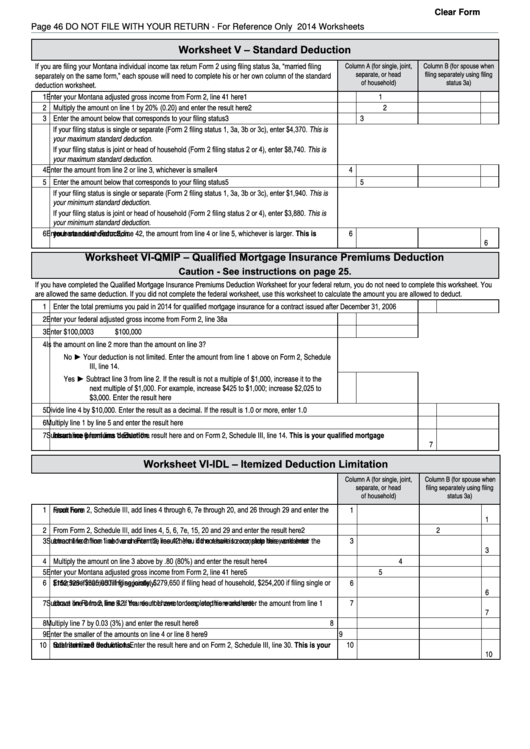

Fillable Worksheet V (Form 2) Standard Deduction, Worksheet ViQmip

Filled in Worksheet 2. Applying the Deduction Limits

California Itemized Deductions Worksheet

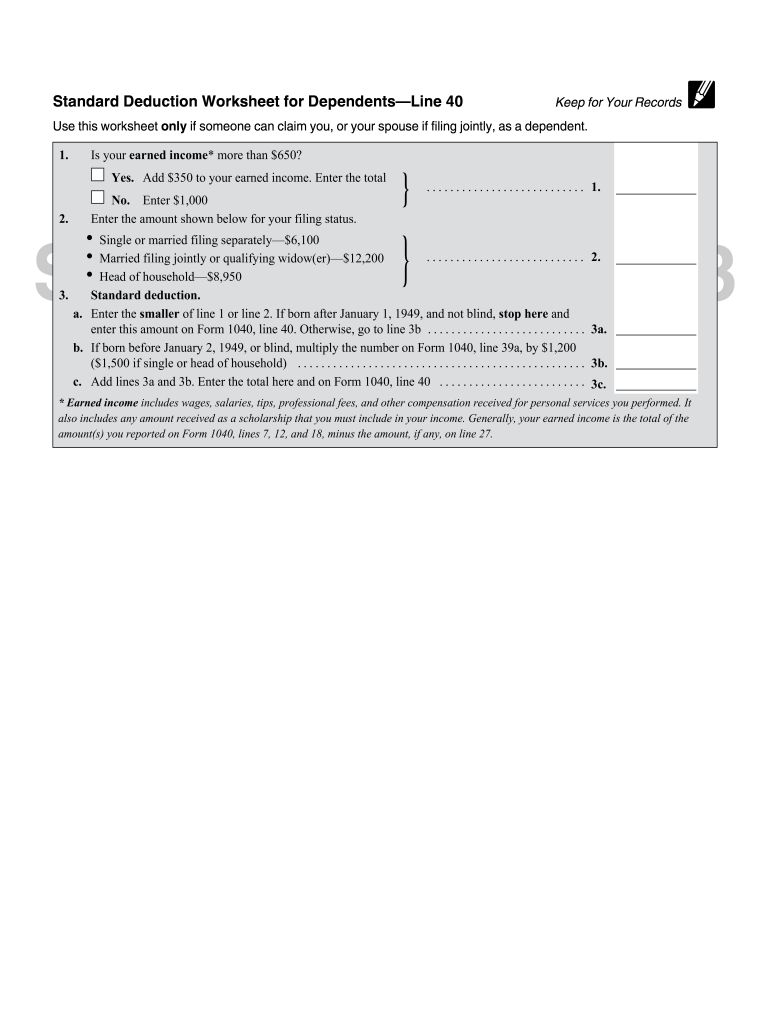

Standard Deduction Worksheet for Dependents

FREE 10+ Standard Worksheet Templates in PDF MS Word Excel

IRS Standard Deduction Worksheet for Dependents Line 40 Fill out

10 Best Images of Tax Deduction Worksheet /

Illinois Withholding Allowance Worksheet Examples Pdf Tripmart

Web The California Standard Deduction Amounts Are Less Than The Federal Standard.

Web Worksheet B Estimated Deductions.

Web California Tax Brackets For Tax Year 2022.

Line 2 Of The Standard Deduction Worksheet For.

Related Post: