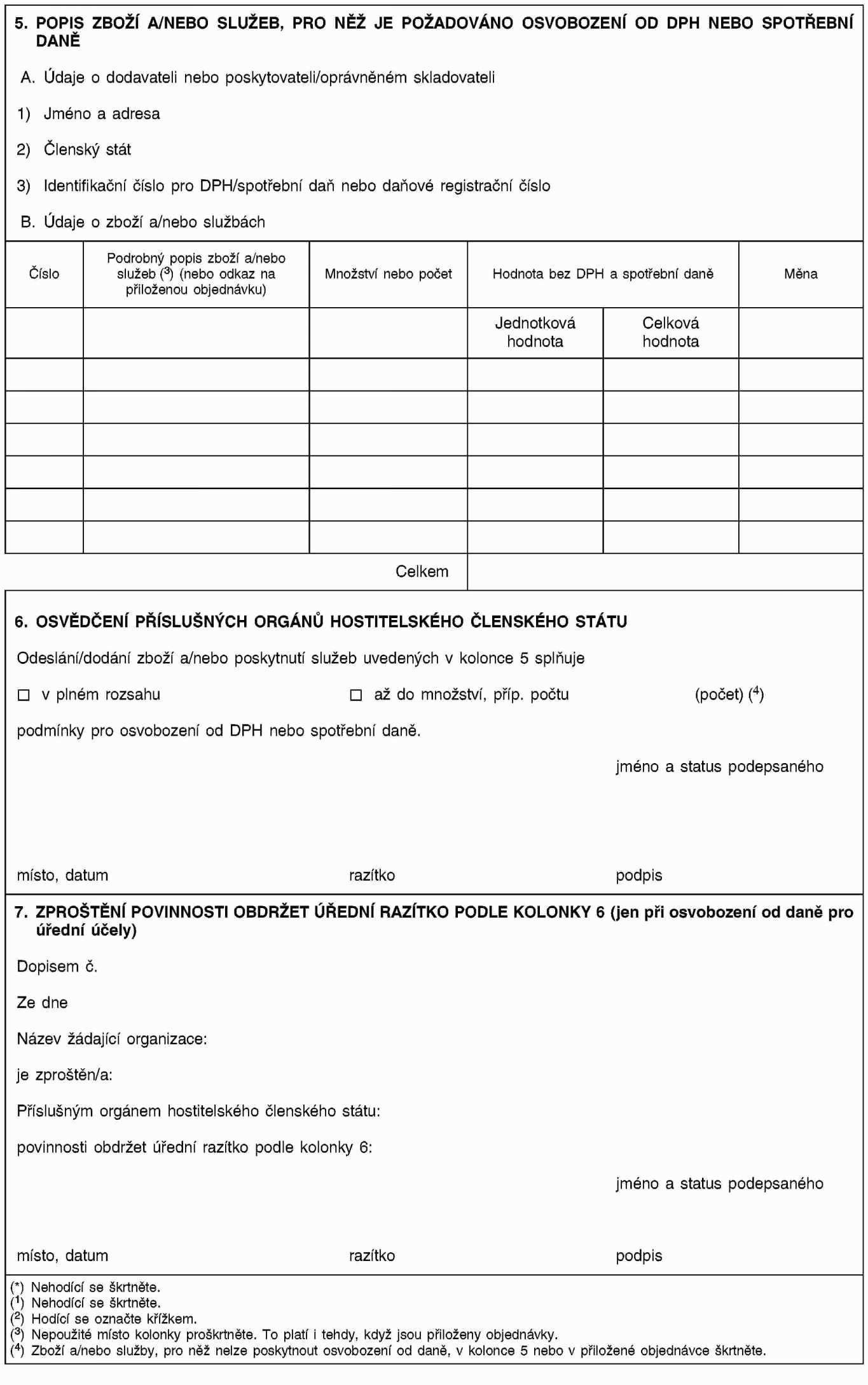

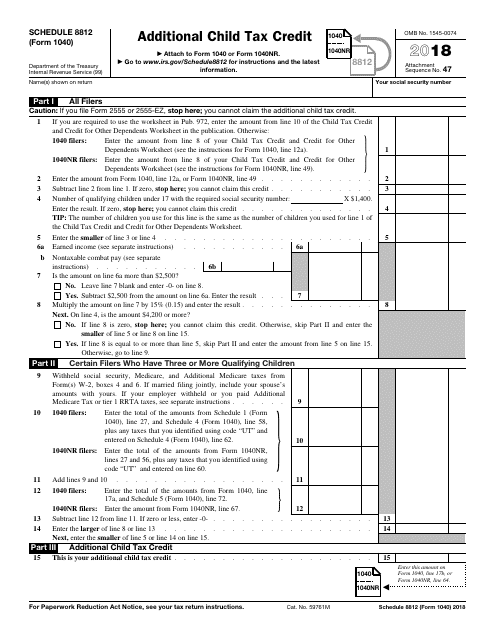

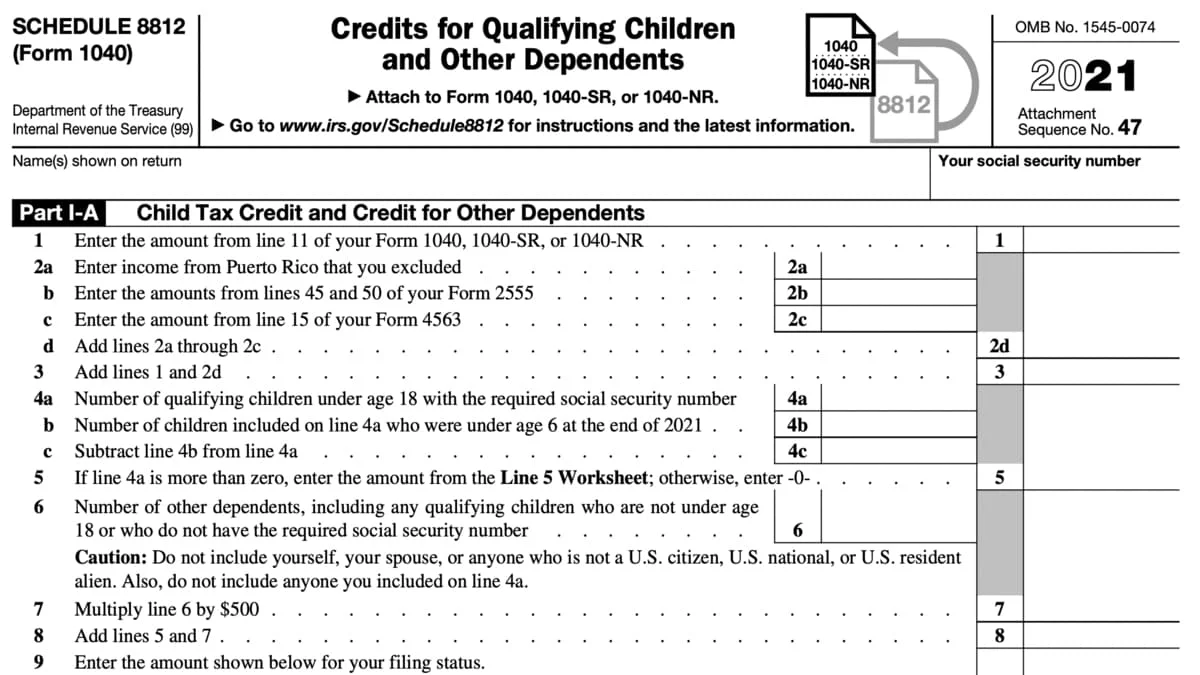

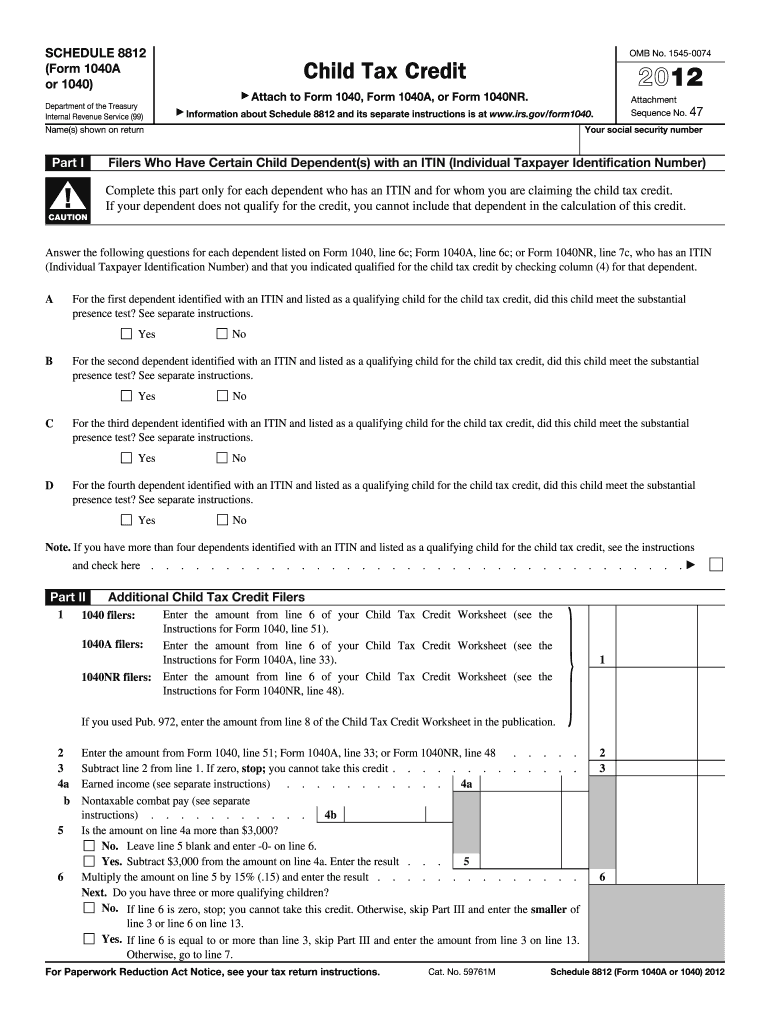

Credit Limit Worksheet A 8812

Credit Limit Worksheet A 8812 - Credits for qualifying children and other dependents. As @thomasm125 explained, the worksheet, credit. Understanding the additional child tax credit begins with the child tax credit. Should be completed by all filers to claim the basic. 11) part ii deductible home mortgage interest 12) enter the total of the average balances of all mortgages on all qualified homes. Web review the child tax credit and credit for other dependents worksheet to see whether they qualify for the credit. You will first need to complete the form using the schedule 8812 instructions and then enter the results on your form 1040. Web you'll use form 8812 to calculate your additional child tax credit. Web this is the qualified loan limit. If you are using turbotax, you will not have to make the entries on form 8812. For 2022, there are two parts to this form: Web how to file form 8812. Web this is the qualified loan limit. Web the credit limit worksheet of form 8863 is a section of the form that is used to calculate the amount of the education tax credit that a taxpayer is eligible to claim. • if line 11 is. Understanding the additional child tax credit begins with the child tax credit. Web march 30, 2023 11:45 am. For 2022, there are two parts to this form: You'll need to include the. Web schedule 8812 is the form used to claim the additional child tax credit. Should be completed by all filers to claim the basic. For all returns except tax year 2021, the child. Web review the child tax credit and credit for other dependents worksheet to see whether they qualify for the credit. The schedule 8812 (form 1040) and its instructions have been revised to be the single source for figuring and reporting the. Web schedule 8812 (form 1040). You will first need to complete the form using the schedule 8812 instructions and then enter the results on your form 1040. You'll need to include the. Web this is the qualified loan limit. Web laws calm legal forms guide form 88 63 is a united states internal revenue service tax form used for claiming. Understanding the additional child tax credit begins with the child tax credit. Web schedule 8812 (form 1040) department of the treasury internal revenue service. You'll need to include the. Web march 30, 2023 11:45 am. Web how to file form 8812. Web how to file form 8812. You will first need to complete the form using the schedule 8812 instructions and then enter the results on your form 1040. Web review the child tax credit and credit for other dependents worksheet to see whether they qualify for the credit. Web you'll use form 8812 to calculate your additional child tax credit.. You'll need to include the. If you are using turbotax, you will not have to make the entries on form 8812. Web review the child tax credit and credit for other dependents worksheet to see whether they qualify for the credit. Web schedule 8812 is the form used to claim the additional child tax credit. Should be completed by all. Web review the child tax credit and credit for other dependents worksheet to see whether they qualify for the credit. Web schedule 8812 (form 1040). Web how to file form 8812. Web march 30, 2023 11:45 am. Web this is the qualified loan limit. Web how to file form 8812. The schedule 8812 (form 1040) and its instructions have been revised to be the single source for figuring and reporting the child tax credits and credit. For 2022, there are two parts to this form: • if line 11 is. Should be completed by all filers to claim the basic. You will first need to complete the form using the schedule 8812 instructions and then enter the results on your form 1040. • if line 11 is. Web schedule 8812 is the form used to claim the additional child tax credit. Understanding the additional child tax credit begins with the child tax credit. Should be completed by all filers to. For 2022, there are two parts to this form: Web march 30, 2023 11:45 am. Web schedule 8812 is the form used to claim the additional child tax credit. Web you'll use form 8812 to calculate your additional child tax credit. Web schedule 8812 (form 1040). Web how to file form 8812. Web this is the qualified loan limit. If you are using turbotax, you will not have to make the entries on form 8812. Credits for qualifying children and other dependents. Web the credit limit worksheet of form 8863 is a section of the form that is used to calculate the amount of the education tax credit that a taxpayer is eligible to claim. Web laws calm legal forms guide form 88 63 is a united states internal revenue service tax form used for claiming available education credits this form can be used for claiming the. Understanding the additional child tax credit begins with the child tax credit. • if line 11 is. As @thomasm125 explained, the worksheet, credit. The schedule 8812 (form 1040) and its instructions have been revised to be the single source for figuring and reporting the child tax credits and credit. Web schedule 8812 (form 1040) department of the treasury internal revenue service. For all returns except tax year 2021, the child. You will first need to complete the form using the schedule 8812 instructions and then enter the results on your form 1040. Web review the child tax credit and credit for other dependents worksheet to see whether they qualify for the credit. Should be completed by all filers to claim the basic. You'll need to include the. Credits for qualifying children and other dependents. Web schedule 8812 is the form used to claim the additional child tax credit. Web schedule 8812 (form 1040) department of the treasury internal revenue service. 11) part ii deductible home mortgage interest 12) enter the total of the average balances of all mortgages on all qualified homes. Should be completed by all filers to claim the basic. Web you'll use form 8812 to calculate your additional child tax credit. Web laws calm legal forms guide form 88 63 is a united states internal revenue service tax form used for claiming available education credits this form can be used for claiming the. Web march 30, 2023 11:45 am. For all returns except tax year 2021, the child. Understanding the additional child tax credit begins with the child tax credit. As @thomasm125 explained, the worksheet, credit. Web how to file form 8812. Web this is the qualified loan limit. The schedule 8812 (form 1040) and its instructions have been revised to be the single source for figuring and reporting the child tax credits and credit. You will first need to complete the form using the schedule 8812 instructions and then enter the results on your form 1040.Fillable Form 8812 Additional Child Tax Credit printable pdf download

Form 8812, Additional Child Tax Credit printable pdf download

Child Tax Credit 2022 Limit Bed Frames Ideas

Irs form 8812 Fill out & sign online DocHub

Publication 972 2020 Child Tax Credit And For Other Dependents Internal

Credit limit worksheet Fill online, Printable, Fillable Blank

Credit Limit Worksheet 2016 —

Irs Form 1040 Schedule D Fillable 1040 Form Printable

Schedule 1 AGI Tax Form 2022 2023 Schedules TaxUni

8812 2012 schedule form Fill out & sign online DocHub

Web Review The Child Tax Credit And Credit For Other Dependents Worksheet To See Whether They Qualify For The Credit.

If You Are Using Turbotax, You Will Not Have To Make The Entries On Form 8812.

Web The Credit Limit Worksheet Of Form 8863 Is A Section Of The Form That Is Used To Calculate The Amount Of The Education Tax Credit That A Taxpayer Is Eligible To Claim.

Web Schedule 8812 (Form 1040).

Related Post: