Debt Snowball Method Worksheet

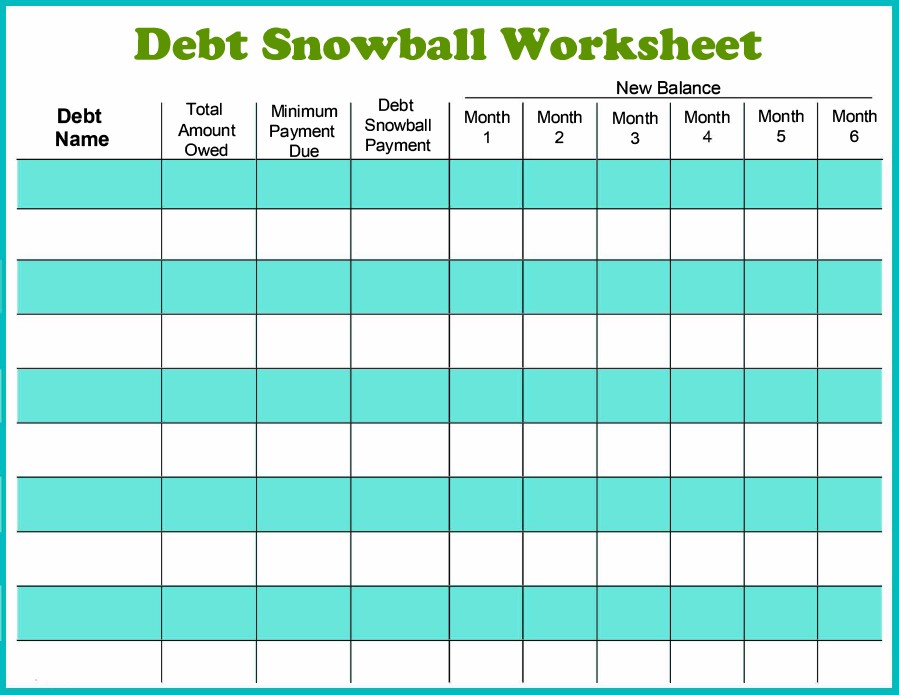

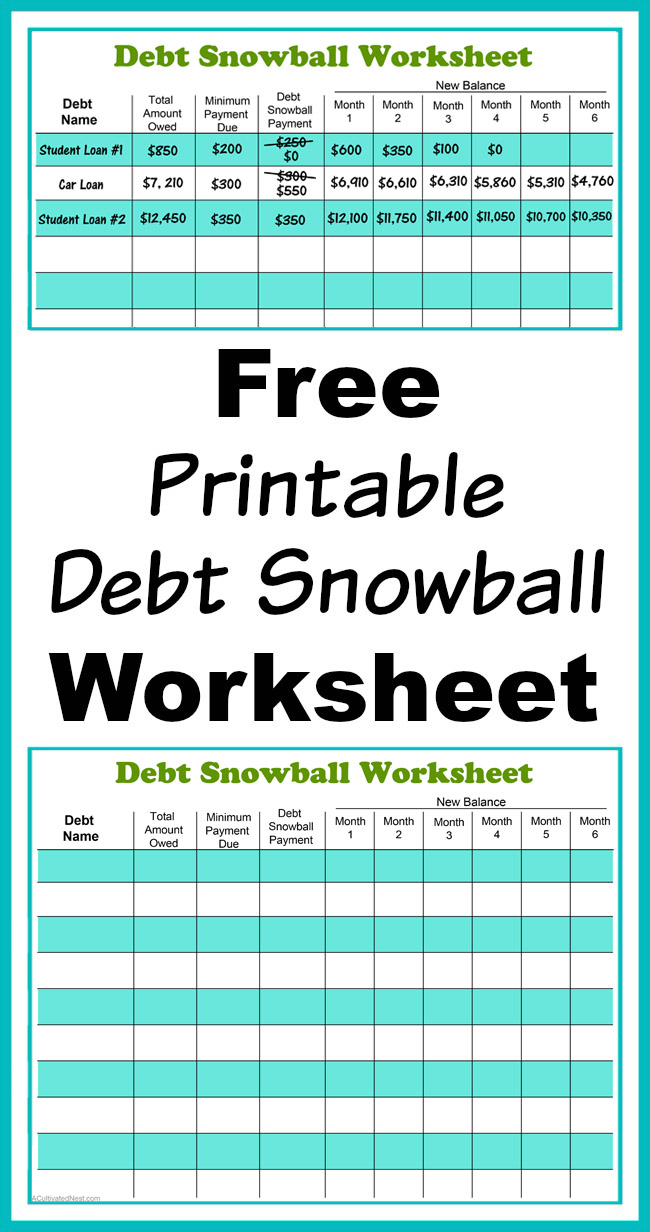

Debt Snowball Method Worksheet - Any additional money you have should be used to pay off the smallest debt. Repeat until each debt is paid in full. .paying off debt doesn't have to be so hard. Use our free debt snowball calculator. Once that is paid off, use that money to pay the second. Web a debt snowball spreadsheet is one of the most effective tools for tackling your debt payoff goals in 2023. Determine if you can afford to put any extra towards your debt each month (even $10 can make a big difference). Web a debt snowball spreadsheet is a tool used in this popular method for paying off debt. Web this free printable debt snowball worksheet is pretty easy to use. Web use our debt snowball calculator to help you eliminate your credit card, auto, student loan, and other debts. Cards offering up to 21 months with no interest on transferred balances are one of the best weapons americans have in the battle against credit card debt. Web in this article, we’ll detail what a debt snowball method is, how it works, and how to create a debt snowball spreadsheet in google sheets. List all your debts by how much. Web in this method, you’ll use a debt snowball spreadsheet or a debt snowball form. Web in this article, we’ll detail what a debt snowball method is, how it works, and how to create a debt snowball spreadsheet in google sheets. Web below are 10 debt snowball worksheets that you can download for free to use to track your debt. In the first worksheet, you enter your creditor information and your total monthly payment. Web you can organize your snowball debt as follows: Once that is paid off, use that money to pay the second. Web all you need to do is download and print the debt snowball tracker worksheets. Any additional money you have should be used to pay. Easily create a debt reduction schedule based on the popular debt snowball strategy, or experiment with your own custom strategy. Repeat until each debt is paid in full. Check out the screenshots of the debt snowball calculator below: This method allows you to come up with crucial steps of paying off debts. The first page in the kit is the. You will also include your monthly payment and the amounts you have paid on it each month. Web researchers say the snowball method is the best way to pay off debt — here's a simple spreadsheet that can make it work for you. Web use our debt snowball calculator to help you eliminate your credit card, auto, student loan, and. Web with the debt snowball method, pay your smallest debts first. Web the snowball method spreadsheet from sample.net for excel gives a unique vantage point of what it means to utilize the debt snowball payment method in all its glory. Snag a 0% balance transfer credit card. If not, you have heard about it. The first page in the kit. Check out the screenshots of the debt snowball calculator below: Web derek sall, financial expert and founder of life and my finances, says this about the debt snowball effect and the impactful spreadsheet he created: Any additional money you have should be used to pay off the smallest debt. Web use our debt snowball calculator to help you eliminate your. Employing the snowball method is the most effective way to get. This sheet will help lay out your debts and motivate you to do more. Web how to use the debt snowball method with free debt snowball worksheet. The debt snowball, made famous for being part of dave ramsey’s baby steps, helped me and my wife pay off over $52,000. Web the best thing about the debt snowball method is how simple it is to do. You’ll need a template to keep track of all your debts. You need to work out how much you can put towards this first debt while covering the minimum payments. If you prefer to use a spreadsheet to track your debt payoff progress,you can. If you prefer to use a spreadsheet to track your debt payoff progress,you can grab my debt payoff toolkit here. Start with the debt with the smallest balance and end with the debt with the largest balance. Web use our debt snowball calculator to help you eliminate your credit card, auto, student loan, and other debts. You need to work. You’ll pay off your debts in record time! Determine if you can afford to put any extra towards your debt each month (even $10 can make a big difference). Cards offering up to 21 months with no interest on transferred balances are one of the best weapons americans have in the battle against credit card debt. Easily create a debt reduction schedule based on the popular debt snowball strategy, or experiment with your own custom strategy. Here you will list all of your debts from smallest to largest. Snag a 0% balance transfer credit card. You have probably come across the debt snowball spreadsheet. Using a debt snowball worksheet helps you prioritize your debts and figure out your debt payoff plan (you can download ours below). Web in this method, you’ll use a debt snowball spreadsheet or a debt snowball form. Web using our sample debt snowball worksheet, you’d start with your $200 store credit card debt since it has the lowest balance. List your debts from smallest to largest regardless of interest rate. Pay as much as possible on your smallest debt. This method allows you to come up with crucial steps of paying off debts. In my opinion, the debt snowball excel spreadsheet is the most impactful tool out there. Web the best thing about the debt snowball method is how simple it is to do. This sheet will help lay out your debts and motivate you to do more. Repeat until each debt is paid in full. Web below are 10 debt snowball worksheets that you can download for free to use to track your debt payoff process. You’ll need a template to keep track of all your debts. You need to work out how much you can put towards this first debt while covering the minimum payments. You need to work out how much you can put towards this first debt while covering the minimum payments. Determine if you can afford to put any extra towards your debt each month (even $10 can make a big difference). Using a debt snowball worksheet helps you prioritize your debts and figure out your debt payoff plan (you can download ours below). Web derek sall, financial expert and founder of life and my finances, says this about the debt snowball effect and the impactful spreadsheet he created: Once that is paid off, use that money to pay the second. The first page in the kit is the debt snowball payments page. It only requires a debt snowball calculator and a debt snowball worksheet. Make a list of all your debts using the table provided. If not, you have heard about it. This debtbuster worksheet works best if you put the smallest debt at the top of the list and the biggest debt at the. Check out the screenshots of the debt snowball calculator below: If you prefer to use a spreadsheet to track your debt payoff progress,you can grab my debt payoff toolkit here. Aim to pay off the smallest debt first. List all your debts by how much you owe. On the left you write in the names of all your different debt sources, like “credit cardx”, “car loan”, “student loan #1”, “student loan #2” etc. Web a debt snowball spreadsheet is a tool used in this popular method for paying off debt.38 Debt Snowball Spreadsheets, Forms & Calculators

Free Debt Snowball Method Worksheet Simply Unscripted

What is the Best Method for Paying Off Debt? Worksheet Template Tips

How to Conquer the Debt Snowball Tinkering with Coupons (& More)

The Debt Snowball Method A Complete Guide with Printables Debt

Pin by SUGARR&&SALTT on MONEY TALK in 2020 Debt snowball, Debt

Free Printable Debt Snowball Worksheet Pay Down Your Debt!

Dave Ramsey Debt Snowball Worksheet Worksheets are obviously the

10++ Debt Snowball Worksheet

payoff debt, snowball method, dave ramsey, debt sheet, printable

Web With The Debt Snowball Method, Pay Your Smallest Debts First.

It Lists All Debt In Ascending Order By Balance Owed And Includes The Minimum Payments Due.

Here You Will List All Of Your Debts From Smallest To Largest.

Any Additional Money You Have Should Be Used To Pay Off The Smallest Debt.

Related Post: