Do I Need To Send Worksheets With My Tax Return

Do I Need To Send Worksheets With My Tax Return - Web to track your federal return, the irs has a handy tool at irs.gov/refunds to check your refund's status. You can usually get a. Web you may not have to file a federal income tax return if your income is below a certain amount. From burning down your own house to claiming the wrong number of dependents, some sly strategies might help lower your. But, you must file a tax return to claim a refundable tax credit or a. Each year, most people who work are required to file a federal income tax return. Click the check your refund button. Web find out how to get and where to mail paper federal and state tax forms. Web the time limit for applying is 4 years after the end of the tax year you are claiming for. If you must file, you have two options: Web the time limit for applying is 4 years after the end of the tax year you are claiming for. Web find out how to get and where to mail paper federal and state tax forms. Web the 10 riskiest tax return moves. Click the check your refund button. But, you must file a tax return to claim a refundable. Web you may not have to file a federal income tax return if your income is below a certain amount. Web the time limit for applying is 4 years after the end of the tax year you are claiming for. Web to track your federal return, the irs has a handy tool at irs.gov/refunds to check your refund's status. But,. You can usually get a. Web the 10 riskiest tax return moves. Typically, your federal income tax return is due on april 15 (or thereabouts) every year. Click the check your refund button. You need to submit a separate application for each tax year. Typically, your federal income tax return is due on april 15 (or thereabouts) every year. Web you may not have to file a federal income tax return if your income is below a certain amount. But, you must file a tax return to claim a refundable tax credit or a. Each year, most people who work are required to file. From burning down your own house to claiming the wrong number of dependents, some sly strategies might help lower your. Web find out how to get and where to mail paper federal and state tax forms. You can usually get a. If you must file, you have two options: Web options for filing a tax return. Each year, most people who work are required to file a federal income tax return. You need to submit a separate application for each tax year. Web to track your federal return, the irs has a handy tool at irs.gov/refunds to check your refund's status. If you must file, you have two options: But, you must file a tax return. Typically, your federal income tax return is due on april 15 (or thereabouts) every year. Web to track your federal return, the irs has a handy tool at irs.gov/refunds to check your refund's status. Click the check your refund button. You can usually get a. You need to submit a separate application for each tax year. Web to track your federal return, the irs has a handy tool at irs.gov/refunds to check your refund's status. Typically, your federal income tax return is due on april 15 (or thereabouts) every year. Click the check your refund button. Web you may not have to file a federal income tax return if your income is below a certain amount.. You can usually get a. Web the 10 riskiest tax return moves. Each year, most people who work are required to file a federal income tax return. You need to submit a separate application for each tax year. Web options for filing a tax return. Web the 10 riskiest tax return moves. Web find out how to get and where to mail paper federal and state tax forms. From burning down your own house to claiming the wrong number of dependents, some sly strategies might help lower your. Click the check your refund button. Each year, most people who work are required to file a. Web options for filing a tax return. Web you may not have to file a federal income tax return if your income is below a certain amount. Web the time limit for applying is 4 years after the end of the tax year you are claiming for. But, you must file a tax return to claim a refundable tax credit or a. Web to track your federal return, the irs has a handy tool at irs.gov/refunds to check your refund's status. You need to submit a separate application for each tax year. From burning down your own house to claiming the wrong number of dependents, some sly strategies might help lower your. Typically, your federal income tax return is due on april 15 (or thereabouts) every year. Web find out how to get and where to mail paper federal and state tax forms. Click the check your refund button. If you must file, you have two options: You can usually get a. Each year, most people who work are required to file a federal income tax return. Web the 10 riskiest tax return moves. But, you must file a tax return to claim a refundable tax credit or a. Click the check your refund button. Typically, your federal income tax return is due on april 15 (or thereabouts) every year. Each year, most people who work are required to file a federal income tax return. Web the 10 riskiest tax return moves. Web to track your federal return, the irs has a handy tool at irs.gov/refunds to check your refund's status. Web find out how to get and where to mail paper federal and state tax forms. You can usually get a. Web options for filing a tax return. If you must file, you have two options: Web you may not have to file a federal income tax return if your income is below a certain amount.59 best Tax time images on Pinterest Tax deductions, Accounting and Desk

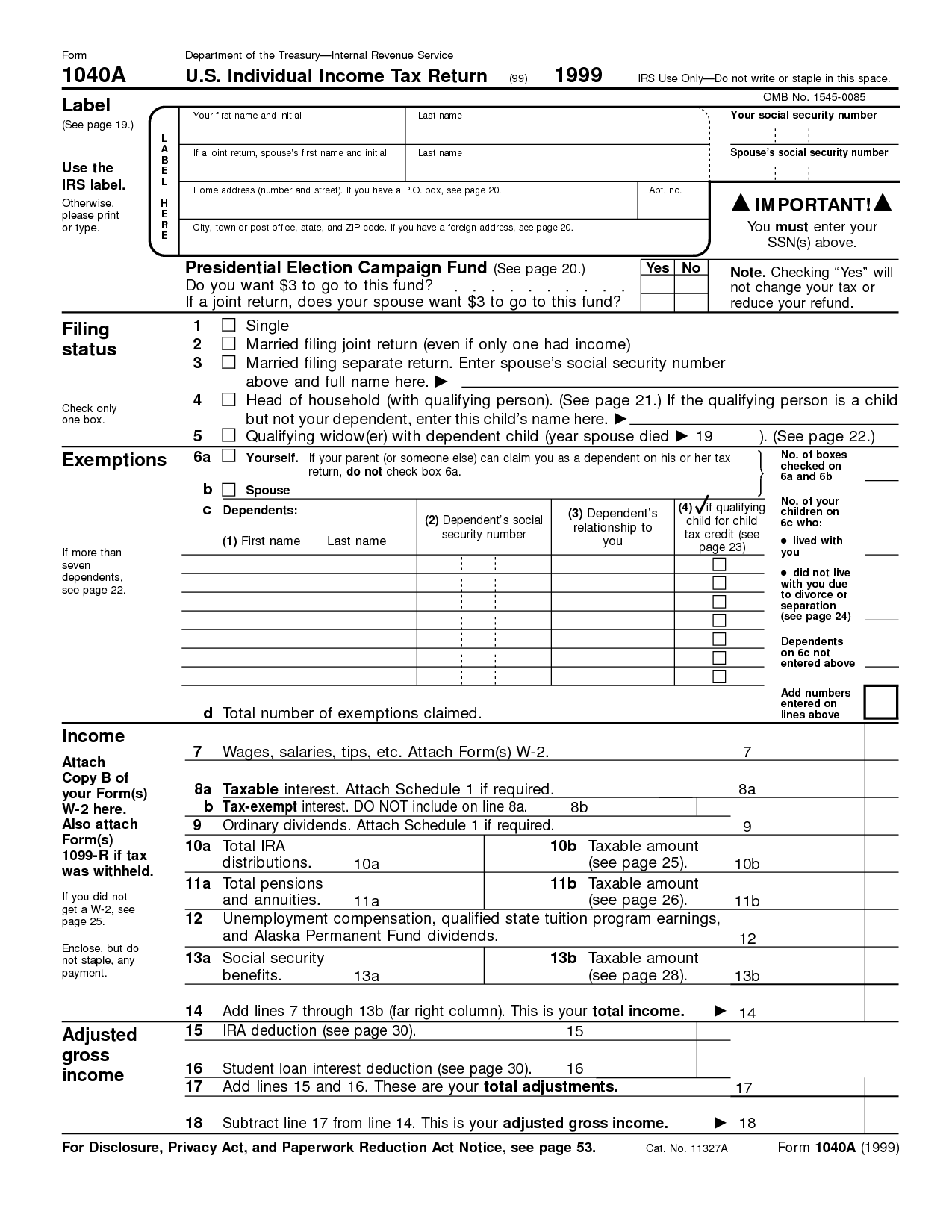

Tax Return, Fake Tax return, tax return, Irs tax forms

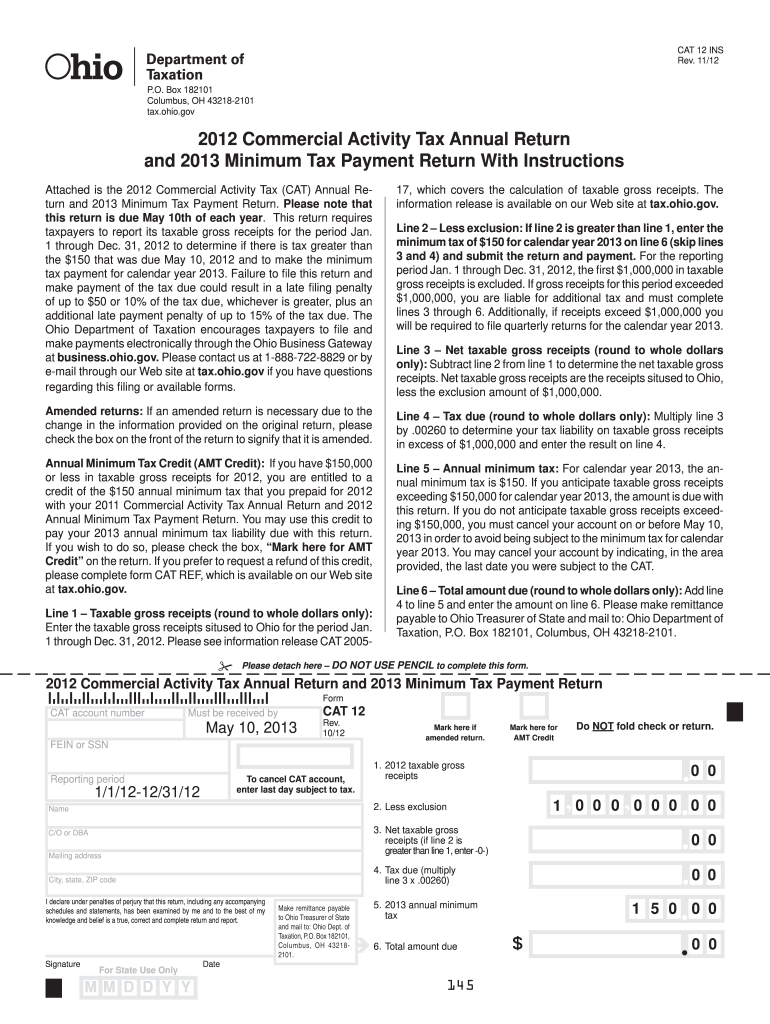

Ohio Cat Tax Worksheet Fill Online, Printable, Fillable, Blank

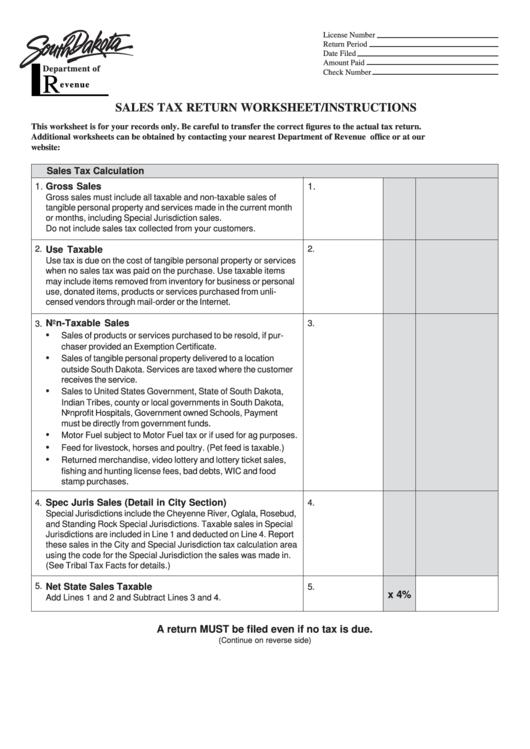

Sales Tax Return Worksheet printable pdf download

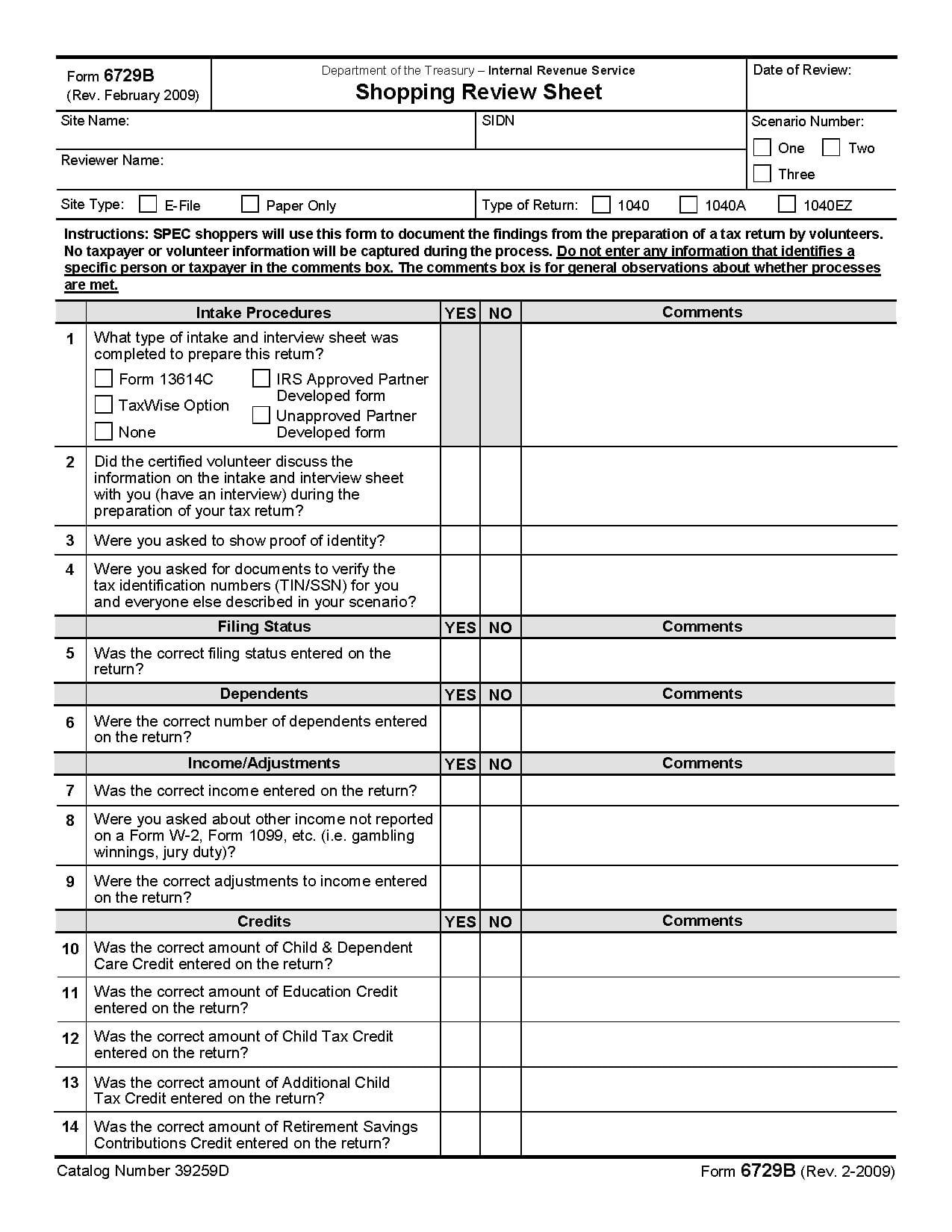

Tax Return Preparation Tax Return Preparation Worksheet —

Free Sales Tax Worksheets Teaching money, Money math worksheets, Real

Free File Fillable Forms file your tax return online, free

When do I need to send my Tax Return Information to my accountant?

REV414 (P/S) 2012 PA Nonresident Tax Withholding Worksheet Free Download

18 Best Images of Business Tax Organizer Worksheet Tax Deduction

You Need To Submit A Separate Application For Each Tax Year.

From Burning Down Your Own House To Claiming The Wrong Number Of Dependents, Some Sly Strategies Might Help Lower Your.

Web The Time Limit For Applying Is 4 Years After The End Of The Tax Year You Are Claiming For.

Related Post: