Fannie Mae Income Calculation Worksheet Excel

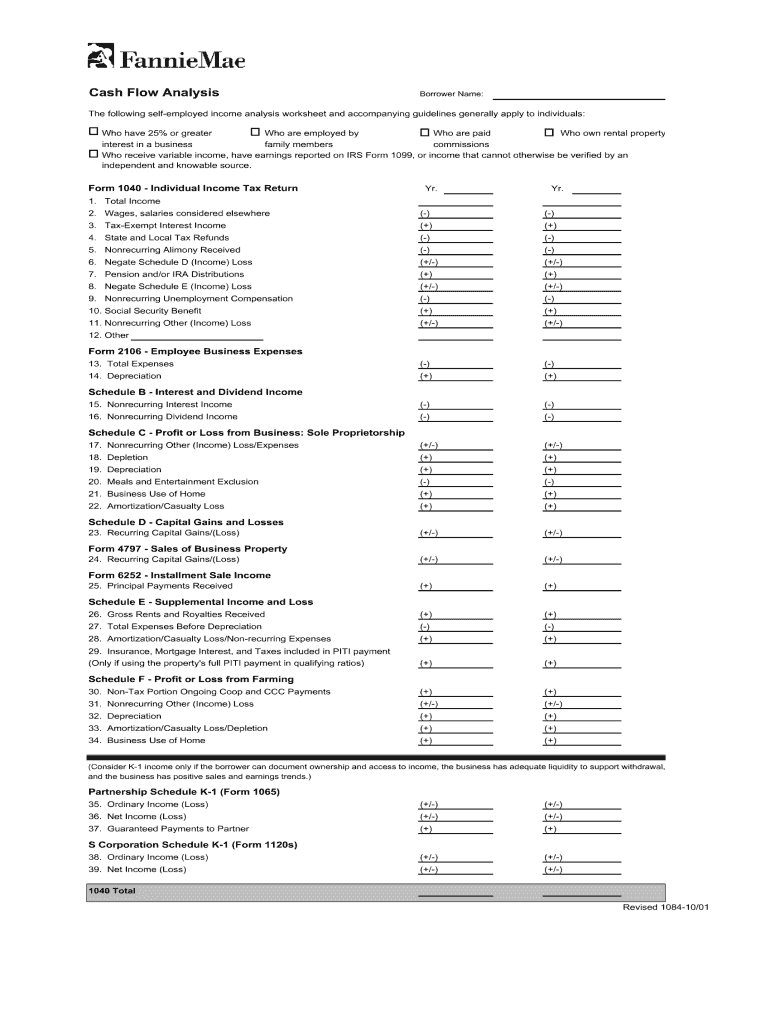

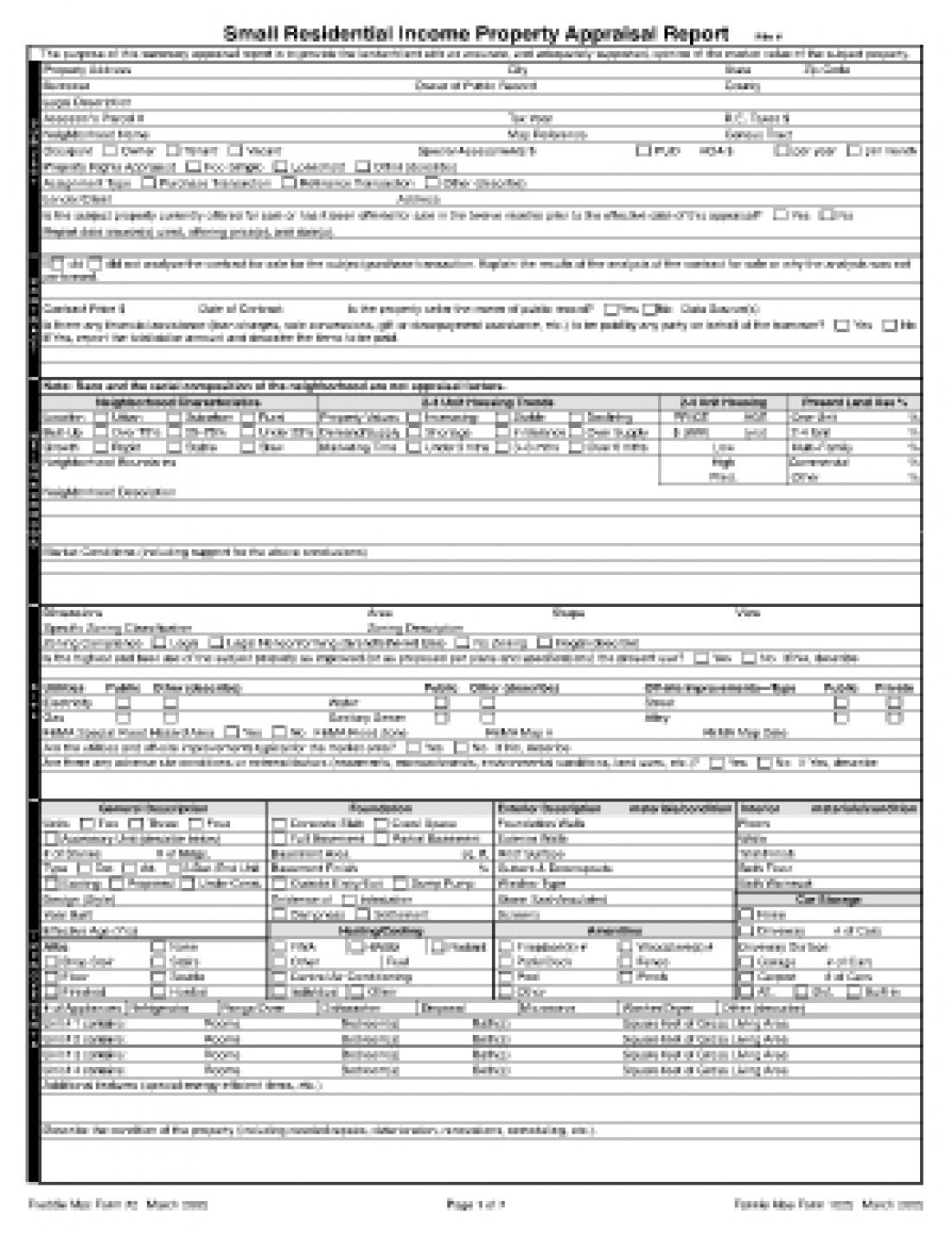

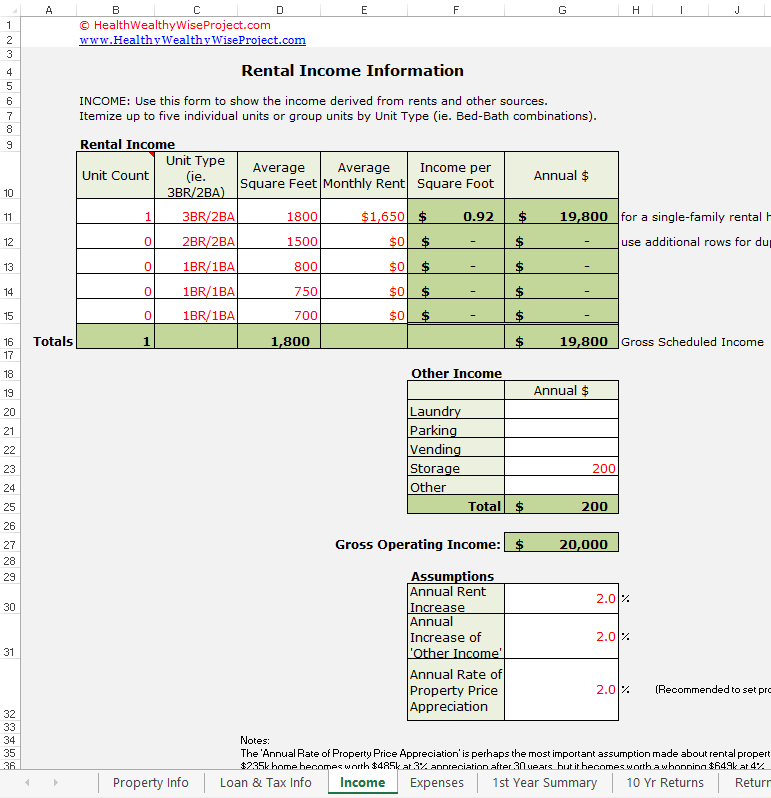

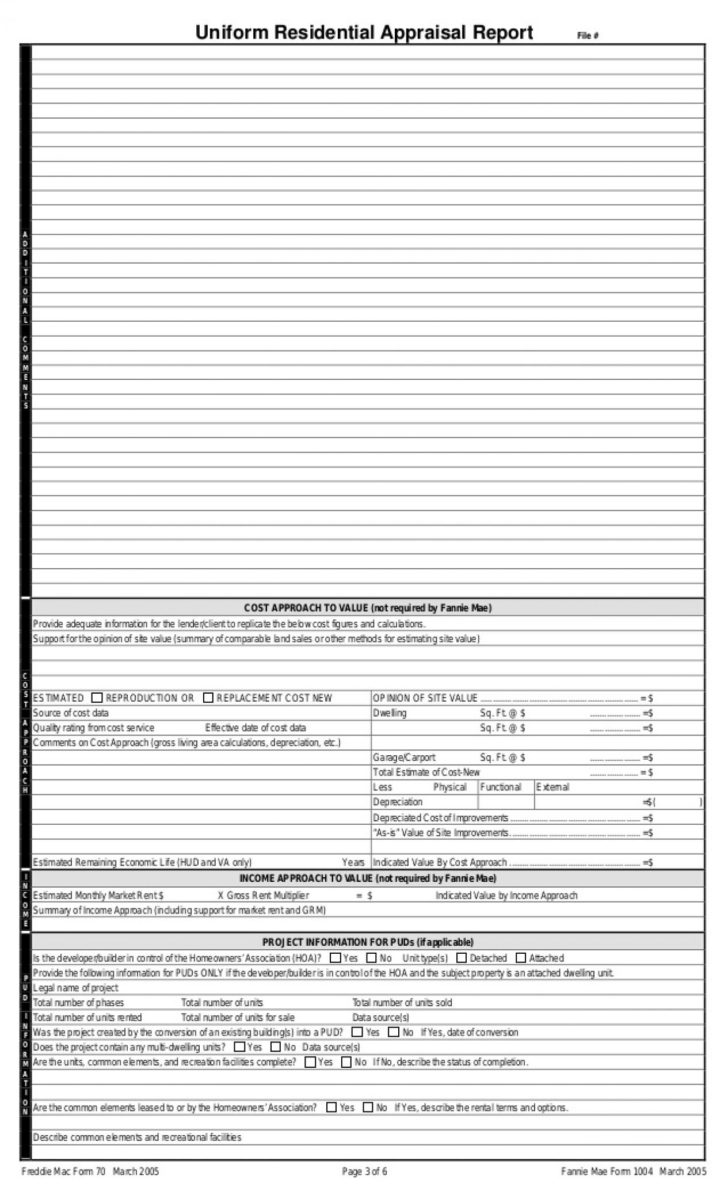

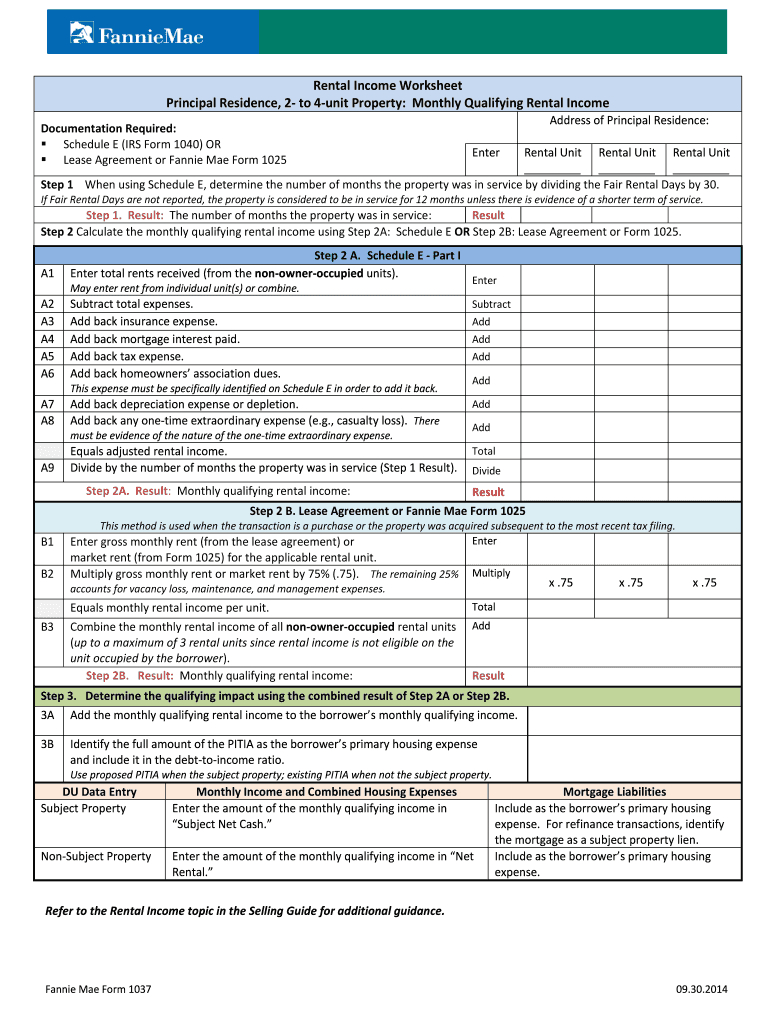

Fannie Mae Income Calculation Worksheet Excel - Schedule e or step 2b: (hourly gross pay x average # of hours worked per week x 52 weeks) / 12 months. The rental income worksheets are:. Fannie mae income worksheet, fannie mae. Web fannie mae income worksheet: Web this service is provided for the sole purpose of showing the applicable area median income (ami) for each applicable census tract. Lender may use the ami limits for purposes of. Web keep your career on the right track. Web calculate monthly qualifying rental income (loss) using step 2a: Web fannie mae publishes worksheets that lenders may use to calculate rental income. Web fannie mae income worksheet: Web use this worksheet to calculate qualifying rental income for fannie mae form 1038 (individual rental income from investment property(s) (up to 4 properties). Web fannie mae publishes worksheets that lenders may use to calculate rental income. A1 enter total rents received. Web a lender may use fannie mae rental income worksheets (form 1037 or. Web use fannie mae rental income worksheets (form 1037 or form 1038) to evaluate individual rental income (loss)reported on schedule e. Lease agreement or fannie mae form 1007 or form 1025. Web keep your career on the right track. Fannie mae income worksheet, fannie mae. The rental income worksheets are:. Web use our online calculators to determine qualifying income (amiquic) and analyze tax returns (amitrac). Get quick access to fannie mae rental income forms, too. (hourly gross pay x average # of hours worked per week x 52 weeks) / 12 months. Fannie mae income worksheet, fannie mae. (weekly gross pay x 52 pay periods) / 12 months. Web use fannie mae rental income worksheets (form 1037 or form 1038) to evaluate individual rental income (loss)reported on schedule e. Web calculate monthly qualifying rental income (loss) using step 2a: Web a lender may use fannie mae rental income worksheets (form 1037 or form 1038) or a comparable form to calculate individual rental income (loss) reported on schedule e.. (hourly gross pay x average # of hours worked per week x 52 weeks) / 12 months. Fannie mae income worksheet, fannie mae. Web this service is provided for the sole purpose of showing the applicable area median income (ami) for each applicable census tract. Get quick access to fannie mae rental income forms, too. Our income analysis tools and. Web use our online calculators to determine qualifying income (amiquic) and analyze tax returns (amitrac). A1 enter total rents received. Our income analysis tools and job aids are designed to help you evaluate qualifying income quickly and easily. Web fannie mae publishes worksheets that lenders may use to calculate rental income. Web calculate monthly qualifying rental income (loss) using step. Web use fannie mae rental income worksheets (form 1037 or form 1038) to evaluate individual rental income (loss)reported on schedule e. Our income analysis tools and job aids are designed to help you evaluate qualifying income quickly and easily. Web calculate monthly qualifying rental income (loss) using step 2a: Web a lender may use fannie mae rental income worksheets (form. Get quick access to fannie mae rental income forms, too. Fannie mae income worksheet, fannie mae. Web keep your career on the right track. Web use our online calculators to determine qualifying income (amiquic) and analyze tax returns (amitrac). A1 enter total rents received. Web use our online calculators to determine qualifying income (amiquic) and analyze tax returns (amitrac). Web use this worksheet to calculate qualifying rental income for fannie mae form 1038 (individual rental income from investment property(s) (up to 4 properties). Income calculations from irs form 1040 irs form 1040 federal individual income tax return year: Our income analysis tools and job. (weekly gross pay x 52 pay periods) / 12 months. Web keep your career on the right track. Lease agreement or fannie mae form 1007 or form 1025. Web calculate monthly qualifying rental income (loss) using step 2a: Use of these worksheets is optional. (hourly gross pay x average # of hours worked per week x 52 weeks) / 12 months. Get quick access to fannie mae rental income forms, too. Fannie mae income worksheet, fannie mae. (weekly gross pay x 52 pay periods) / 12 months. Web fannie mae income worksheet: Lease agreement or fannie mae form 1007 or form 1025. Web fannie mae publishes worksheets that lenders may use to calculate rental income. The rental income worksheets are:. Web keep your career on the right track. Web calculate monthly qualifying rental income (loss) using step 2a: Web use this worksheet to calculate qualifying rental income for fannie mae form 1038 (individual rental income from investment property(s) (up to 4 properties). Web a lender may use fannie mae rental income worksheets (form 1037 or form 1038) or a comparable form to calculate individual rental income (loss) reported on schedule e. Web this service is provided for the sole purpose of showing the applicable area median income (ami) for each applicable census tract. Lender may use the ami limits for purposes of. A1 enter total rents received. Schedule e or step 2b: Web use our online calculators to determine qualifying income (amiquic) and analyze tax returns (amitrac). Income calculations from irs form 1040 irs form 1040 federal individual income tax return year: Web use fannie mae rental income worksheets (form 1037 or form 1038) to evaluate individual rental income (loss)reported on schedule e. Use of these worksheets is optional. Fannie mae income worksheet, fannie mae. Web use our online calculators to determine qualifying income (amiquic) and analyze tax returns (amitrac). (weekly gross pay x 52 pay periods) / 12 months. (hourly gross pay x average # of hours worked per week x 52 weeks) / 12 months. Web use this worksheet to calculate qualifying rental income for fannie mae form 1038 (individual rental income from investment property(s) (up to 4 properties). Web calculate monthly qualifying rental income (loss) using step 2a: Web a lender may use fannie mae rental income worksheets (form 1037 or form 1038) or a comparable form to calculate individual rental income (loss) reported on schedule e. Web this service is provided for the sole purpose of showing the applicable area median income (ami) for each applicable census tract. Web fannie mae income worksheet: Our income analysis tools and job aids are designed to help you evaluate qualifying income quickly and easily. The rental income worksheets are:. A1 enter total rents received. Schedule e or step 2b: Get quick access to fannie mae rental income forms, too. Income calculations from irs form 1040 irs form 1040 federal individual income tax return year: Use of these worksheets is optional.35 fannie mae rental worksheet excel support worksheet

Fannie Mae Self Employed Worksheet —

Fannie Mae Self Employed Worksheet —

Fannie Mae Investment Property Calculation Worksheet Invest Walls

Fannie Mae Self Employed Worksheet —

Fannie Mae Investment Property Calculation Worksheet Invest Walls

Fannie Mae Calculation Worksheet Fill Online, Printable

Fannie Mae Rental Worksheet Excel Promotiontablecovers

Fannie Mae Fill Online Printable —

Fannie Mae Rental Worksheet Excel Worksheet List

Web Keep Your Career On The Right Track.

Lender May Use The Ami Limits For Purposes Of.

Web Use Fannie Mae Rental Income Worksheets (Form 1037 Or Form 1038) To Evaluate Individual Rental Income (Loss)Reported On Schedule E.

Lease Agreement Or Fannie Mae Form 1007 Or Form 1025.

Related Post: