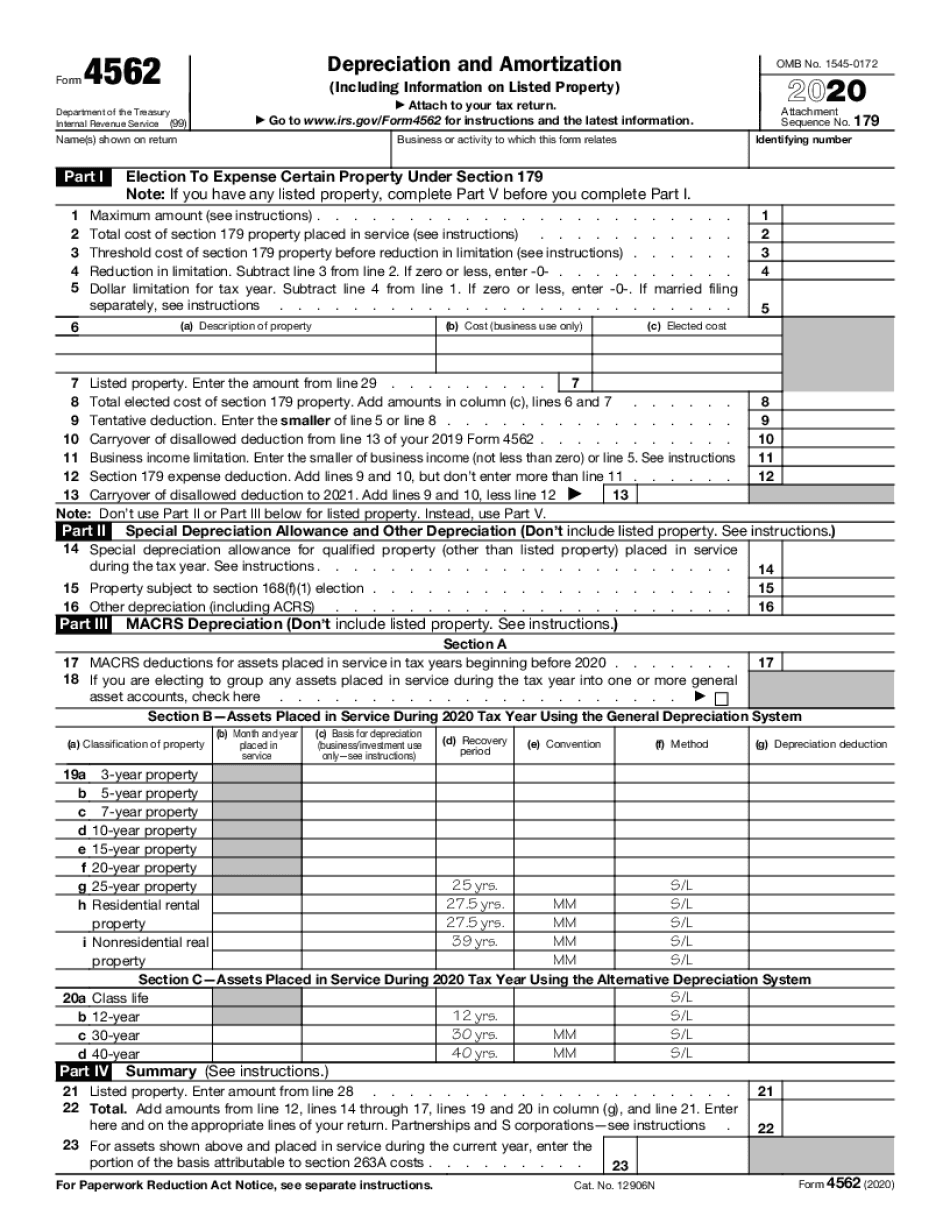

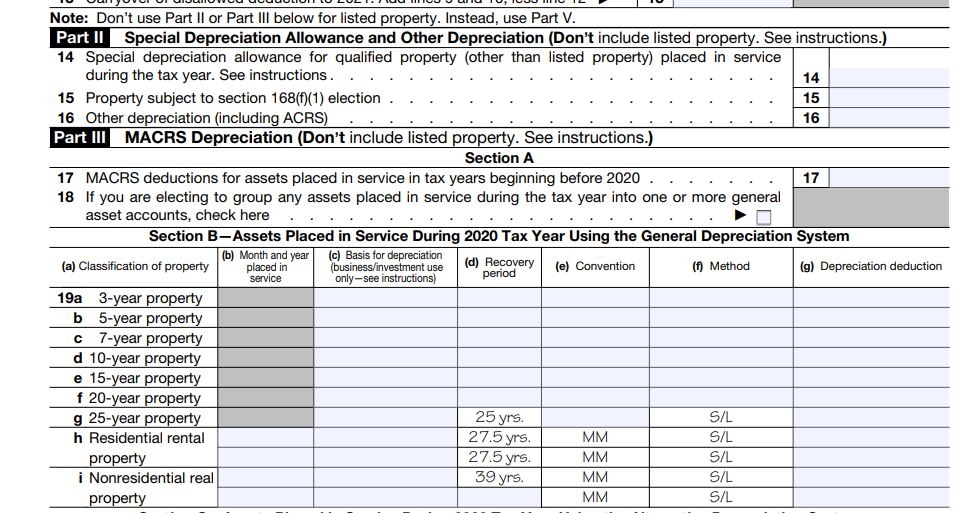

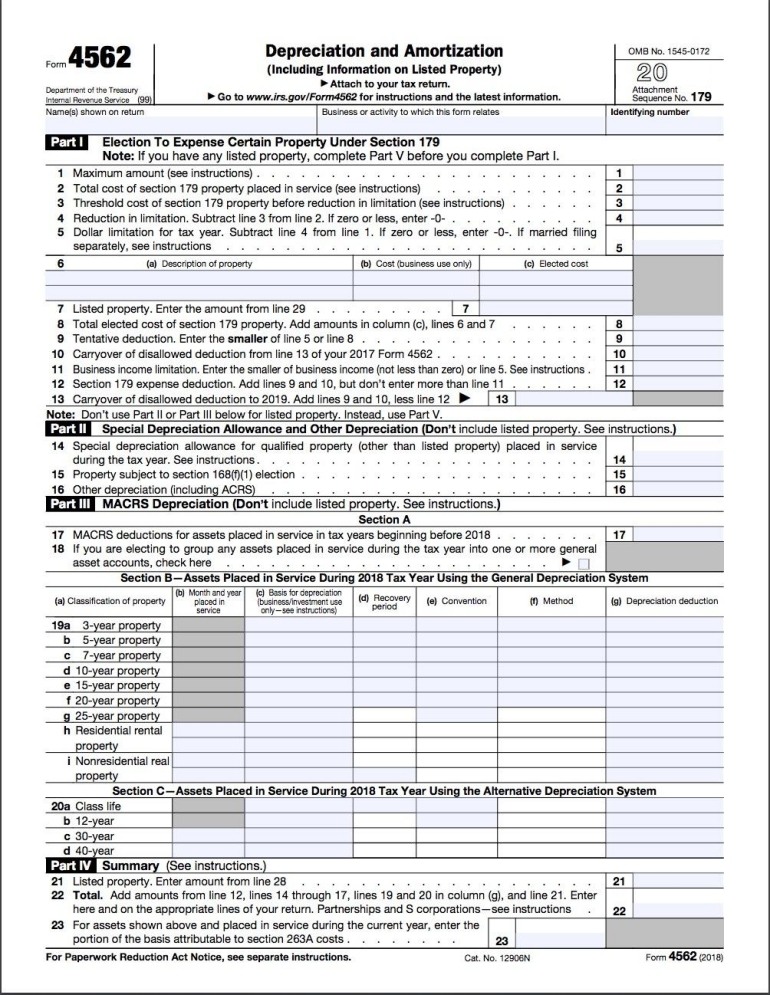

Form 4562 Depreciation And Amortization Worksheet

Form 4562 Depreciation And Amortization Worksheet - Save your changes and share. Web depreciation is used to recover the cost of tangible property such as machinery, equipment, furniture, buildings, and improvements. Web 50% bonus first year depreciation can be elected over the 100% expensing for the first tax year ending after september 27, 2017. 12906n 21 22 form 4562 (2022) page 2 form 4562 (2022) part v listed property (include automobiles, certain other vehicles, certain aircraft, and property used for. Web print worksheet for irs 4562 depreciation and amortization (tffam1411m000) use this session to provide federal tax book data in irs form 4562 format. Depreciation refers to the calculated loss in. If you are expensing any section 179 property placed into service, you may need to use the following worksheet to calculate the. Edit & sign form 4562 depreciation and amortization from anywhere. Web use form ftb 3885l, depreciation and amortization, to compute depreciation and amortization allowed as a deduction on form 568, limited liability company return of. Web download or print the 2022 federal (depreciation and amortization (including information on listed property)) (2022) and other income tax forms from the federal. Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. Web 50% bonus first year depreciation can be elected over the 100% expensing for the first tax year ending after september 27, 2017. Web 7 rows form 4562: Assets such as buildings, machinery,. Web depreciation is used to recover the cost. Web upload the form 4562 depreciation and amortization worksheet. Edit & sign form 4562 depreciation and amortization from anywhere. 12906n 21 22 form 4562 (2022) page 2 form 4562 (2022) part v listed property (include automobiles, certain other vehicles, certain aircraft, and property used for. Web print worksheet for irs 4562 depreciation and amortization (tffam1411m000) use this session to provide. Web print worksheet for irs 4562 depreciation and amortization (tffam1411m000) use this session to provide federal tax book data in irs form 4562 format. Web irs form 4562 is used to claim deductions for the depreciation or amortization of tangible or intangible property. Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how. Impairment has that act of writing off a tangible asset over multiples charge years. Web 50% bonus first year depreciation can be elected over the 100% expensing for the first tax year ending after september 27, 2017. Form 4562 is the depreciation and amortization form, used when filing an income tax return. Web 7 rows form 4562: Depreciation refers to. Depreciation and amortization (including information on listed property) 2022 : Assets such as buildings, machinery,. Web irs form 4562 is used to claim deductions for the depreciation or amortization of tangible or intangible property. Form 4562 is the depreciation and amortization form, used when filing an income tax return. Web 50% bonus first year depreciation can be elected over the. Web download or print the 2022 federal (depreciation and amortization (including information on listed property)) (2022) and other income tax forms from the federal. Web make sure your property info carried over to the property profile section first. 12906n 21 22 form 4562 (2022) page 2 form 4562 (2022) part v listed property (include automobiles, certain other vehicles, certain aircraft,. Web 7 rows form 4562: Web irs form 4562 is used to claim deductions for the depreciation or amortization of tangible or intangible property. Instructions for form 4562, depreciation. 12906n 21 22 form 4562 (2022) page 2 form 4562 (2022) part v listed property (include automobiles, certain other vehicles, certain aircraft, and property used for. Use your original ' date. Web upload the form 4562 depreciation and amortization worksheet. Web 7 rows form 4562: Depreciation and amortization (including information on listed property) 2022 : Web follow the instructions on federal form 4562, depreciation and amortization, for listed property 1 maximum dollar limitation $ 25,000. Edit & sign form 4562 depreciation and amortization from anywhere. Edit & sign form 4562 depreciation and amortization from anywhere. Web 7 rows form 4562: Form 4562 is used to. Instructions for form 4562, depreciation. Web download or print the 2022 federal (depreciation and amortization (including information on listed property)) (2022) and other income tax forms from the federal. Form 4562 is the depreciation and amortization form, used when filing an income tax return. Web upload the form 4562 depreciation and amortization worksheet. 12906n 21 22 form 4562 (2022) page 2 form 4562 (2022) part v listed property (include automobiles, certain other vehicles, certain aircraft, and property used for. Web information about form 4562, depreciation and amortization, including recent. Web use form ftb 3885l, depreciation and amortization, to compute depreciation and amortization allowed as a deduction on form 568, limited liability company return of. If you are expensing any section 179 property placed into service, you may need to use the following worksheet to calculate the. Assets such as buildings, machinery,. Web print worksheet for irs 4562 depreciation and amortization (tffam1411m000) use this session to provide federal tax book data in irs form 4562 format. Web make sure your property info carried over to the property profile section first. Web irs form 4562 is used to claim deductions for the depreciation or amortization of tangible or intangible property. Instructions for form 4562, depreciation. Form 4562 is used to. Depreciation refers to the calculated loss in. Web follow the instructions on federal form 4562, depreciation and amortization, for listed property 1 maximum dollar limitation $ 25,000. Use your original ' date in service ' and ' cost' and turbotax will calculate depreciation. Web depreciation is used to recover the cost of tangible property such as machinery, equipment, furniture, buildings, and improvements. 12906n 21 22 form 4562 (2022) page 2 form 4562 (2022) part v listed property (include automobiles, certain other vehicles, certain aircraft, and property used for. Impairment has that act of writing off a tangible asset over multiples charge years. Web where are depreciation both amortization? Web upload the form 4562 depreciation and amortization worksheet. Depreciation and amortization (including information on listed property) 2022 : Form 4562 is the depreciation and amortization form, used when filing an income tax return. Web 50% bonus first year depreciation can be elected over the 100% expensing for the first tax year ending after september 27, 2017. Save your changes and share. Web make sure your property info carried over to the property profile section first. Save your changes and share. 12906n 21 22 form 4562 (2022) page 2 form 4562 (2022) part v listed property (include automobiles, certain other vehicles, certain aircraft, and property used for. Web depreciation is used to recover the cost of tangible property such as machinery, equipment, furniture, buildings, and improvements. Depreciation and amortization (including information on listed property) 2022 : Web print worksheet for irs 4562 depreciation and amortization (tffam1411m000) use this session to provide federal tax book data in irs form 4562 format. Web irs form 4562 is used to claim deductions for the depreciation or amortization of tangible or intangible property. If you are expensing any section 179 property placed into service, you may need to use the following worksheet to calculate the. Web download or print the 2022 federal (depreciation and amortization (including information on listed property)) (2022) and other income tax forms from the federal. Use your original ' date in service ' and ' cost' and turbotax will calculate depreciation. Assets such as buildings, machinery,. Web where are depreciation both amortization? Form 4562 is the depreciation and amortization form, used when filing an income tax return. Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. Web 7 rows form 4562: Depreciation refers to the calculated loss in.Understanding Form 4562 How To Account For Depreciation And

form 4562 depreciation and amortization worksheet Fill Online

Publication 946 How To Depreciate Property; Form 4562

2020 Form 4562 Depreciation and Amortization21 Nina's Soap

Form 4562 Depreciation and Amortization YouTube

Form 4562, Depreciation Expense

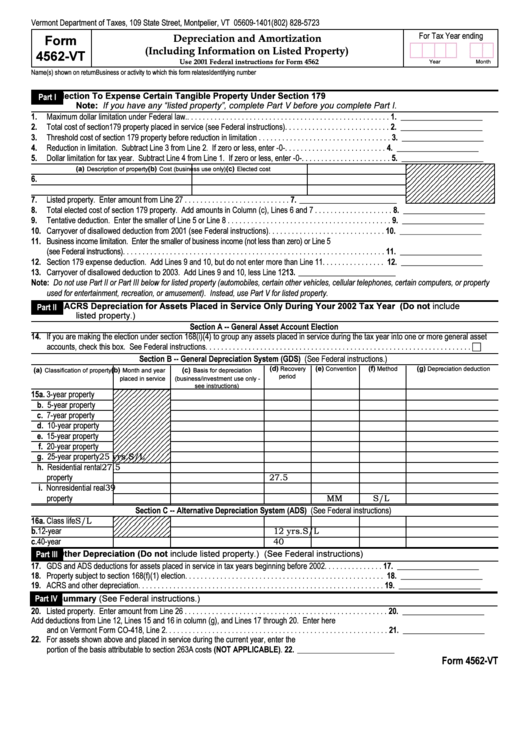

Form 4562Vt Depreciation And Amortization (Including Information On

Fillable IRS Form 4562 Depreciation and Amortization Printable

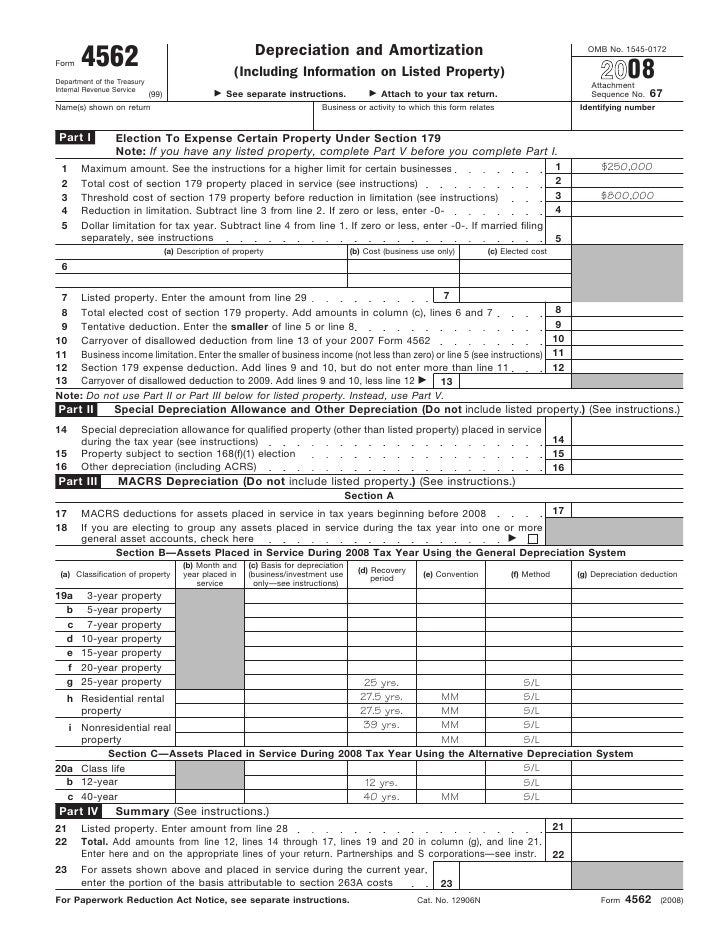

Form 4562Depreciation and Amortization

Form 4562Depreciation and Amortization

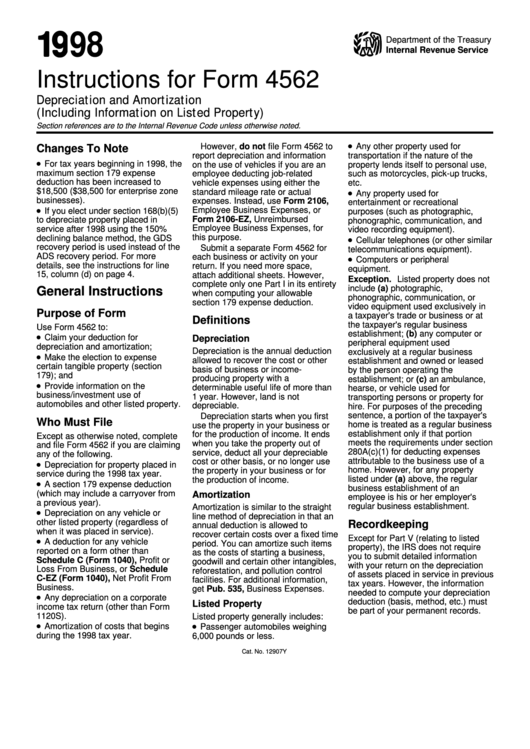

Instructions For Form 4562, Depreciation.

Web Follow The Instructions On Federal Form 4562, Depreciation And Amortization, For Listed Property 1 Maximum Dollar Limitation $ 25,000.

Web Use Form Ftb 3885L, Depreciation And Amortization, To Compute Depreciation And Amortization Allowed As A Deduction On Form 568, Limited Liability Company Return Of.

Form 4562 Is Used To.

Related Post: