Georgia Retirement Income Exclusion Worksheet

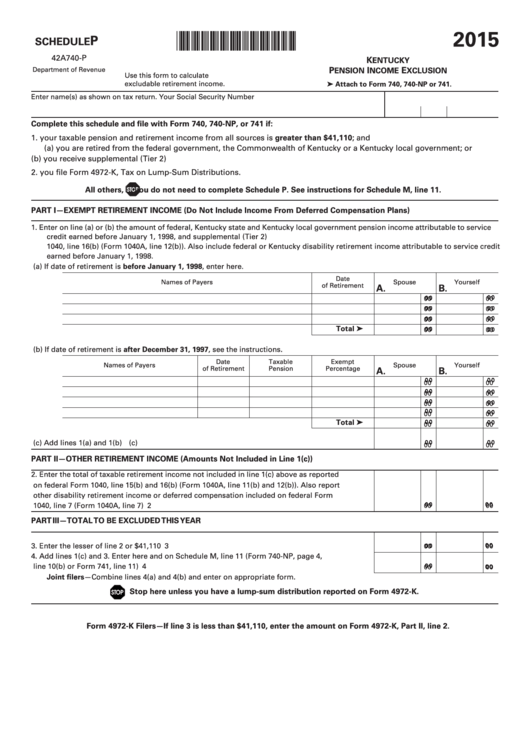

Georgia Retirement Income Exclusion Worksheet - To get the exclusion, a person will have to complete. Taxpayers under age 62 and permanently disabled also qualify for the. Web the ga retirement exclusion (should really be called the ga seniors exclusion) is available to any resident of ga who is 62 to 64 years of age or who is younger than 62. Find a suitable template on the internet. For taxpayers 65 or older, the retirement. Web you can designate resident spouse retirement income as taxable to georgia for married taxpayers filing a nonresident georgia return. Go to the ganrpy screen, in the income. Web the list shown on the georgia department of revenue website for retirement income is in a sense incomplete, in that it does not include other income which is on. Web video instructions and help with filling out and completing georgia retirement income exclusion worksheet form. Web video instructions and help with filling out and completing georgia retirement income exclusion worksheet form. Web the ga retirement exclusion (should really be called the ga seniors exclusion) is available to any resident of ga who is 62 to 64 years of age or who is younger than 62. Find a suitable template on the internet. Web you can. Web video instructions and help with filling out and completing georgia retirement income exclusion worksheet form. Find a suitable template on the internet. Taxpayers under age 62 and permanently disabled also qualify for the. Web you can designate resident spouse retirement income as taxable to georgia for married taxpayers filing a nonresident georgia return. For taxpayers 65 or older, the. Go to the ganrpy screen, in the income. Web video instructions and help with filling out and completing georgia retirement income exclusion worksheet form. Taxpayers under age 62 and permanently disabled also qualify for the. Find a suitable template on the internet. To get the exclusion, a person will have to complete. To get the exclusion, a person will have to complete. Taxpayers under age 62 and permanently disabled also qualify for the. Web the ga retirement exclusion (should really be called the ga seniors exclusion) is available to any resident of ga who is 62 to 64 years of age or who is younger than 62. Web you can designate resident. Web the ga retirement exclusion (should really be called the ga seniors exclusion) is available to any resident of ga who is 62 to 64 years of age or who is younger than 62. To get the exclusion, a person will have to complete. Find a suitable template on the internet. Taxpayers under age 62 and permanently disabled also qualify. Web video instructions and help with filling out and completing georgia retirement income exclusion worksheet form. Go to the ganrpy screen, in the income. Taxpayers under age 62 and permanently disabled also qualify for the. For taxpayers 65 or older, the retirement. To get the exclusion, a person will have to complete. For taxpayers 65 or older, the retirement. Web video instructions and help with filling out and completing georgia retirement income exclusion worksheet form. Go to the ganrpy screen, in the income. Web the ga retirement exclusion (should really be called the ga seniors exclusion) is available to any resident of ga who is 62 to 64 years of age or. Web video instructions and help with filling out and completing georgia retirement income exclusion worksheet form. Web the ga retirement exclusion (should really be called the ga seniors exclusion) is available to any resident of ga who is 62 to 64 years of age or who is younger than 62. Taxpayers under age 62 and permanently disabled also qualify for. Web you can designate resident spouse retirement income as taxable to georgia for married taxpayers filing a nonresident georgia return. Taxpayers under age 62 and permanently disabled also qualify for the. Web the list shown on the georgia department of revenue website for retirement income is in a sense incomplete, in that it does not include other income which is. Web you can designate resident spouse retirement income as taxable to georgia for married taxpayers filing a nonresident georgia return. Web the list shown on the georgia department of revenue website for retirement income is in a sense incomplete, in that it does not include other income which is on. Web video instructions and help with filling out and completing. Find a suitable template on the internet. Taxpayers under age 62 and permanently disabled also qualify for the. To get the exclusion, a person will have to complete. Web the ga retirement exclusion (should really be called the ga seniors exclusion) is available to any resident of ga who is 62 to 64 years of age or who is younger than 62. For taxpayers 65 or older, the retirement. Web the list shown on the georgia department of revenue website for retirement income is in a sense incomplete, in that it does not include other income which is on. Web you can designate resident spouse retirement income as taxable to georgia for married taxpayers filing a nonresident georgia return. Web video instructions and help with filling out and completing georgia retirement income exclusion worksheet form. Go to the ganrpy screen, in the income. To get the exclusion, a person will have to complete. Web video instructions and help with filling out and completing georgia retirement income exclusion worksheet form. Web the ga retirement exclusion (should really be called the ga seniors exclusion) is available to any resident of ga who is 62 to 64 years of age or who is younger than 62. Find a suitable template on the internet. Web you can designate resident spouse retirement income as taxable to georgia for married taxpayers filing a nonresident georgia return. Web the list shown on the georgia department of revenue website for retirement income is in a sense incomplete, in that it does not include other income which is on. For taxpayers 65 or older, the retirement.Fillable Schedule P Kentucky Pension Exclusion 2015

IRS clarifies payment plans for expanded child tax credit, unemployment

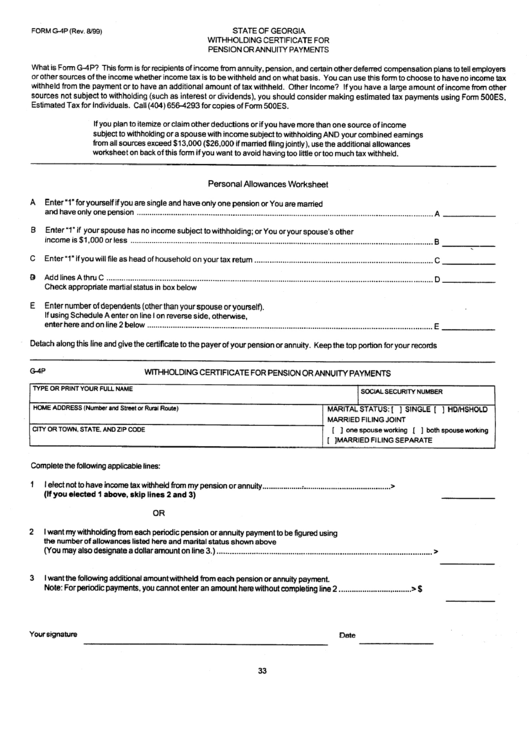

Form G4p State Of Withholding Certificate For Pension Or

43 colorado pension and annuity exclusion worksheet Worksheet For Fun

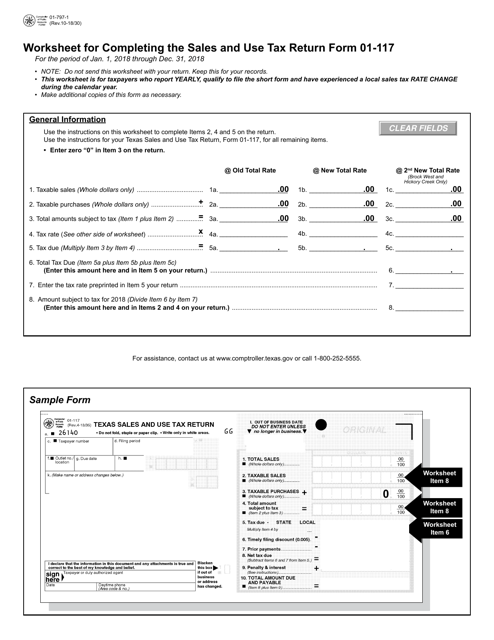

Form 01797 Download Fillable PDF or Fill Online Worksheet for

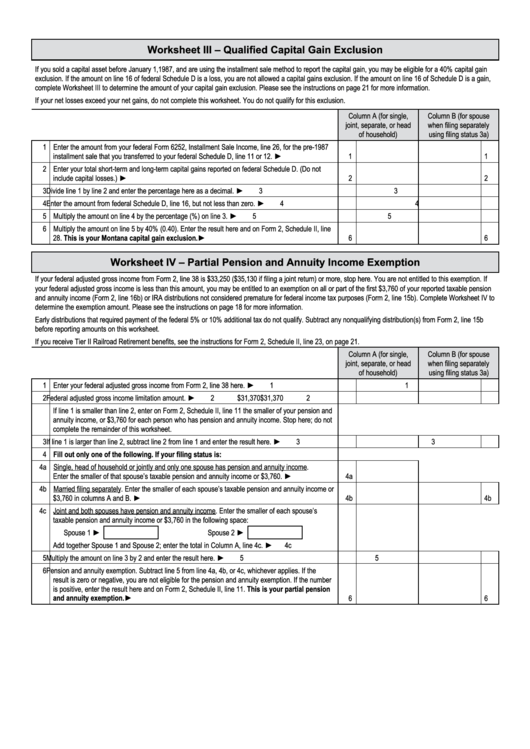

Worksheet Iii And Iv Qualified Capital Gain Exclusion And Partial

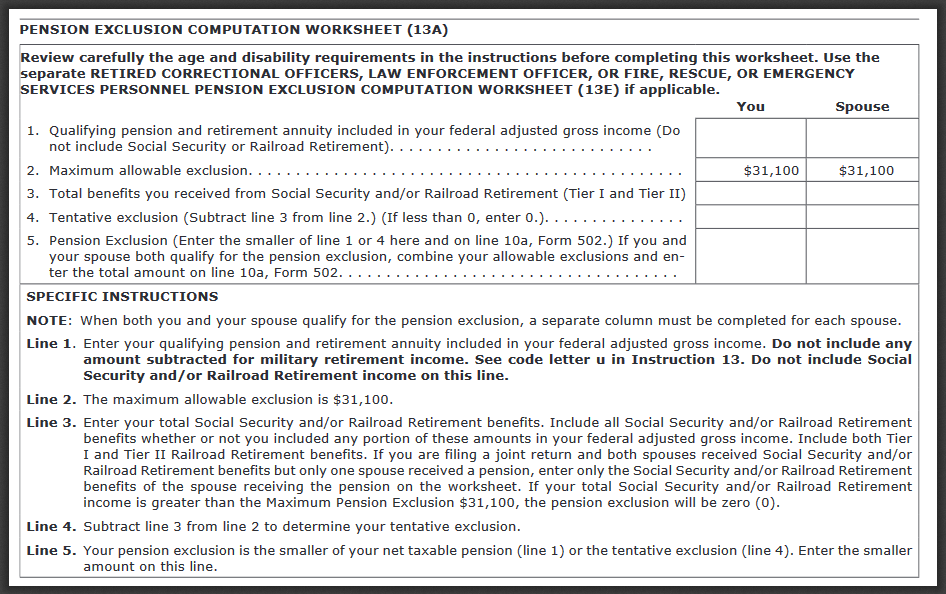

Schedule P (740) Kentucky Pension Exclusion Form 42A740P

Revenue Primer for State Fiscal Year 2021 Budget and

Retirement Exclusion Worksheet Universal Network

Maryland pension exclusion may include a state tax deduction

Taxpayers Under Age 62 And Permanently Disabled Also Qualify For The.

Go To The Ganrpy Screen, In The Income.

Related Post: