Renter's Credit Qualification Worksheet

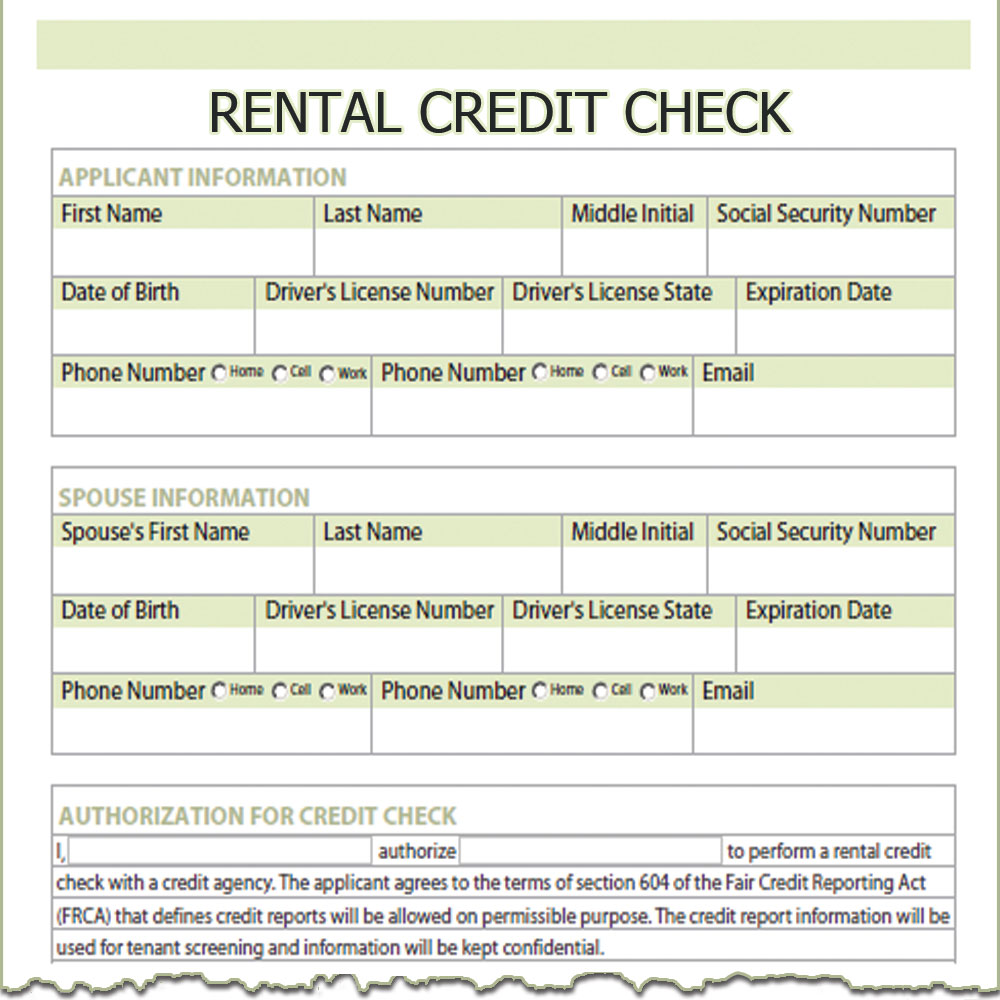

Renter's Credit Qualification Worksheet - Web rent credit means a total equal to $0.00/ sq. Loan sizing ratios under 220, 223 and 231. Fill out “nonrefundable renter’s credit qualification record” (available in the california income tax return booklet) for your own tax records (don’t send the form to. You have a valid social security number or individual tax identification number; Web a property tax deduction of 18% of your rent. Web to tax credit projects underwritten for that program unless adjusted for the new pilot in separate guidance. Rent credit shall be equal to the difference between the base rent and the floor multiplied. You are a minnesota resident or spent at least 183 days in the. Web let’s say you’re angling to go from being a renter to a homeowner. Web how you get it: Fill out “nonrefundable renter’s credit qualification record” (available in the california income tax return booklet) for your own tax records (don’t send the form to. Loan sizing ratios under 220, 223 and 231. Fill out “nonrefundable renter’s credit qualification record” (available in the california income tax return booklet) for your own tax records (don’t send the form to. Web to. The taxpayer must be a resident of california for the entire year if filing form 540, or at least. Loan sizing ratios under 220, 223 and 231. Web how you get it: You have a valid social security number or individual tax identification number; Web with tenant screening criteria, most landlords include a credit check to provide a detailed look. Fill out “nonrefundable renter’s credit qualification record” (available in the california income tax return booklet) for your own tax records (don’t send the form to. Rent credit shall be equal to the difference between the base rent and the floor multiplied. Web let’s say you’re angling to go from being a renter to a homeowner. You have a valid social. Use of these worksheets is optional. Web to claim the renter’s credit for california, all of the following criteria must be met: You have a 685 credit score, which qualifies you for a $200,000 mortgage with an interest rate of. Qualification record for nonresident renter's credit : Web how you get it: Fill out “nonrefundable renter’s credit qualification record” (available in the california income tax return booklet) for your own tax records (don’t send the form to. Web how you get it: Fill out “nonrefundable renter’s credit qualification record” (available in the california income tax return booklet) for your own tax records (don’t send the form to. Sections 3.4, 3.5, & 3.7.. You can claim either the deduction or the credit when you file your state tax return. Fill out “nonrefundable renter’s credit qualification record” (available in the california income tax return booklet) for your own tax records (don’t send the form to. Multiplied by the premises area. Web with tenant screening criteria, most landlords include a credit check to provide a. Use of these worksheets is optional. Web how you get it: A property tax credit of $50. Qualification record for nonresident renter's credit : Web let’s say you’re angling to go from being a renter to a homeowner. You can claim either the deduction or the credit when you file your state tax return. Web a property tax deduction of 18% of your rent. Sections 3.4, 3.5, & 3.7. Use of these worksheets is optional. Web how you get it: Web to tax credit projects underwritten for that program unless adjusted for the new pilot in separate guidance. Use of these worksheets is optional. Web fannie mae publishes four worksheets that lenders may use to calculate rental income. A property tax credit of $50. You have a valid social security number or individual tax identification number; Web to qualify, all of these must be true: Sections 3.4, 3.5, & 3.7. You have a 685 credit score, which qualifies you for a $200,000 mortgage with an interest rate of. Loan sizing ratios under 220, 223 and 231. The taxpayer must be a resident of california for the entire year if filing form 540, or at least. Web how you get it: Multiplied by the premises area. To claim the ca renter's. Web a property tax deduction of 18% of your rent. Web this article explains how to claim the ca renter's credit on an individual return, who qualifies for the credit, and the credit amounts. You can claim either the deduction or the credit when you file your state tax return. Web with tenant screening criteria, most landlords include a credit check to provide a detailed look at the applicant’s financial situation. Web rent credit means a total equal to $0.00/ sq. Loan sizing ratios under 220, 223 and 231. Fill out “nonrefundable renter’s credit qualification record” (available in the california income tax return booklet) for your own tax records (don’t send the form to. Qualification record for nonresident renter's credit : Web to tax credit projects underwritten for that program unless adjusted for the new pilot in separate guidance. You have a valid social security number or individual tax identification number; Rent credit shall be equal to the difference between the base rent and the floor multiplied. Web to claim the renter’s credit for california, all of the following criteria must be met: You are a minnesota resident or spent at least 183 days in the. Web to qualify, all of these must be true: Sections 3.4, 3.5, & 3.7. Web let’s say you’re angling to go from being a renter to a homeowner. Web fannie mae publishes four worksheets that lenders may use to calculate rental income. You have a 685 credit score, which qualifies you for a $200,000 mortgage with an interest rate of. Use of these worksheets is optional. Rent credit shall be equal to the difference between the base rent and the floor multiplied. Fill out “nonrefundable renter’s credit qualification record” (available in the california income tax return booklet) for your own tax records (don’t send the form to. You have a valid social security number or individual tax identification number; The taxpayer must be a resident of california for the entire year if filing form 540, or at least. Sections 3.4, 3.5, & 3.7. A property tax credit of $50. Web fannie mae publishes four worksheets that lenders may use to calculate rental income. Web how you get it: Loan sizing ratios under 220, 223 and 231. To claim the ca renter's. You are a minnesota resident or spent at least 183 days in the. Web to claim the renter’s credit for california, all of the following criteria must be met: Web with tenant screening criteria, most landlords include a credit check to provide a detailed look at the applicant’s financial situation. Credit history is one of the essential parts of the.Periodic Inspection Checklist for Rental Units PDF Form Fill Out and

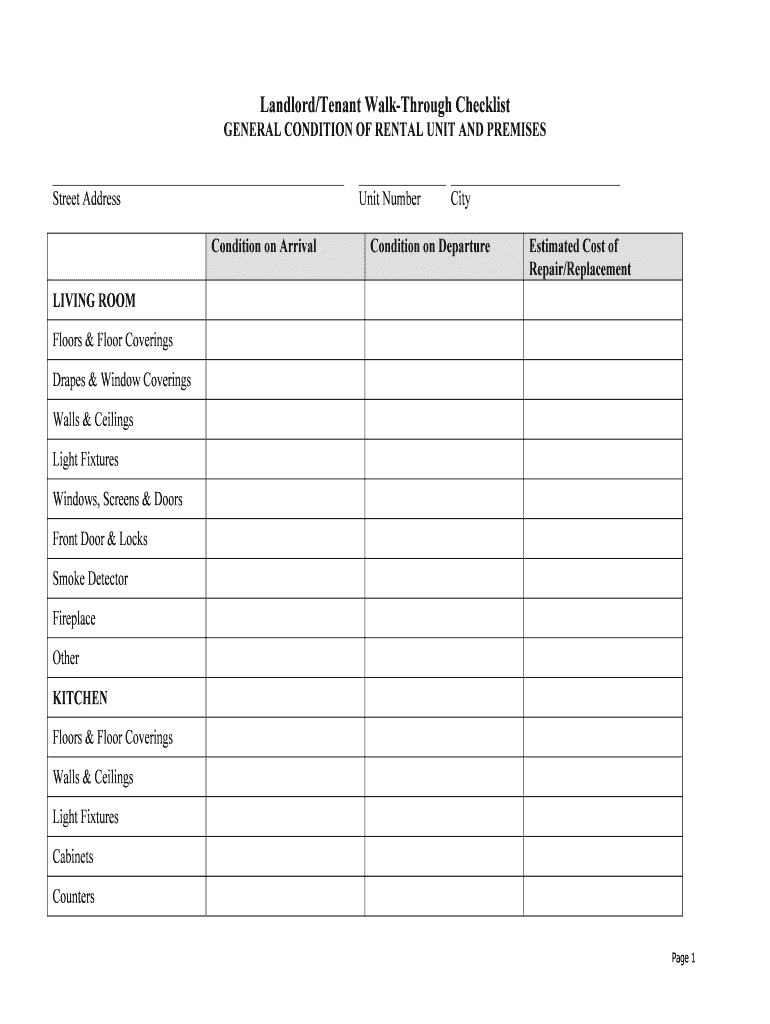

rental checkout form Google Search RENTAL Rental agreement

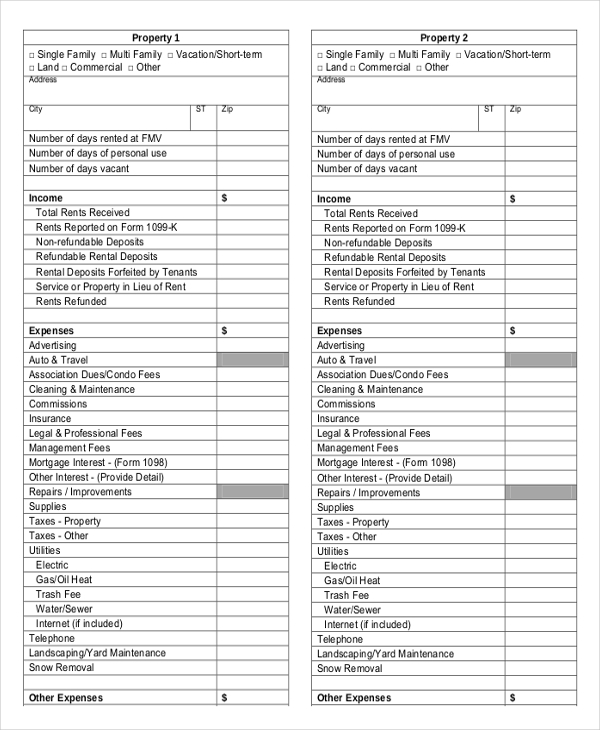

Awesome easy budget worksheet pdf Literacy Worksheets

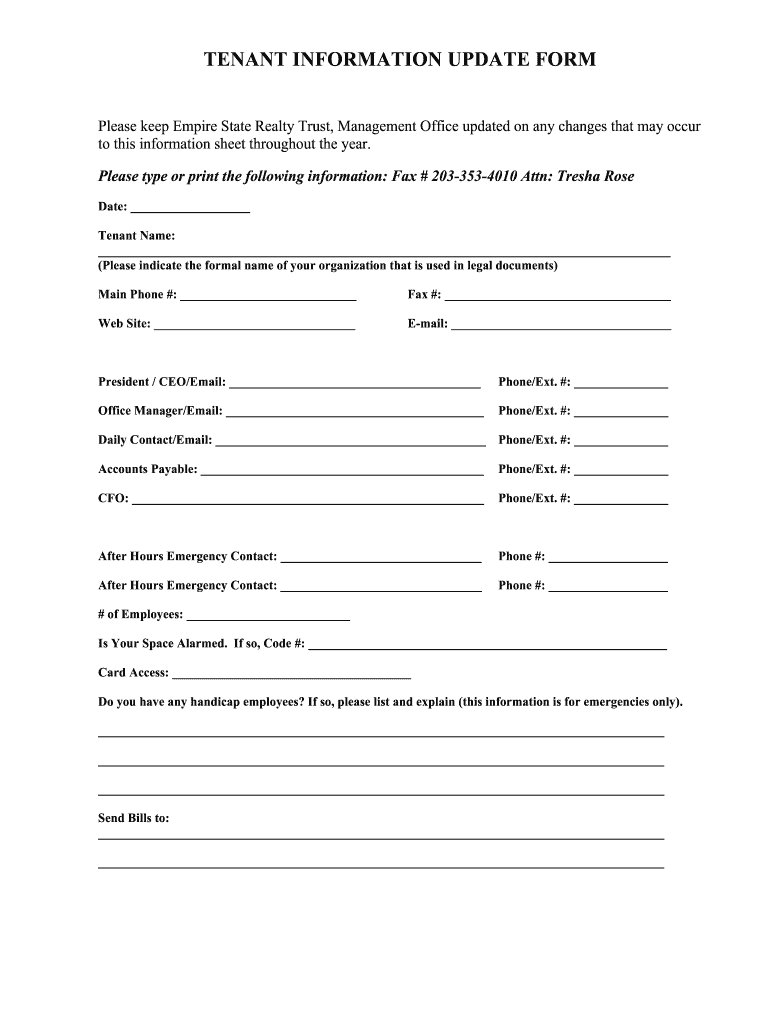

Tenant Information Sheet Fill Online, Printable, Fillable, Blank

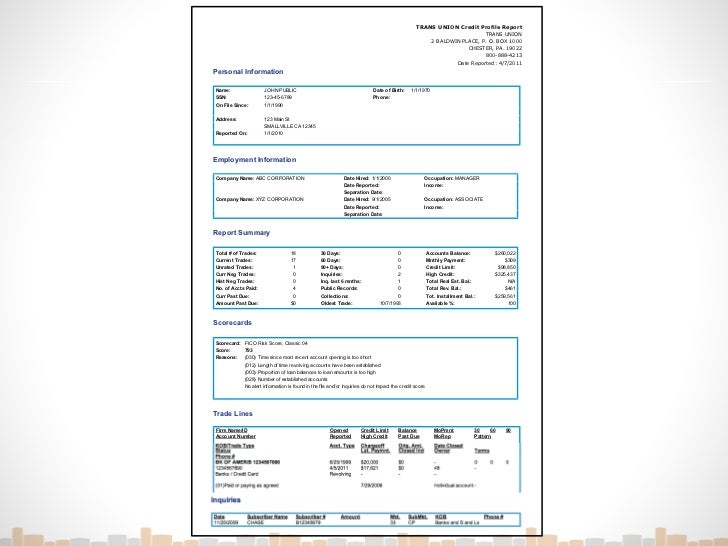

Rental Credit Check

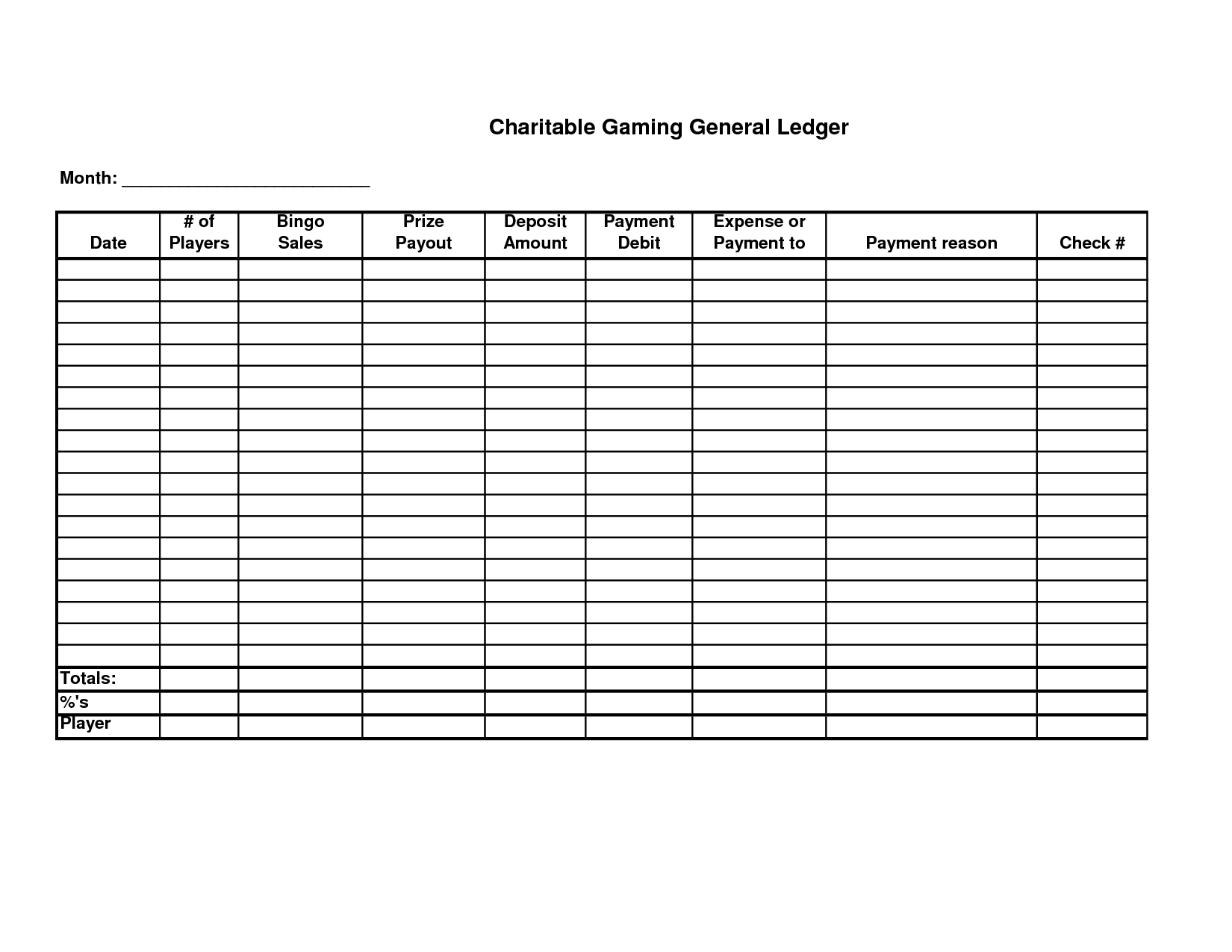

Printable Ledger Template Rent Receipts Rental Forms Simple With Free

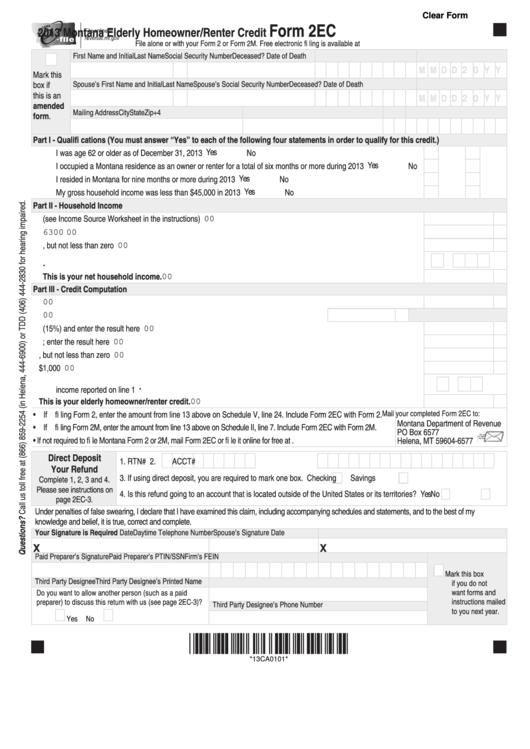

Fillable Form 2ec Montana Elderly Homeowner/renter Credit 2013

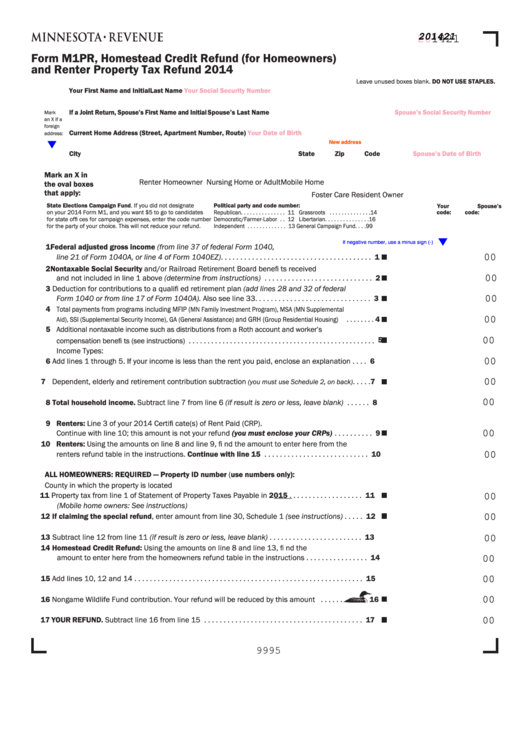

Fillable Form M1pr Minnesota Homestead Credit Refund (For Homeowners

Minnesota Property Tax Refund Fill Out and Sign Printable PDF

Unraveling A Renter's Credit Report

Web Rent Credit Means A Total Equal To $0.00/ Sq.

Web Let’s Say You’re Angling To Go From Being A Renter To A Homeowner.

Web A Property Tax Deduction Of 18% Of Your Rent.

Web To Qualify, All Of These Must Be True:

Related Post: